Master of Financial Management (MFM) Course: Master of Financial Management is one of the most growing and enthusiastic courses that has come to light very recently. For all participants who are seeking to pursue this course, this article will give an insight into the eligibility, syllabus, scope, and salary of this course. For further details on the admission and application process of this course, this article has been written with the precision of keeping in mind the best needs of the students.

- Master of Financial Management (MFM) Course Highlights

- About Master of Financial Management (MFM) Course

- Top Institutes for Master of Financial Management (MFM) Course in India

- Syllabus for Master of Financial Management (MFM) Course

- Master of Financial Management (MFM) Course Eligibility Criteria

- Master of Financial Management (MFM) Course Admission Details

- Job Profiles Under Master of Financial Management (MFM) Course

- Salaries Offered to Financial Management Professionals

- What are the job opportunities of the famous positions accessible for MFM graduates?

- What is the normal salary of an MFM graduate?

- Is there any age limit for the Masters of Financial Management course?

- How might I top off the application structure for the Masters of Financial Management course?

- Is there any requirement for a Masters of Financial Management Admission?

- What is the normal charge for a Masters of Financial Management course?

- What is the base pass rate required for admission to the Masters in Financial Management?

- What are the qualification models to seek after the MFM course?

- What is the term of the Masters of Financial Management (MFM) course?

