TS Grewal Accountancy Class 11 Solutions Chapter 12 Accounting for Bills of Exchange – Here are all the TS Grewal solutions for Class 11 Accountancy Chapter 12. This solution contains questions, answers, images, explanations of the complete Chapter 12 titled Accounting for Bills of Exchange of Accountancy taught in Class 11. If you are a student of Class 11 who is using TS Grewal Textbook to study Accountancy, then you must come across Chapter 12 Accounting for Bills of Exchange. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete TS Grewal Solutions for Class 11 Accountancy Chapter 12 Accounting for Bills of Exchange in one place.

TS Grewal Accountancy Class 11 Solutions Chapter 12 Accounting for Bills of Exchange

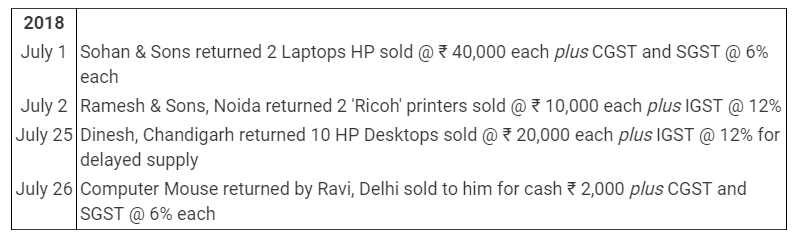

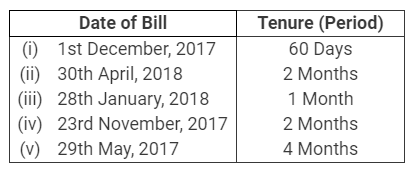

Question 1.

Calculate the due dates of the bills in the following cases:

Solution:

Note:

(i) As per this Question, point no. iii. Correct answer is Due Date of 3rd March 2018. While, according to the book is solution is 1st March 2018.

(ii) As per this Question, point no. ii. Correct answer is Due Date of 3rd July 2018. While, according to the book is solution is 3rd July 2017

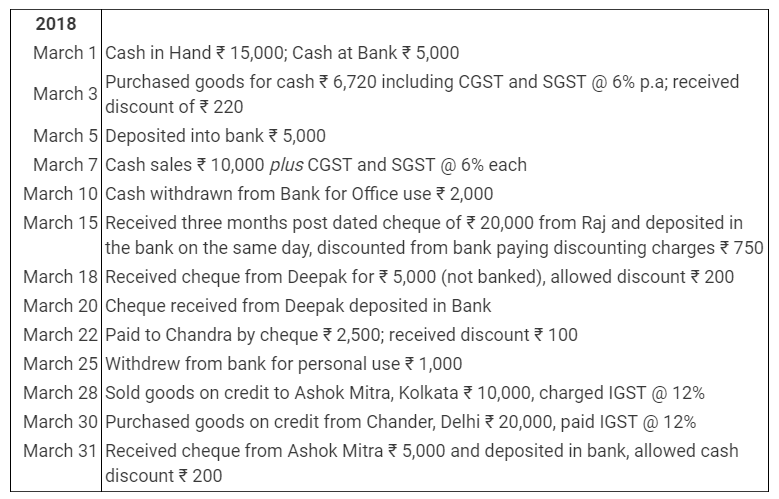

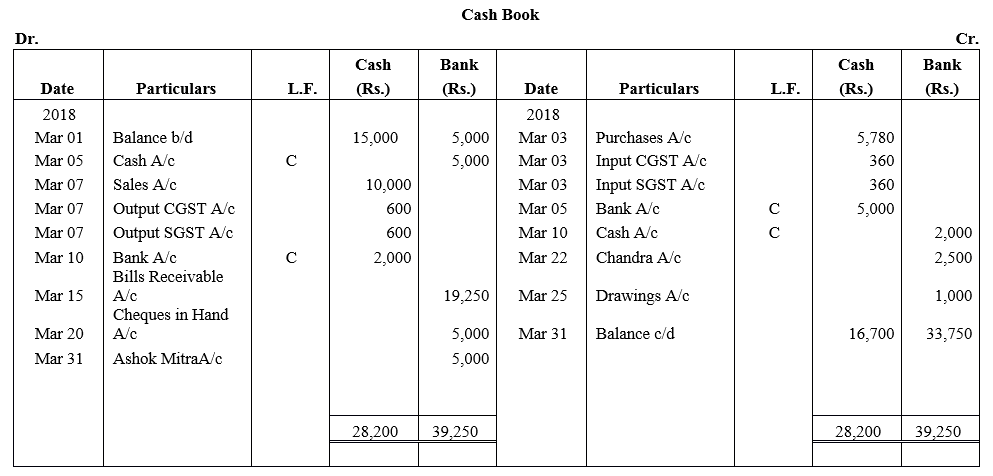

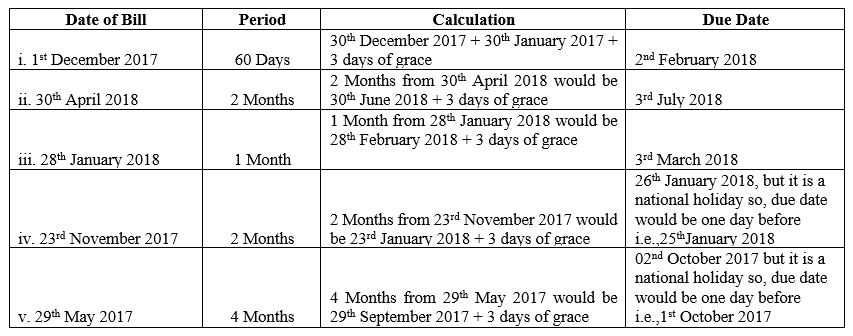

Question 2.

On 10th March, 2018, A draws on B a bill at 3 months for ₹20,000 which B accepts immediately and returns to A. The bill is honoured due date.

Pass necessary Journal entries in the books of both the parties.

Solution:

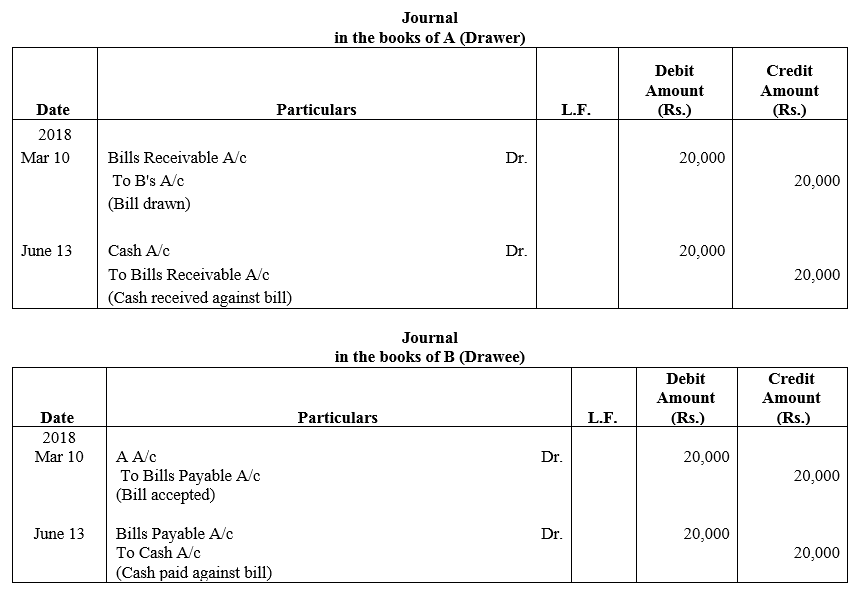

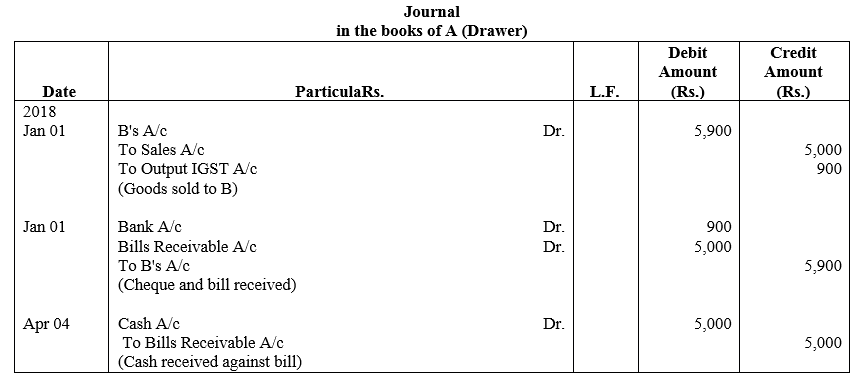

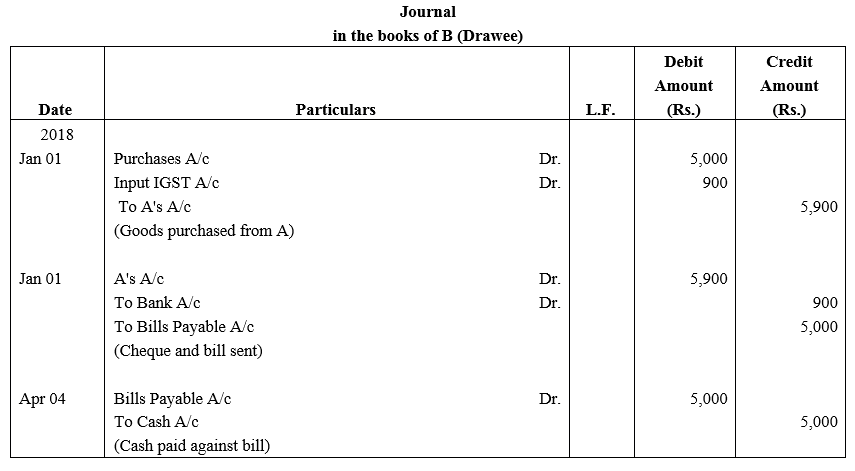

Question 3.

On 1st January, 2018, A sold goods to B for ₹ 5,000 plus IGST @ 18%. A received ₹ 900 by cheque from B and drew on him a bill for the balance amount payable 3 months after date. The bill was duly accepted by B. A retained the bill till due date. On due date, the bill was paid. Pass Journal entries in the books of A and B. Also, show necessary accounts in the books of both the parties.

Solution:

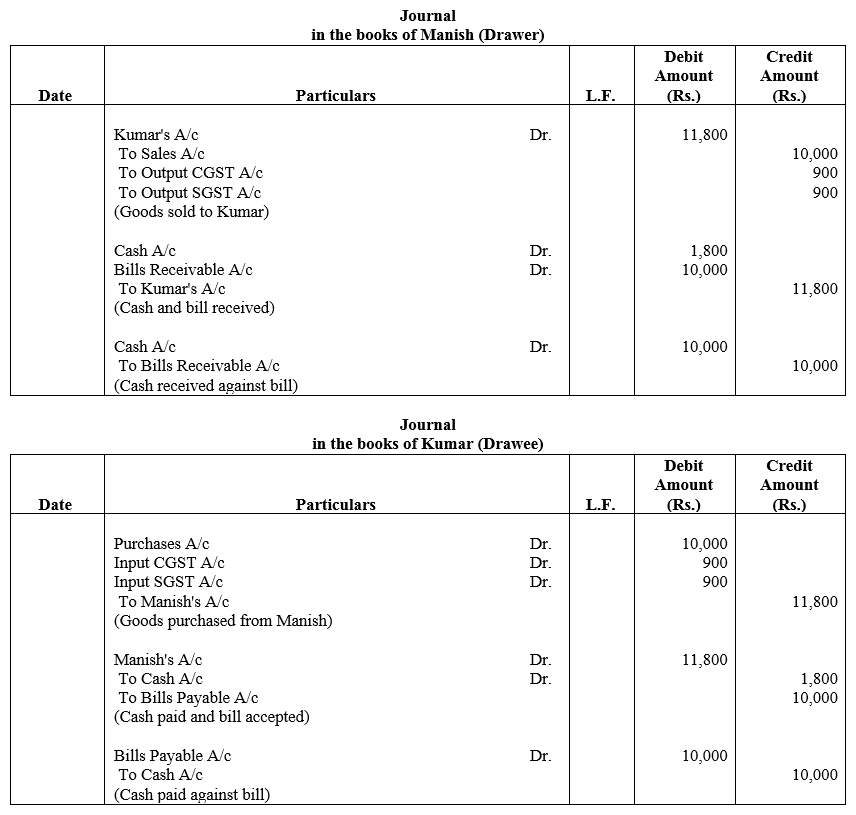

Question 4.

Manish sold goods to Kumar for ₹ 10,000 plus CGST and SGST @ 9% each. He received ₹ 1,800 in cash and drew on him a bill for ₹ 10,000 payable 3 months after date. Kumar accepted the bill and returned it to Manish. On due date, Manish presented the bill to Kumar who honoured it. Pass Journal entries in the books of both the parties.

Solution:

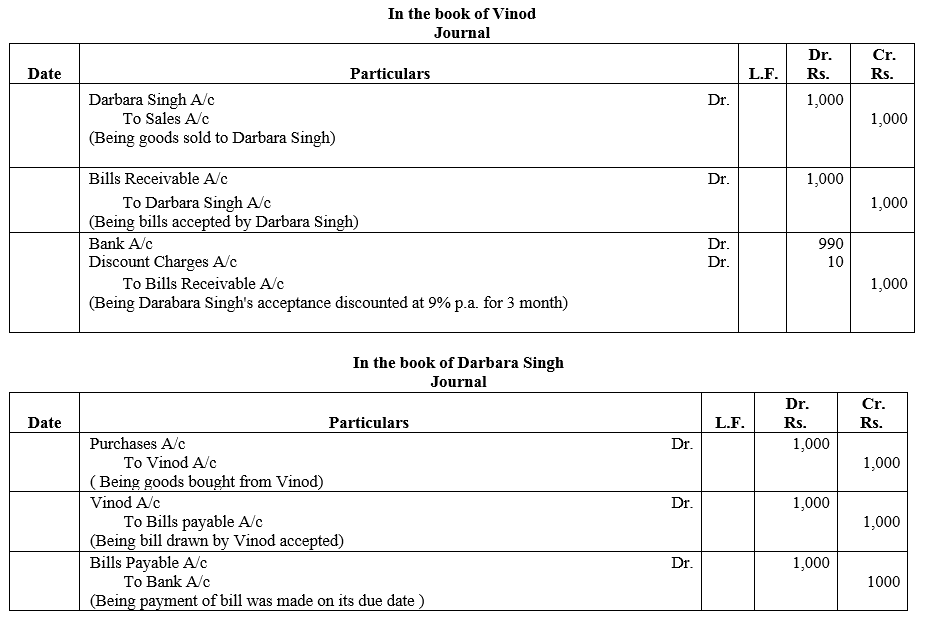

Question 5.

Vinod sold goods to Darbara Singh for ₹ 1,000. He drew on the latter a bill for the amount payable 3 months after date.He discounted the bill with his bankers for ₹ 990. On maturity, the bill is duly met. Make the Journal entries in the books of Vinod and Darbara Singh.

Solution:

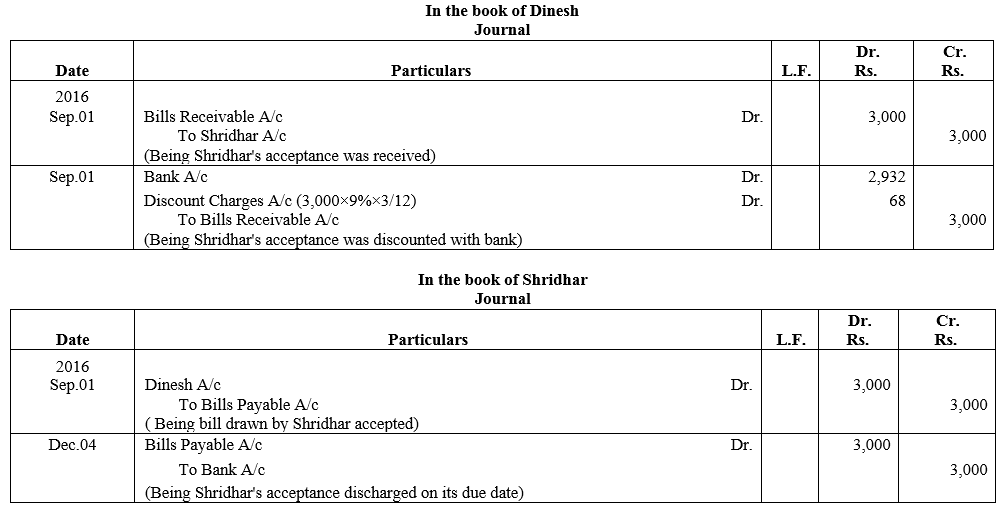

Question 6.

Dinesh received from Shridhar an acceptance for ₹ 3,000 on 1st September, 2016 at 3 months. Dinesh got the acceptance discounted at 9% p.a. from his bank. On the due date, Shridhar paid the required amount.

Give the Journal entries in the books of Dinesh and Shridhar.

Solution:

Question 7.

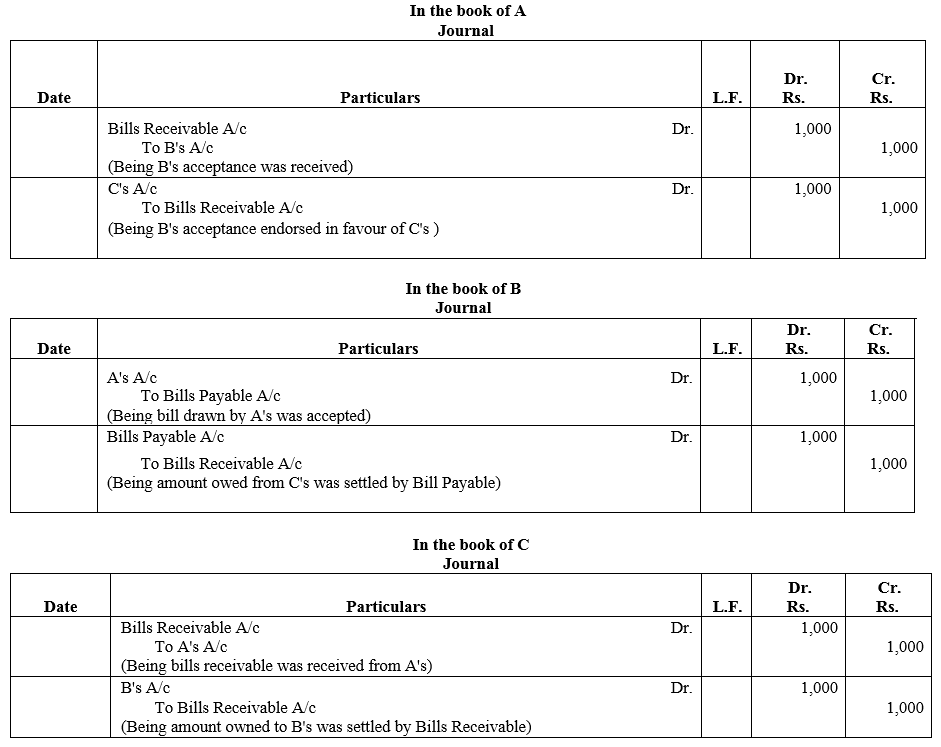

A drew a bill of ₹ 1,000 on B for 3 months which was duly accepted by the latter. A endorsed the bill to C in full payment of his own acceptance to C for a like amount. C endorsed the bill to B.

