MSW Course Details: The MSW Course Full Form is a Master of Social Work. It is a master’s degree in social work. It is a two-year professional degree, consisting of macro and micro aspects of social work practices in terms of the community, hospitals, schools, and other fields of social service work.

The two-year postgraduate degree in MSW has a lot of scope in the field of social work. In the medical area, the opportunities for jobs are much higher. Candidates can work as healthcare social workers, therapists, or social workers on mental health.

Check more about other types of Course Details Streamwise, and Category wise.

- A Brief on Masters In Social Work (MSW) Course

- Skillset Required for MSW Course

- MSW (Master of Social Work) Course Eligibility Criteria

- Master Of Social Work (MSW) Course Details

- MSW Entrance Exams

- List of Top Colleges in India Offering MSW Course

- MSW Course Fees Structure

- Masters in Social Work Distance Course Eligibility

- MSW Course Syllabus

- MSW Course Subjects

- MSW Course Specializations

- MSW Course Job Profiles

- Salary Offered After MSW Course

- What is the use of the MSW Course?

- What is the Eligibility Criteria for MSW?

- What is the job Profile after we pursue MSW?

A Brief on Masters In Social Work (MSW) Course

Social work is related to serving people and communities and groups to improve their individual and collective well-being. It takes the help of sociology, psychology, Social Science, political science, public health, community development, law, and economics to solve individual and community levels.

Social work is essential and has its roots in society’s attempts at large to deal with the problem of poverty and inequality. Social work is ravelled with the idea of charity work, in broader terms. The concept of charity goes back to early times, and the tradition of providing for the needy has roots in all the world religions.

- The number of weak, needy, and disadvantaged people in India is growing day by day. Because of factors such as education, alcoholism, drug abuse, poverty, racism, unemployment, health, people are suffering daily all over the globe.

- The MSW course provides a start to social personalities involved in people’s lives connected with the kind of social injustice, either indirectly or directly.

- MSW is the only course that provides required training to work in different sections of society regarding social work, social service, and social justice.

Skillset Required for MSW Course

Applicants who want to pursue the MSW course need to have excellent communication skills. Some additional key skills that an aspirant should hold on to when thinking of pursuing the course are listed below:

- Empathy

- Good listener

- Emotional intelligence

- Critical thinking

- Tolerance

- Social perceptiveness

- Persuasion

- Integrity

- Ability to set boundaries

- Self-awareness

- Ability to coordinate

MSW (Master of Social Work) Course Eligibility Criteria

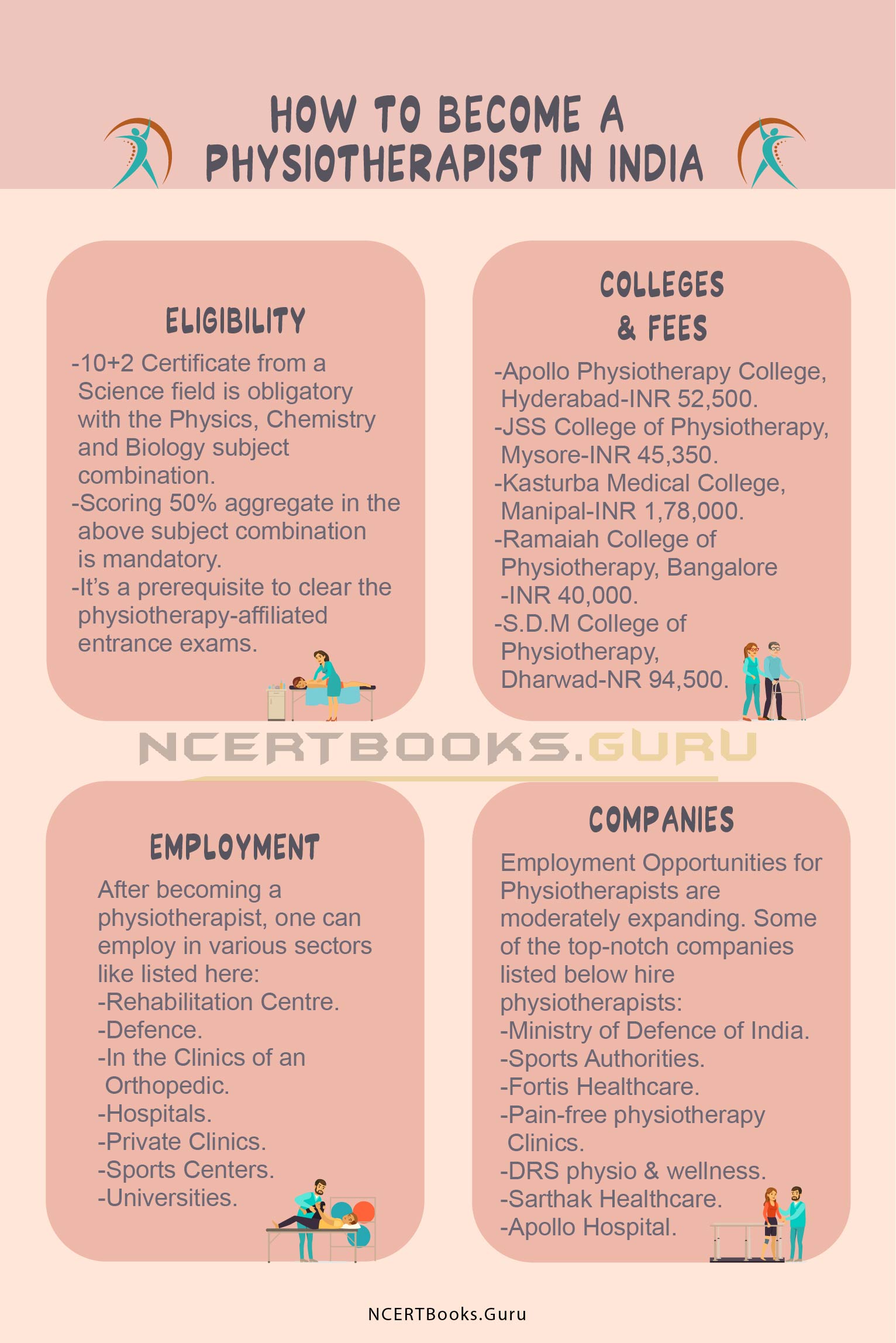

The eligibility required is the following:

- Bachelor of Social Work (BSW) from any recognized college with a minimum of 50% marks.

- Science/Management/Humanities/Social Science/ and other qualifications are also eligible for the MSW course if the student has obtained a minimum of 50%.

- Students waiting for their Bachelor’s degree results can also apply for the program with the scores they have.

Master Of Social Work (MSW) Course Details

- MSW Full form- Master of social work

- Course Level- Postgraduate

- Duration- 2 years

- Examination Type- Semester Type

- MSW Course Qualification- Graduation in any Stream

- MSW Course Admission Process- Merit-Based + Written Test, followed by Personal Interview or Group Discussion.

- Average Fees-INR 1-2 Lakhs

- Job Positions – Social Worker, Public Welfare Managers, Consultants, Project Coordinator, Professor, Training Coordinator, etc.

- Average Salary- INR 3-5 LPA

- Job Sectors- Government Dept., NGOs, Global Counselling Centre, Health Industry, Human Rights Agencies, etc.

