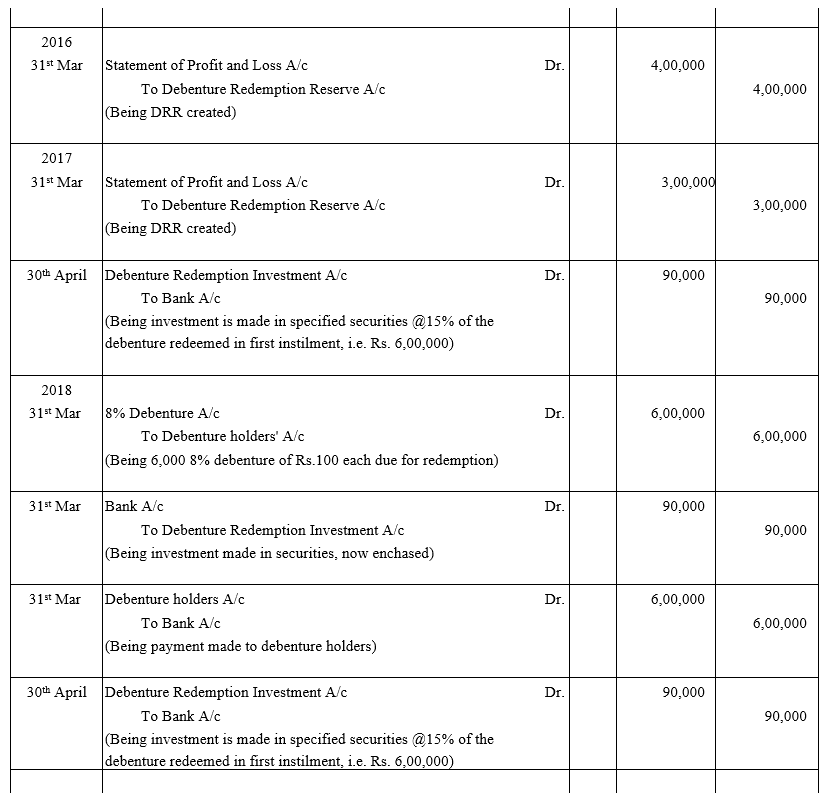

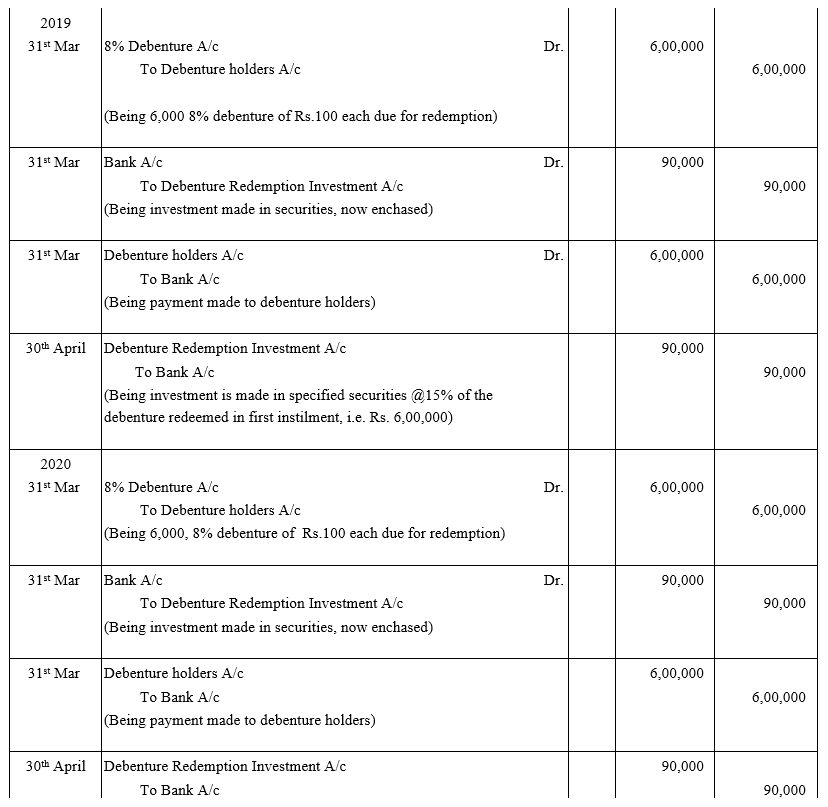

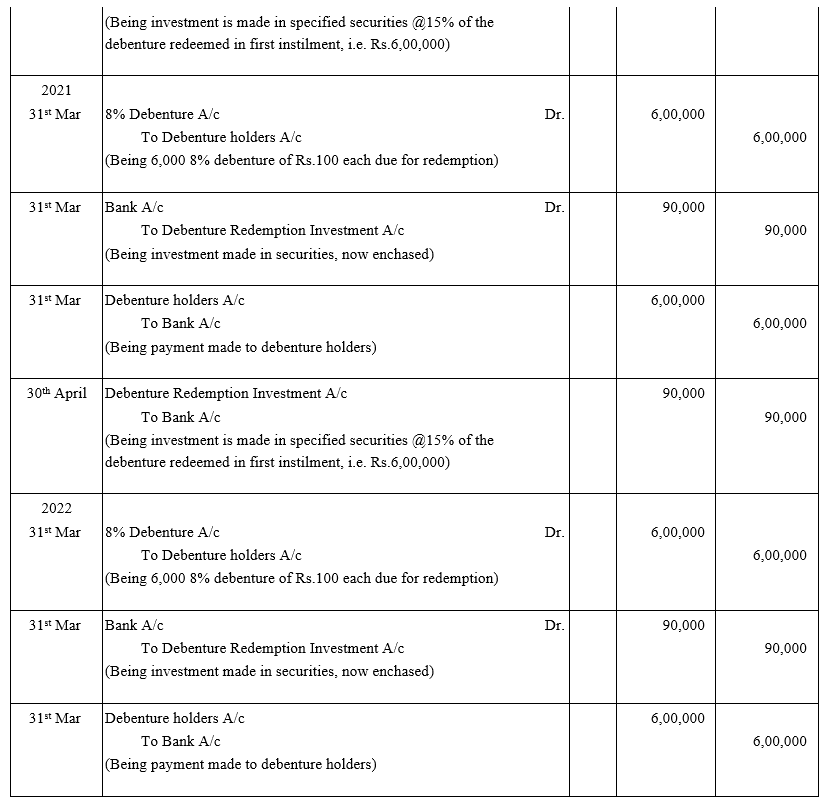

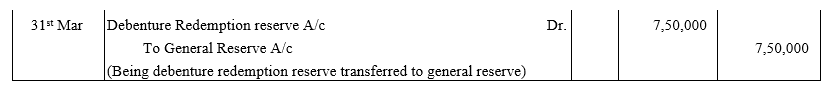

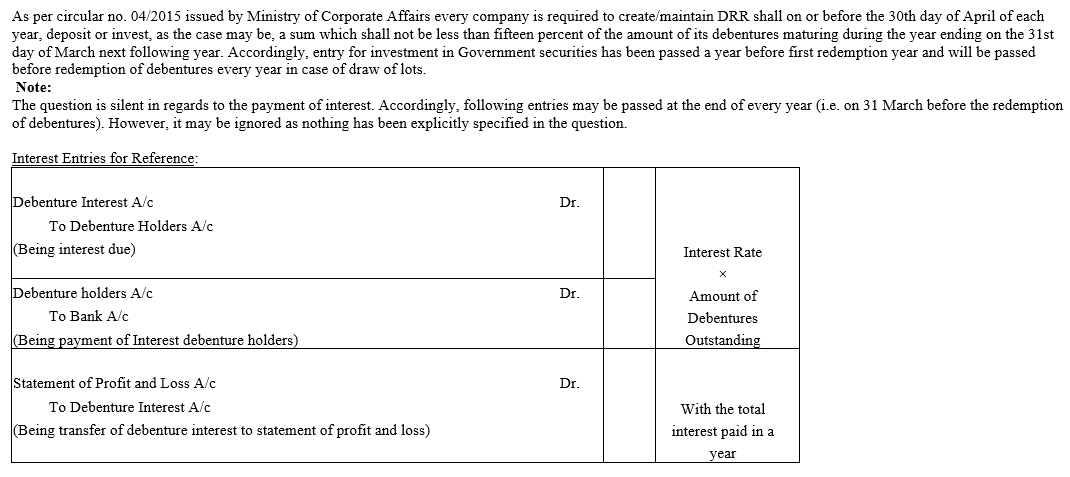

TS Grewal Accountancy Class 11 Solutions Chapter 5 Journal – Here are all the TS Grewal solutions for Class 11 Accountancy Chapter 5. This solution contains questions, answers, images, explanations of the complete Chapter 5 titled Journal of Accountancy taught in Class 11. If you are a student of Class 11 who is using TS Grewal Textbook to study Accountancy, then you must come across Chapter 5 Journal. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete TS Grewal Solutions for Class 11 Accountancy Chapter 5 Journal in one place.