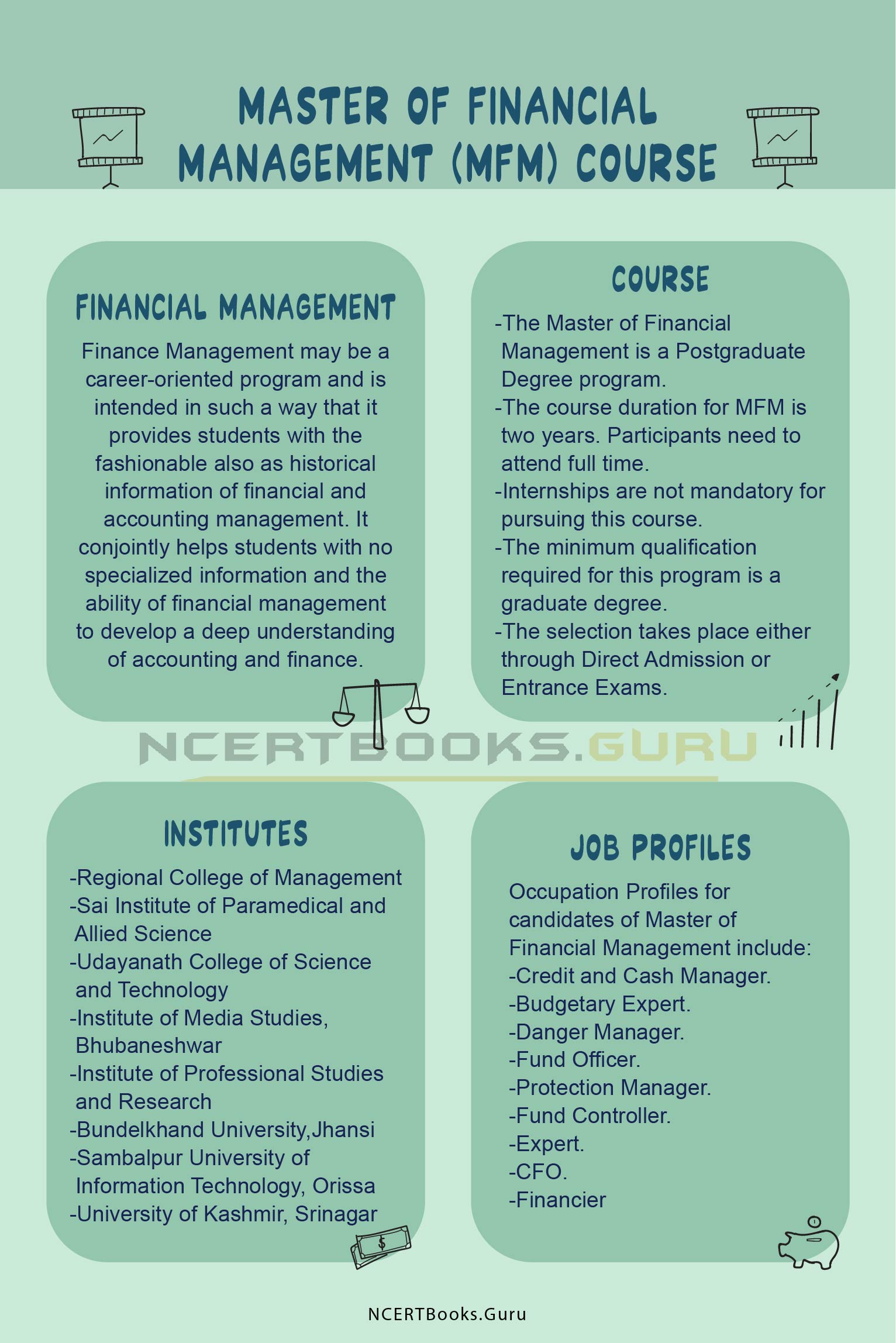

What is Financial Management?

Finance Management may be a career-oriented program and is intended in such a way that it provides students with the fashionable also as historical information of financial and accounting management. It conjointly helps students with no specialized information and the ability of financial management to develop a deep understanding of accounting and finance.

It is a biennial program and is best suited to candidates who have continually been fascinated by finance, risk management, project designing and management, economic analysis, promoting analysis, audit, company designing, etc. besides the interest within the higher than subjects. Candidates should have smart analytical skills and the latest information on online applications.

Master of Financial Management (MFM) Course Highlights

- The Master of Financial Management is a Postgraduate Degree program.

- The course duration for MFM is two years. Participants need to attend full time.

- Internships are not mandatory for pursuing this course.

- The minimum qualification required for this program is a graduate degree.

- The selection for Master of Financial Management takes place either through Direct Admission or Entrance Exams.

- The course fee for this program varies in the range of Rs.5,000 to Rs. 2,12,000 depending on the institution the candidate gets enrolled in.

- The different perspective job profiles include Banking, Research Institutions, Financial Companies, Private Companies, etc.

- The job professions for the candidates include Chief Financial Officer, Finance Manager, Insurance Manager, Credit and Cash Manager, Consultant, Treasurer, Risk Manager, Financial Officer.

- The average salary for the candidate on completion of this course ranges between Rs. 7,00,000 to Rs. 35,00,000 per annum depending on the profession and type of job they pursue.

About Master of Financial Management (MFM) Course

Master of Finance Management degree program contains exercises in the central regions of regulatory and administrative dynamic, for instance, Managerial Economics, Organizational Behavior, Quantitative Techniques, Corporate Laws, Financial Accounting and so on., and furthermore in different zones of money, for instance, Financial Services, Financial Management, International Finance, Investment Management, International Accounting, Project Appraisal, and so forth.

The term of the program is two years and isolated into four semesters. The two-year ace degree course will outfit the competitors with logical and reasonable abilities for monetary dynamic. The program is stacked with a wide scope of vocation openings, both at the scholarly and corporate levels. The main year of the program is proposed to be an overall administration program with up-and-comers being prepared on the reason for the various subjects and monetary administration just as getting significance appreciation of money and control.

The subsequent year contains progressed programs with conclusive themes and tasks critical to the subject and introduced to explicit points in the diverse zone of budgetary administration. The Master of Finance Management Course is reasonable for those up-and-comers who have a decent enthusiasm for trade, fund, and diverse Mathematical exercises and need to become a speaker or teacher. Applicants ought to be fully informed regarding the investigation and information regarding the matter just as the current worldwide – public money related situation.