Solution:

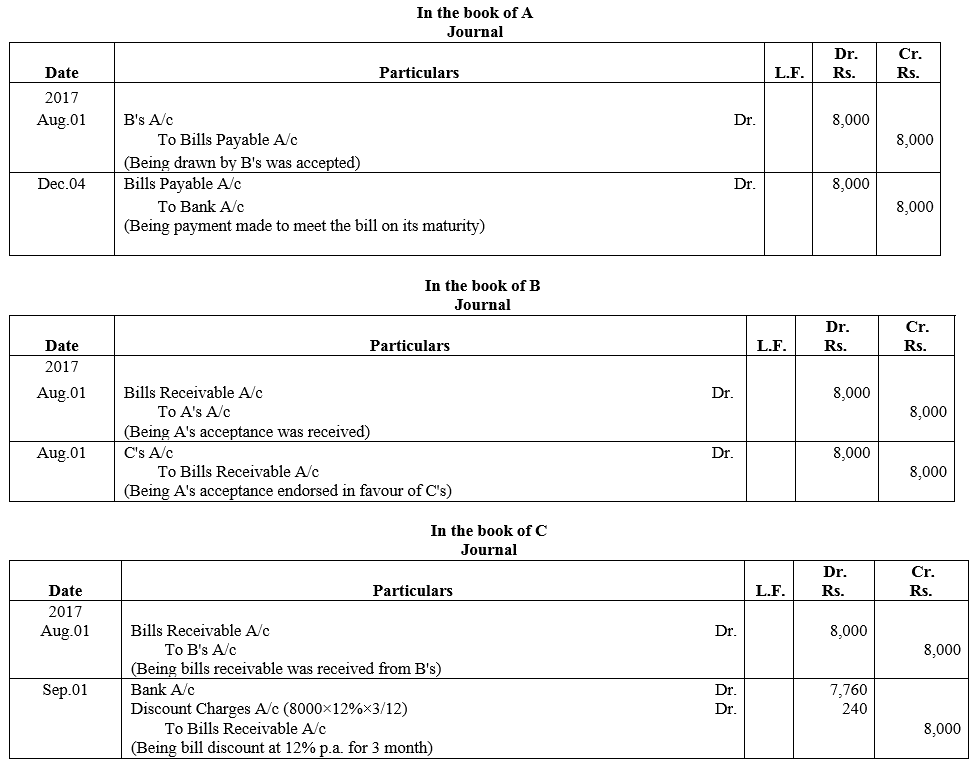

Question 8.

A owed B ₹ 8,000. He gave a bill for the same on 1st August, 2017 payable after 4 months at the Bank of India. Chandni Chowk, Delhi. Immediately after receiving the bill, B endorsed it to C in payment of his debt. On 1st Sepetember, C discounted the bill at 12% p.a. The bill is met on due date. Pass the necessary Journal entries in the books of A, B and C.

Solution:

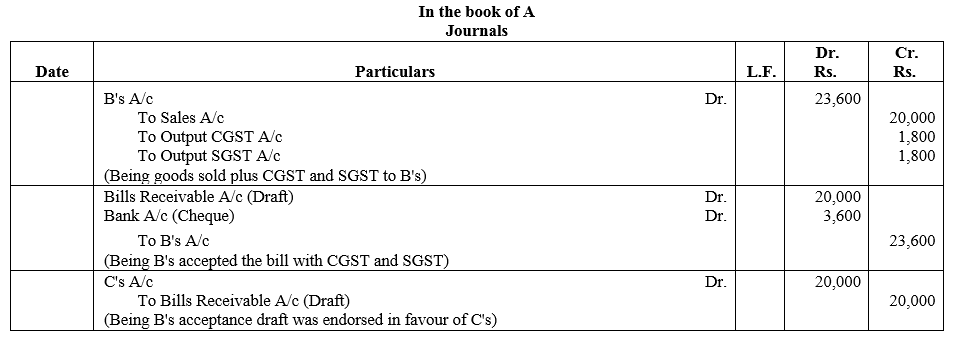

Question 9.

A sold goods to B for ₹ 20,000 plus CGST and SGST @ 9% each on credit 3 months. B paid A ₹ 3,600 by cheque and accepted a draft for the balance amount. The draft was endorsed in favour of C, who got the payment on maturity.

Give Journal entries in the books of A.

Solution:

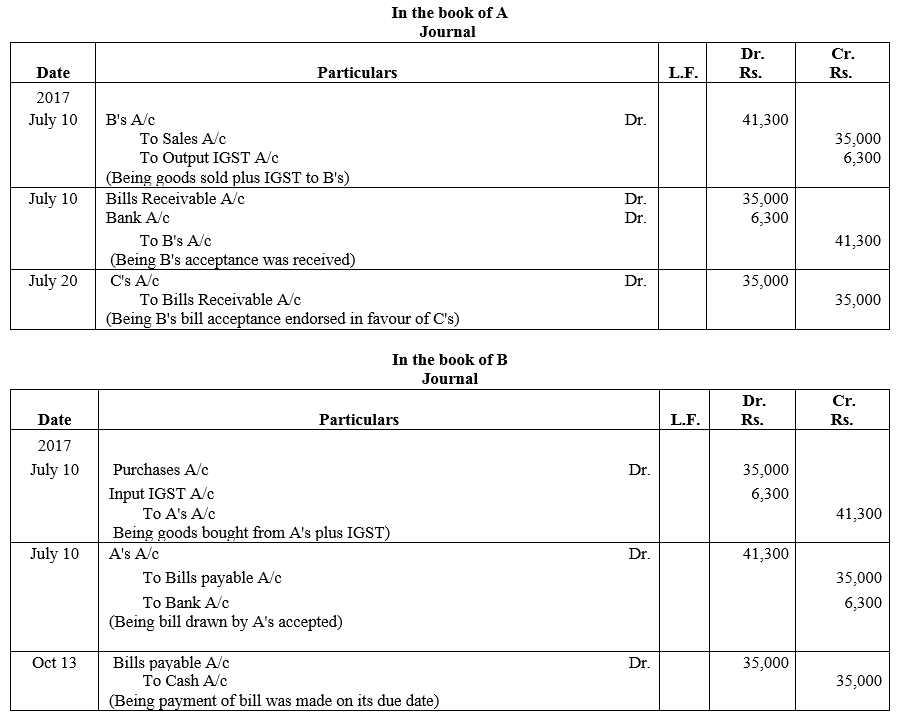

Question 10.

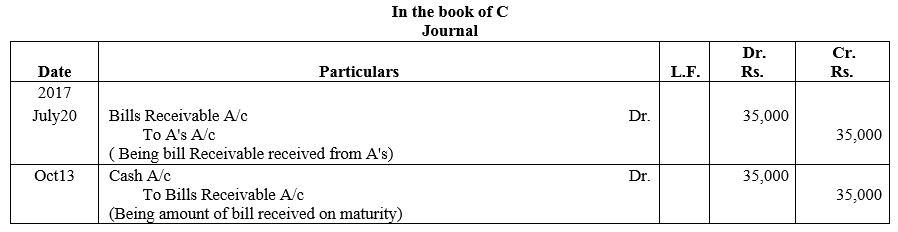

On 10th July, 2017, A sold goods to B for ₹ 35,000 plus IGST @ 18%. He drew on him a 3 months bill for ₹ 35,000 and received cheque for the balance amount. B accepted the bill. After 10 days, A endorsed the bill to his creditor C. On due date, acceptance is duly met. Show entries in the books of A, B and C.

Solution:

Question 11.

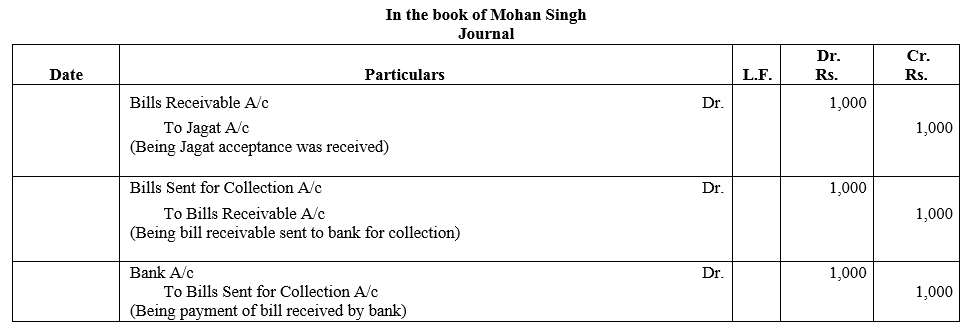

Mohan Singh draws a bill on Jagat for ₹ 1,000 payable 2 months after date. Immediately after its acceptance, Mohan Singh sends the bill to his bank for collection. On due date, bank gets the payment. Make the entries in the books of all the parties.

Solution:

Question 12.

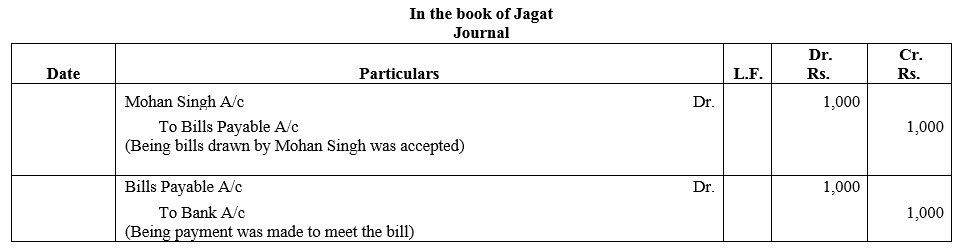

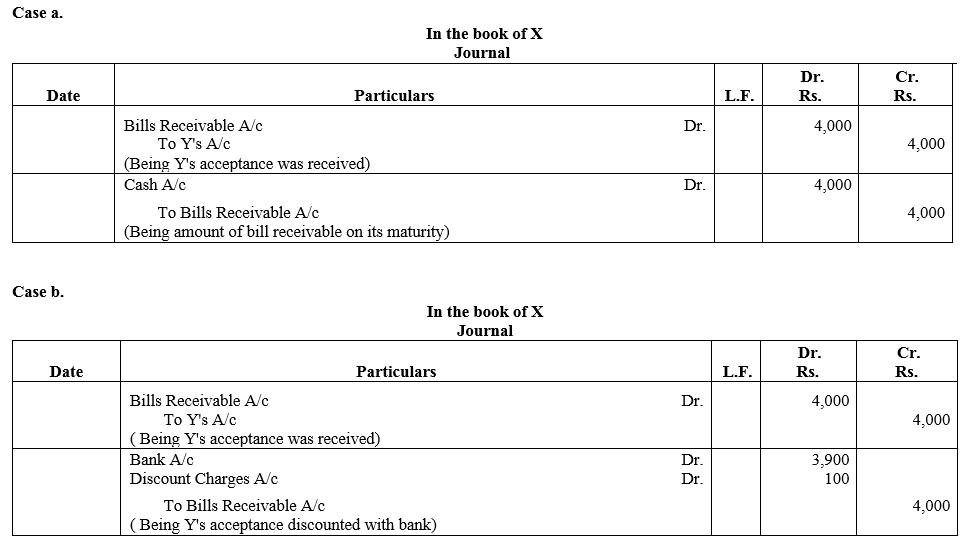

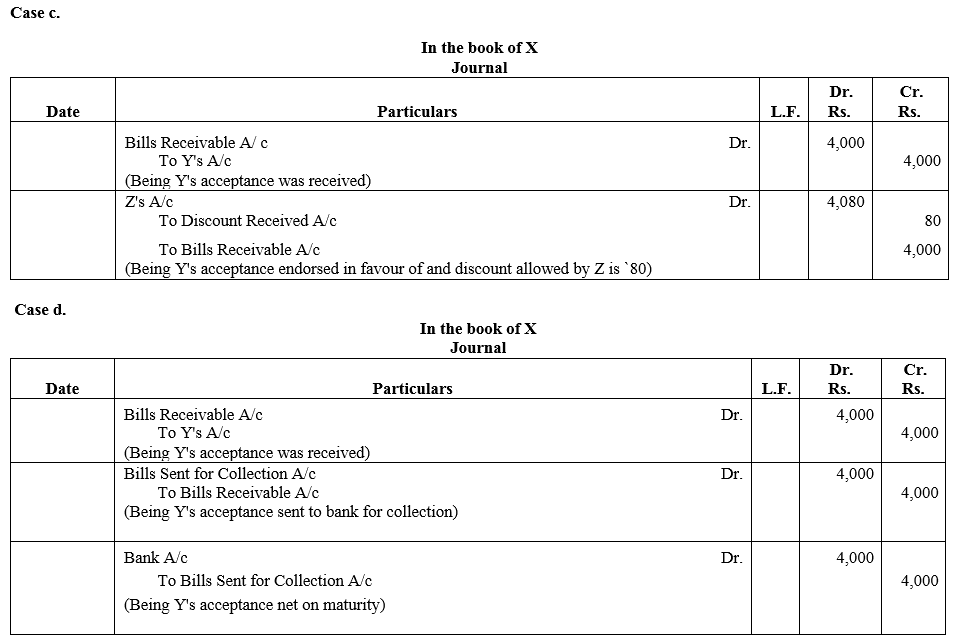

X draws on Y a bill for ₹ 4,000 which was duly accepted by Y. Y meets the bill on its due date. Show what entries would be passed in the books of X under each of the following circumstances:

(a) If X retains the bill till due date.

(b) If X discounts the same with his banker paying ₹ 100 for discount.

(c) If X endorses the same to his creditor Z in full settlement of his debt of ₹ 4,080.

(d) If X sends the bill to his banker for collection the next day.

Solution:

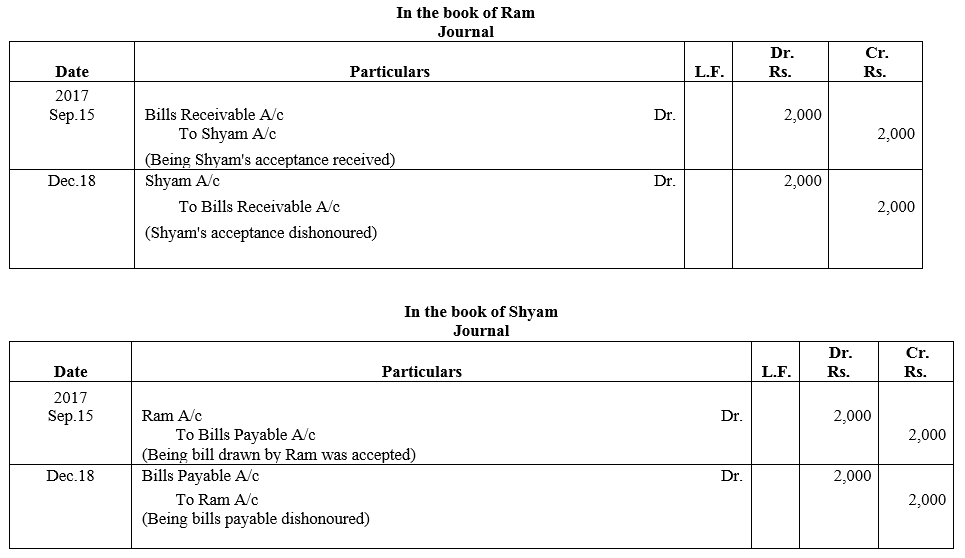

Question 13.

Ram draws a bill for ₹ 2,000 on Shyam on 15th September, 2017 for 3 months. On maturity, Shyam failed to honour th bill.

Pass the necessary Journal entries in the books of Ram and Shyam.

Solution:

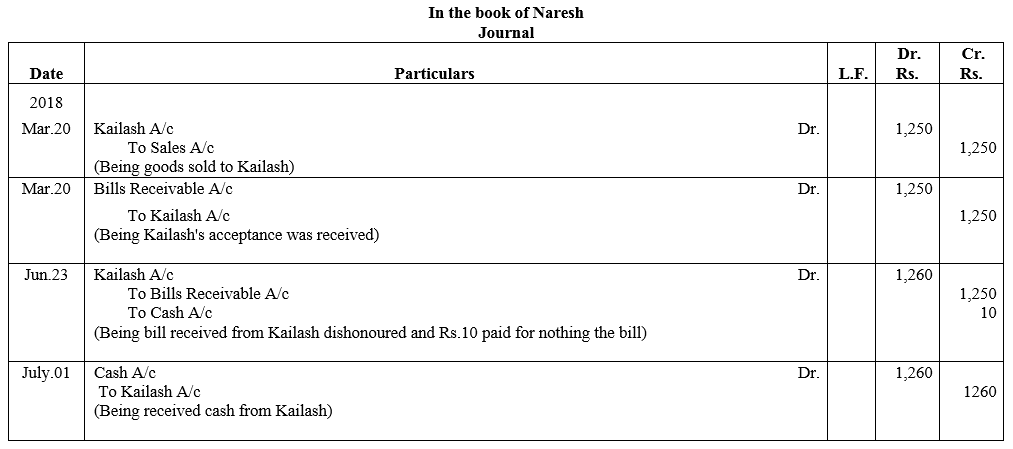

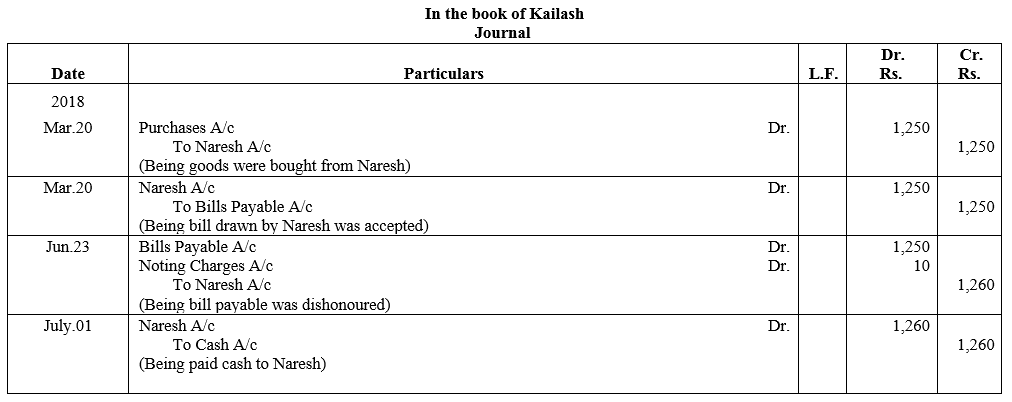

Question 14.

