Introduction

Money transfers are a very common and cautious phenomenon. There are several ways to transfer money from one bank account to another in the contemporary situation.

These different processes are simple ways but must be carried out with high understanding and precaution to avoid unethical activities. However, large amounts of money are commonly transferred by visiting a bank.

You can also find differences between articles on various topics that you need to know. Just tap on the quick link available and get to know the basic differences between them.

What is the Difference Between NEFT and RTGS?

About NEFT

NEFT is an abbreviation for National Electronics Funds Transfer. It is an effective way of transferring electronic funds from one bank account to another bank account. This is a national scheme that allows money transfers among Indian Banks only.

NEFT is a process that settles money in batches. The transaction quite complicated but allows the secure processing of funds. The timing slot for NEFT transactions among banks is 8 am to 7 pm, settling transactions on an hourly basis.

About RTGS

RTGS is an abbreviation for Real-Time Gross Settlement. It is the simplest and fastest way of transferring funds between account holders in banks of India. The process involves the real-time transfer of electronic funds.

RTGS enables the transfer of funds all at once and in very less time. The minimum amount of fund transfer through RTGS is 2 Lakhs. One can avail of both online and offline options to transfer electronic funds via RTGS.

Difference Between NEFT and RTGS

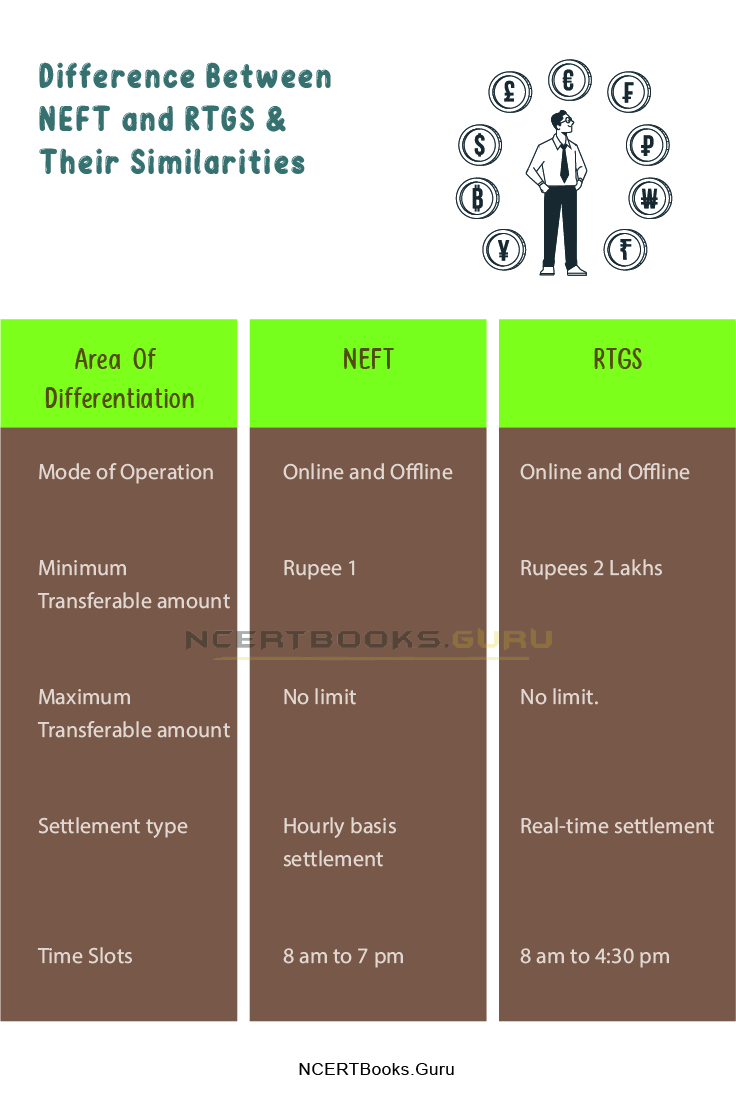

| Area Of Differentiation | NEFT | RTGS |

| Mode of Operation | Online and Offline | Online and Offline |

| Minimum Transferable amount | Rupee 1 | Rupees 2 Lakhs |

| Maximum Transferable amount | No limit | No limit. |

| Settlement type | Hourly basis settlement | Real-time settlement |

| Time Slots | 8 am to 7 pm | 8 am to 4:30 pm |

| Delayed Transactions | The transaction shall resume on the next working day if initiated after the cut-off time | The transactions are cancelled if initiated after mentioned cut-off time |

| Transaction failure | If a transaction fails, the beneficiary bank refunds the settled amount within two hours. | If the transaction fails, the beneficiary bank must refund the amount upon remittance within an hour. |

| Charges | The maximum charges for NEFT transfers do not exceed 25 Rupees + GST. | The maximum charges for NEFT transfers do not exceed 55 Rupees + GST. |

Similarities of NEFT and RTGS Music

- Both NEFT and RTGS are secure ways of transferring electronic money from one bank account to another bank account.

- Both NEFT and RTGS can be availed in offline and online modes. Either way can be practised.

- Both the transfer analytics are noted in the records of the Reserve Bank Of India.

- Both the NEFT and RTGS mode of transferring funds is liable to certain charges with added GST. These charges differ according to the amount of money being transferred.

- Both the options for transferring money is limited to Indian banks and Indian bank accounts only. This is a national scheme of secure money transfers.

Frequently Asked Questions on Difference Between NEFT and RTGS

Question:

Can I do NEFT or RTGS on my own?

Answer:

Both NEFT and RTGS can be done at the comfort of time and place using internet banking. The basic need for this method is a stable internet connection and internet banking credentials.

Question:

Does NEFT take more time than RTGS?

Answer:

Yes, NEFT takes slightly more time than RTGS.

Question:

Is it safe to choose NEFT or RTGS?

Answer:

NEFT and RTGS are both secured options for money transfers.