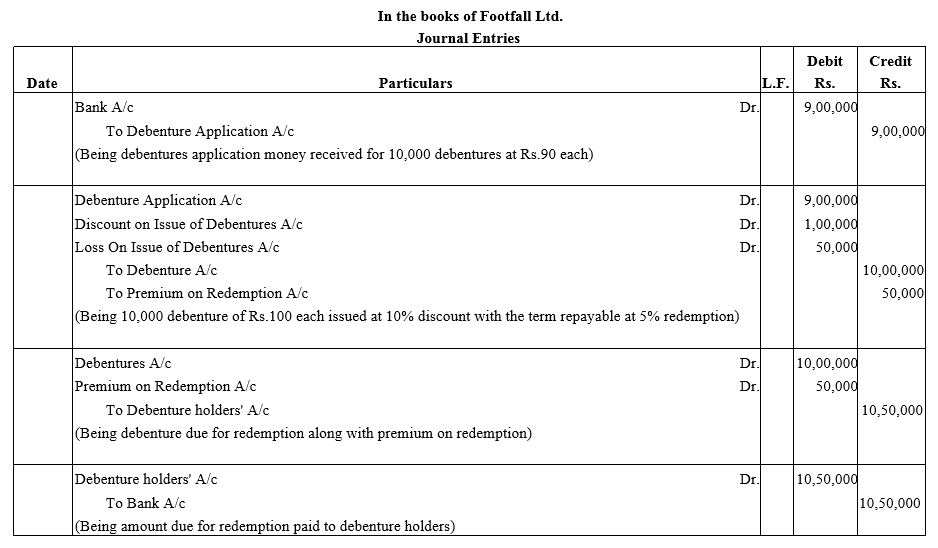

TS Grewal Accountancy Class 11 Solutions Chapter 5 Journal