On 20th March, 2018, Naresh sold goods to Kailash to the vlaue of ₹ 1,250, taking a bill at 3 months for the amount. On maturity, the bill was dishonoured. Naresh paid ₹ 10 as noting charges. On 1st July, Kailash cleared his account by paying ₹ 1,260.

Make the entries in the books of both the parties to record the above transactions.

Solution:

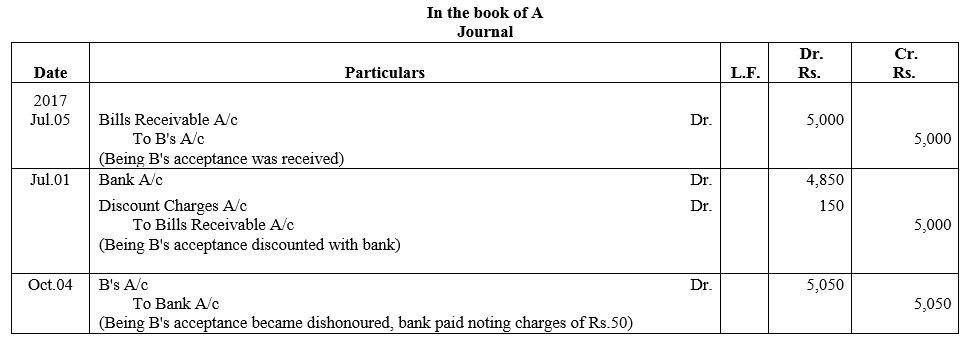

Question 15.

On 1st July, 2017, A drew a bill for ₹ 5,000 on B payable after 3 months. A discounted it with the Bank for ₹ 4,850. On maturity B failed to pay the amount of his acceptance and the bank had to pay ₹ 50 as noting charges.

Draw up the necessary Journal entries in the books of A and B.

Solution:

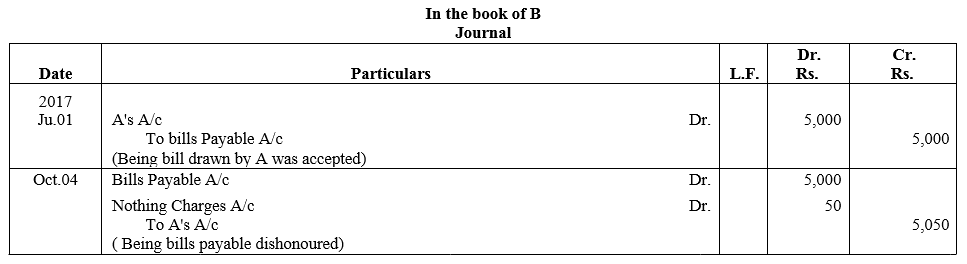

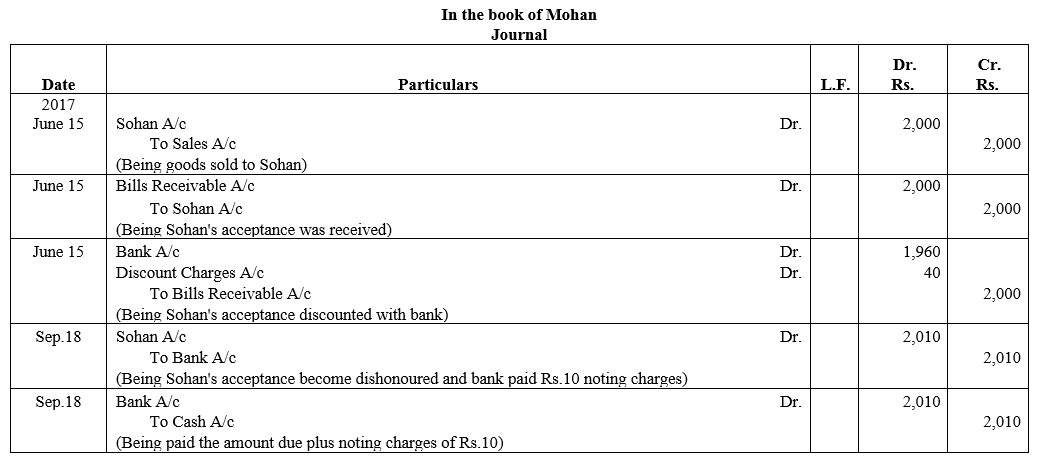

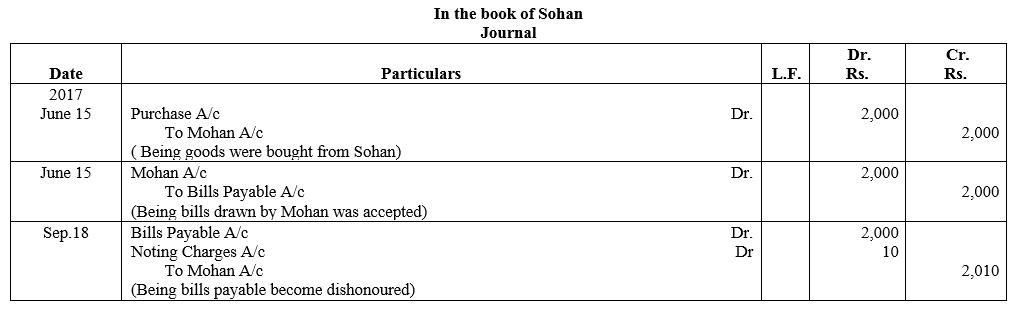

Question 16.

On 15th June, 2017, Mohan sold goods to Sohan valued at ₹ 2,000. He drew a bill at 3 months for the amount and discounted the same with his bankers at ₹ 1,960. On the due date the bill was dishonoured and Mohan paid to the bank the amount due plus the noting charges of ₹ 10.

Draft the Journal entries in the books of all parties.

Solution:

Question 17.

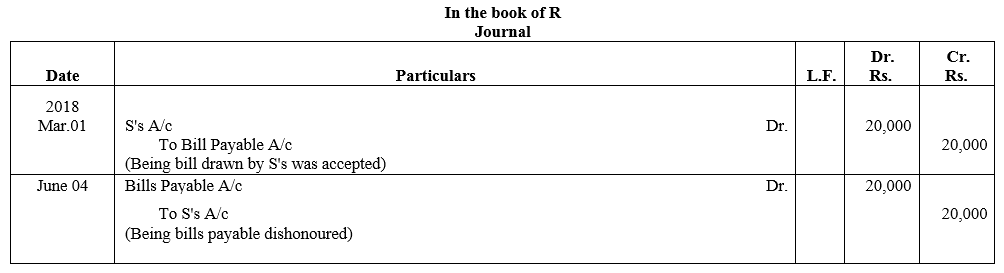

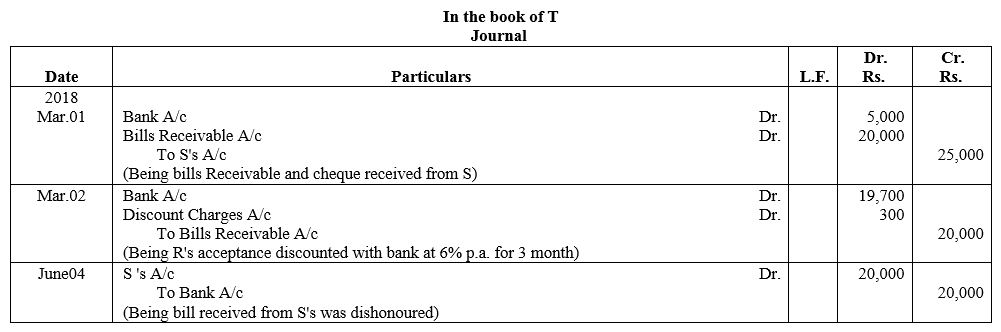

On 1st March, 2018, R accepted a Bill of Exchange of ₹ 20,000 from S payable 3 months after date in full settlement of his dues. On the same day S endorsed the Bill of Exchanges to T together with a cheque for ₹ 5,000 in settlement of his debt to the latter. On 2nd March, 2018, T discounted the Bill of Exchange @ 6% p.a. with his bankers. On maturity the Bill of Exchange was dishonoured.

Journalise the transactions in the books of R and T.

Solution:

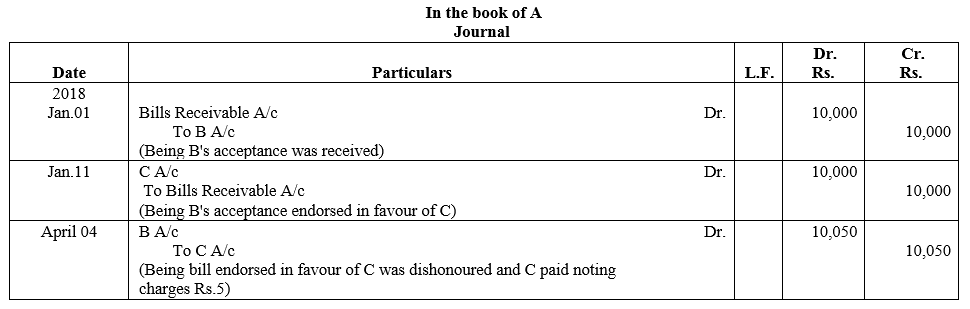

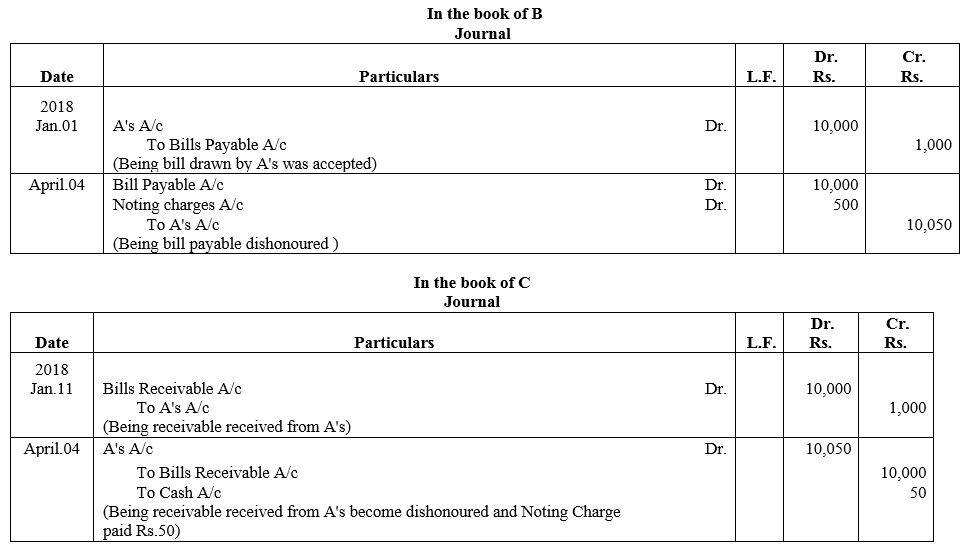

Question 18.

On 1st January, 2018, A drew a bill on B for ₹ 10,000 payable after 3 months. B accepted the bill and returned it to A. After 10 days, A endorsed the bill to his creditor C. On the due date, the bill was dishonoured and C paid ₹ 50 as noting charges.

Record the transactions in the books of A, B and C.

Solution:

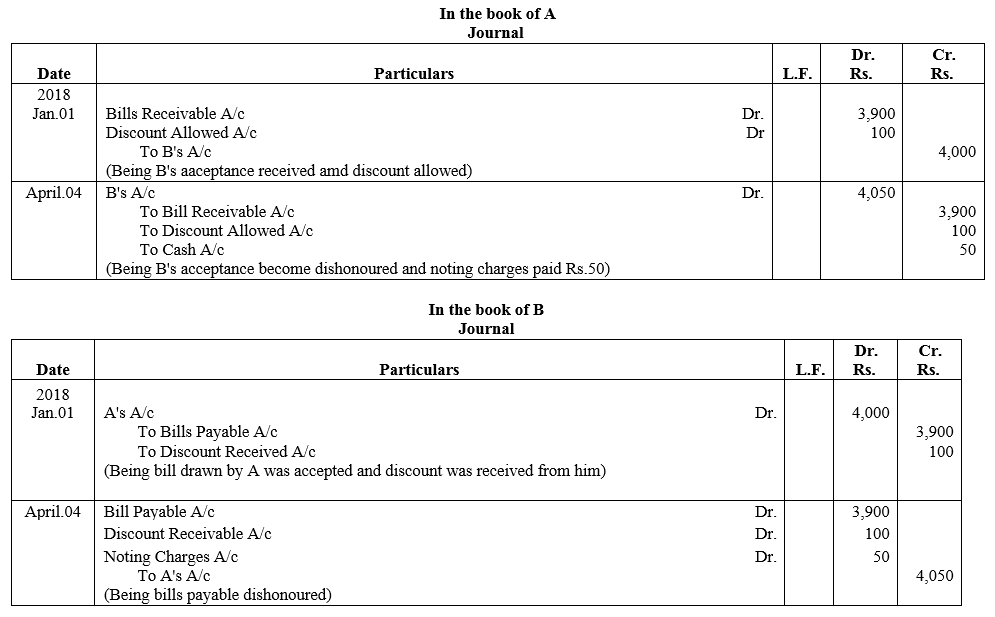

Question 19.

B owes A ₹ 4,000. On 1st January, 2018, B accepts a 3 months bill for ₹ 3,900 being in full settlement of the claim. At its due date the bill is dishounoured. Nothing charges ₹ 50 are paid by A. Give the Journal entries in the books of A and B.

Solution:

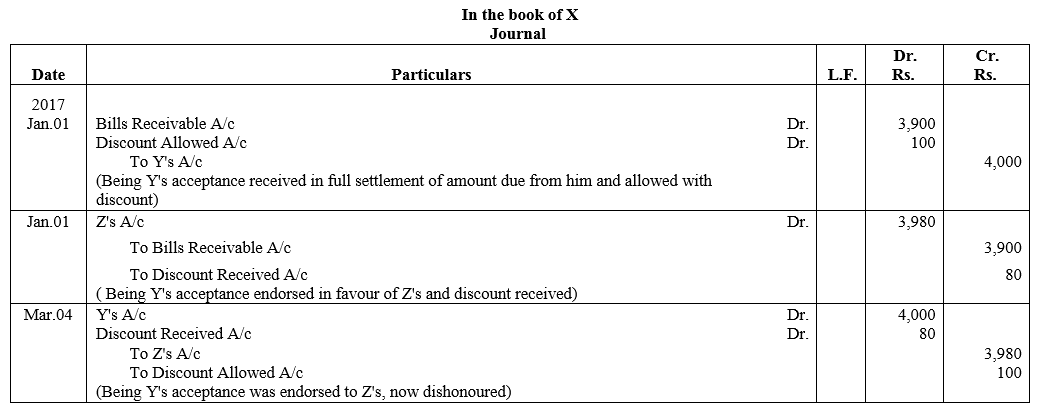

Question 20.

Y owes X ₹ 4,000. On 1st January, 2017, Y accepts a 3 months bill for ₹ 3,900 in satisfaction of his full claim. On the same date, it was endorsed by X to Z in satisfaction of his claim of ₹ 3,980. The bill is dishonoured on the due date. Give the Journal entries in the books of X.

Solution:

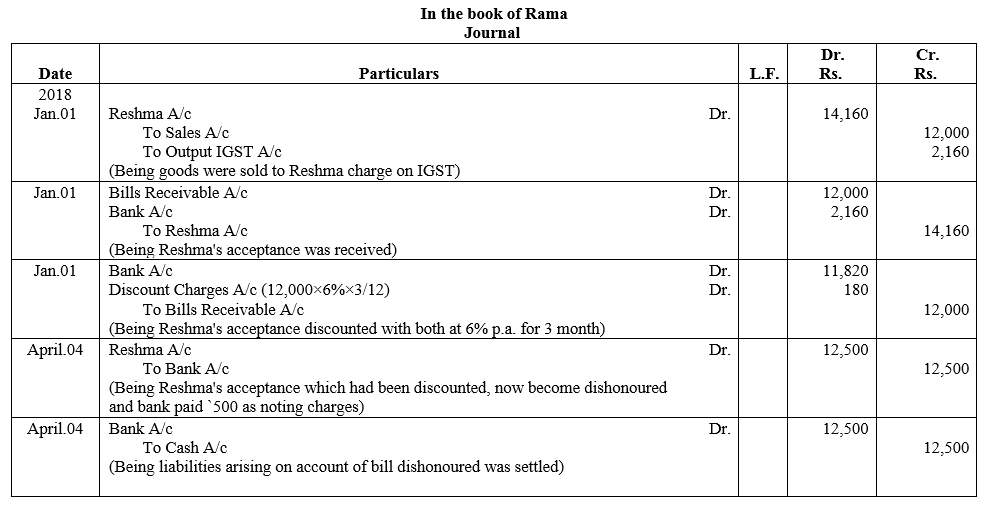

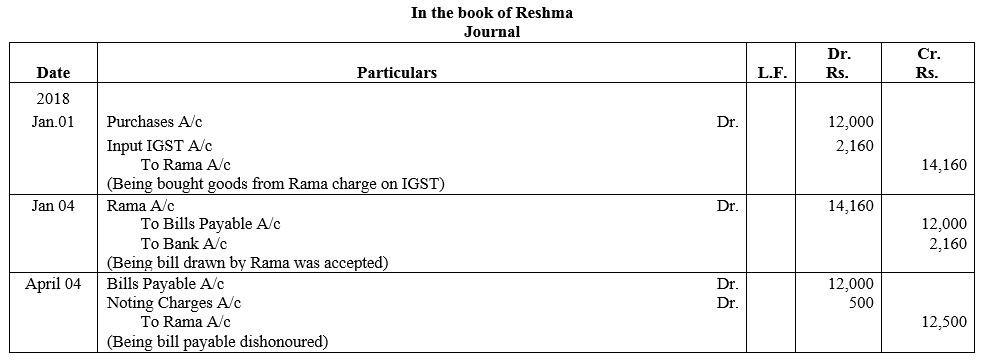

Question 21.

Rama sold goods of ₹ 12,000, charged IGST @ 18% to Reshma on 1st January, 2018. On the same date Rama draws a bill on Reshma for ₹ 12,000 for a period of 3 months and received the balance amount by cheque. On receipt of the bill on 1st January, 2018 duly accepted by Reshma, Rama discounts it with a bank at 6% p.a. On the date of maturity, the bill was dishonoured, the bank having to pay ₹ 500 as noting charges. Reshma paid the due amount less ₹ 500 in full settlement.

