TS Grewal Accountancy Class 11 Solutions Chapter 6 Ledger – Here are all the TS Grewal solutions for Class 11 Accountancy Chapter 6. This solution contains questions, answers, images, explanations of the complete Chapter 6 titled Ledger of Accountancy taught in Class 11. If you are a student of Class 11 who is using TS Grewal Textbook to study Accountancy, then you must come across Chapter 6 Ledger. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete TS Grewal Solutions for Class 11 Accountancy Chapter 6 Ledger in one place.

TS Grewal Accountancy Class 11 Solutions Chapter 6 Ledger

Here on NCERTBooks.Guru, you can access to TS Grewal Book Solutions in free pdf for Accountancy for Class 11 so that you can refer them as and when required. The TS Grewal Solutions to the questions after every unit of TS Grewal textbooks aimed at helping students solving difficult questions.

For a better understanding of this chapter, you should also see summary of Chapter 6 Ledger , Accountancy, Class 11.

TS Grewal Solutions Class 11 Accountancy Chapter 6 Ledger

Class 11, Accountancy Chapter 6, Ledger solutions are given below in PDF format. You can view them online or download PDF file for future use.

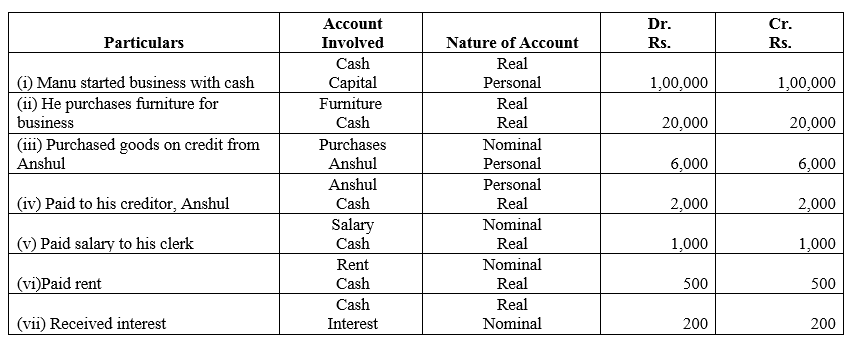

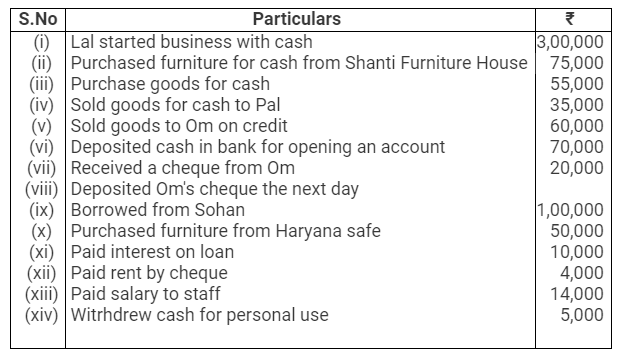

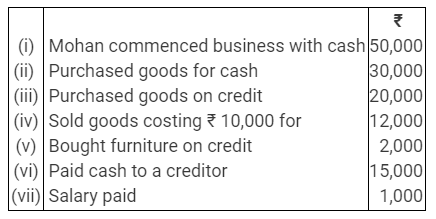

Question 1.

On 1st April, 2018, Mohit started business with a capital of ₹ 50,000. He made the following transactions:

You are required to journalise the above transactions and show the respective Ledger accounts.

Solution:

Question 2.

Suresh, Kanpur commenced business on 1st January, 2018 introducing capital in cash ₹ 1,00,000. His other transactions during the month were as follows:

Enter the above transactions in his books of account.

