ICWA Course Details: ICWA is the portal to a cost management accountant career. If you aspire to become a Cost Accountant Management, then ICWA is the Course you need to pursue. ICWA is the degree that widens your knowledge on how to regulate finance management competently.

An ICWA Course graduate holds an in-depth knowledge on the regulation of business within the available resources. It becomes the duty of a Cost Accountant to collect and analyze all financial information from all the sectors of the Industry through strategic thinking and work experience. Below is the recorded structure course for aspirants to pursue after twelfth or after graduation.

ICWA Stands for Institute of Cost & Works Accountants of India

This report covers the overall topics like prospectus, course gradations, particulars on qualification, the confirmation process, fee structure, and vocation possibilities.

- Required Skillset for ICWA

- ICWA Course Details

- ICWA Courses Eligibility Criteria

- ICWA Course Duration

- ICWA Course Fee Structure

- ICWA Course Admission Process

- Top Institutes for ICWA Course

- ICWA Course Syllabus

- ICWA Career Prospects

- ICWA Career Options

- Top Recruiters for ICWA

- ICWA Salary Prospects

- What is the required eligibility criteria for the ICWA course exam?

- What are the industries and sectors an ICWA graduate can work?

- What is the skill set required for an ICWA graduate?

- Differentiate between ICWA and CA?

All About ICWA Course Details

ICWAI (Institute of Cost & Works Accountants of India), currently known as The Institute of Cost Accountants of India (ICAI), is a gold standard instructional institution. It offers education, enhances the skills, and aids the development of Cost Accountancy in India.

ICWA is a highly beneficial course that enables aspirants to pursue a career in Cost and Management Accountant. Graduates are given thorough practical training to enhance graduates’ personality development and soft skills.

ICWA ensures a balance between the available resources and expenditures with the help of proper knowledge in Financial and Cost Management.

Required Skillset for ICWA

- Candidates require skills that aid the regulation and management of cost accounting methods and procedures.

- Candidates must possess an in-depth knowledge of standard procedures, concepts, and practices in the related Industry.

- Candidates must possess adequate presentation skills and should be able to perform several tasks related to the field.

ICWA Course Details

| Course | ICWA |

| ICWA Full-form | Institute of Cost and Works Accountants |

| Eligibility Criteria | 10(+2) from recognized board or institution |

| Duration | 18 months |

| Fee Structure | Foundation Stage- ₹4,000/- Intermediate Stage- ₹20,000/- Final Stage- ₹17,000/- |

| Remuneration Structure | ₹3-5 Lakhs per annum/ $53k per annum |

| Similar Courses | CA, CMA, ACCA |

| Employment opportunities | Associate Professor, Cost Controller, Finance Director, Accountant, Chief Auditor, Managing Director, Financial Controller, Chief Accountant, Managing Director, Chief Internal Auditor, Chief Internal Auditor, and Financial Consultant |

ICWA Couse comprises three primary stages- the Foundation Stage, The Intermediate Stage, and the Final Stage.

ICWA Courses Eligibility Criteria

The ICWA course is divided into three primary stages- the Foundation stage, the Intermediate Stage, and the Final Stage.

Aspiring candidates must meet the eligibility criteria to emerge out as a successful ICWA candidate. The essential outline eligibility criteria for candidates is that he/she should have secured a minimum aggregate from a recognized board or institution.

- Eligibility Criteria for ICWA Foundation Stage: Candidates must secure a minimum aggregate in 10th from any recognized institution or board or equivalent. Candidates should have secured a minimum aggregate in 12th from any recognized board or institution or equivalent. Aspirants should be or should have completed the age of 17 years tp deem eligible.

- Eligibility Criteria for ICWA Intermediate Stage: Candidates should have secured a minimum aggregate in their Senior Secondary School Examination (10+2). Candidates should have secured a minimum aggregate in the Graduation/ the Foundation Course in any discipline, excluding fine arts.

- Eligibility Criteria for ICWA Final Stage: Only those candidates who remain qualified in the ICWA Intermediate Stage from the institution are eligible to apply for the ICWA Final Stage.

ICWA Course Duration

The duration for ICWA Course is different for each Stage of examination.

- Foundation Stage: The course duration for ICWA Foundation Stage is a minimum of 8 months’ time-frame.

- Intermediate Stage: The course duration for ICWA Foundation Stage is a minimum of 10 months time-frame.

- Final Stage: The course duration for ICWA Foundation Stage is a minimum of 18 months time-frame.

However, the total time taken to complete the ICWA program depends on the aspirant’s dedication and focus during each Stage of the Course.

