TS Grewal Accountancy Class 11 Solutions Chapter 7 Special Purpose Books I Cash Book – Here are all the TS Grewal solutions for Class 11 Accountancy Chapter 7. This solution contains questions, answers, images, explanations of the complete Chapter 7 titled Special Purpose Books I Cash Book of Accountancy taught in Class 11. If you are a student of Class 11 who is using TS Grewal Textbook to study Accountancy, then you must come across Chapter 7 Special Purpose Books I Cash Book. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete TS Grewal Solutions PDF for Class 11 Accountancy Chapter 7 Special Purpose Books I Cash Book in one place.

TS Grewal Accountancy Class 11 Solutions Chapter 7 Special Purpose Books I Cash Book

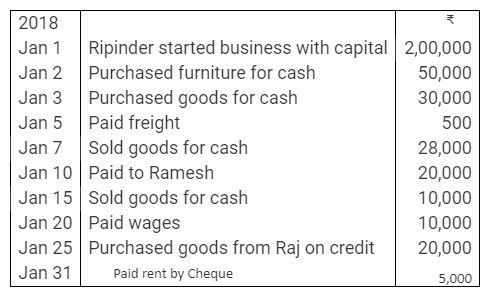

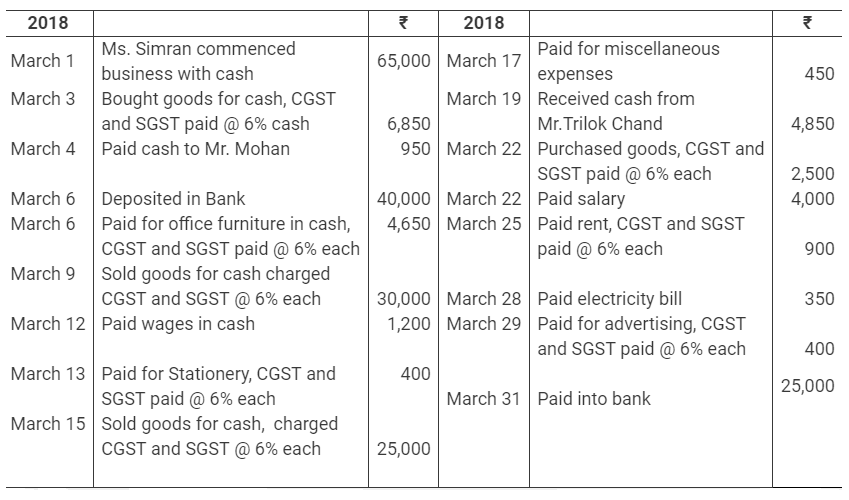

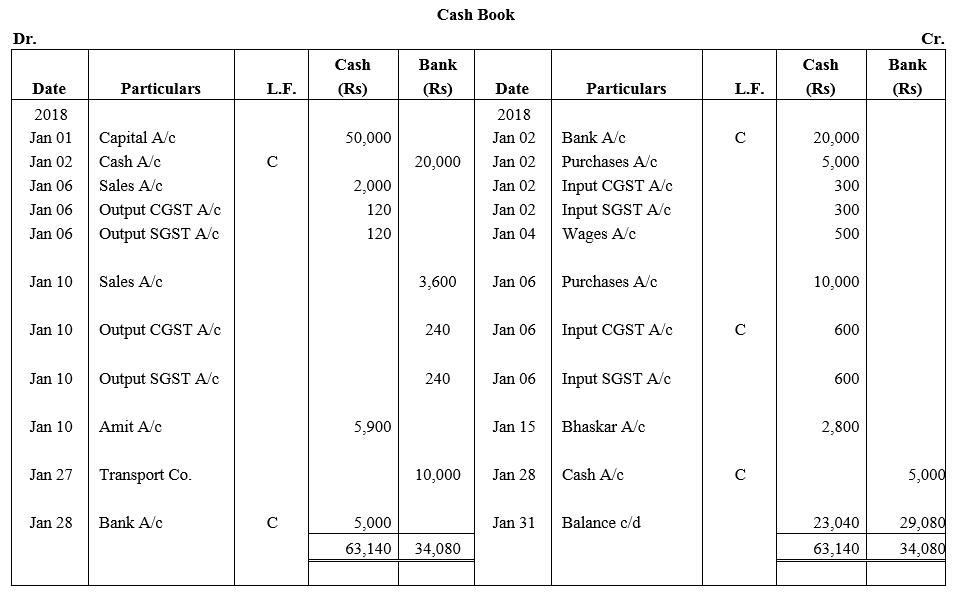

Question 1.

Without Goods and Services Tax (GST)

Enter the following transactions of Mr. Ripinder, Delhi in a Single Column Cash Book and balance it:

Solution:

![]()

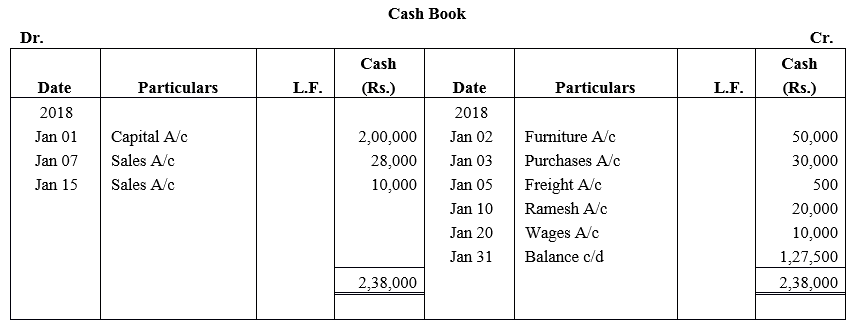

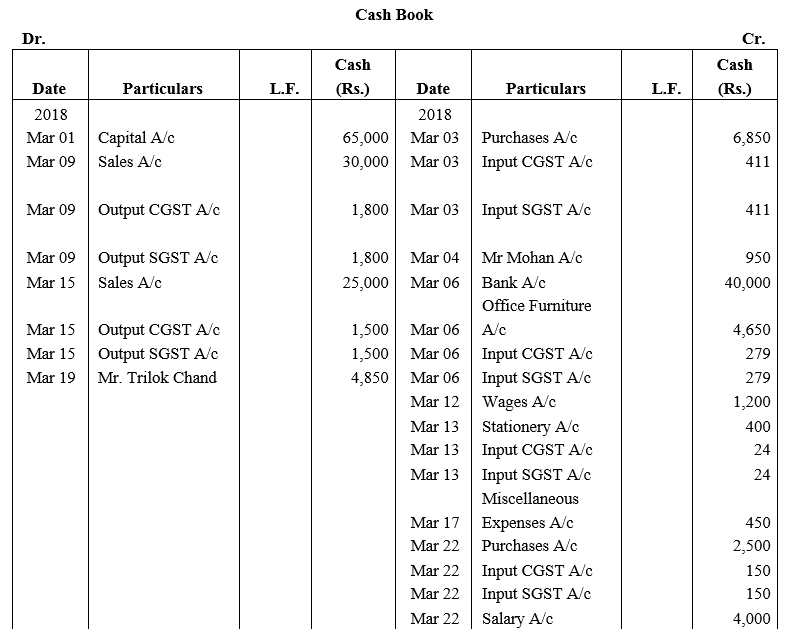

Question 2.

Prepare Simple Cash Book from the following transactions of Mr. Suresh, Delhi:

Solution:

![]()

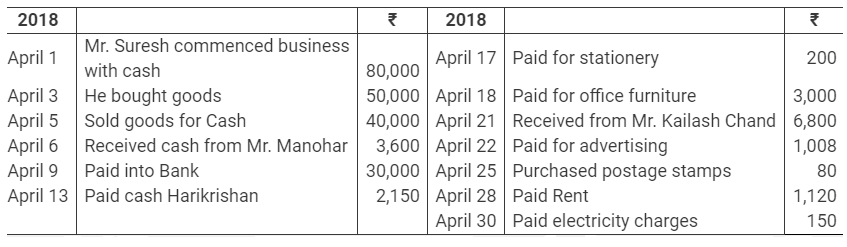

Question 3.