Solution:

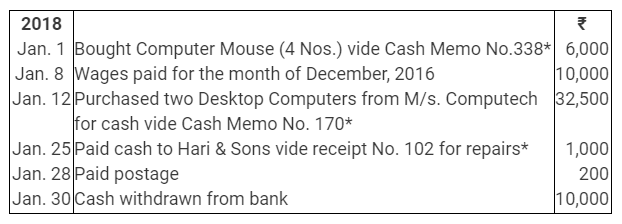

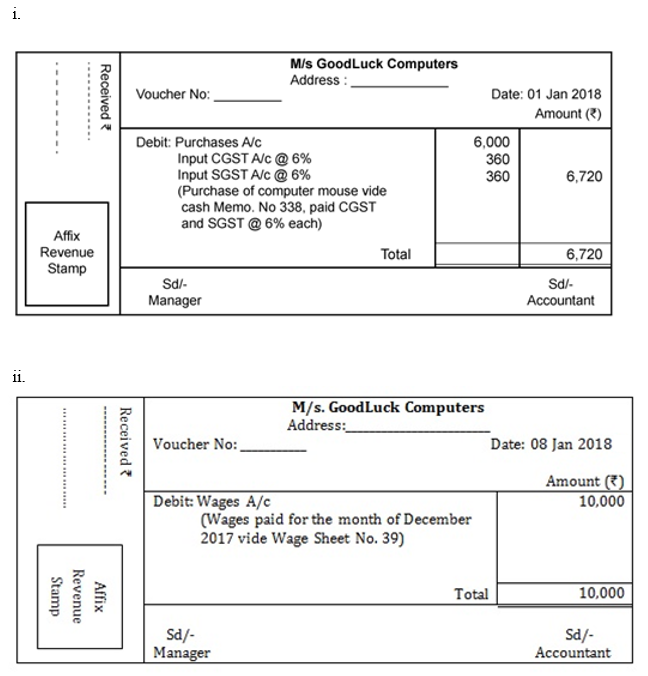

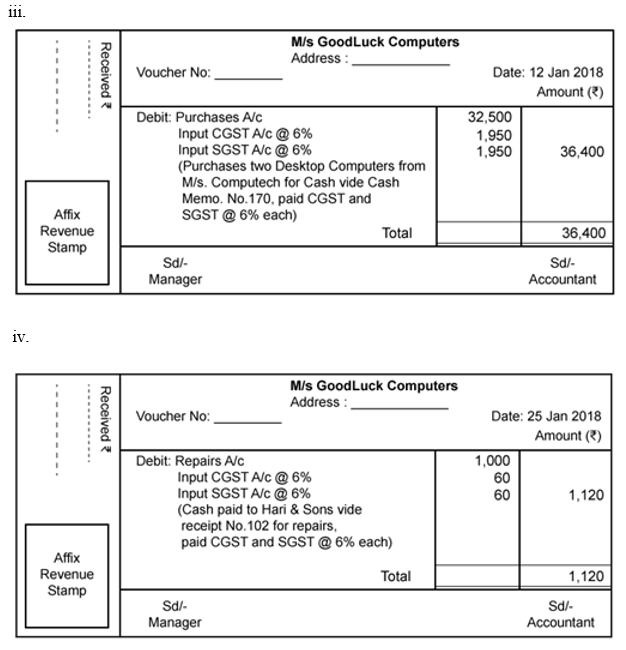

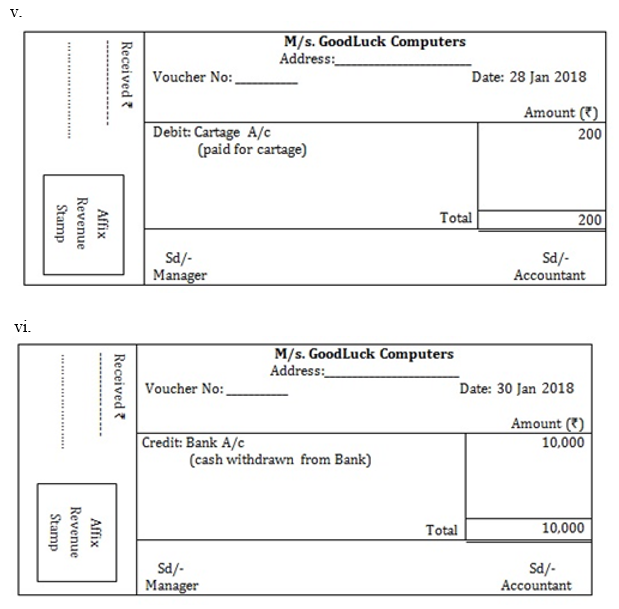

Question 3.