Show Journal entries arising from the above in the books of both Rama and Reshma.

Solution:

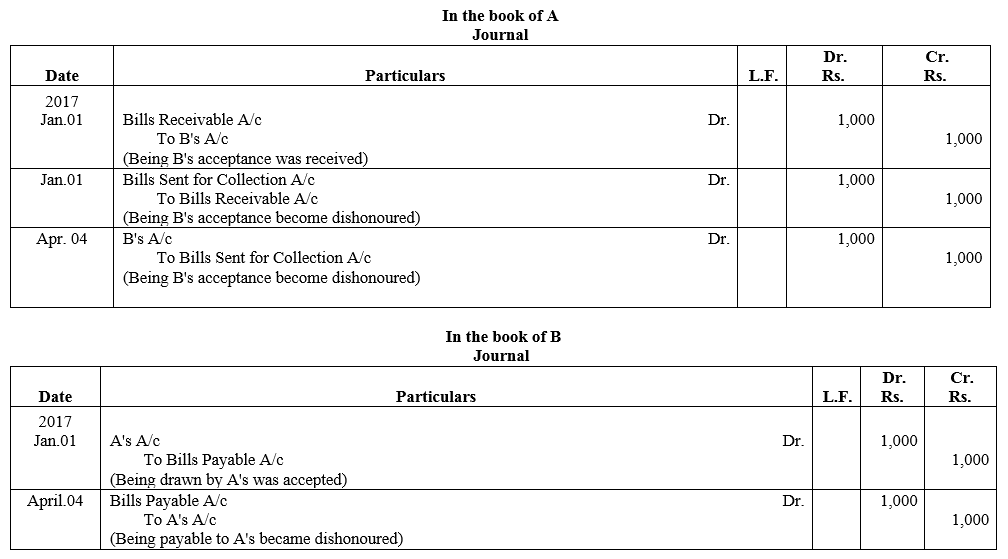

Question 22.

On 1st January, 2017, A draws a bill on B for ₹ 1,000 payable after 3 months. Immediately after its acceptance, A sends the bill to his bank for collection. On the due date, the bill was dishonoured. Record the transactions in the Journals of A and B.

Solution:

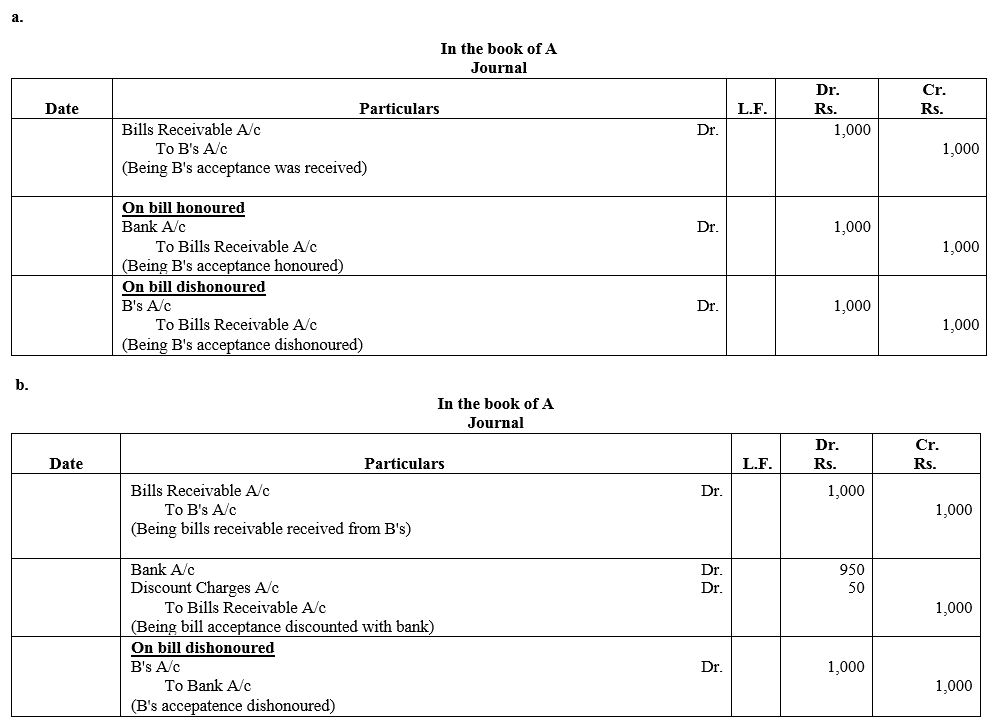

Question 23.

A bill for ₹ 1,000 is drawn by A on B and accepted by the latter payable at the New Bank of India. Show what entries should be passed in the books of A under each of the following circumstances:

(a) If A retained the bill till the due date and then realized it on maturity.

(b) If A discounted it with his bankers for ₹ 950.

(c) If A endorsed it to his creditor C in full settlement of his debt.

(d) If A sent it to his bankers for collection.

Also, give the necessary entries in each of the cases if the bill is dishonoured.

Solution:

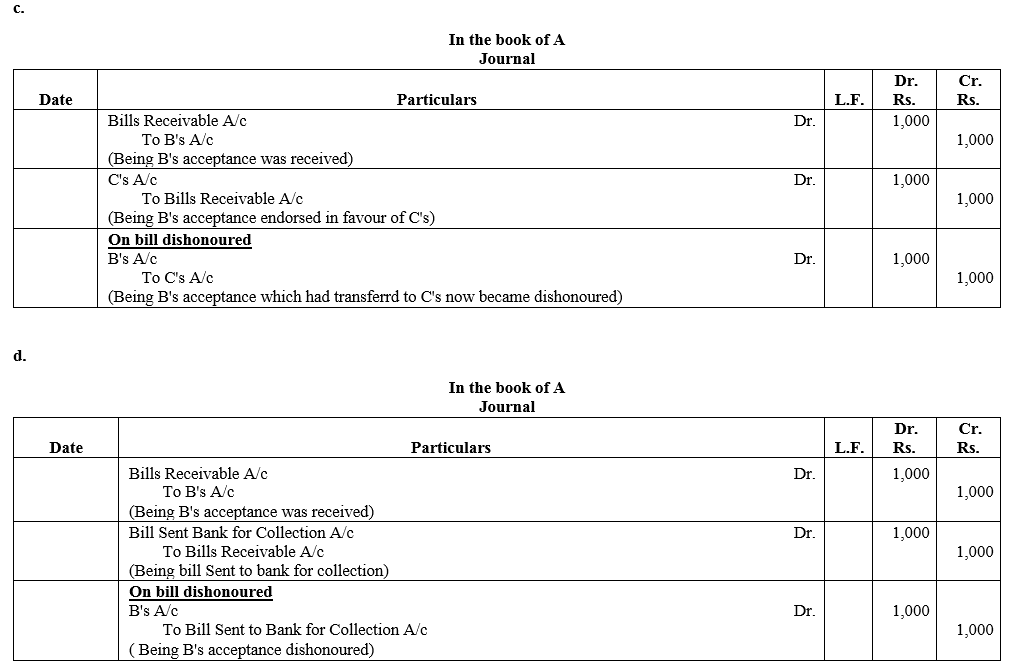

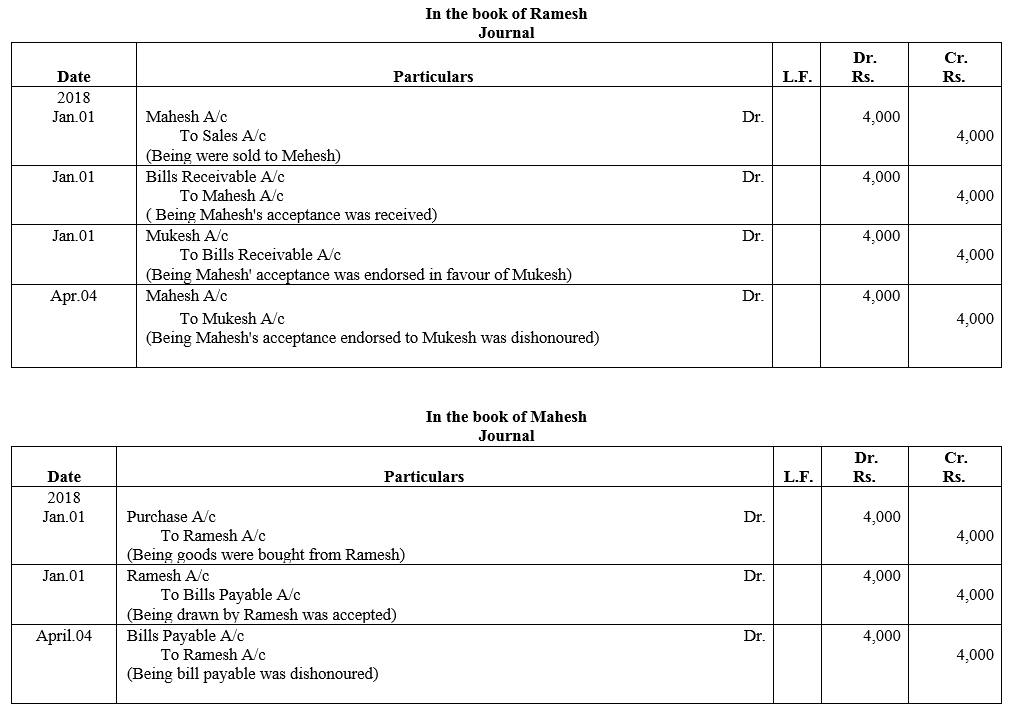

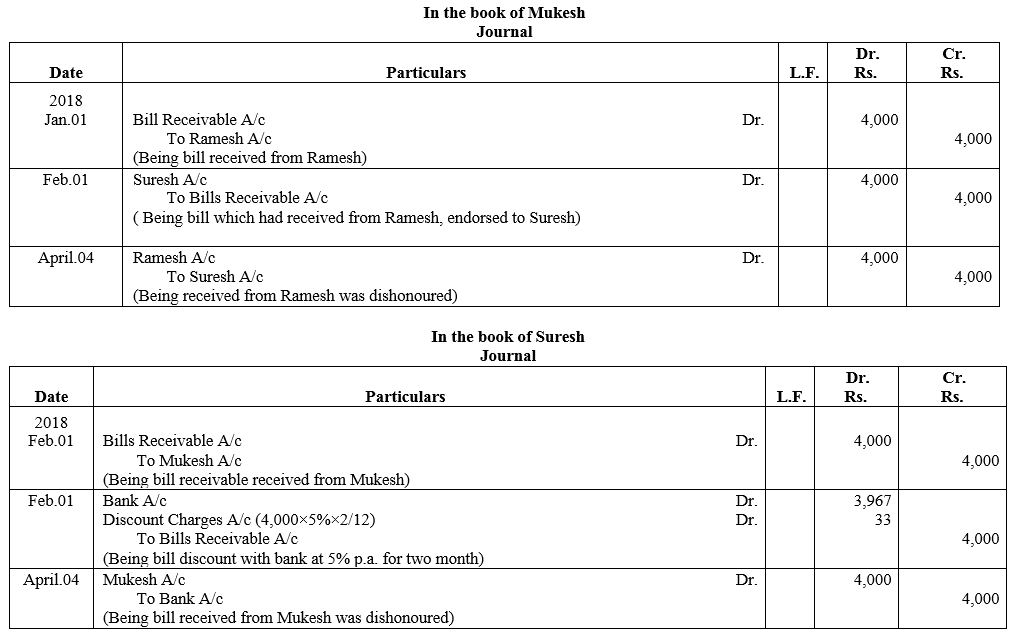

Question 24.

On 1st January, 2018 for goods sold, Ramesh drew a Bill of Exchange on Mahesh for ₹ 4,000, for a period of 3 months. Mahesh accepts it and returns to Ramesh. Ramesh then endorses it to Mukesh who in turn endorses it to Suresh on 1st February, 2018. The bill is then discounted by Suresh on the same date with his banker at 5% p.a. On the due date the bill is dishonoured.

Pass the necessary Journal entries in the books of all the four parties.

Solution:

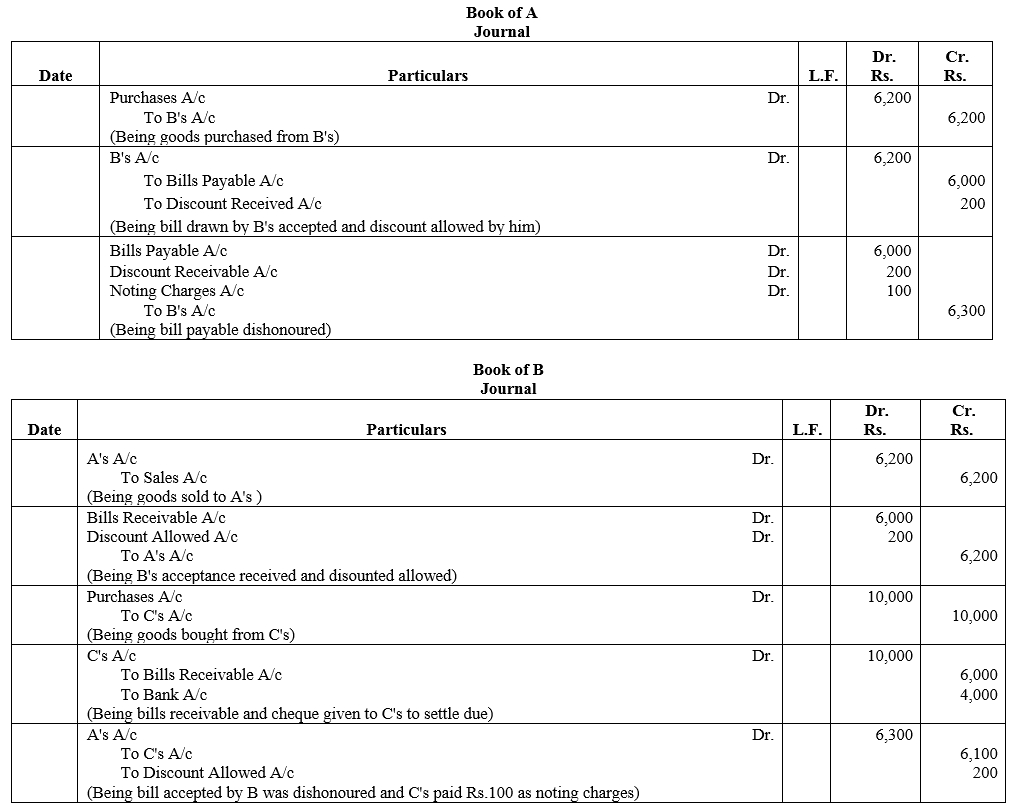

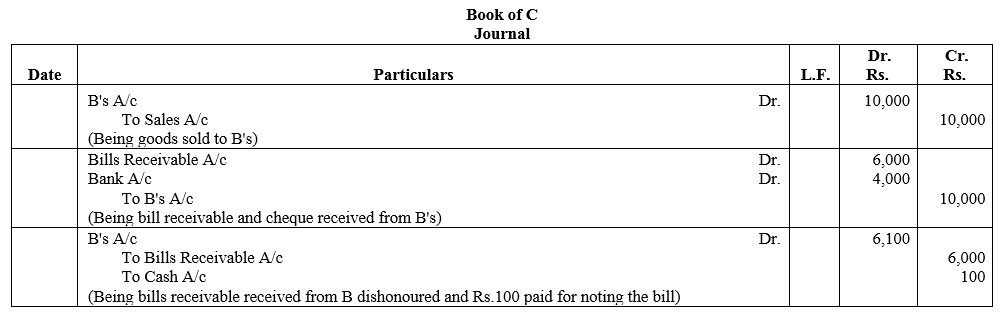

Question 25.

A purchases goods worth ₹ 6,200 from B and gives him his acceptance for ₹ 6,000 in full satisfaction. B purchases goods worth ₹ 10,000 from C and endorses the bill to him, paying the balance by cheque. On maturity the bill is dishonoured, noting charges amounted to ₹ 100.

Give the Journal entries in the books of A, B and C.

Solution:

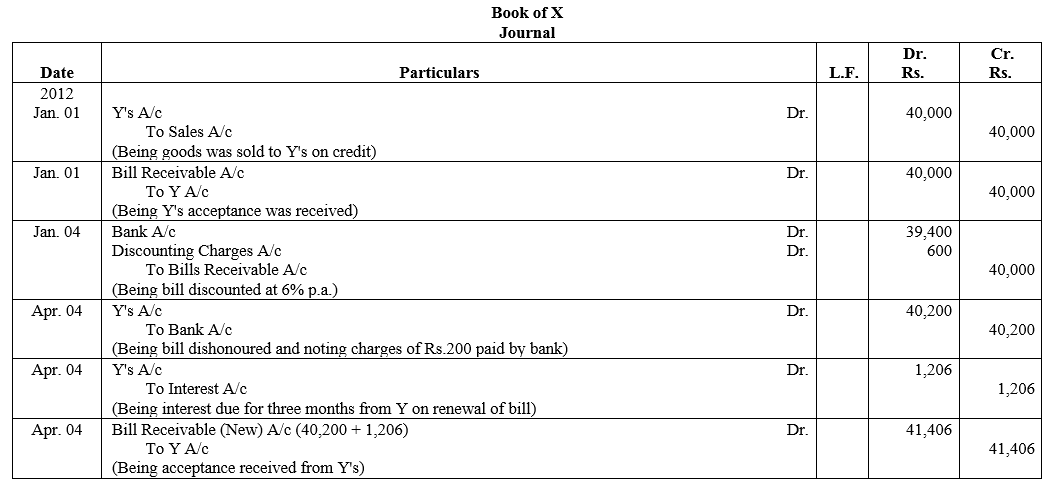

Question 26.

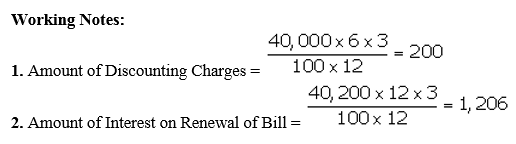

X sells goods for ₹ 40,000 to Y on 1st January, 2012 and on the same day draws a bill on Y at three months for the amount. Y accepts it and returns it to X, who discounted it on 4th January, 2018 with his bank at 6% p.a. The acceptance is dishonoured on the due date and the noting charges were paid by bank being ₹ 200.

On 4th April, 2018, Y accepts a new bill at three months for the amount then due to X together with interest at 12% p.a.

Make Journal entries to record these transactions in the books of X.

Solution:

Question 27.