With Goods and Services Tax (GST)

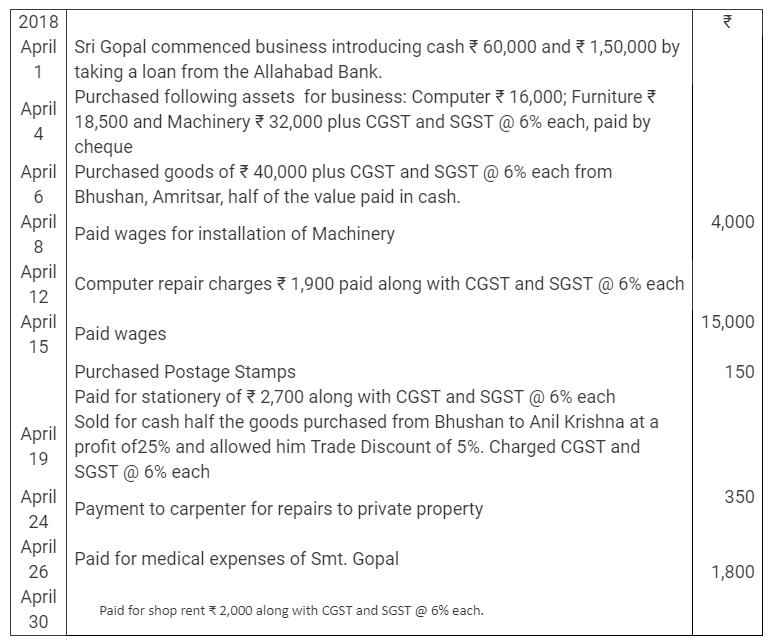

Prepare Simple Cash book of Sri Gopal of Amritsar from the following transactions:

Solution:

![]()

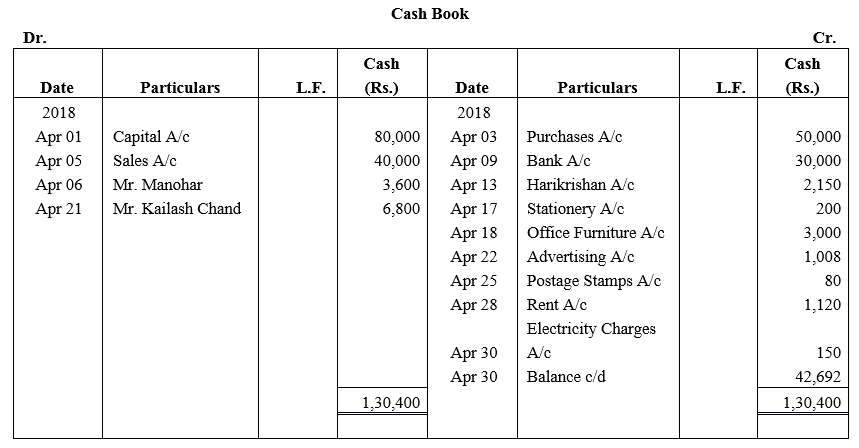

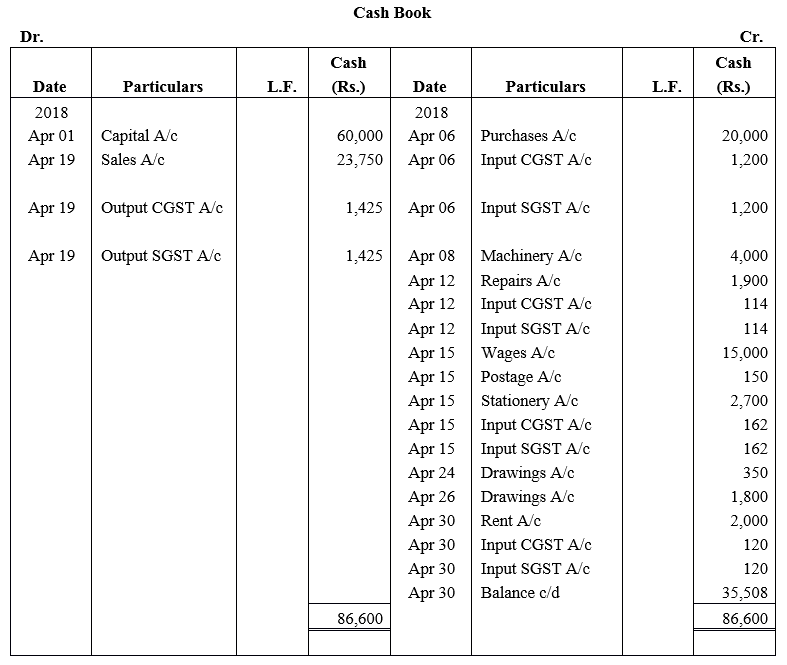

Question 4.

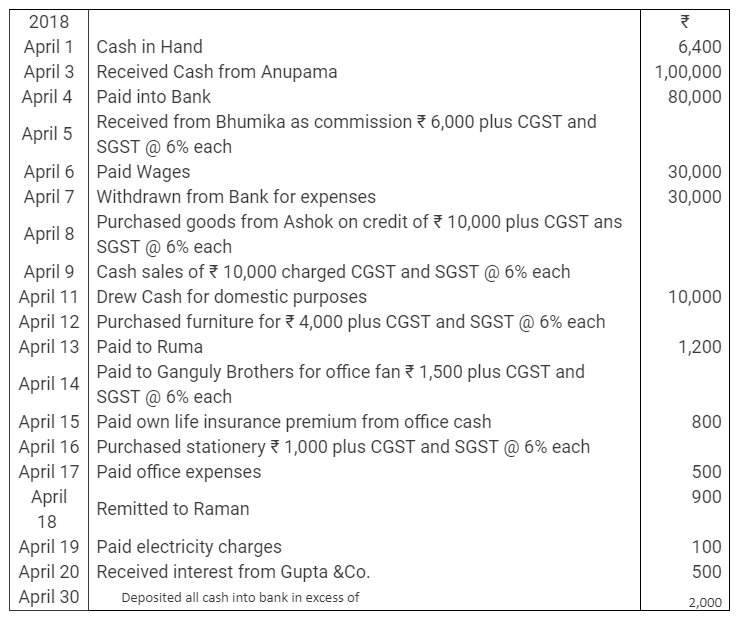

Prepare Simple Cash Book from the following transactions of Simran, Delhi:

Solution:

![]()

Question 5.

From the following prepare Single Column Cash Book of Suresh, Chennai and post them into ledger accounts:

Solution:

![]()

Question 6.

Without Goods and Services Tax (GST)

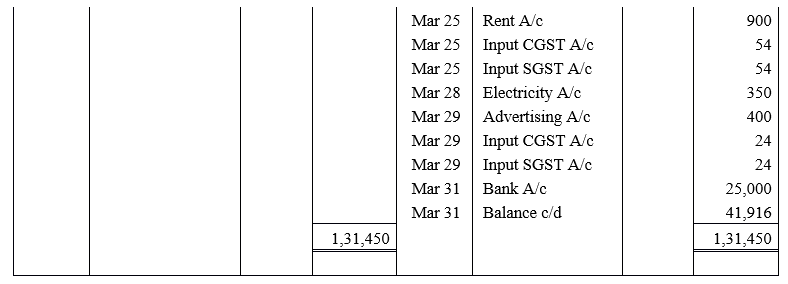

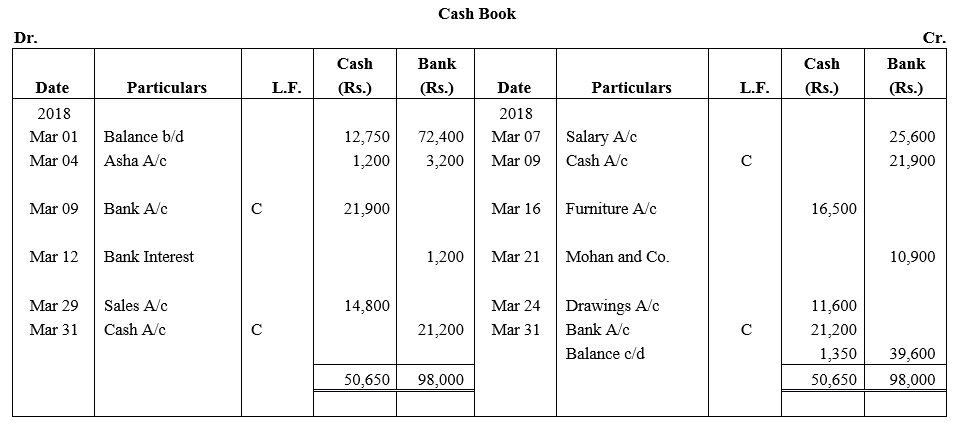

Record the following transactions in Double Columns Cash Book and balance the book on 31st March, 2018:

Solution:

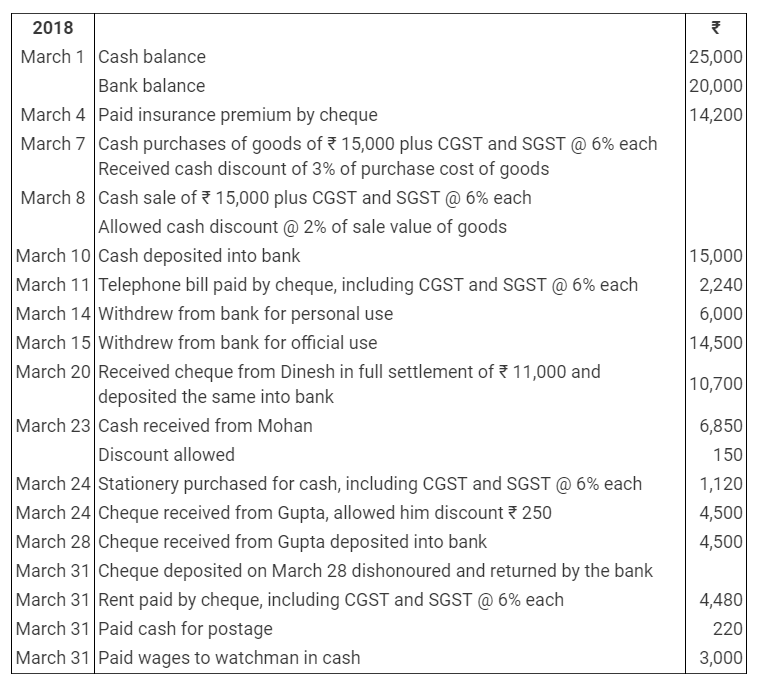

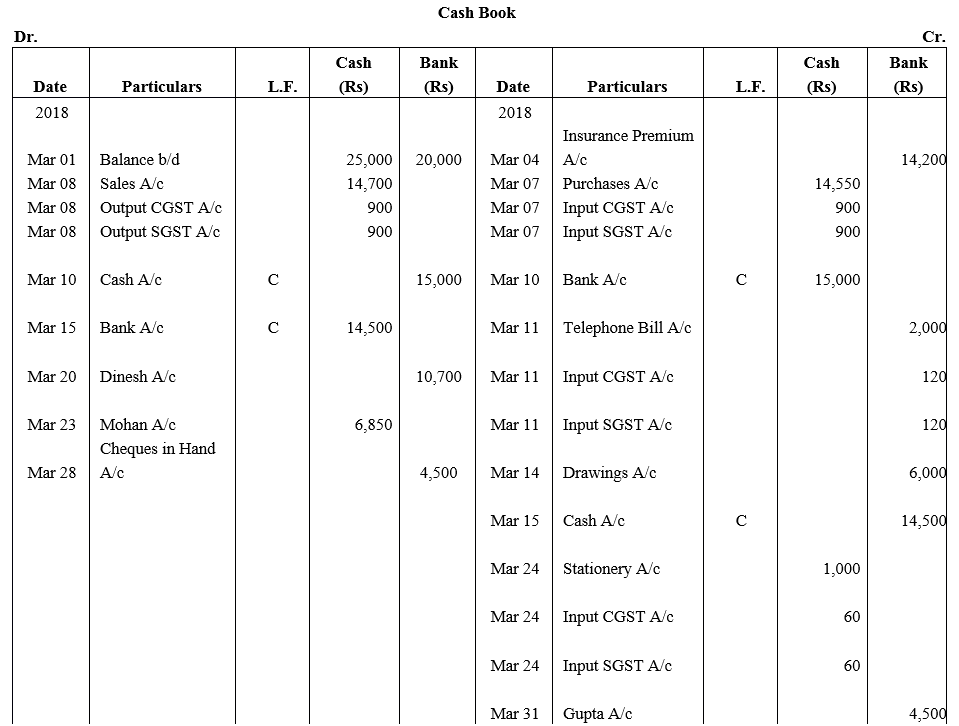

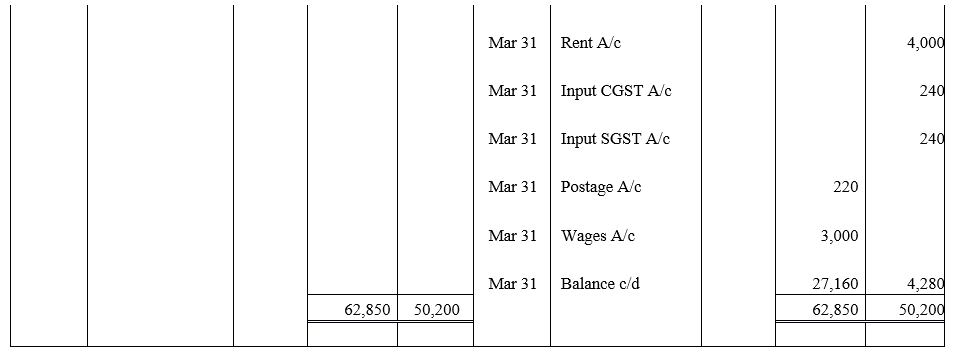

Question 7.

Enter the following transactions in the Double Column Cash Book of M/s. Gupta Store:

Solution:

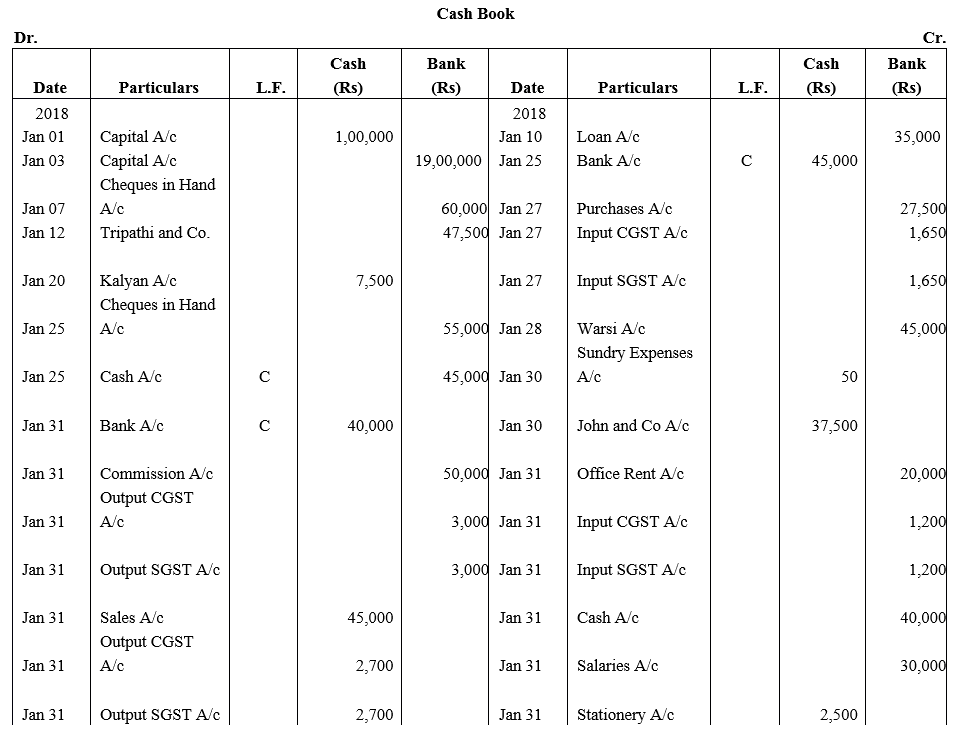

Question 8.