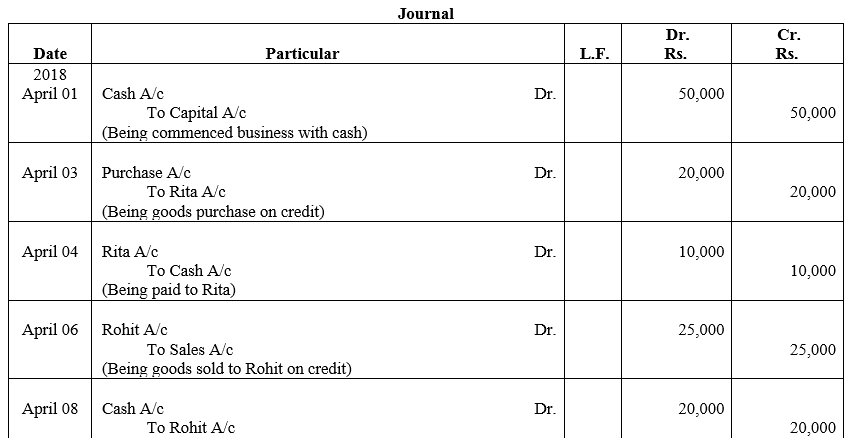

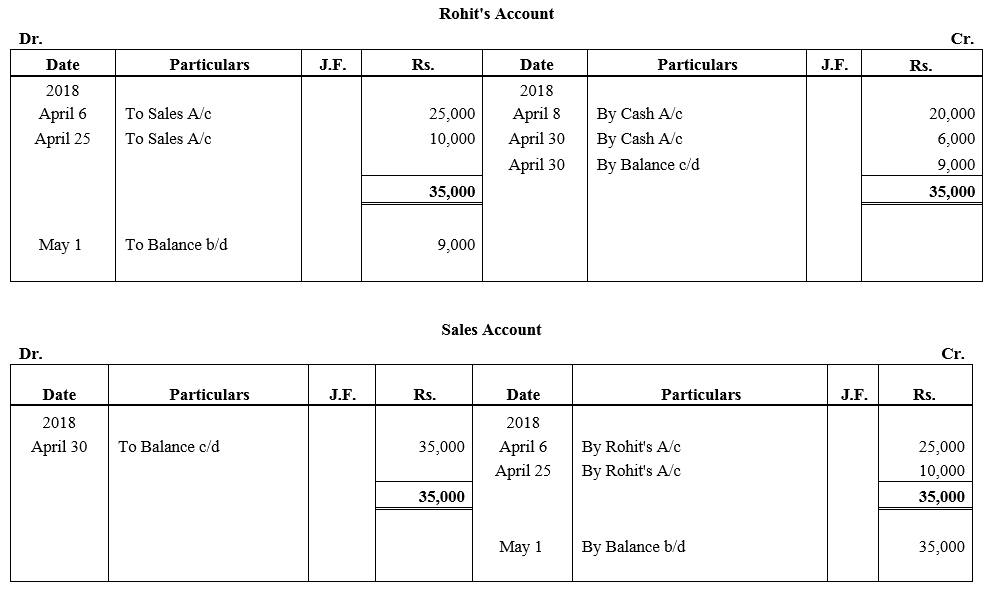

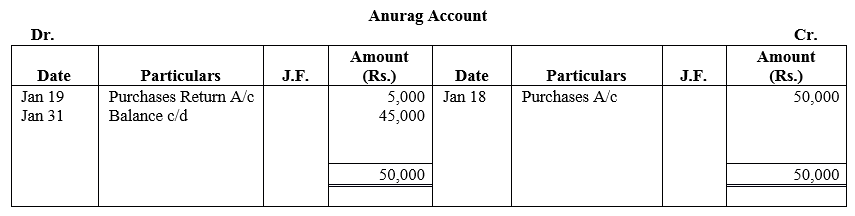