Applicants must have good systematic and numerical abilities, information on current PC innovation, critical thinking, dynamic, honesty, and association aptitudes. Up-and-comer ought to have the thought in regards to the corporate framework and should think pretty much all the charges and different monetary laws concerning their industry.

Top Institutes for Master of Financial Management (MFM) Course in India

| Name of College | Average Annual Fees | City |

| Regional College of Management | Rs. 1,00,00 | Bhubaneshwar |

| Sai Institute of Paramedical and Allied Science | Rs. 77,000 | Dehradun |

| Udayanath College of Science and Technology | Rs. 29,000 | Cuttack |

| Institute of Media Studies | Rs. 80,000 | Bhubaneshwar |

| Institute of Professional Studies and Research | Rs. 1,90,000 | Cuttack |

| Bundelkhand University | Rs. 42,000 | Jhansi |

| Sambalpur University of Information Technology | Rs. 60,000 | Orissa |

| University of Kashmir | Rs. 17,000 | Srinagar |

| University of Delhi | Rs. 20,000 | Delhi |

Syllabus for Master of Financial Management (MFM) Course

First Year

- Indian Financial System.

- Applied Financial Economics.

- Business Information System.

- Banking and Insurance Management.

- Corporate and Securities Law.

- Research Methods and Data Analysis.

- Advanced Corporate Accounting.

- Management of Financial Services.

Second Year

- Direct Taxes.

- Security Analysis and Portfolio Management.

- Treasury Management.

- Debt Markets.

- Debt Markets and Mutual Funds.

- Project Appraisal and Financing.

- Corporate Governance and Business Ethics.

- Management of Public Finance.

- Global Business Finance.

Get to Know More about other types of Course Details Streamwise, and Category wise

Master of Financial Management (MFM) Course Eligibility Criteria

To get affirmation in the MFA course, one must meet the accompanying qualification rules.

- Least Qualification Required: Bachelor’s certificate.

- Least Marks Required: half for the overall class and 45% for the held classification.

- Subjects Requirement: Candidates from business or money foundation are preferred during admission.

- Work Experience: Many colleges expect the possibility to hold in any event two years of work involved with the Finance field.

Master of Financial Management (MFM) Course Admission Details

- Admission to the MFM program in India can fluctuate contingent on a foundation’s prudence.

- Numerous business schools concede up-and-comers carefully on merit premise.

- Some institutes direct their own placement tests for confirmations.

- Regardless, understudies’ exhibition in the passing assessment is considered at the hour of definite choice.

The candidates who are wanting to join the MFM program must need to initially apply for the program after their graduation. Conceivably they will fill the application structure for an entrance test or for the affirmation on the legitimacy premise. Different schools and colleges are additionally offering confirmation dependent on the CAT score.

For example, the University of Delhi offers confirmation dependent on the CAT Percentile. Along these lines, the intrigued candidates will fill the application structure and will fill every single detail of the CAT assessment. A Group Discussion and Personal Interview likewise will be accessible for the applicant. In the event that the candidates navigate every one of these methods, at that point, they will be offered a seat for the Master of Financial Management (MFM) course. Following are some placement test that is led by a portion of the Bachelor of Arts schools in India:

- Feline.

- University of Kashmir Entrance Exam.

- Gulbarga University Entrance Exam.

Read More Related Articles:

- MBA Course Details

- MBA Computer Science Course

- MBA in Education Management Course

- Courses After MBA

- Shipping Management Courses

Job Profiles Under Master of Financial Management (MFM) Course

Master of Financial Management course prepares the possibility to exceed expectations in a business vocation in any aspect of the world. The MFM program guarantees that competitors have a severe range of abilities required for budgetary administration, making them work prepared both for the private and open segments.

With adequate information and expert experience, up-and-comers can likewise become budgetary specialists. Money related specialists during their activity make budgetary arrangements for people and plan the obtaining of different organizations. Recorded beneath are some mainstream work jobs and business zones for MFM postgraduates.

Work Areas for candidates of Master of Financial Management include

- Instruction and Research Institutes.