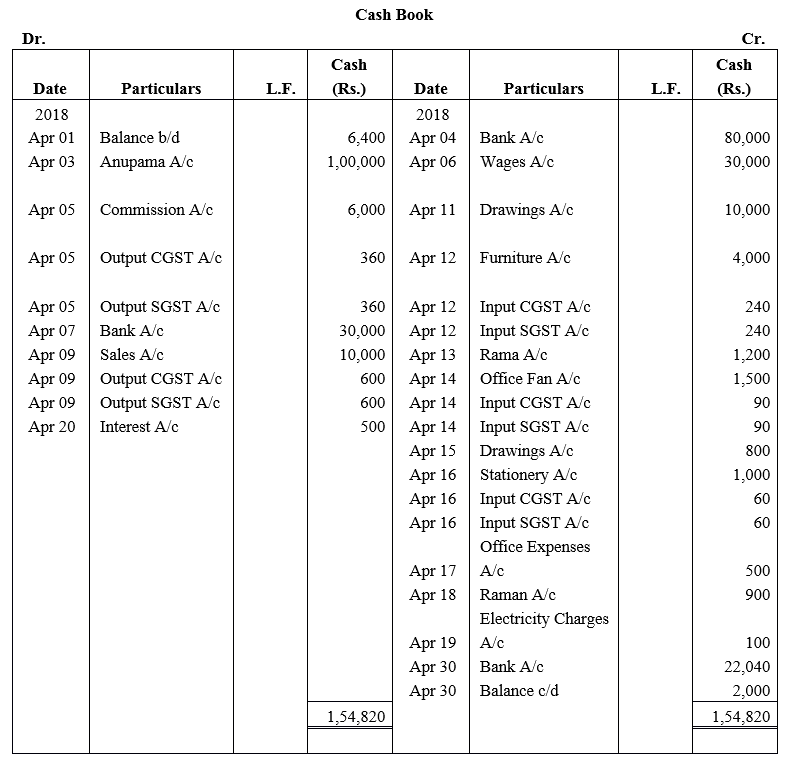

Prepare Two-column Cash Book of Bimal, Lucknow from the following transactions:

Solution:

![]()

Question 9.

Prepare Two-column Cash Book from the following transactions of Mani, Kochi;

Solution:

![]()

Question 10.

Prepare Two-column Cash Book of Vinod, Delhi from the following transactions:

Solution:

![]()

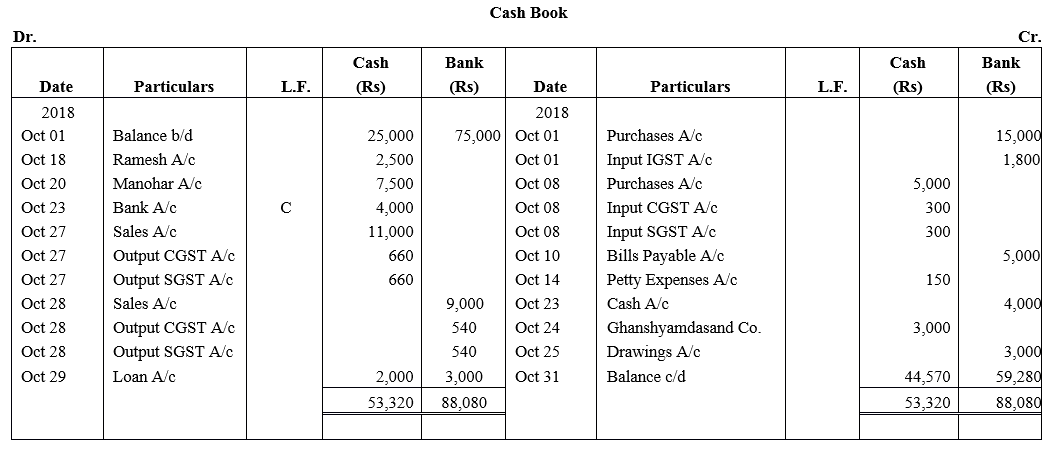

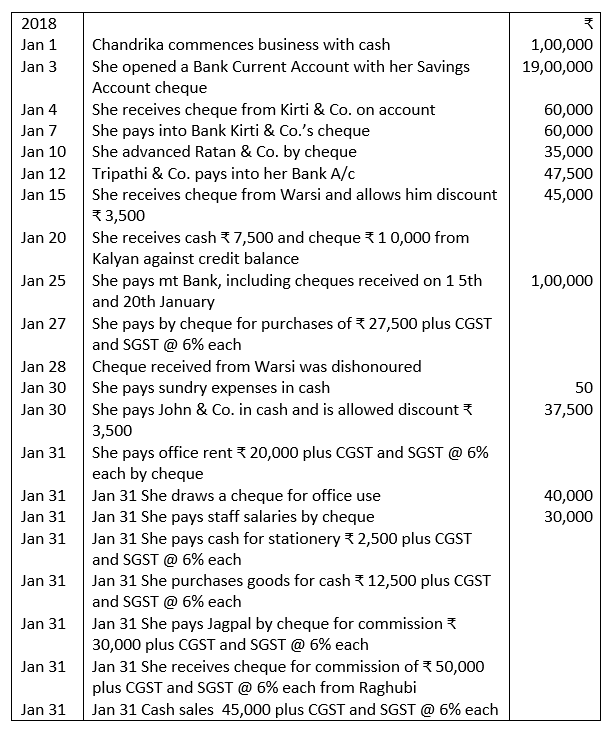

Question 11.