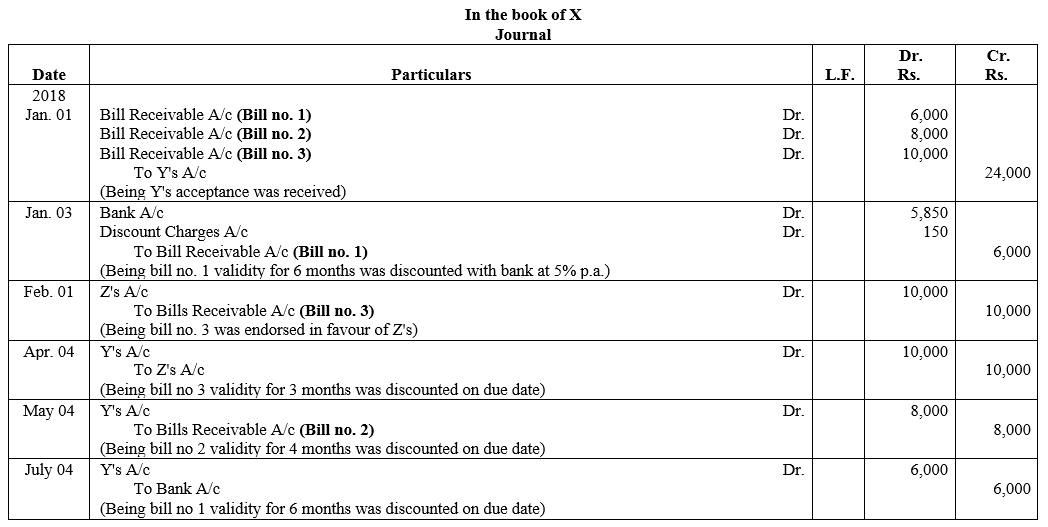

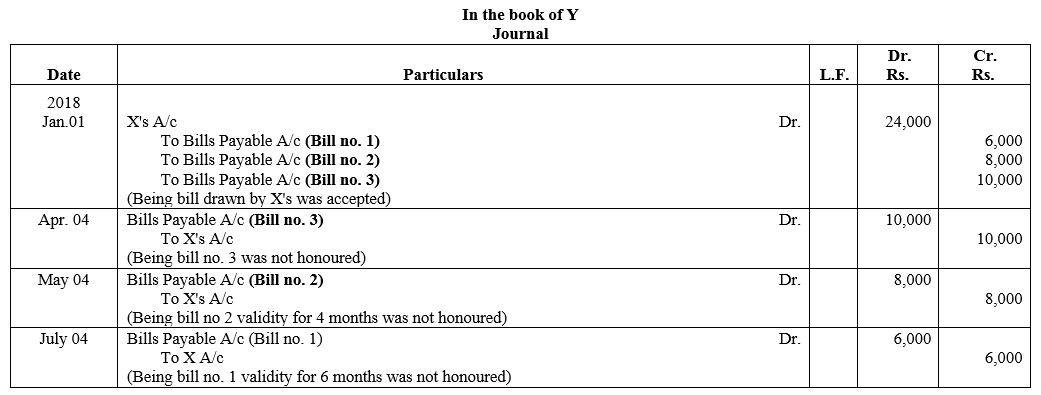

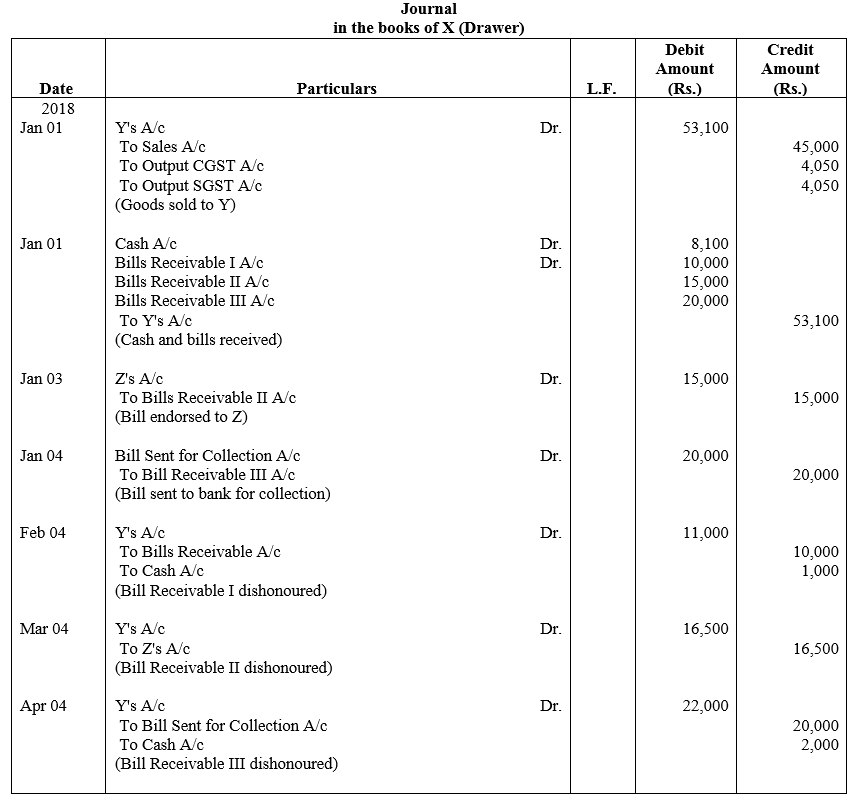

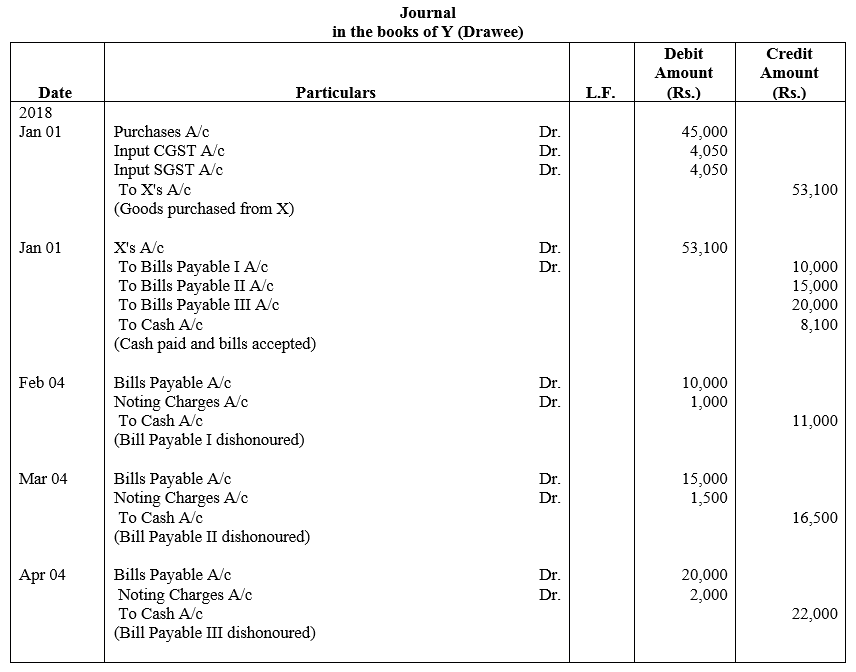

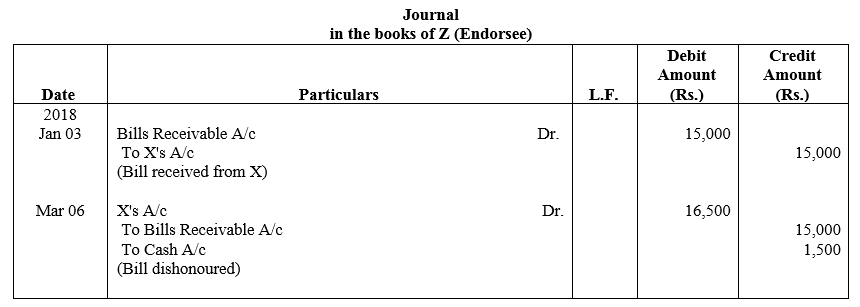

On 1st January, 2018, X received from Y three Bills of Exchange for ₹ 6,000; ₹ 8,000; and ₹ 10,000 for 6 months, 4 months and 3 months respectively. On 3rd January the first bill was discounted by X with his bankers at a discount of 5% p.a. On 1st February the 3rd bill was endorsed in favour of a creditor Z. The second bill was retained till the due date. On due dates all the three bills were dishonoured.

Show the necessary Journal entries in the books of X and Y.

Solution:

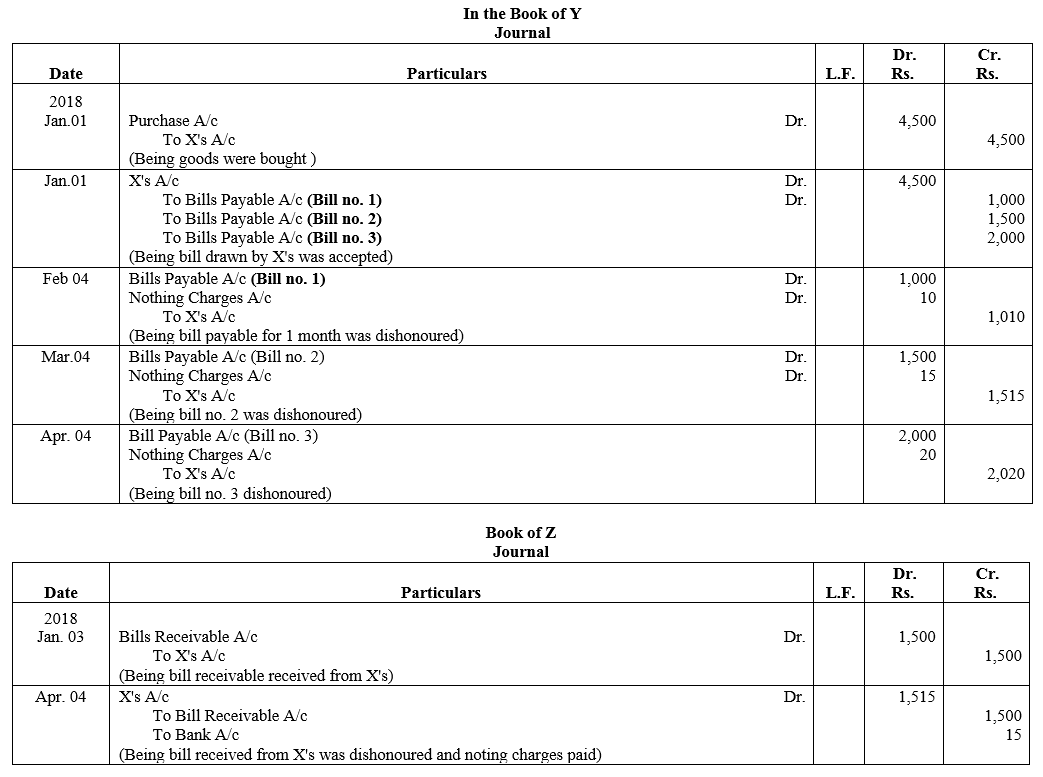

Question 28.

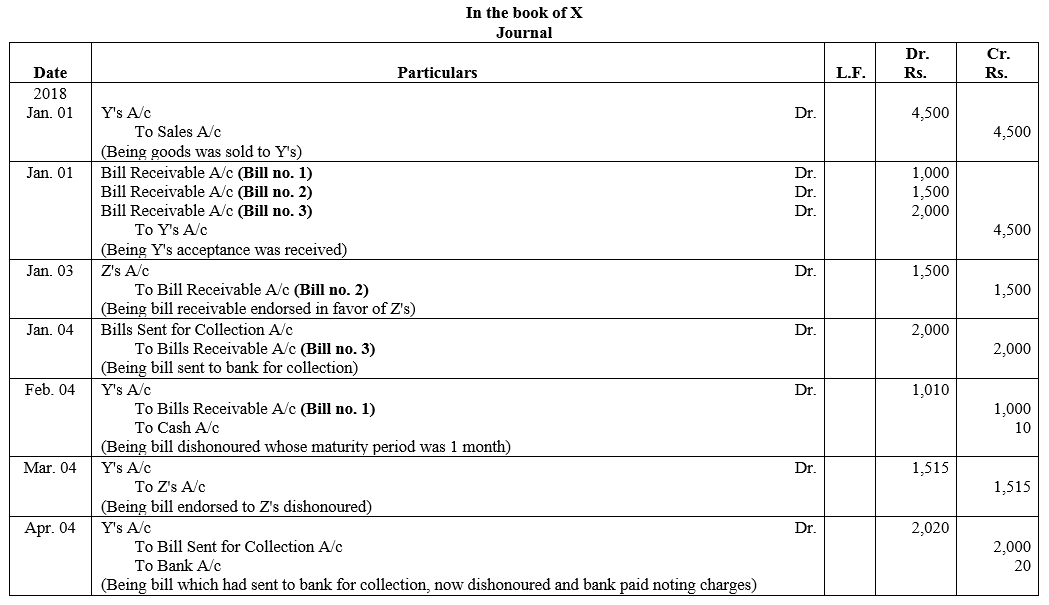

On 1st January, 2018, Mr. X sold goods to Mr. Y for ₹ 4,500 on credit and drew 3 bills on him first bill for ₹ 1,000 for 1 month, second bill for ₹ 1,500 for 2 months and third bill for ₹ 2,000 for 3 months. Mr. Y accepted and returned all the bills to Mr. X.

The first bill was retained by Mr. X till the date of maturity. Second bill was endorsed to his creditor Mr. Z on 3rd January, 2018 and third bill was sent to bank for collection on 4th January, 2017. On maturity all the bills were dishonoured and noting charges amount to ₹ 10, ₹ 15 and ₹ 20 respectively. Give the Journal entries in the books of X, Y and Z.

Solution:

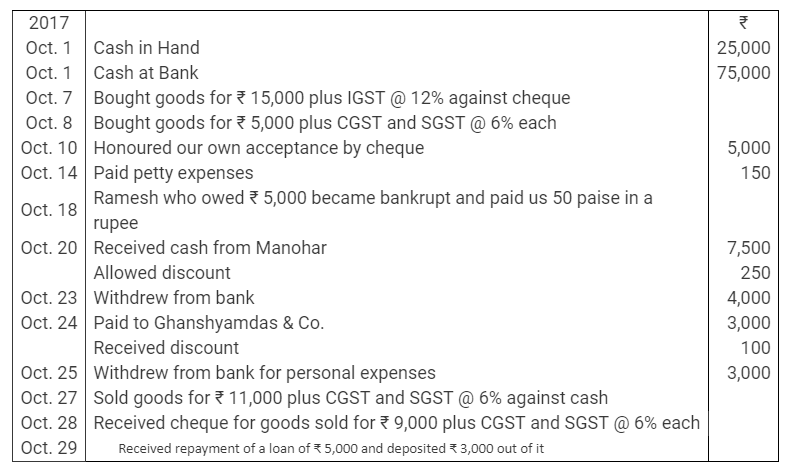

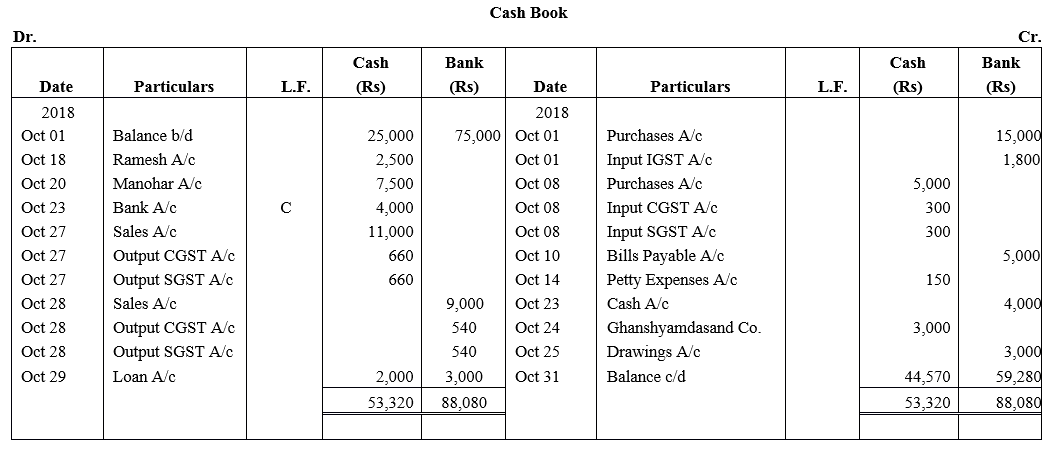

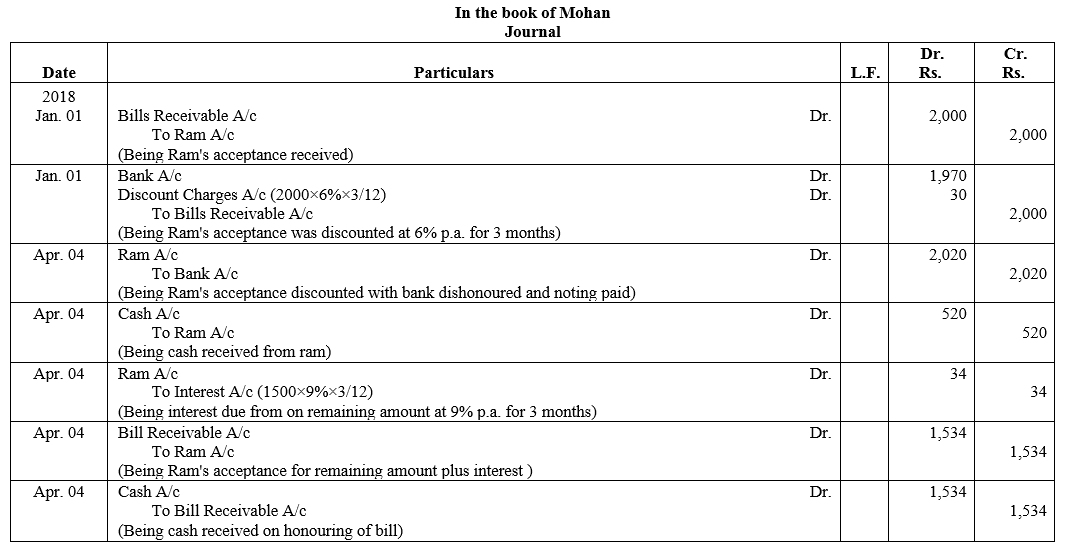

Question 29.

Ram owes ₹ 2,000 to Mohan on 1st January, 2018. On this date, he accepted a draft for the amount for 3 months. Mohan got the bill discounted at his bank @ 6% p.a. On the due date, the bill was dishonured, nothing charges ₹ 20. Ram agreed to pay ₹ 520 immediately and accept another bill for the remaining amount for 3 months together with interest at 9% p.a. This bill was met on the due tate. Give the Journal entries in the books of both the parties.