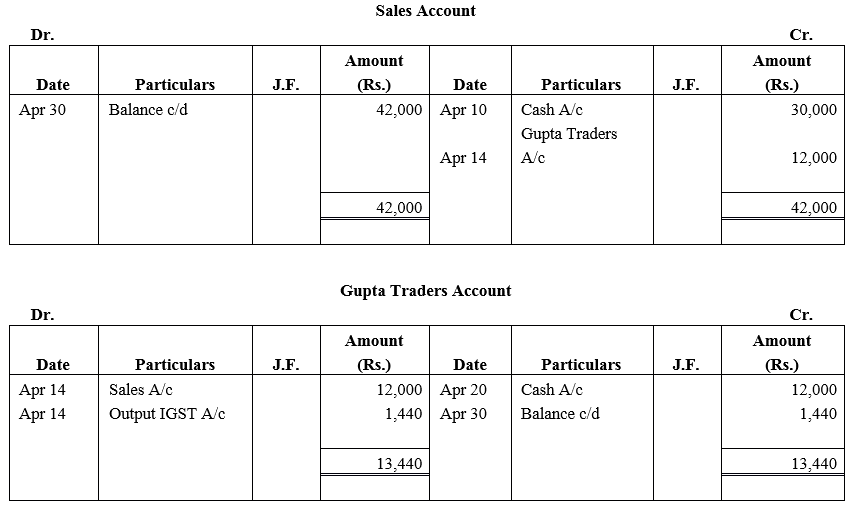

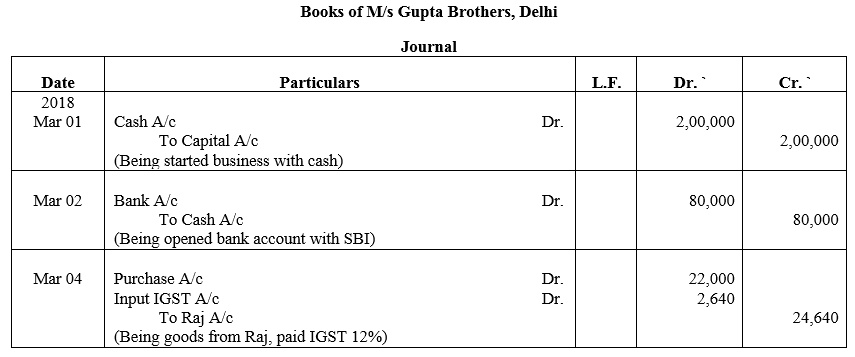

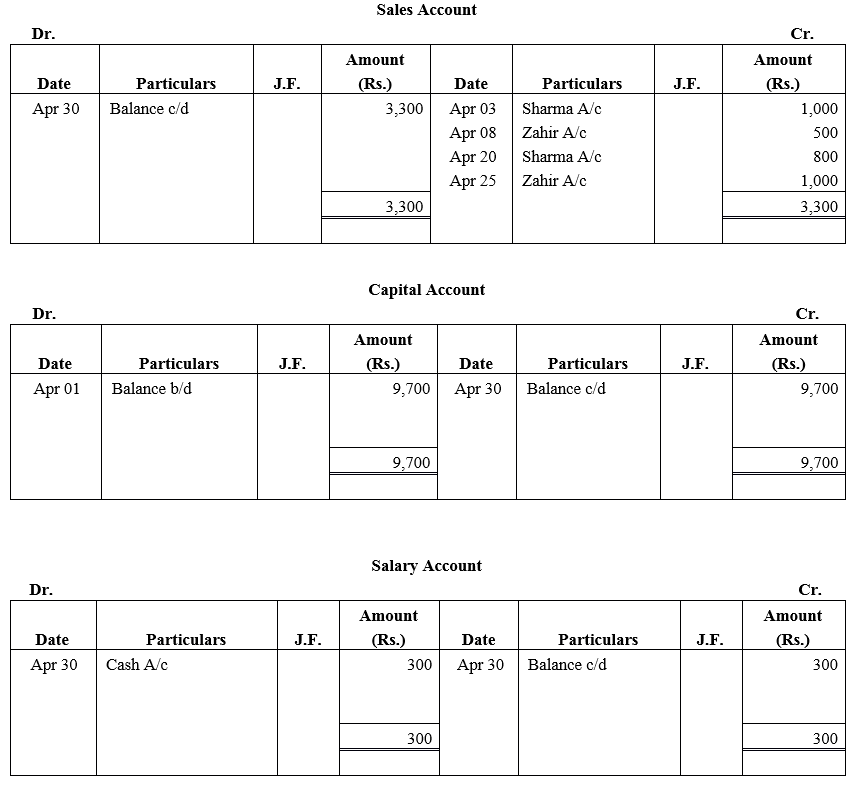