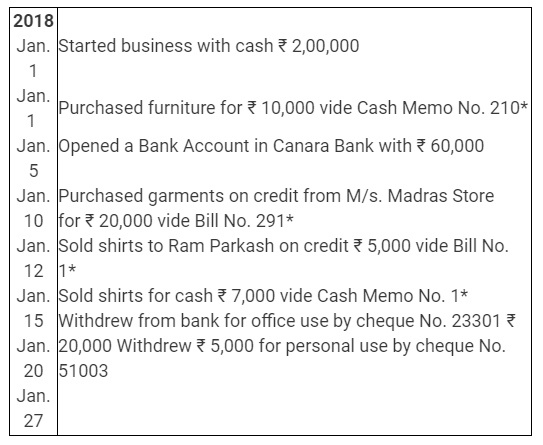

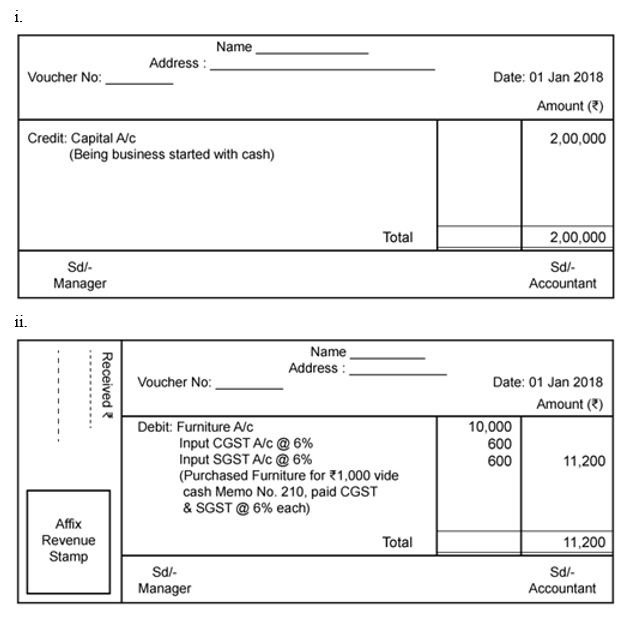

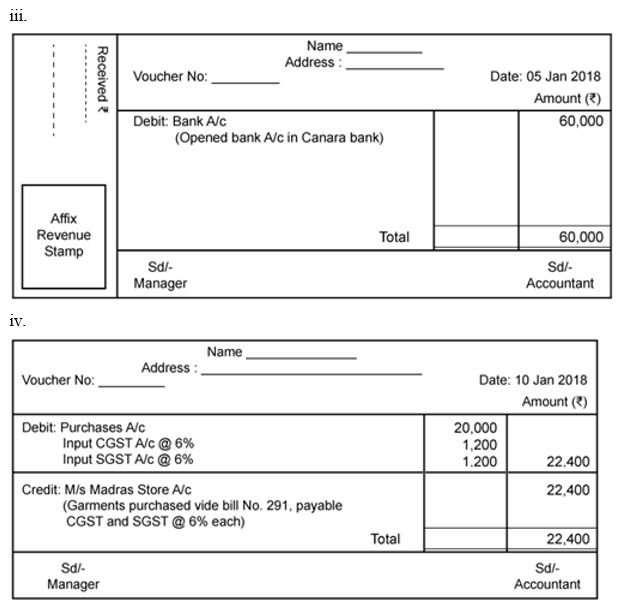

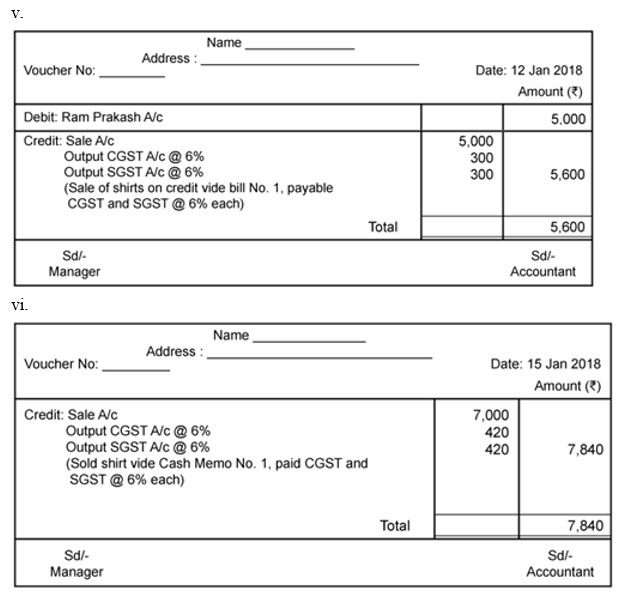

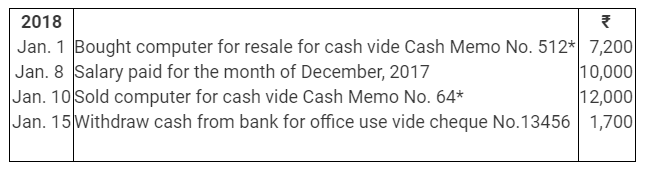