Solution:

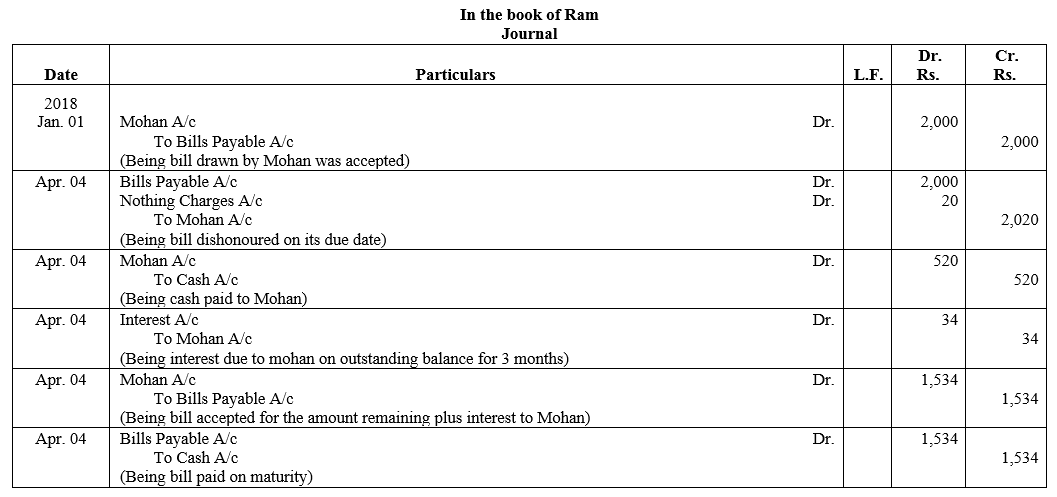

Question 30.

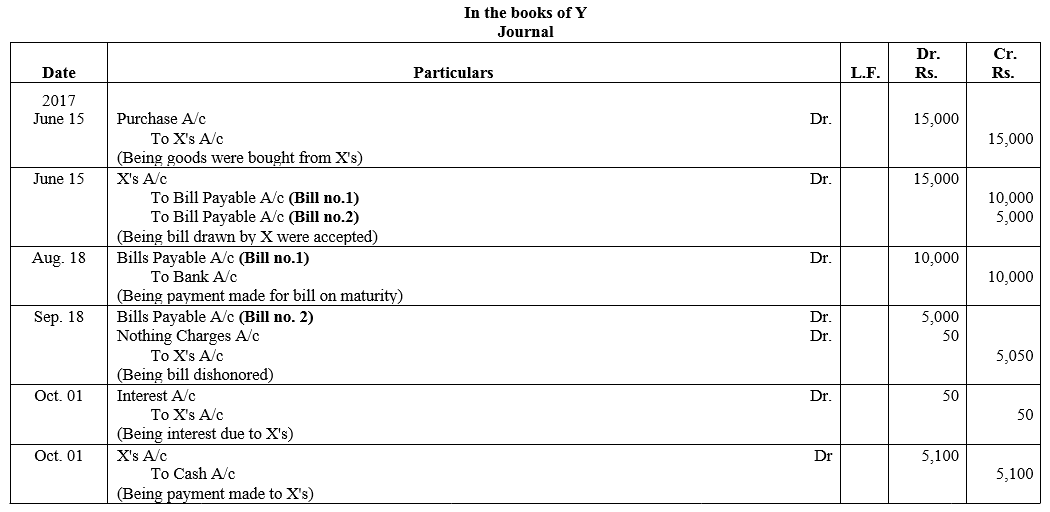

On 15th June, 2017, X sold to Y goods to the value of ₹ 15,000 drawing upon the latter two bills, one for ₹ 10,000 payable 2 months after date and other for ₹ 5,000 payable 3 months after date, X discounted the first bill with his bankers at 6% p.a. and endorsed the second bill in favour of his creditor, Z. The first bill was met on maturity but the second was dishonoured. Z paid ₹ 50 as noting charges. On 1st October, Y cleared his account to X by paying ₹ 5,100 which included ₹ 50 a s interest.

Solution:

Question 31.

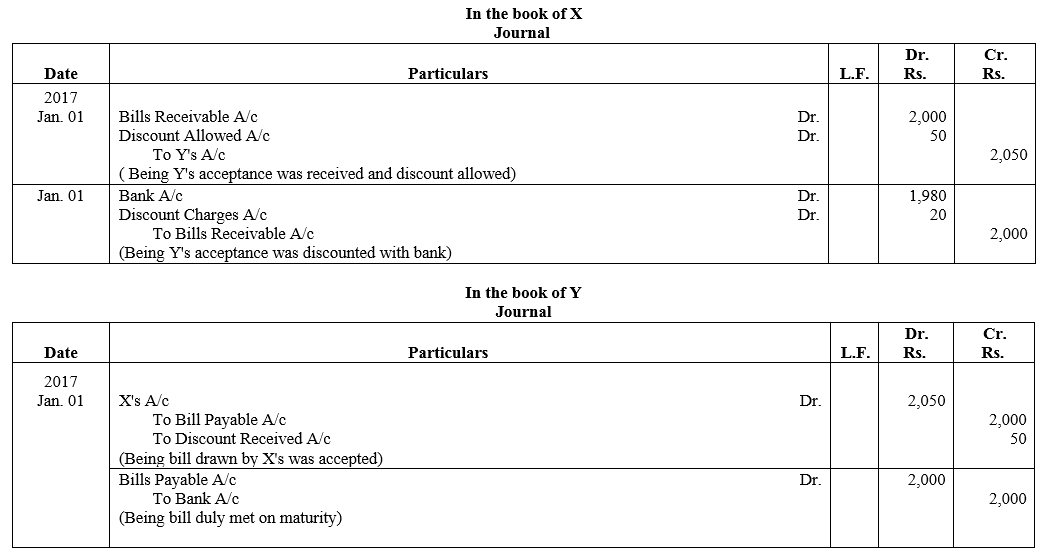

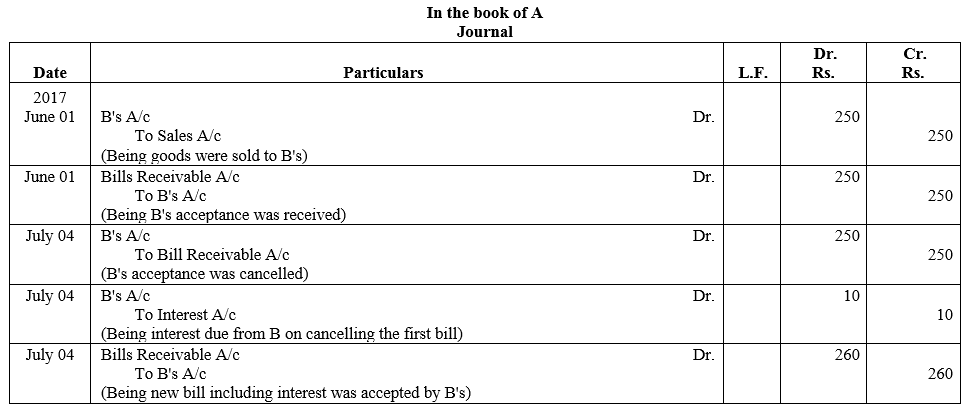

X draws a bill on Y for ₹ 2,000 on 1st January, 2017, Y accepts the same and returns it to X. The bill was drawn by X in full settlement of a debt owing by Y amounted to ₹ 2,050. X discounts the bill on the same date with the Central Bank of India for ₹ 1,980. At maturity the bill was duly met by Y. Give the entries in the books of X and Y. Suppose the bill is dishonoured, what entries witll be passed?

Solution:

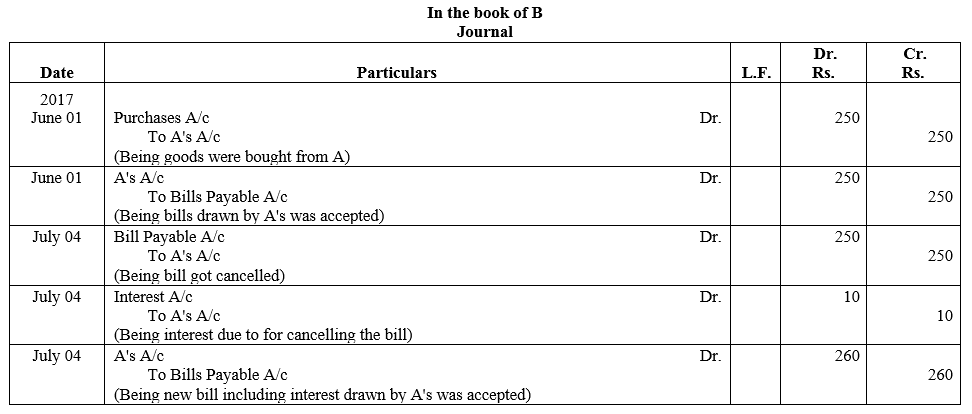

Question 32.

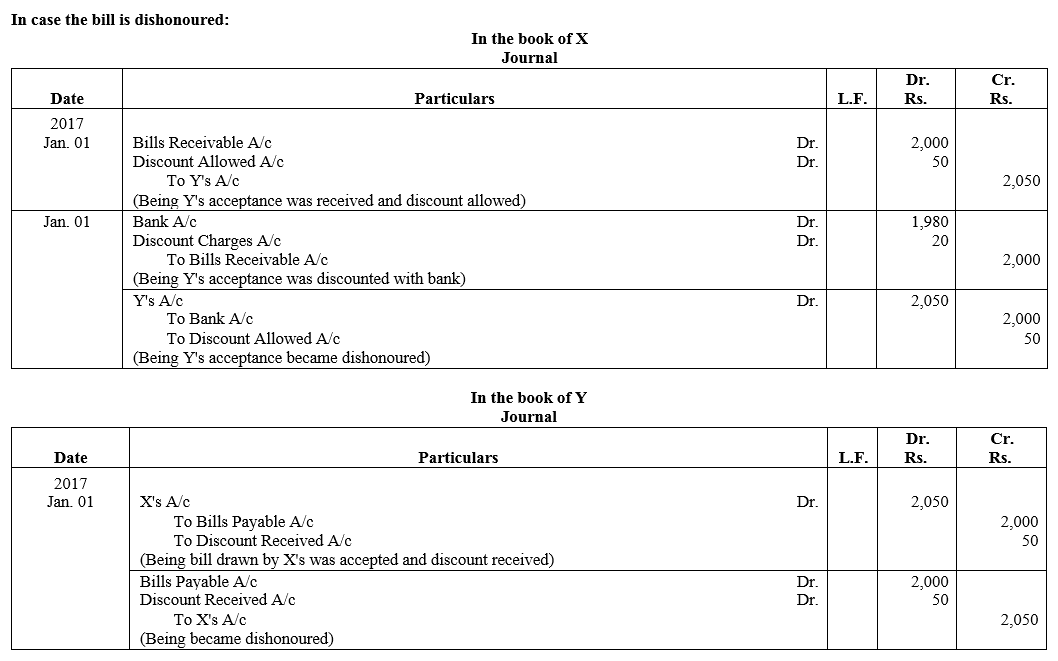

On 1st June, 2017 A sold goods to B for ₹ 250. B gave to A his acceptance payable 1 month after date. Before maturity B requests A to renew it, which A does adding ₹ 10 to the new bill for interest. Make the necessary Journal entries to record these transactions in the books of both A and B.

Solution:

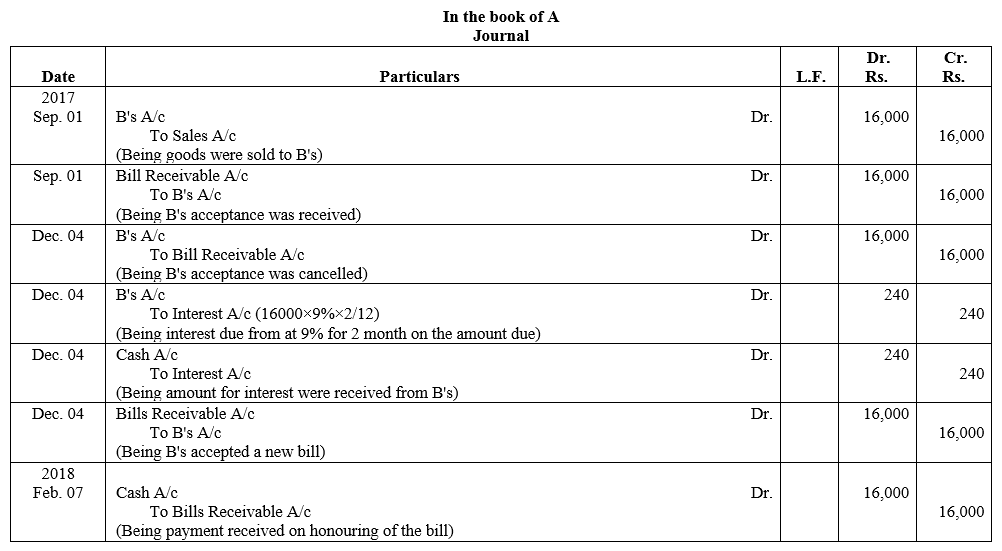

Question 33.

A sold goods to B on 1st September, 2017 for ₹ 16,000. B immediately accepted a 3 months bill. On the due date, B requested that the bill be renewed for a further period of 2 months. A agreed provided interest at 9% p.a. was paid immediately in cash. To this B was agreeable. The second bill was met on the due date. Give the Journal entries in the books of A.

Solution:

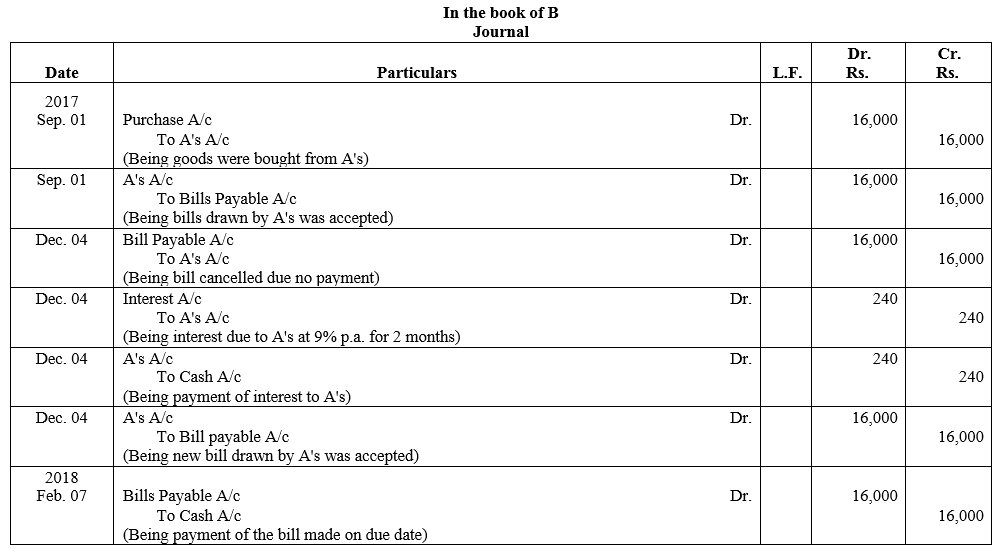

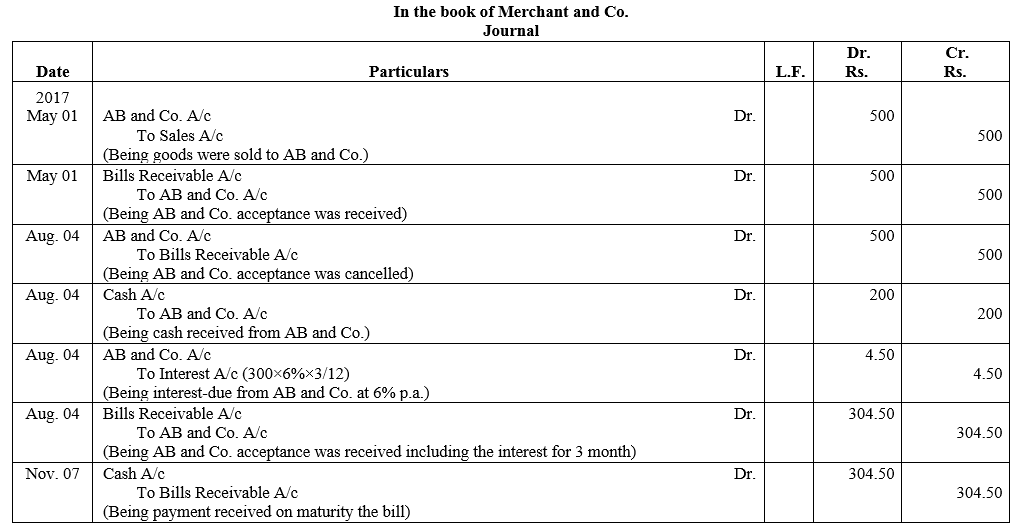

Question 34.

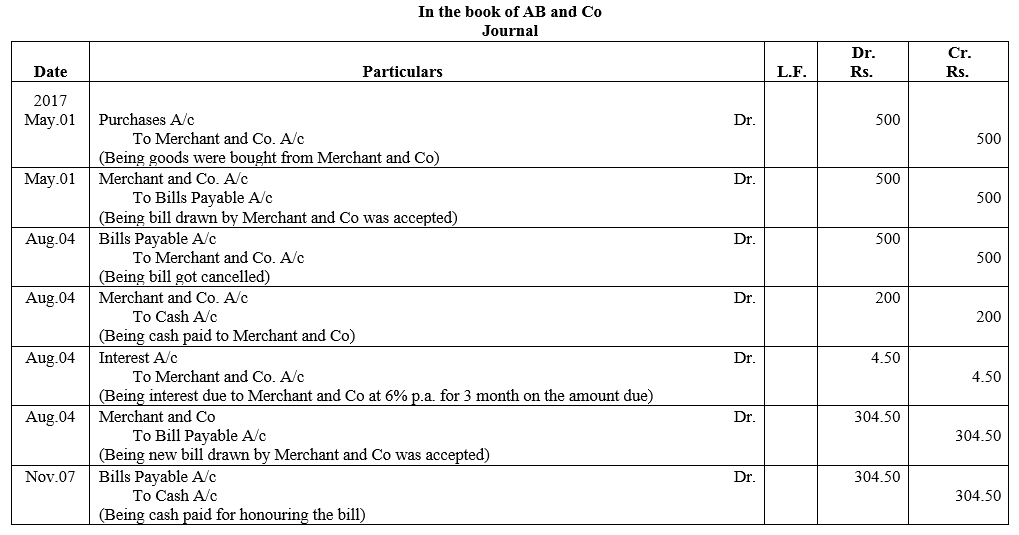

On 1st May, 2017 Merchant & Co. sold goods to AB & Co. valued at ₹ 500 and drew upon them a bill at 3 months for the amount. AB & Co.

accepted the draft on presentation. When the bill was about to mature. AB & Co. expressed their inability to meet it, and offered to pay Merchant & Co. ₹ 200 in cash and to accept a fresh bill for the balance plus interest at 6% p.a. for 3 months Merchant & Co. agreed to the proposal and bill was renewed. On maturity, the bill was duly met.