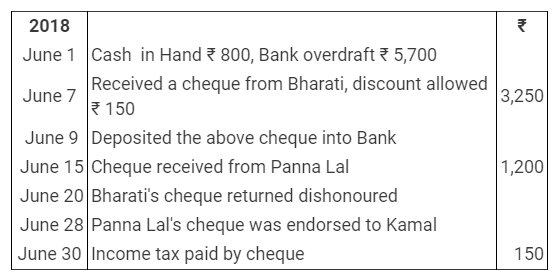

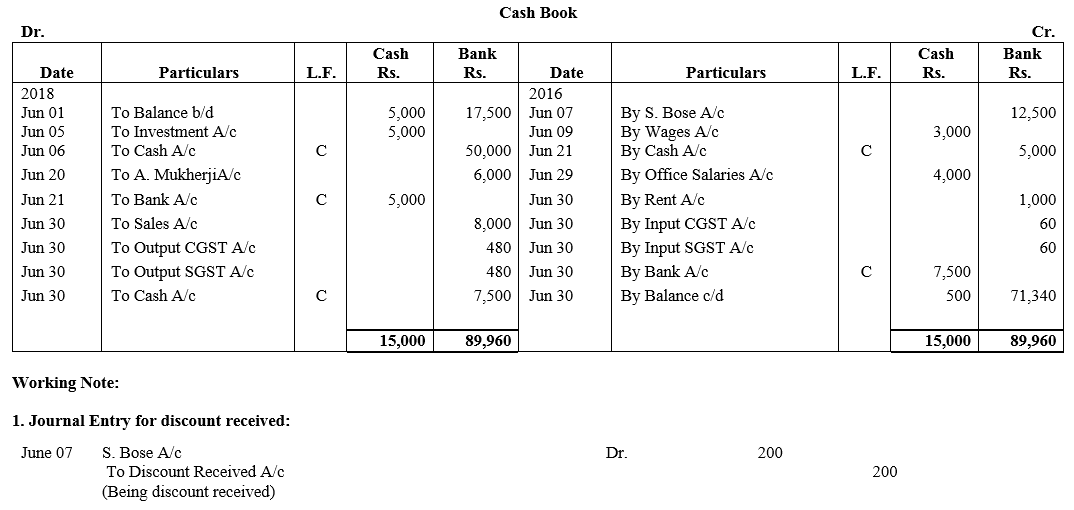

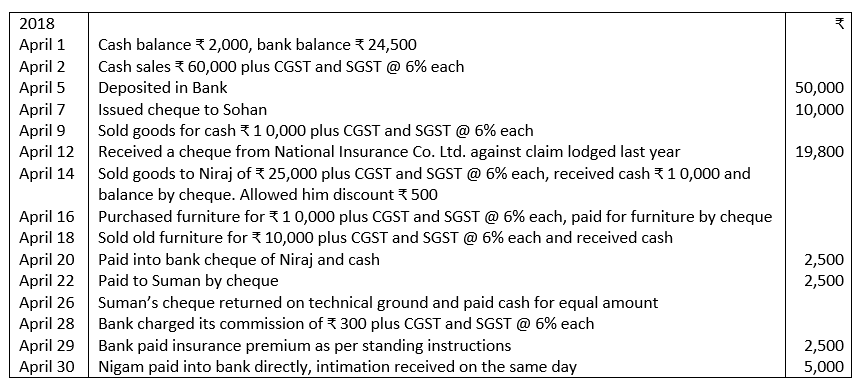

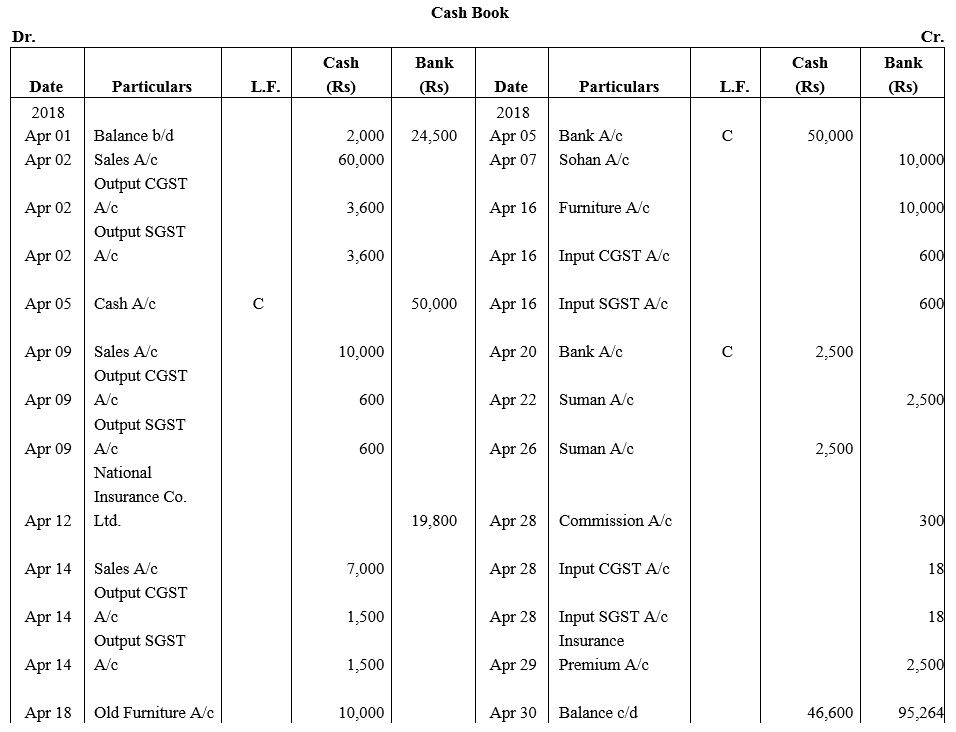

Enter the following transactions in the Cash Book of Chandrika of Chandigarh:

Solution:

![]()

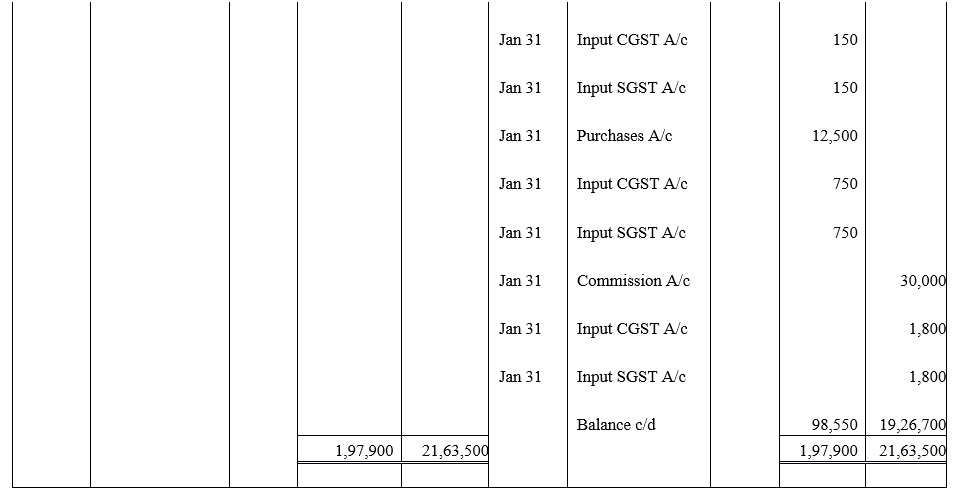

Question 12.

Enter the following transactions in Two-column Cash Book of Reema, Chandigarh and find out cash and bank balances:

Solution:

![]()