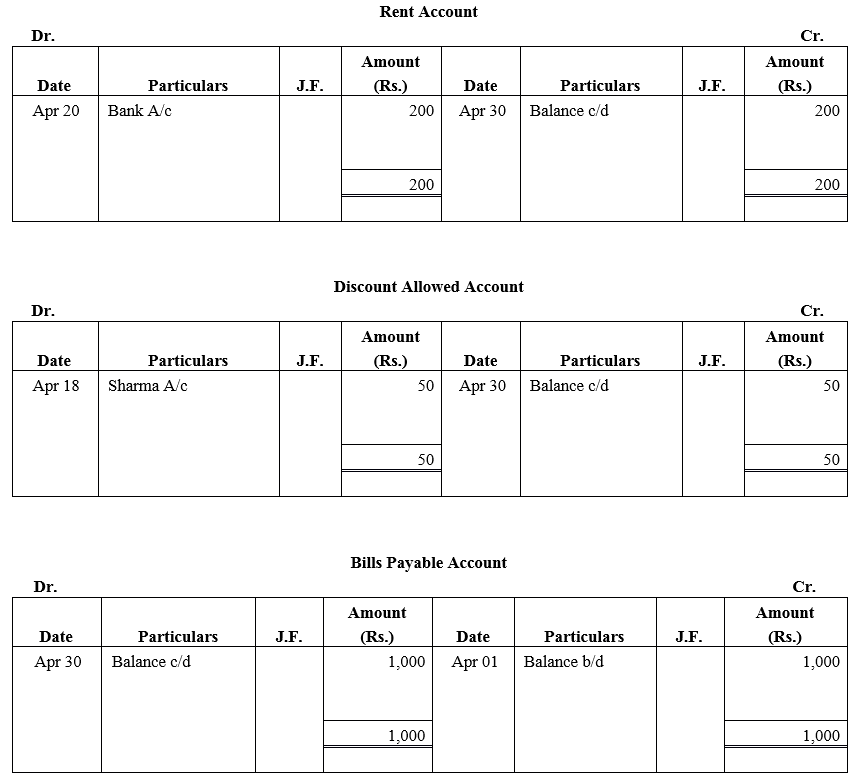

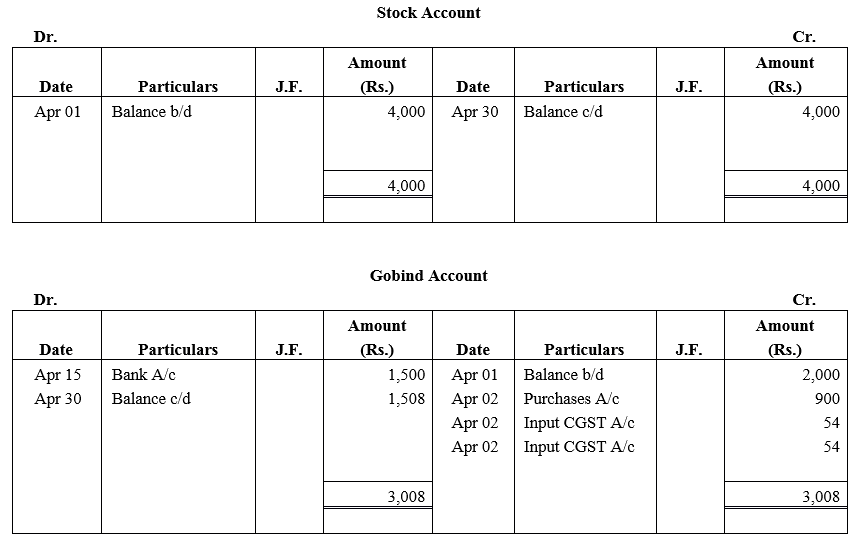