Make the entries in the books of both the parties to record the above transactions.

Solution:

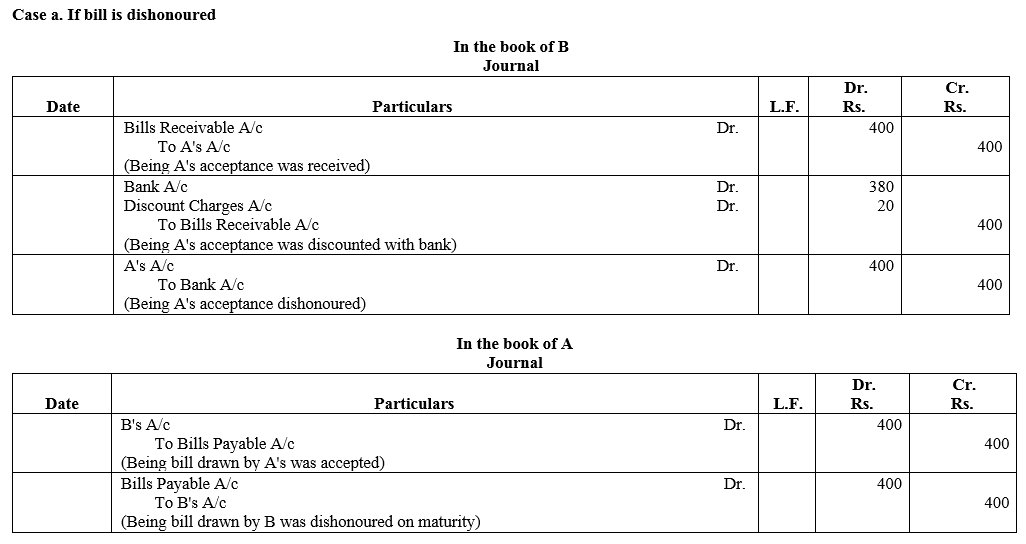

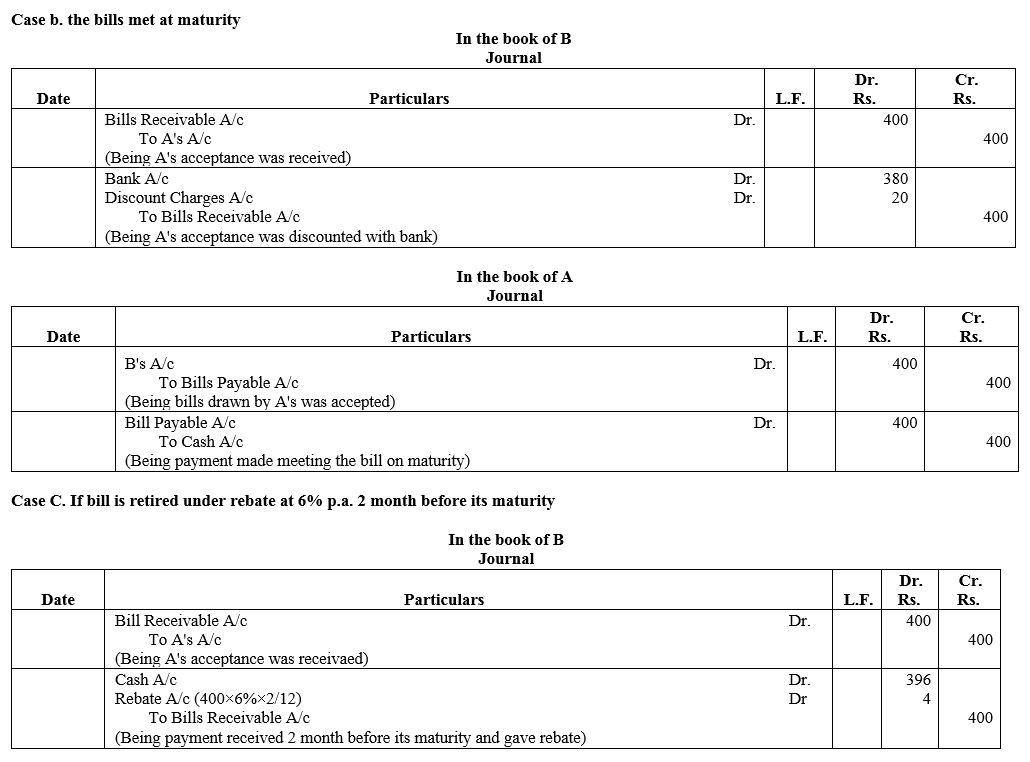

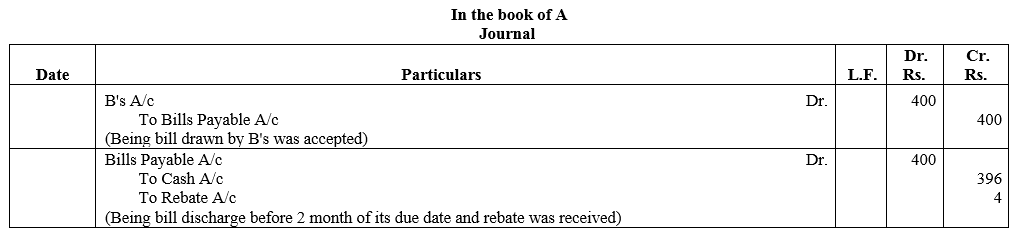

Question 35.

A owed B ₹ 400. A accepted a Bill of Exchange at 3 months date for this amount which B discounted for ₹ 380.

Give the necessary Journal entries in the books of A and B if this bill is:

(a) dishonoured on the due date;

(b) met at maturity and

(c) retired under rebate at 6% p.a. 2 months before its maturity.

Solution:

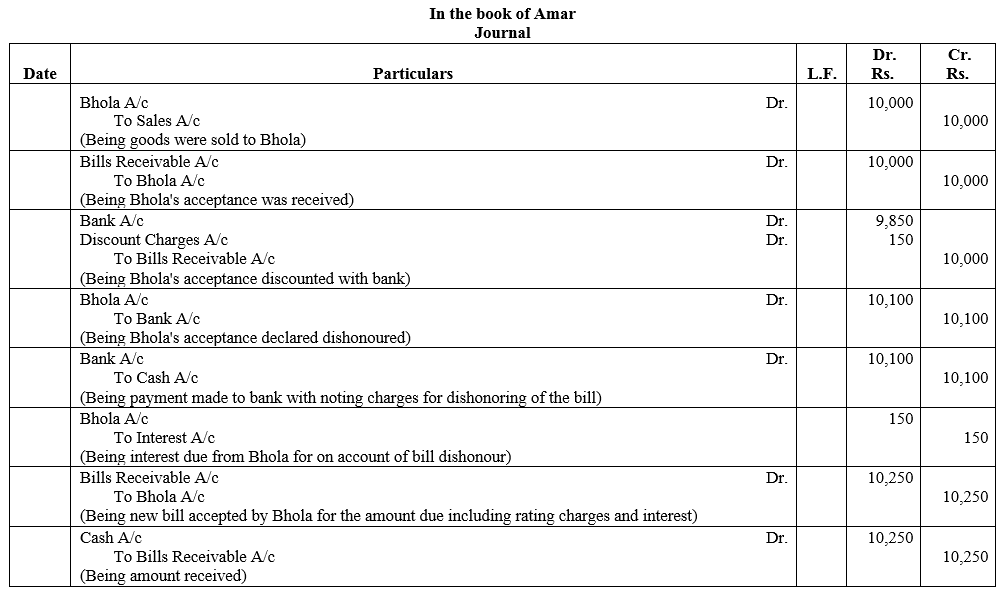

Question 36.

Amar sells goods to Bhola for ₹ 10,000 and draws upon him a bill for the amount payable 3 months after date. The bill is accepted by Bhola. Amar discounts the bill with his bankers at a discount of ₹ 150 inclusive of all charges. Bhola fails to meet this bill on maturity. Amar pays off his banker and his expenses amounting to ₹ 100. Bhola gives a fresh bill, 2 months date to Amar for ₹ 10,250, which he met at maturity.

Show the necessary Journal entries in Amar’s books.

Solution:

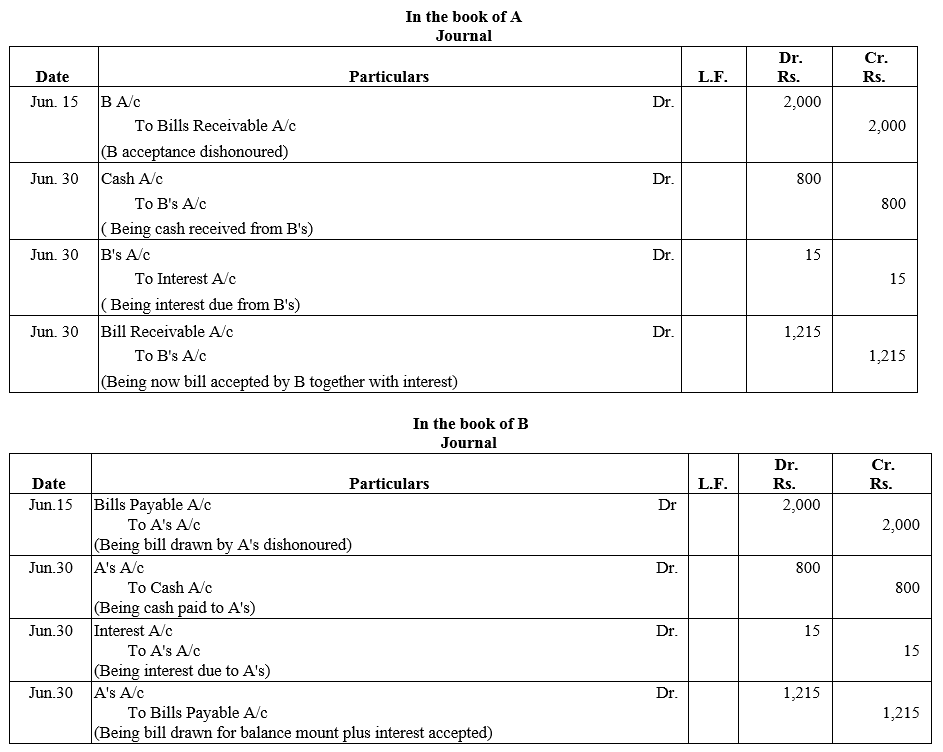

Question 37.

‘B’ being unable to meet his acceptance for ₹ 2,000 due on 15th June, approaches the Drawer ‘A’ (who is in possession of the bill) on 30th June, with the request to receive ₹ 800 in cash and draw on him for the balance plus ₹ 15 for interest at 3 months date and cancel the old bill for ₹ 2,000. A agrees to this. Pass the entries in the books of A and B.

Solution:

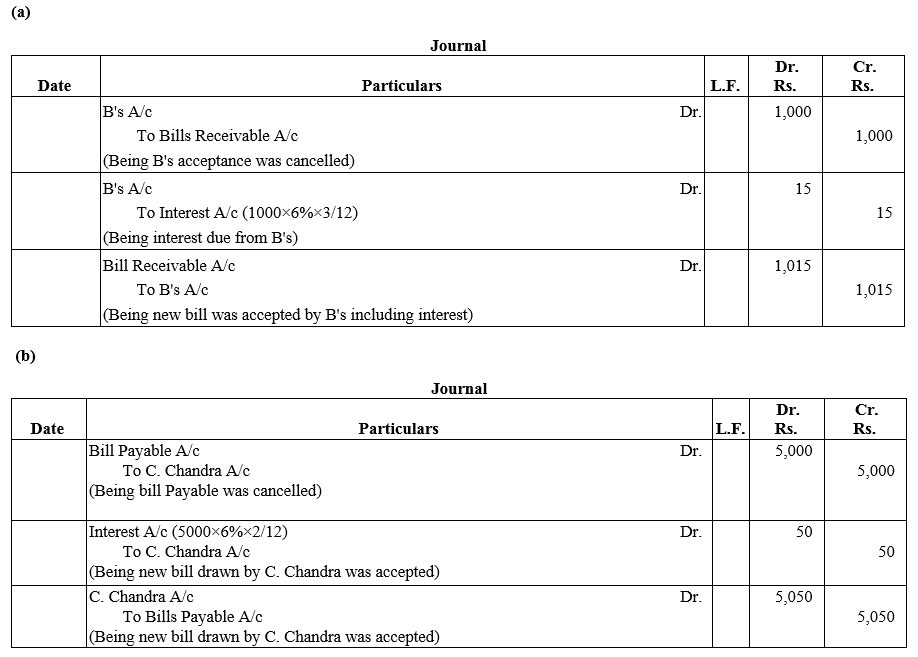

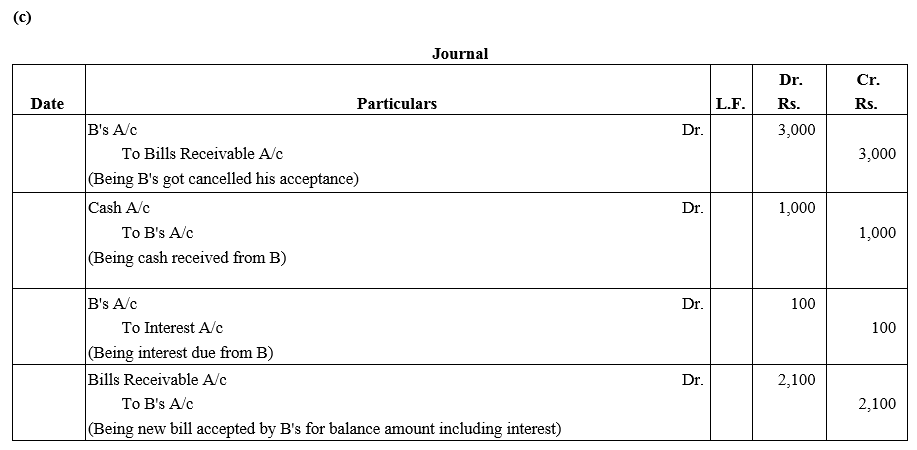

Question 38.

Give the Journal entries for the following:

(a) B’s acceptance to us for ₹ 1,000 due this day, renewed at his request for 3 months with interest @ 6% p.a.

(b) Our bill to C. Chandra for ₹ 5,000 renewed for 2 months with interest @ 6% p.a.

(c) B’s acceptance of ₹ 3,000 is discharged on his paying us cash ₹ 1,000 and accepting a fresh bill for the balance with interest ₹ 100.

Solution:

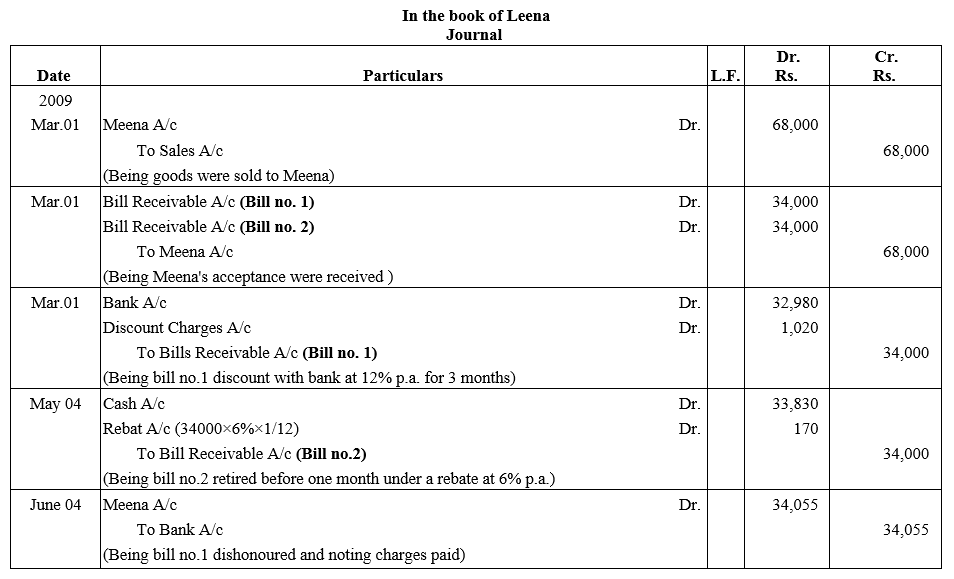

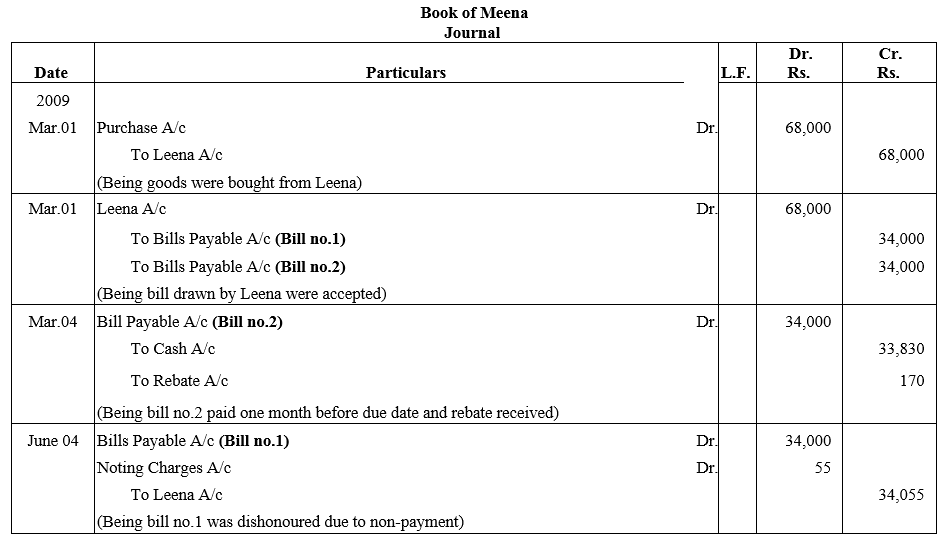

Question 39.

Leena sold goods to Meena on 1st March, 2009 for ₹ 68,000 and drew two Bills of Exchange of the equal amount upon Meena payable after three months. Leena immediately discounted the first bill with her bank at 12% p.a. The bill was dishonoured by Meena and Bank paid ₹ 55 as noting charges. The second bill was retired on 4th May, 2009 under a rebate of 6% p.a. with mutual agreement. Journalise the above in the books of Leena and Meena.