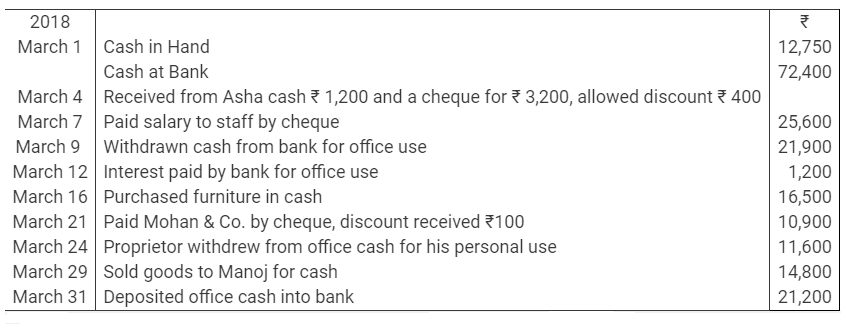

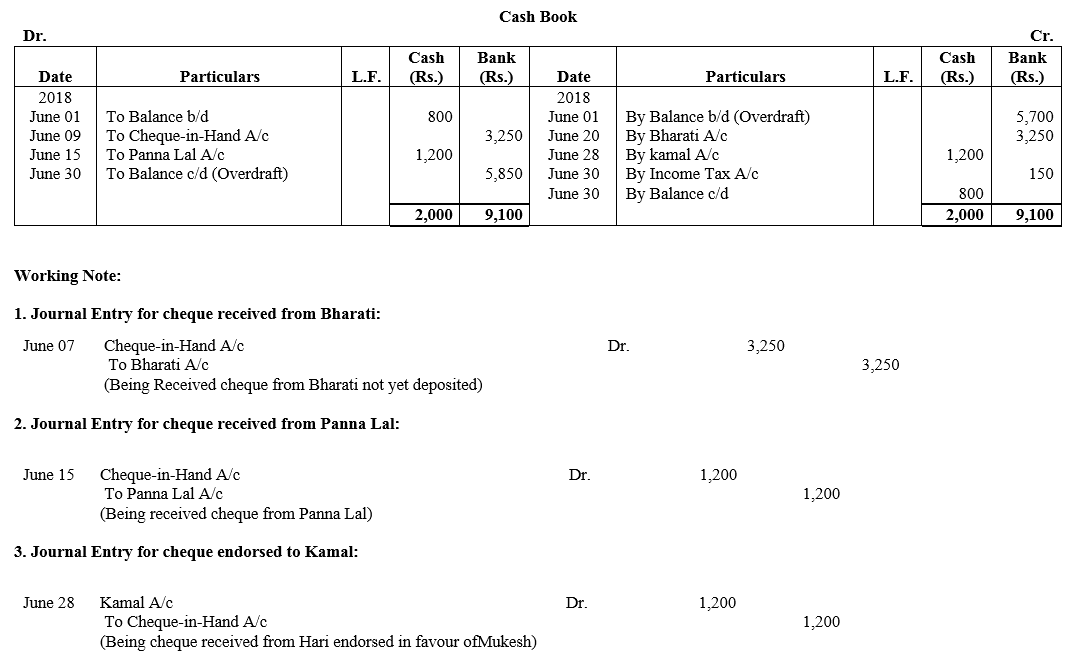

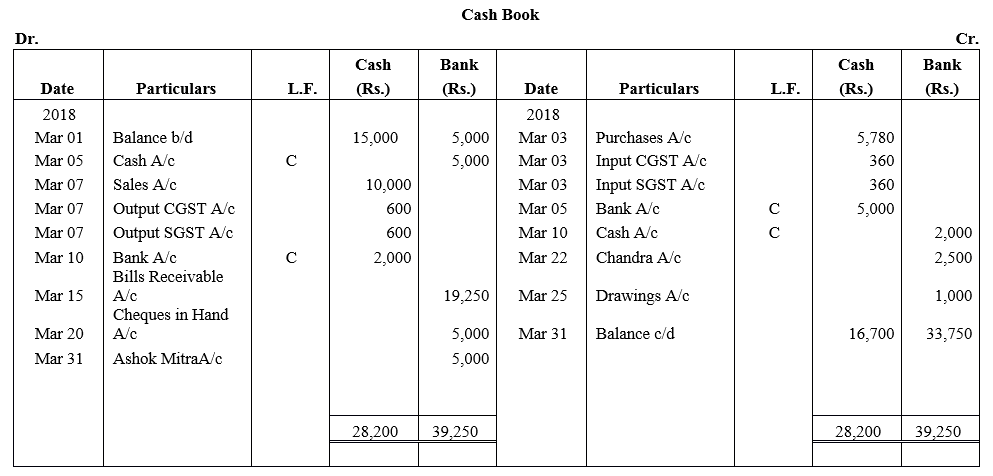

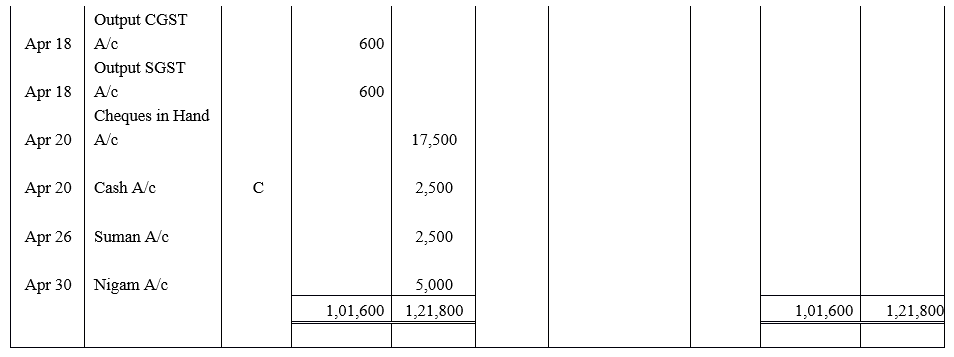

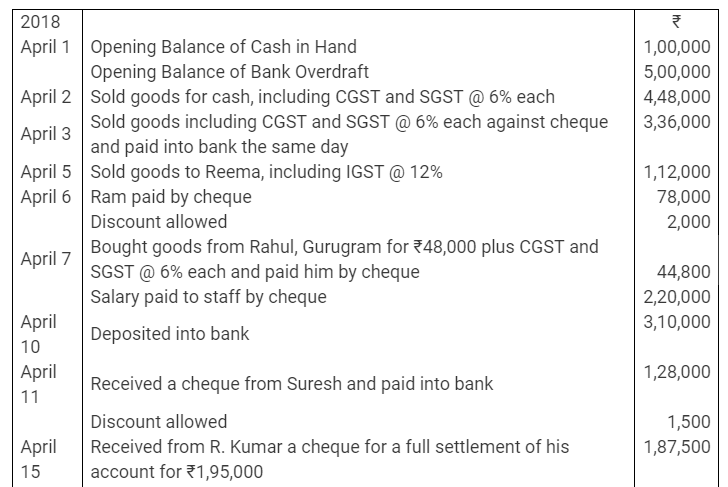

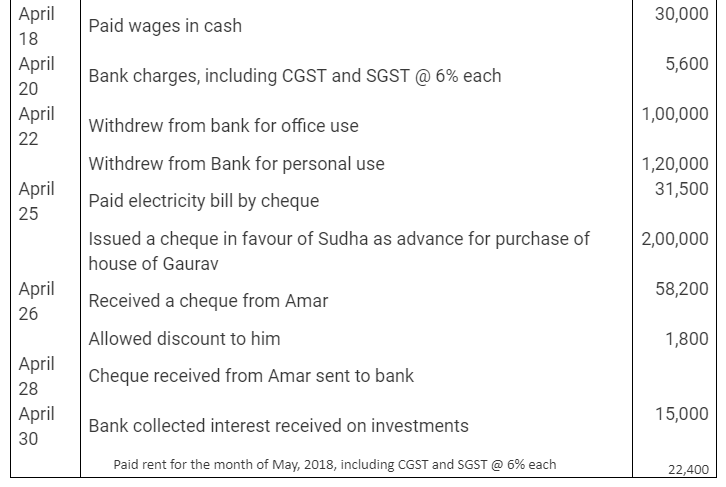

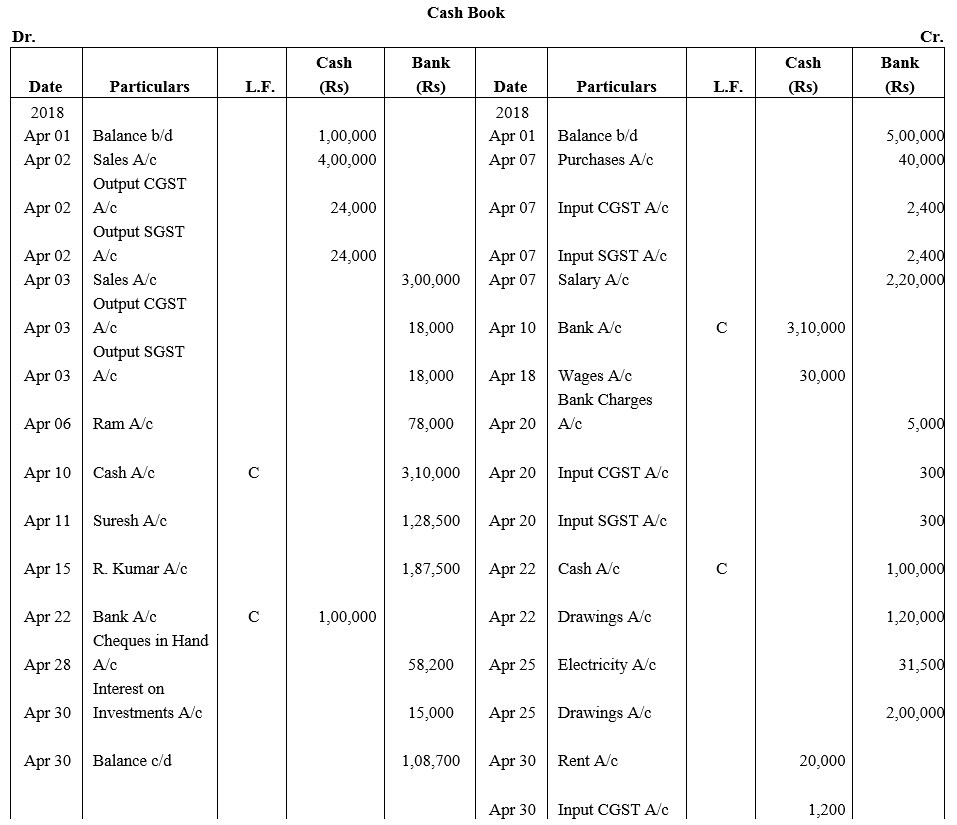

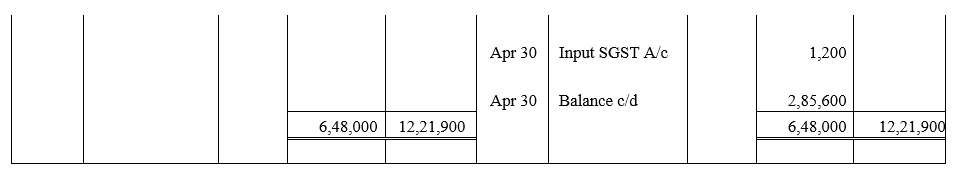

Question 13.