- Government Agencies.

- Firms.

- Budgetary Institutions

Occupation Profiles for candidates of Master of Financial Management include

- Credit and Cash Manager.

- Budgetary Expert.

- Danger Manager.

- Fund Officer.

- Protection Manager.

- Fund Controller.

- Expert.

- CFO.

- Financier

Salaries Offered to Financial Management Professionals

Accountants: Rs. 2,00,000 to Rs. 3,00,000.

An accountant is dependable to get ready capital record passages, resources, and liabilities, investigating and assembling account data, and analyze monetary records. They guarantee that documents are precise and that charges are paid on time.

Financial Plan Manager: Rs. 3,00,000 to Rs. 4,00,000.

The budget Manager is dependable to build up the organization’s spending plan and direct hierarchical spending to ensure that it is inside the budget.

Business Analyst: Rs. 8,00,000 to Rs. 9,00,000.

Business Analyst is accountable for planning and change of the business framework. They are in association and correspondence with the partners of the undertaking and topic specialists to comprehend their issues, issues, and requirements.

Budgetary Analyst: Rs. 3,00,000 to Rs. 4,00,000.

Financial Analyst is capable of investigating and looking at money related data through making, gathering, and observing monetary models for choice help, They additionally improve budgetary status through breaking down the outcomes, recognizing patterns checking fluctuations, and prescribing activities to management.

Speculation Analyst: Rs. 9,00,000 to Rs. 10,00,000.

Investment Analyst is capable of giving stockbrokers, securities exchange brokers, and reserve supervisors with monetary data, suggestions, and guidance got from venture information of whole the world.

Depending upon the profile of the job and the firm that a candidate chooses to work in, the salary varies. Salaries for some other professions include:

- Chief Financial Officer: Rs.7,80,000 too Rs. 80,00,000.

- Insurance Manager: Rs. 4,40,000 to Rs. 11,90,000.

- Finance Offier: Rs. 1,60,000 to Rs. 7,00,000.

- Finance Expert: Rs. 2,20,000 to Rs. 5,00,000.

FAQ’s on Master of Financial Management (MFM) Course

Question 1.

What are the job opportunities of the famous positions accessible for MFM graduates?

Answer:

A portion of the mainstream work profiles accessible for MFM graduates is Finance Officer, Finance Controller, Chief Financial Officer, Risk Manager, Consultant, Treasurer, and so on.

Question 2.

What is the normal salary of an MFM graduate?

Answer:

At first, the normal pay of an MGM graduate went between Rs 4.5 LPA to Rs 5 LPA. However, with 3 to 5 years of experience, and alumni can acquire in the middle of Rs 10 LPA.

Question 3.

Is there any age limit for the Masters of Financial Management course?

Answer:

There is no particular age breaking point to seek after Masters of Financial Management course. Nonetheless, you can cross-check with your preferred school.

Question 4.

How might I top off the application structure for the Masters of Financial Management course?

Answer:

In many universities, the application structures can be filled in online mode which is accessible on the official site, or you can download a similar fill it in online mode if the school acknowledges disconnected application.

Question 5.

Is there any requirement for a Masters of Financial Management Admission?

Answer:

In the vast majority of the schools, Masters of Financial Management affirmation is done based on merit. Be that as it may, some foundation leads their own placement test for confirmations.

Question 6.

What is the normal charge for a Masters of Financial Management course?

Answer:

The normal charge for Masters of Financial Management ranges between Rs 30,000/ – to Rs 2,12,000/ – every year.

Question 7.

What is the base pass rate required for admission to the Masters in Financial Management?

Answer:

The base rate required for Masters of Financial Management is half.

Question 8.

What are the qualification models to seek after the MFM course?

Answer:

So as to seek a Masters of Financial Management Course, applicants need to make sure about a Bachelor Degree.

Question 9.

What is the term of the Masters of Financial Management (MFM) course?

Answer:

The term of the Masters of Financial Management course is of 2 years.