Solution:

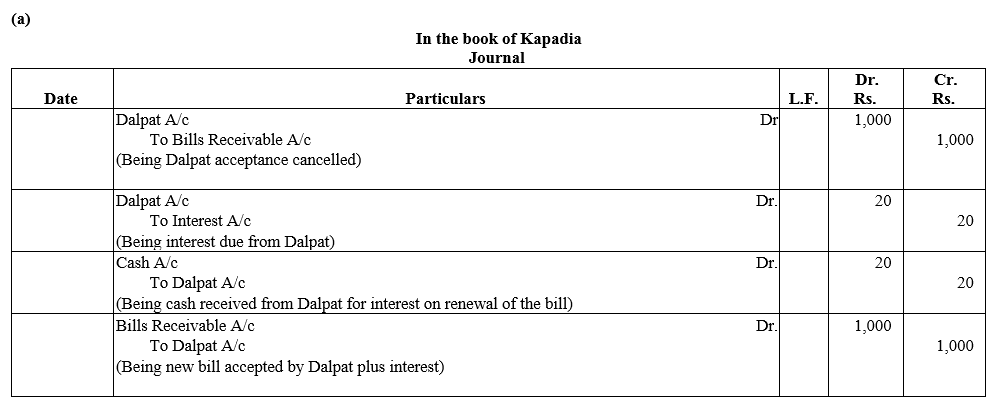

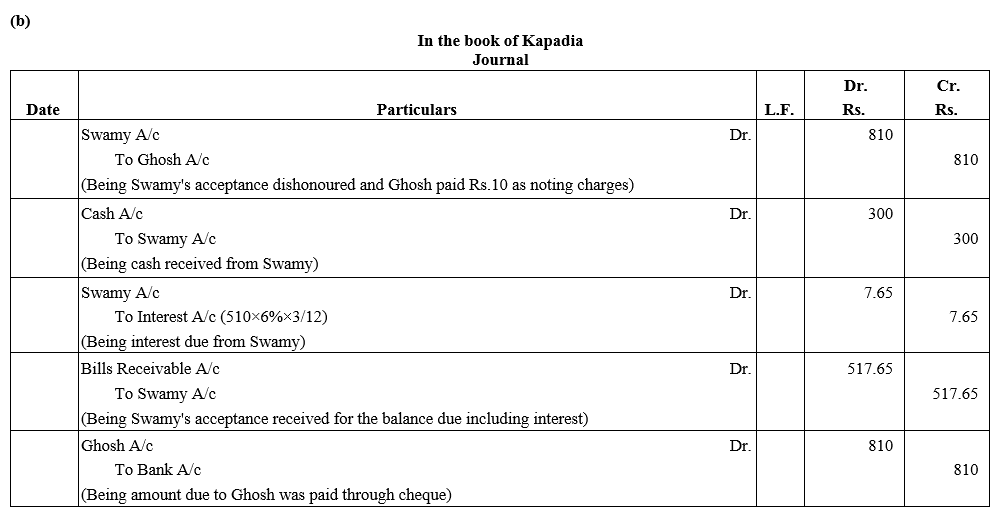

Question 40.

How will you record the following transactions in the books Kapadia?

(a) A bill received from Dalpat for ₹ 1,000 has to be renewed, Dalpat agrees to pay ₹ 20 as interest.

(b) Swamy’s bill for ₹ 800 endorsed in favour of Ghosh dishonoured, Ghosh pays ₹ 10 as noting charges. Swamy pays ₹ 300 immediately and agrees to accept a new bill for 3 months for the balance together with interest at 6% p.a. Ghosh’s Account is settled by cheque.

Solution:

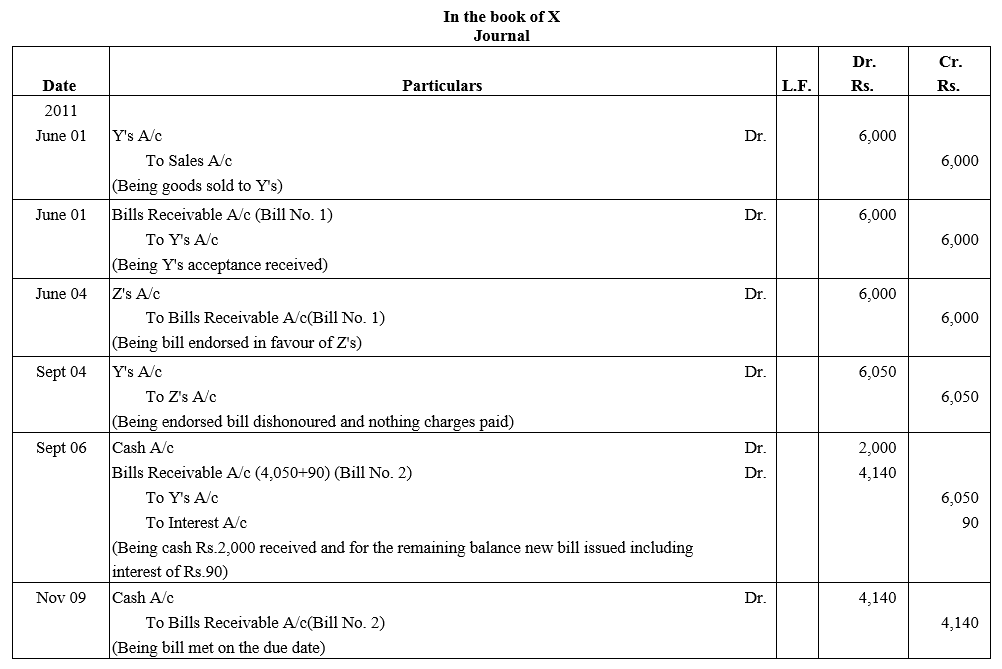

Question 41.

Y purchased goods for ₹ 6,000 on 1st June, 2011 from X and on the same date accepted a bill payable after three months. 3 days later, X

endorsed the bill to Z. On maturity, the bill was dishonoured for non-payment and Z had to pay ₹ 50 as noting charges. Two days after the dishonour of bill, Y paid ₹ 2,000 to X and requested him to draw a second bill for the balance plus ₹ 90 for the amount of interest, payable after two months. X accepted the proposal and draws the bill on Y, which was accepted by Y and was duly met on maturity.

Pass Journal entries for the above transactions in the books of X.

Solution:

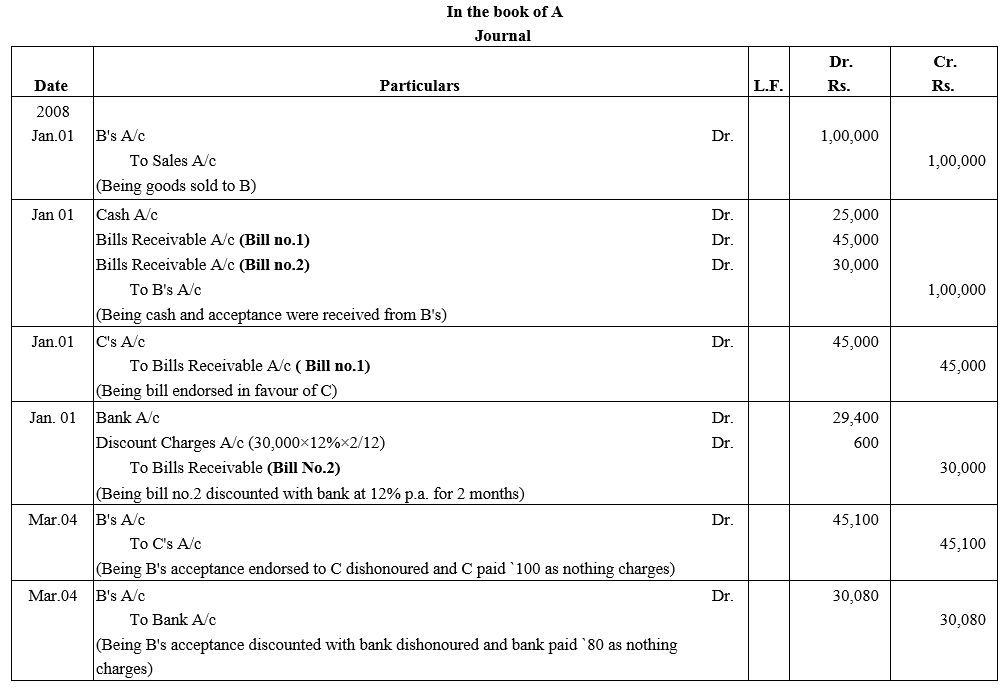

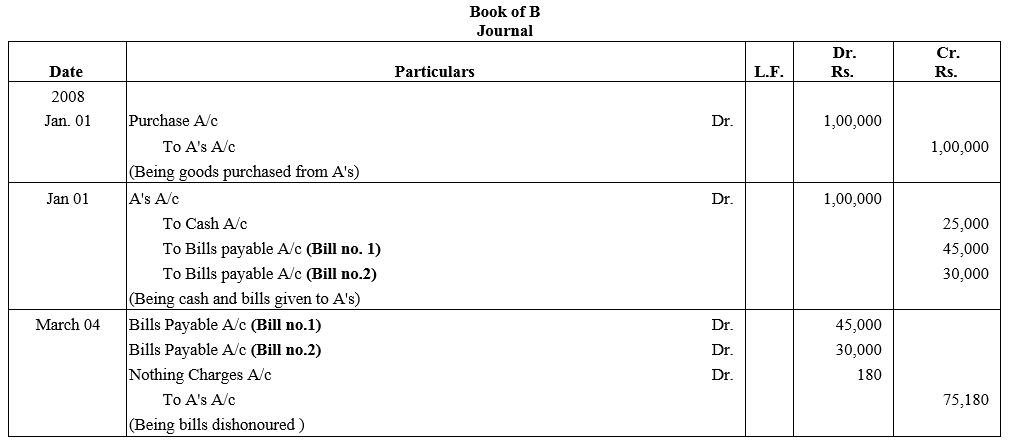

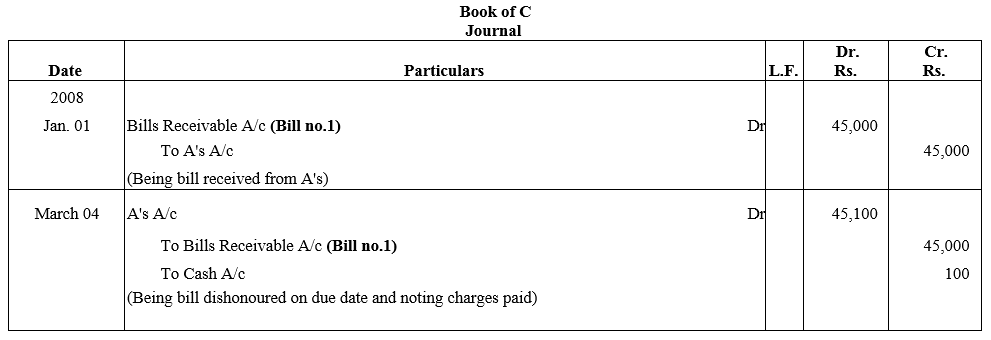

Question 42.

On 1st January, 2008, A sold goods to B for ₹ 1,00,000 received ₹ 25,000 in cash and drew two bills, first ₹ 45,000 and second for ₹ 30,000 of two months each. Both bills were duly accepted by B. First bill was endorsed to C in settlement of his account of ₹ 45,000 and second bill was discounted from the bank at the rate of 12% p.a. On the due date of these bills, both bills were dishonoured, C has paid ₹ 100 and bank has paid ₹ 80 as noting charges. Pass Journal entries in the books of A, B and C.

Solution:

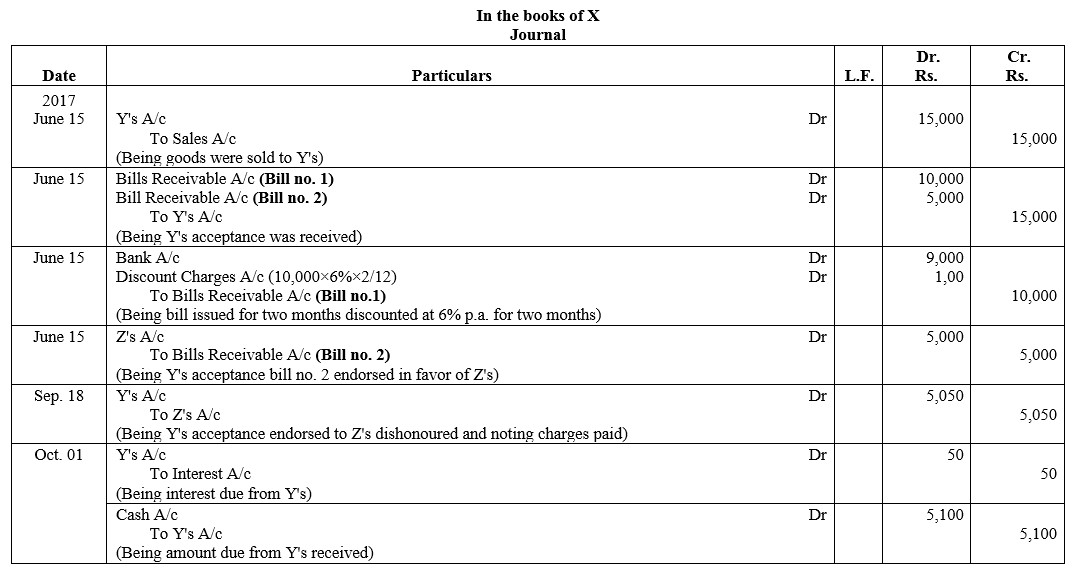

Question 43.

On 1st January, 2018, Mr. X sold goods to Mr. Y for ₹45,000 plus CGST and SGST @ 9% each on credit. Mr. Y paid the amount of GST immediately in cash. Mr. X drew 3 bills on him: first bill for ₹10,000 for 1 month, second bill for ₹15,000 for 2 months and third bill for ₹20,000 for 3 months. Mr. Y accepted and returned all the bills to Mr. X.

Solution:

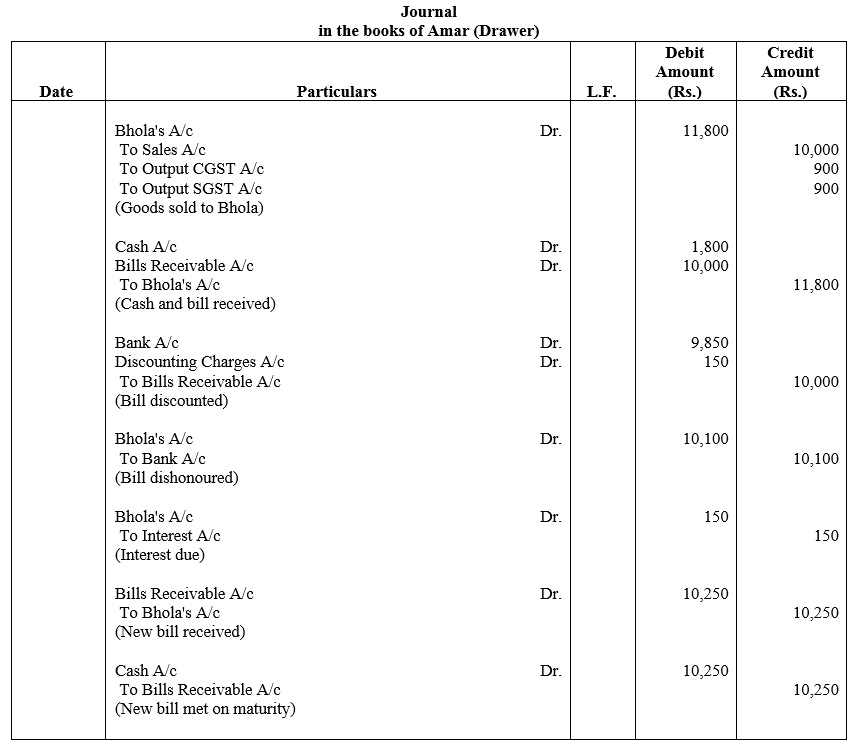

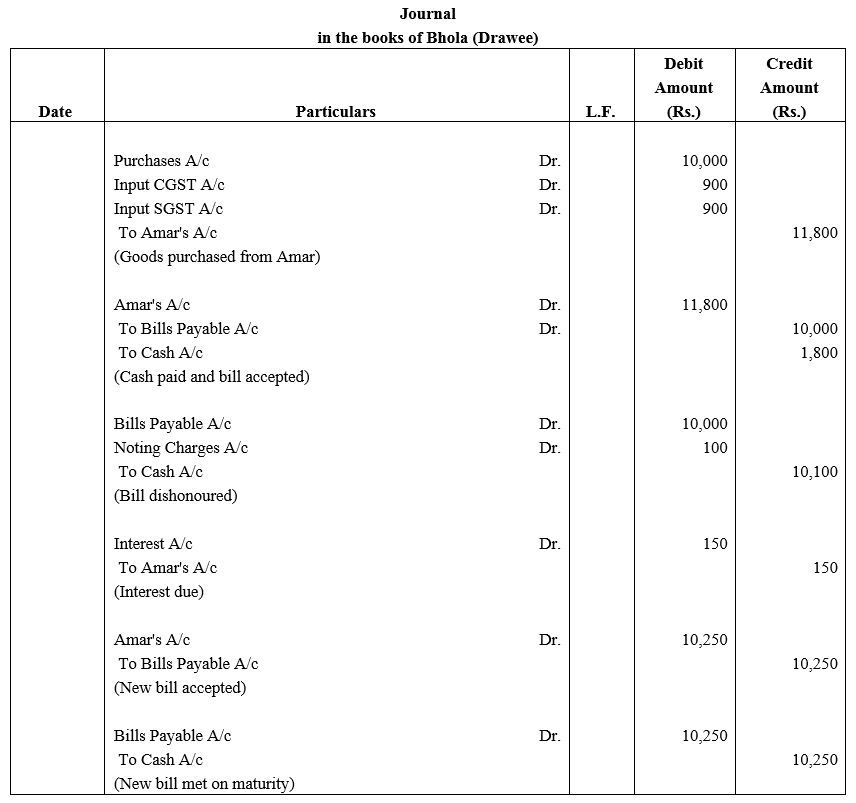

Question 44.

Amar sells goods to Bhola for ₹10,000 plus CGST and SGST @ 9% each. he receives the GST amount in cash and draws upon Bhola a bill for the balance amount payable 3 months after date. The bill is accepted by Bhola. Amar discounts the bill with his bank at a discount of ₹150 inclusive of all charges. Bhola fails to meet this bill on maturity. Amar pays off his bank and his expenses amounting to ₹100. Bhola gives a fresh bill of 2 months date to Amar for ₹10,250, which he meets at maturity.

Show necessary Journal entries in Amar’s books.

Solution:

We hope the TS Grewal Accountancy Class 11 Solutions Chapter 12 Accounting for Bills of Exchange help you. If you have any query regarding TS Grewal Accountancy Class 11 Solutions Chapter 12 Accounting for Bills of Exchange, drop a comment below and we will get back to you at the earliest.