ICWA Course Fee Structure

The approximate Fee Structure for the ICWA course is different for three stages of the Course.

- For Foundation Stage: The ICWA Course Exam Fee payment for Foundation Stage is Rs.4,000/-

- For Intermediate Stage: The ICWA Course Exam Fee payment for Intermediate Stage is Rs.20,000/-

- For Final Stage: The ICWA Course Exam Fee payment for Final Stage is Rs.17,000/-

ICWA Course Admission Process

The Admission Procedure for ICWA will be based on the ICWAI entrance examination conducted by the ICAI (Institute of Cost Accountants of India) for all the three stages of the exam- the Foundation, Intermediate, and Final exam. The ICWA examination is conducted twice in the same year- June and December.

For those candidates seeking to apply for the ICWA course exams in December, are needed to apply latest by June 30. Those candidates seeking to apply for the ICWA course exams in June are needed to reply latest by December 31 of the previous year.

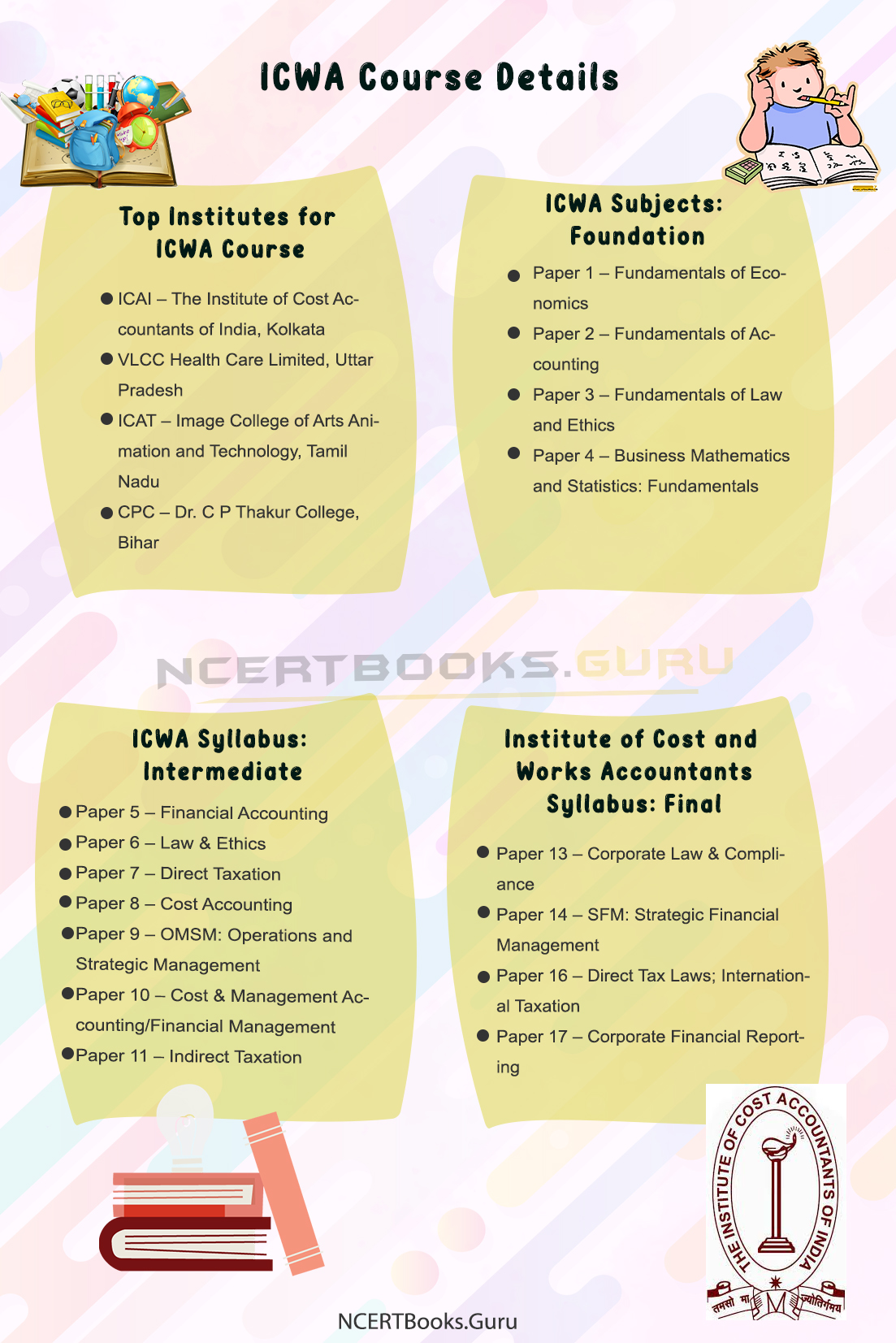

Top Institutes for ICWA Course

- ICAI – The Institute of Cost Accountants of India, Kolkata

- VLCC Health Care Limited, Uttar Pradesh

- ICAT – Image College of Arts Animation and Technology, Tamil Nadu

- CPC – Dr. C P Thakur College, Bihar

- ICWAI – Institute of Cost and Works Accountants of India, Delhi

ICWA Course Syllabus

ICWA Subjects: Foundation

- Paper 1 – Fundamentals of Economics

- Paper 2 – Fundamentals of Accounting

- Paper 3 – Fundamentals of Law and Ethics

- Paper 4 – Business Mathematics and Statistics: Fundamentals

ICWA Syllabus: Intermediate

- Paper 5 – Financial Accounting

Paper 6 – Law & Ethics

Paper 7 – Direct Taxation

Paper 8 – Cost Accounting - Paper 9 – OMSM: Operations and Strategic Management

- Paper 10 – Cost & Management Accounting/Financial Management

- Paper 11 – Indirect Taxation

- Paper 12 – CAA: Company Accounts & Audit

Institute of Cost and Works Accountants Syllabus: Final

- Paper 13 – Corporate Law & Compliance

Paper 14 – SFM: Strategic Financial Management

Paper 16 – Direct Tax Laws; International Taxation - Paper 17 – Corporate Financial Reporting

- Paper 18 – Indirect Tax Laws, Practice

- Paper 19 – Cost & Management Audit

- Paper 20 – SFP: Strategic Performance Mgt & Business Valuation

ICWA Career Prospects

With the advancement of demands in management positions, costs, and the economy, ICWA graduates’ demand is on a rapid rise. ICWA graduates have a high demand in the private sector, public sectors, government sectors, finance and banking sectors, training sectors, development agencies, and the education industry. ICWA graduates hold significant positions in managerial positions available in various industries and organizations under the public and private sectors.