Also, Refer

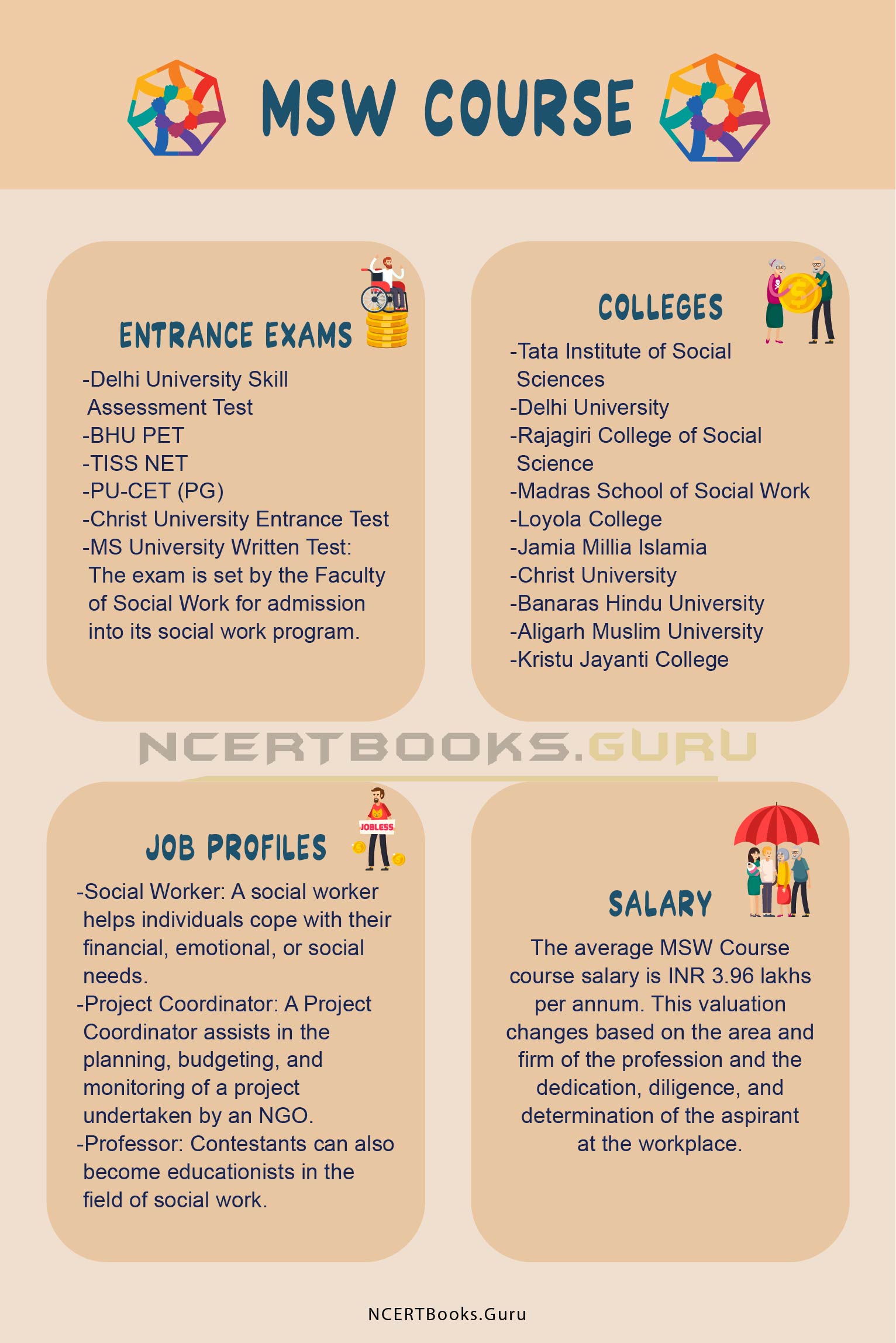

MSW Entrance Exams

Colleges select students based on the written test or assessment test scores, followed by a Personal Interview.

Some of the tests are

- Delhi University Skill Assessment Test

- BHU PET

- TISS NET

- PU-CET (PG)

- Christ University Entrance Test

- MS University Written Test: The exam is set by the Faculty of Social Work for admission into its social work program.

List of Top Colleges in India Offering MSW Course

Here, we are mentioning some top listed colleges that are offering MSW undergraduate courses. You can choose the best college according to your preference. It is always better to research the college before joining it.

- Tata Institute of Social Sciences

- Delhi University

- Rajagiri College of Social Science

- Madras School of Social Work

- Loyola College

- Jamia Millia Islamia

- Christ University

- Banaras Hindu University

- Aligarh Muslim University

- Kristu Jayanti College

- Stella Maris College

- Central University of Rajasthan

MSW Course Fees Structure

The fee structure varies from college to college. The average course fee for the Masters of Social Work varies from 8000 to 2 lakhs per annum.