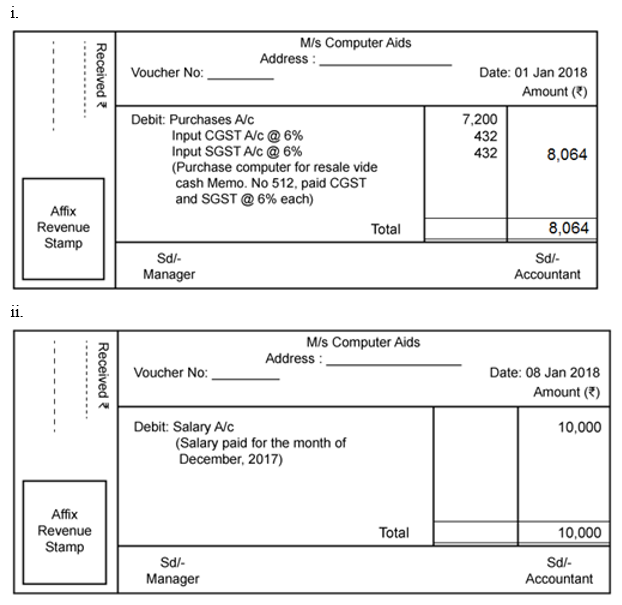

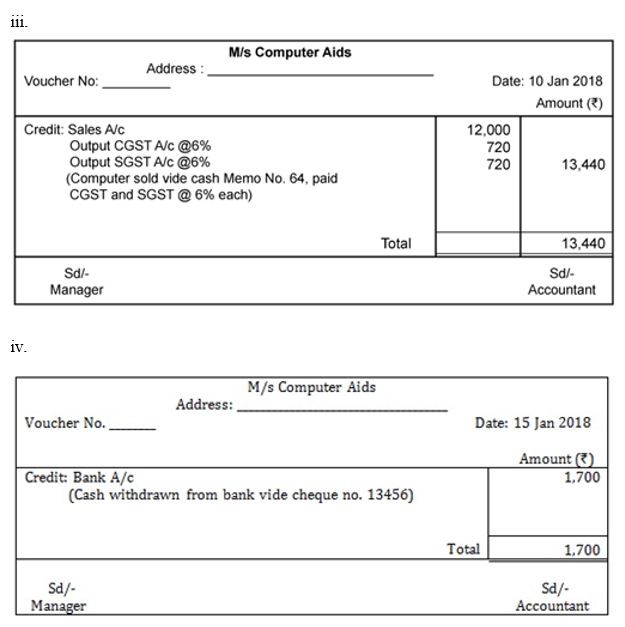

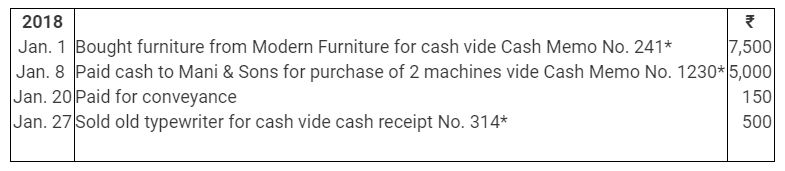

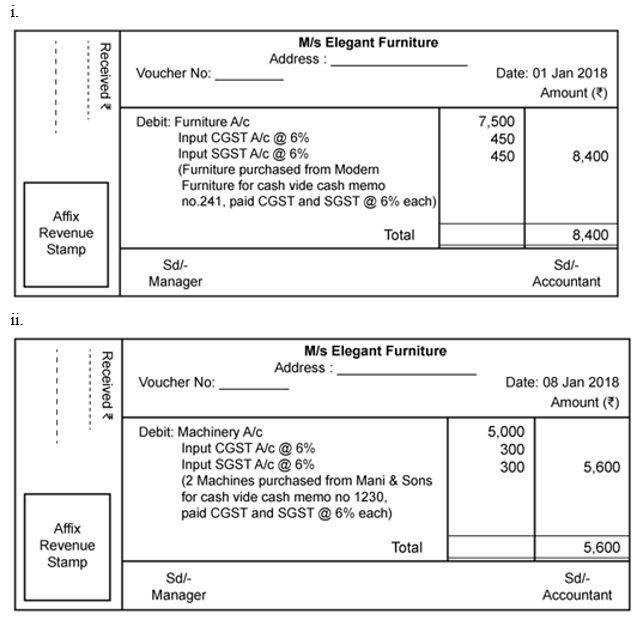

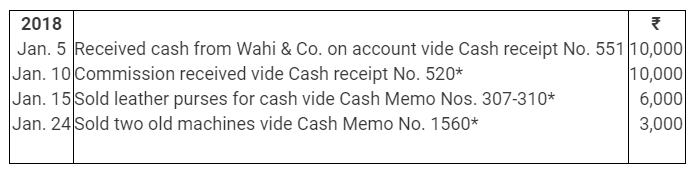

Journalise the following transactions in the books of Afzal, Kolkata and post them to the Ledger:

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions, transactions marked (*) are not subject to levy of GST.

Solution:

Question 4.