Write the following transactions in the Cash Book of Premium Stores, Kolkata (Proprietor Amrit Kumar):

Solution:

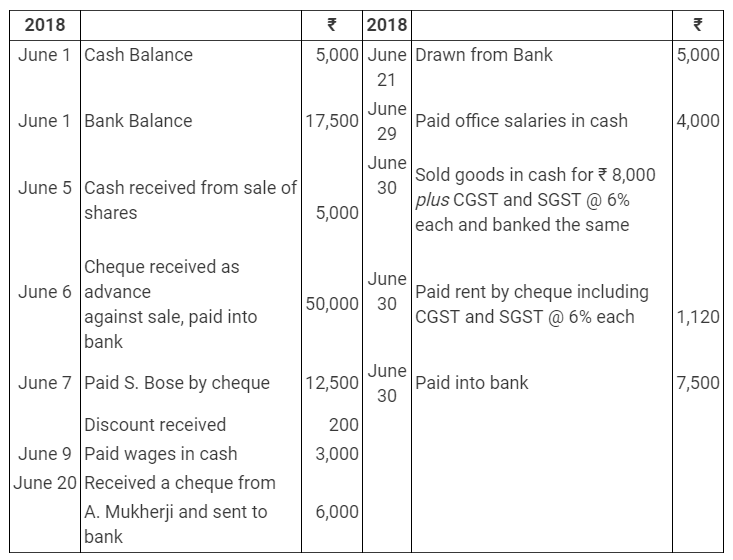

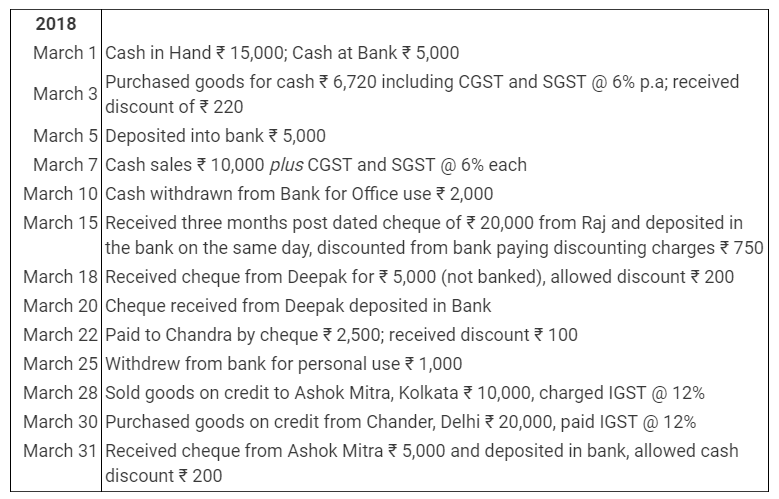

Question 14.

Record the following transactions in Two-column Cash Book of Ripple, Delhi:

Solution:

![]()

Question 15.

Enter the following transactions in Two-column Cash Book of Gaurav, Delhi:

Solution:

![]()

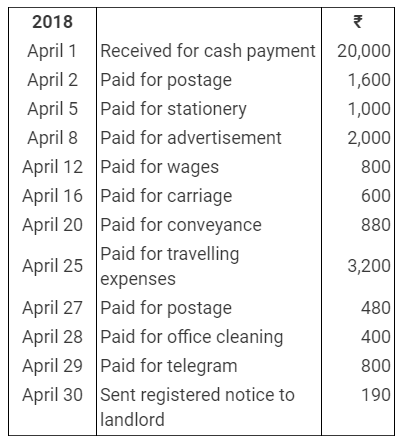

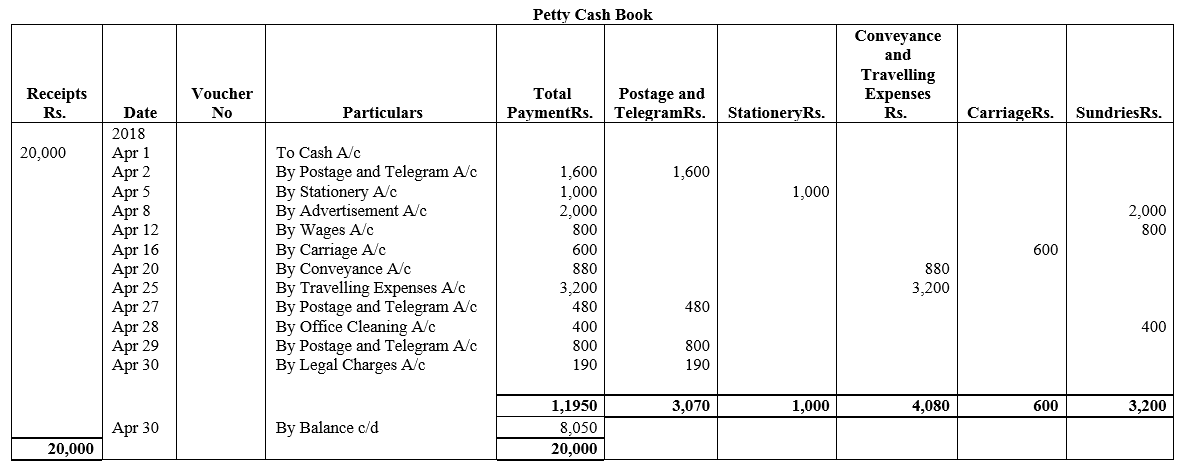

Question 16.

From the following information, prepare an Analytical Petty Cash Book:

Solution:

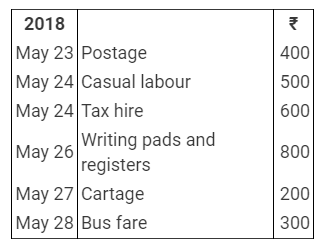

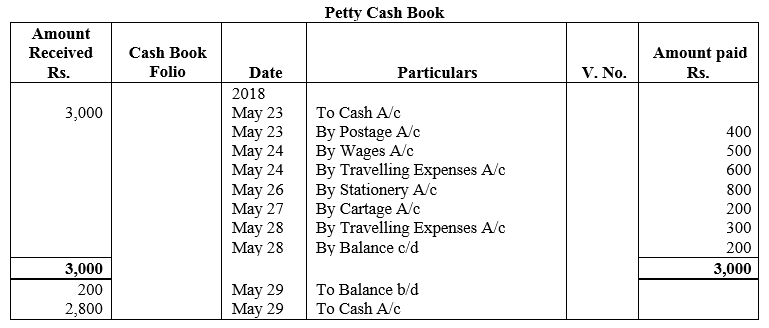

Question 17.

The following transactions took place during the week ended 28th May, 2018. How will you record them in the Petty Cash Book which was maintained with a weekly ‘float&’ of ₹ 3,000?