Masters in Social Work Distance Course Eligibility

The Eligibility Criteria for Masters in social work Distance Education is that the Student must have completed the graduation degree from a regionally certified university. Candidates from any stream Commerce, Humanities, or Science are qualified to pursue MSW as a course at the post-graduation level.

MSW Course Syllabus

MSW Subjects for Semester 1, 2,3, and 4

- Social Work Profession

- Social Group Work

- Social Case Work

- Community Organization

- Concurrent Field Work including Social Work Camp

- Concurrent Field Work including Study Tour

- Analysis of Indian Society

- Social Policy, Planning & Development

- Dynamics of Human Behaviour

- Social Work with Rural, Urban and Tribal Community

- Study of Indian Economics

- Social Work Approaches for Social Development

- Study of Indian Constitution Social Work and Social Justice

- Social Work Research and Statistics

- Social Work Administration

- Personal & Professional Growth

- Field Work including Case Studies

- Block Placement

- Women & Child Development

- Labour Welfare & Legislation

- Criminology & Correctional Administration

- Human Resource Management

- Introduction to Disaster Management

- Medical & Psychiatric Social Work

- Communication and Counselling

MSW Course Subjects

The subjects introduced in the curriculum of the MSW course are enlisted below. Some minor variations may occur in the curricula of colleges, institutes, and universities across the nation.

- Social Work Profession

- Social Group Work

- Social Case Work

- Community Organization

- Concurrent Field Work including Social Work Camp

- Concurrent Field Work including Study Tour

- Analysis of Indian Society

- Social Policy, Planning & Development

- Dynamics of Human Behaviour

- Social Work with Rural, Urban and Tribal Community

- Study of Indian Economics

- Social Work Approaches for Social Development

- Study of Indian Constitution

- Social Work and Social Justice

- Social Work Research and Statistics

- Social Work Administration

- Concurrent Field Work including Summer Placement

- Concurrent Field Work with Case Studies

- Dissertation

- Block Placement

- Women & Child Development

- Labour Welfare & Legislation

- Criminology & Correctional Administration

- Human Resource Management

- Introduction to Disaster Management

- Medical & Psychiatric Social Work

- Communication and Counselling

- Personal & Professional Growth

MSW Course Specializations

- Community Social Work

- Child, Family, and School Social Work

- Mental Health and Substance Abuse Social Work

- Social Work with Military Members and Veterans

- Social Work Administration

- Domestic Violence Counseling

- ElderCare

MSW Course Job Profiles

After completing the MSW course, students can pursue higher studies in social work or opt to get a job in the field of social work after completing their MSW course. Some job profiles that applicants can join after completing their MSW course are listed below:

- Social Worker: A social worker helps individuals cope with their financial, emotional, or social needs.

- Project Coordinator: A Project Coordinator assists in the planning, budgeting, and monitoring of a project undertaken by an NGO.

- Professor: Contestants can also become educationists in the field of social work.

Some reputed organizations that work for the socio-economic support and the welfare of the disadvantaged, orphans, and people with disabilities are:

- CINI

- CRY

- Department of Rural Development

- HelpAge India

- UNESCO

- UNICEF

- Internationally recognized NGO’s

Salary Offered After MSW Course

The average MSW Course course salary is INR 3.96 lakhs per annum. This valuation changes based on the area and firm of the profession and the dedication, diligence, and determination of the aspirant at the workplace.

FAQ’s on MSW Course Details

Question 1.

What is the use of the MSW Course?

Answer:

Social work is essential and has its roots in society’s attempts at large to deal with the problem of poverty and inequality. Social work is ravelled with the idea of charity work, in broader terms.

Question 2.

What is the Eligibility Criteria for MSW?

Answer:

The Eligibility criteria for MSW are

- Bachelor of Social Work (BSW) from any recognized college with a minimum of 50% marks.

- Science/Management/Humanities/Social Science/ and other qualifications are also eligible for the MSW course if the student has obtained a minimum of 50%.

Question 3.

What is the job Profile after we pursue MSW?

Answer:

After completing the MSW course, students can pursue higher studies in social work or opt to get a job in the field of social work after completing their MSW course.