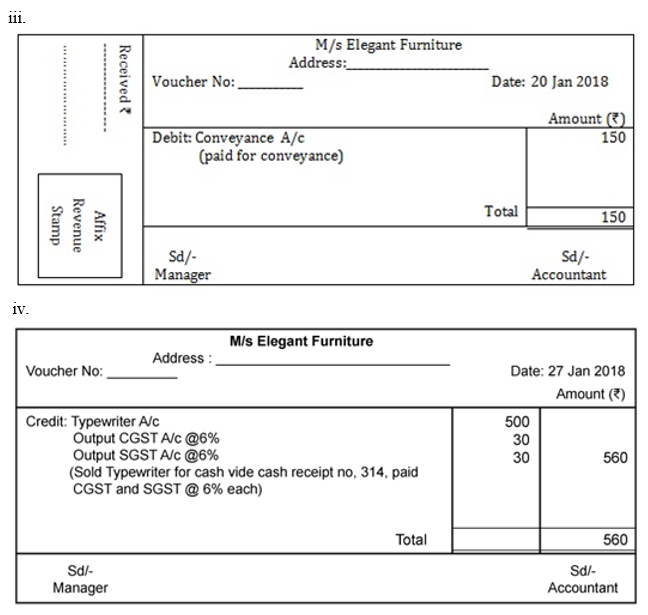

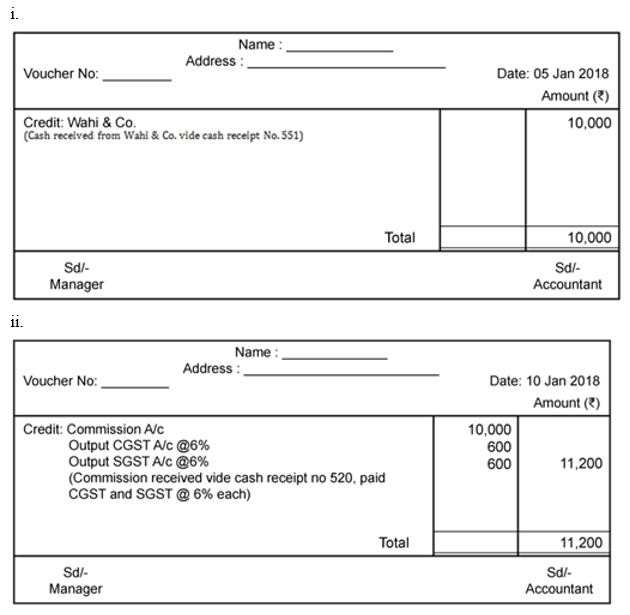

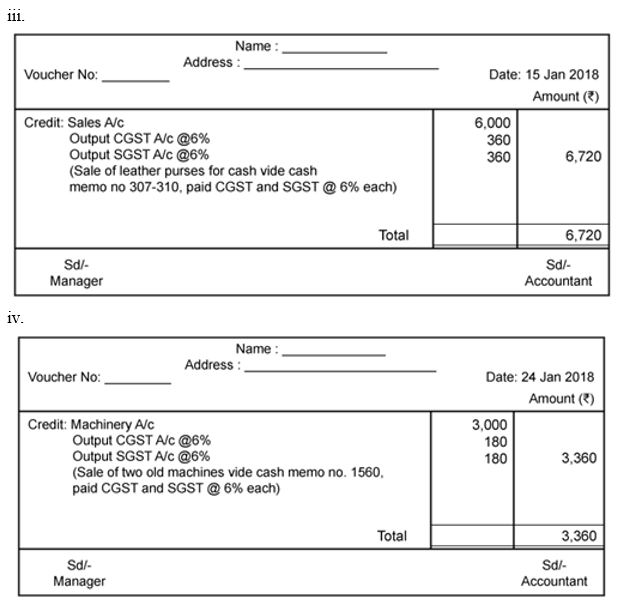

Pass Journal entries of M/s. Bhanu Traders, Delhi from the following transactions. Post them to the Ledger:

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions marked (*) are not subject to levy of GST.

Solution:

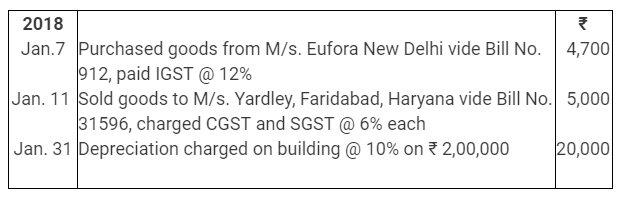

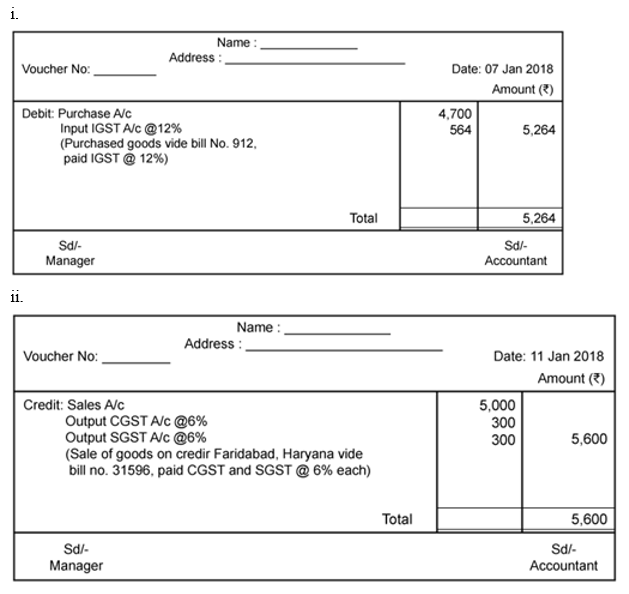

Question 5.

Journalise the following transactions in the Journal of M/s. Gupta Brothers (Prop. Shri R. K. Gupta), Delhi and post them to the Ledger:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Solution:

Question 6.

Following balances appeared in the books of Ashok, Delhi on 1st April, 2018:

Assets: Cash – ₹ 50,000; Stock – ₹ 30,000; Debtors – Ram ₹ 50,000; Machinery – ₹ 60,000.

Liabilities: Creditor – Rajesh ₹ 30,000.

The following transactions took place in April, 2018:

CGST and SGST @ 6% each is levied on intra-state transactions and IGST is levied @ 12% on inter-state transactions. Transactions marked (*) are not subject to levy of GST.

Pass Journal entries for the above transaction, post them into the Ledger and prepare the Trial Balance on 30th April, 2018.

Solution:

Question 7.

On 1st April, 2018, the following were Ledger balances of M/s. Ram & Co., Delhi: Cash in Hand – ₹ 300; Cash at Bank – ₹ 7,000; Bills Payable – ₹ 1,000; Zahir (Dr.) – ₹ 800; Stock – ₹ 4,000; Gobind (Cr.) – ₹ 2,000; Sharma (Dr.) – ₹ 1,500; Rahul (Cr.) – ₹ 900; Capital – ₹ 9,700. Transactions during the month of April, 2018 were:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Post the above transactions to the Ledger and prepare the Trial Balance on 30th April, 2018.

Solution:

Question 8.

You are to open the books of Rajesh Prabhu, Gurugram (Haryana) a trader, through the Journal to record the assets and liabilities and then to record the daily transactions for the month of April, 2018. A Trial Balance is to be extracted as on 30th April, 2018:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Solution:

Question 9.

Enter the following transactions in the Journal of M/s. Karim Bros., Prop. Shri Karim Khan, Kolkata, post to the Ledger and prepare the Trial Balance:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Solution:

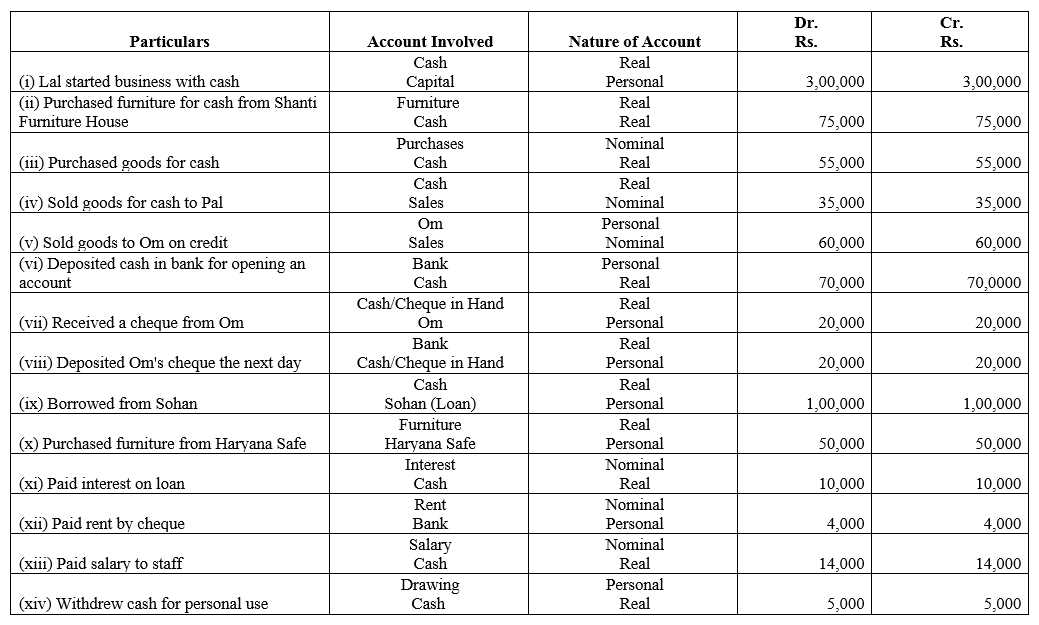

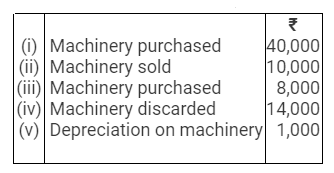

Question 10.

Write up the following transactions in the Journal of Ashok, Delhi and post them to the Ledger for April, 2018. Also, prepare the Trial Balance as on 30th April, 2018.

Solution:

Question 11.

Shri S. K. Gupta, Chandigarh commenced business on 1st April, 2018 with a capital of ₹ 1,20,000 of which ₹ 60,000 was paid into his Bank Account and ₹ 60,000 retained as cash. His other transactions during the month were as follows:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Journalise the above transactions and post them to the Ledger.

Solution:

Question 12.

Journalise the following transactions in the books of Shri Manoj, Kolkata and prepare Ledger Accounts.

Opening Debit Balances:

Cash in Hand – ₹ 15,000; Cash at Bank – ₹ 55,000; Stock – ₹ 28,000; Debtors – ₹ 25,000 (Sunil – ₹ 5,000; Abhay – ₹ 10,000 and Alok – ₹ 10,000); Fixed Assets: Computer and Printer – ₹ 50,000; Furniture – ₹ 10,000; Delivery Van – ₹ 25,000.

Opening Credit Balances:

Bank Loan – ₹ 90,000; Salaries Outstanding – ₹ 15,000; Creditors – ₹ 20,000; Bills Payable – ₹ 10,000; Capital – ₹ 73,000.

Transactions for the month of April, 2018 were:

(i) Purchased goods from M/s Prabhat Electricals – ₹ 10,000 less 10% Trade Discount. Cheque was issued immediately and availed 2% Cash Discount on purchase price.

(ii) Cheque was received from Abhay for the balance allowing him discount of 2%*.

(iii) Cheque was received from Alok for the balance due*.

(iv) Sunil was unable to pay the full dues and offered to pay 75%, which was accepted. Cheque was duly received*.

(v) Gave goods costing ₹ 1,000 as charity. These goods were purchased in Kolkata.

(vi) In a competition held by the RWA where the shop is located an electric iron costing ₹ 500 was given as an award. It had been purchased from Prabhat Electricals, Delhi.

(vii) A debt of ₹ 10,000 that was written off as bad debt in the past was received*.

(viii) Salaries amounting to ₹ 15,000 provided in the books for the month of March, 2018 were paid through cheque*.

(ix) Sales for the month were: Cash Sales ₹ 15,00,000 (Intra-state) and Credit Sales ₹ 3,00,000 (Inter-state).

(x) Purchases for the month were: Cash Purchases ₹ 1,00,000 (Intra-state) and Credit Purchases (Inter-state) ₹ 9,00,000.

Cheques Received from Debtors ₹ 2,00,000; Deposited Cash ₹ 15,00,000.

(xi) Paid to creditors through cheques ₹ 8,90,000*.

(xii) Bank Loan repaid during the month ₹ 20,000*.

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Solution:

Did you find TS Grewal Solutions Class 11 Accountancy Chapter 6 Ledger helpful? If yes, please comment below. Also please like, and share it with your friends!