ICWA graduates get employed in some popular areas such as developmental agencies, consultancy firms, service industries, stock exchanges, company affairs departments, public utility sector, research organizations and training centers, and other regulatory bodies.

ICWA Career Options

- Associate Professor

- Cost Controller

- Finance Director

- Accountant

- Chief Auditor

- Managing Director

- Financial Controller

- Chief Accountant

- Managing Director

- Chief Internal Auditor

- Chief Internal Auditor

- Financial Consultant

See More:

Top Recruiters for ICWA

- ALTRET Industries Pvt. Ltd.

- Zexus Air Services Pvt Ltd

- Micro Inks Limited

- Government and Private Institutions

- Inext Infotech Services

ICWA Salary Prospects

In India, the average salary for a fresher ICWA professional after completing the Course fluctuates between 3 to 4 Lakhs per annum. However, the graduate’s salaries depend on the Industry, experience in the field, and the Job profile. In the USA and other countries, the average salary for an ICWA graduate is around $53k per annum.

FAQ’s on ICWA Course Details

Question 1.

What is the required eligibility criteria for the ICWA course exam?

Answer:

The ICWA course is divided into three primary stages- the Foundation stage, the Intermediate Stage, and the Final Stage. However, aspiring candidates must meet the eligibility criteria to emerge out as a successful ICWA candidate. The essential outline eligibility criteria for candidates is that he/she should have secured a minimum aggregate from a recognized board or institution.

Question 2.

What are the industries and sectors an ICWA graduate can work?

Answer:

ICWA graduates get employed in some popular areas such as developmental agencies, consultancy firms, service industries, stock exchanges, company affairs departments, public utility sector, research organizations and training centers, and other regulatory bodies.

Question 3.

What is the skill set required for an ICWA graduate?

Answer:

AsprisingCandidates require skills that aid the regulation and management of cost accounting methods and procedures. They must possess an in-depth knowledge of standard procedures, concepts, and practices in the related Industry. Finally, candidates must possess adequate presentation skills and should be able to perform several tasks related to the field.

Question 4.

Differentiate between ICWA and CA?

Answer:

ICWA is a cost accounting degree that equips individuals with an in-depth knowledge of the management of finance competently. While CA is a qualification designed in accounting that may be pursued right away after the twelfth exams

Summary

We hope that the complete information on the concept ICWA course details has helped improve your understanding of the subject with in-depth knowledge.