Solution:

![]()

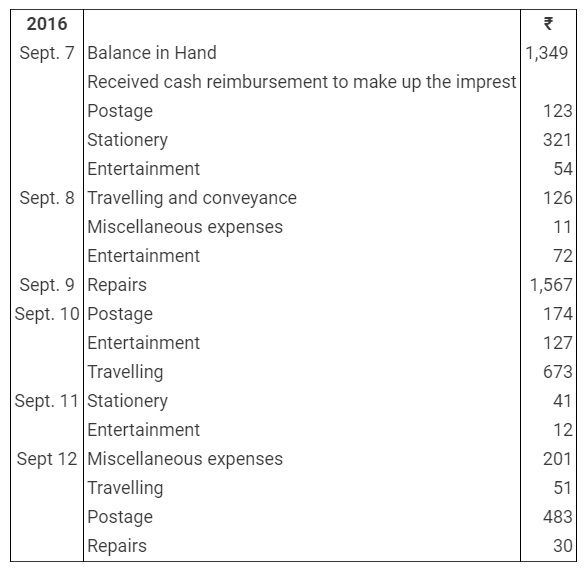

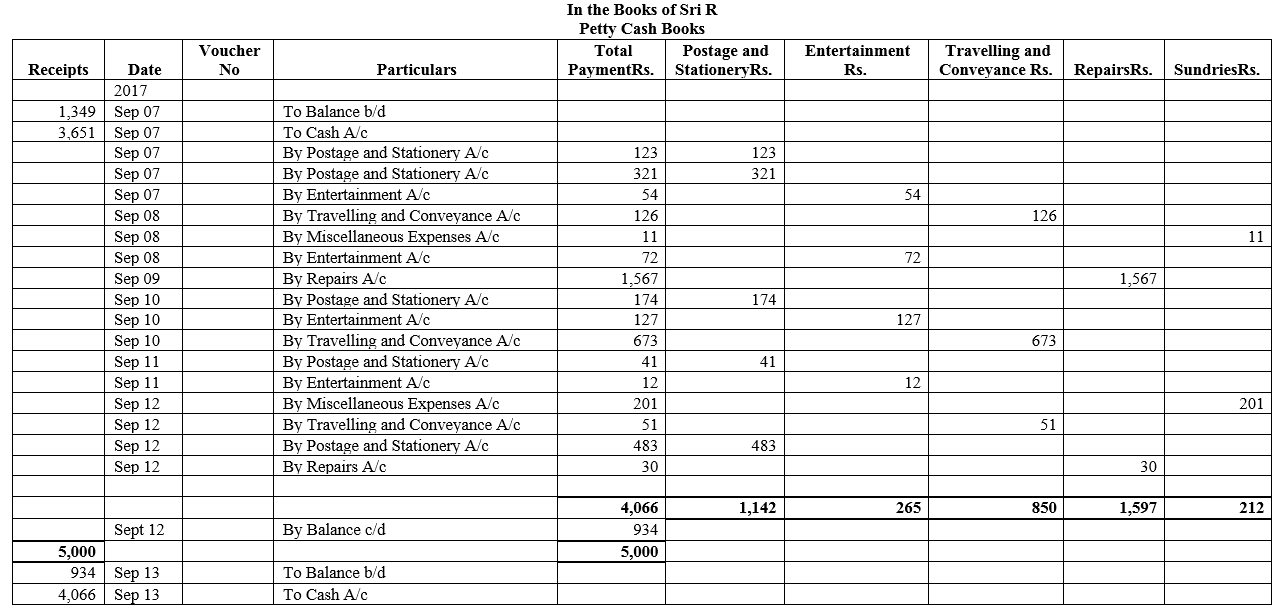

Question 18.

Sri R maintains a Columnar Petty Cash Book on the Imprest System. The imprest amount is ₹ 5,000. From the following information, show how his Petty Cash Book would appear for the week ended 12th September, 2017:

Solution:

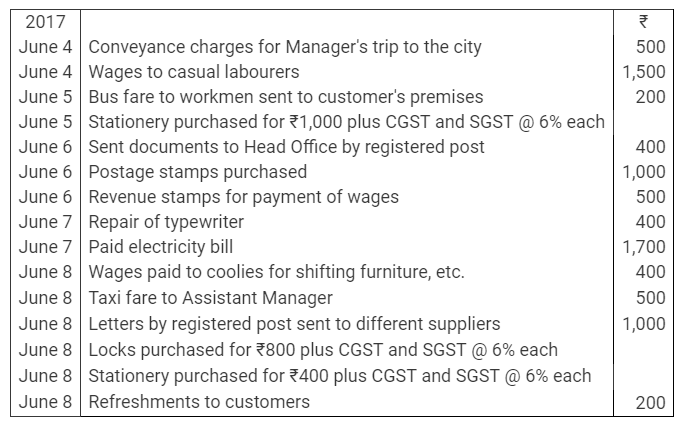

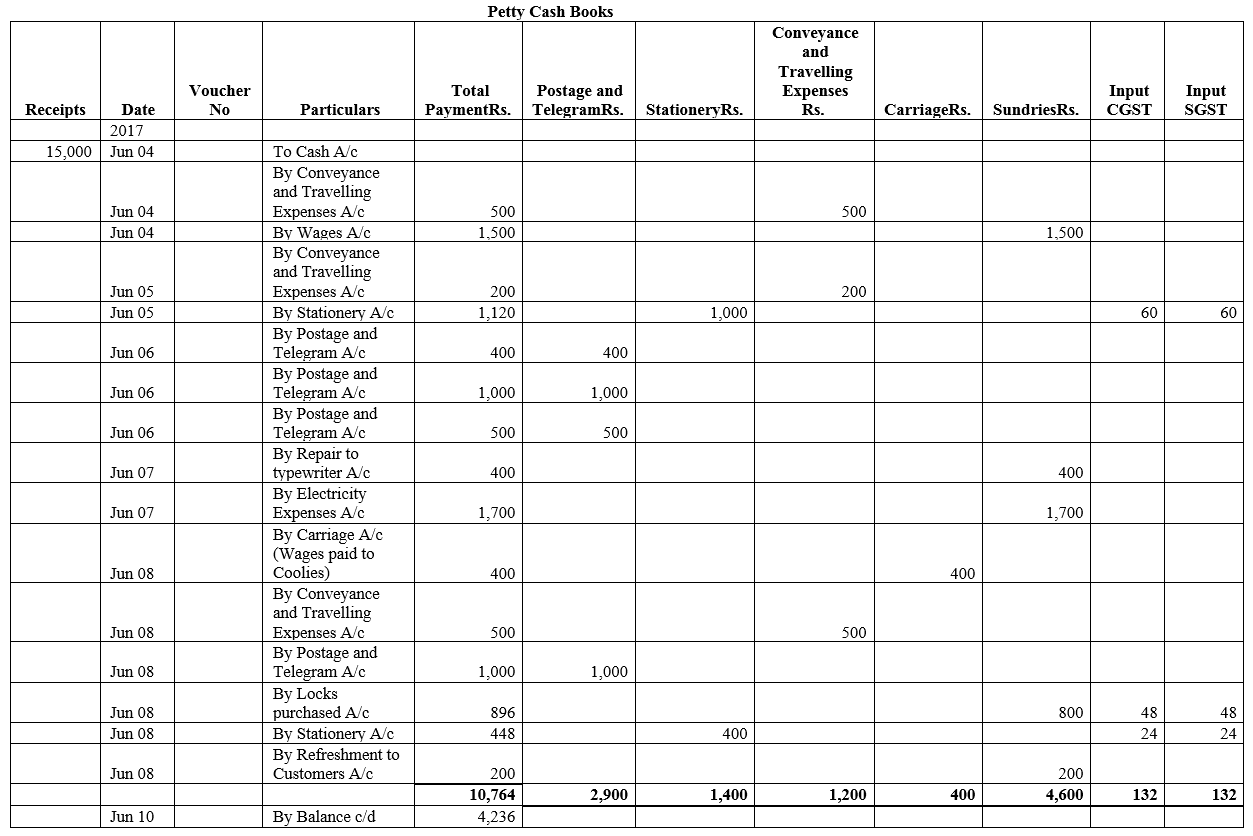

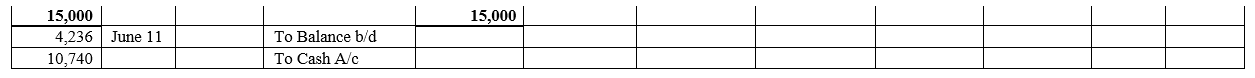

Question 19.

With Goods and Services Tax (GST)

A Petty Cashier in a firm received ₹15,000 as the petty cash imprest on 4th June, 2017. During the week, his expenses were as follows:

Write up the Analytical Petty Cash Book and draft the necessary Journal entries for the payments made.

Solution:

We hope the TS Grewal Accountancy Class 11 Solutions Chapter 7 Special Purpose Books I Cash Book help you. If you have any query regarding TS Grewal Accountancy Class 11 Solutions Chapter 7 Special Purpose Books I Cash Book, drop a comment below and we will get back to you at the earliest.

![]()