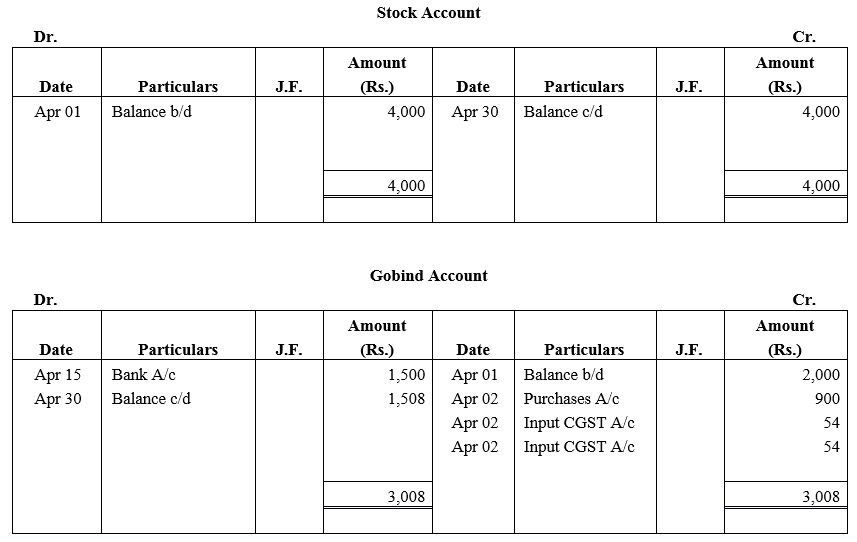

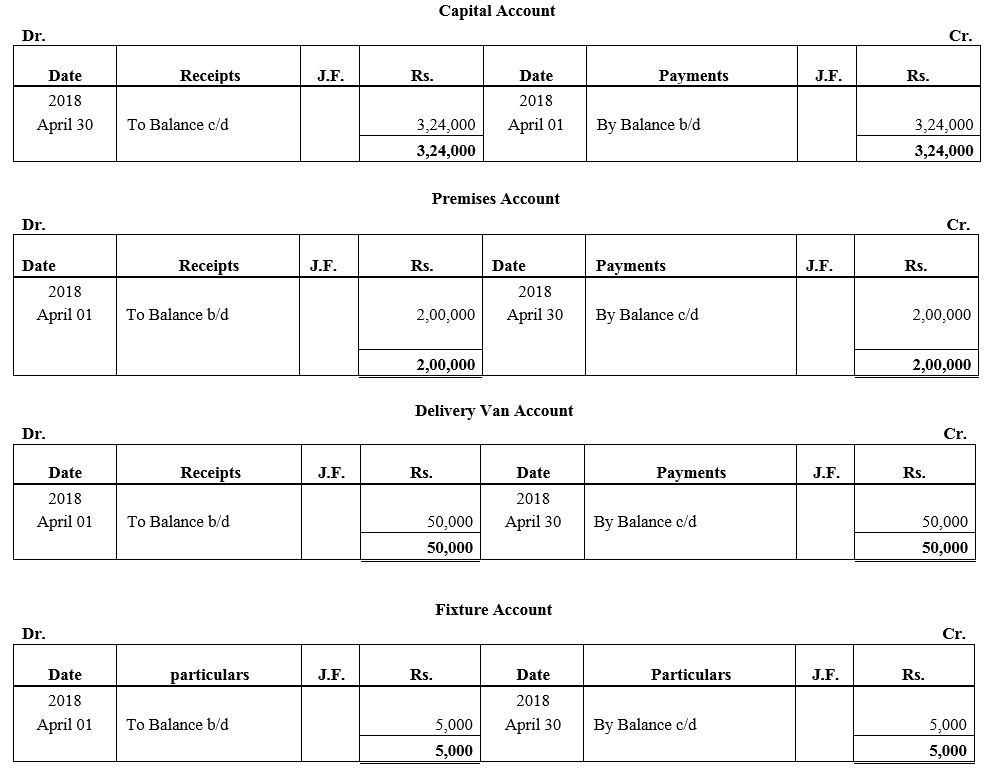

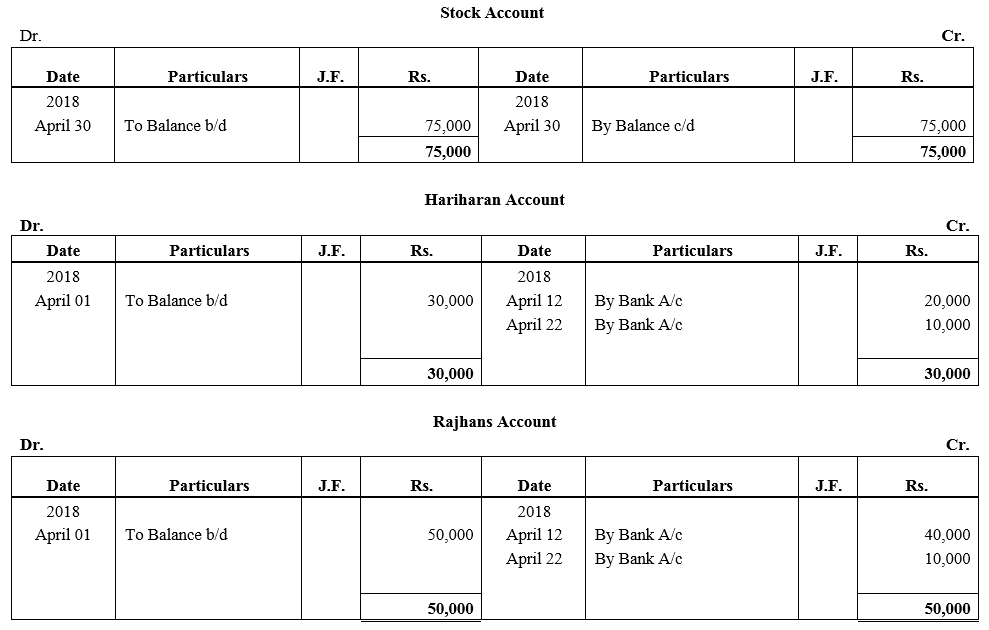

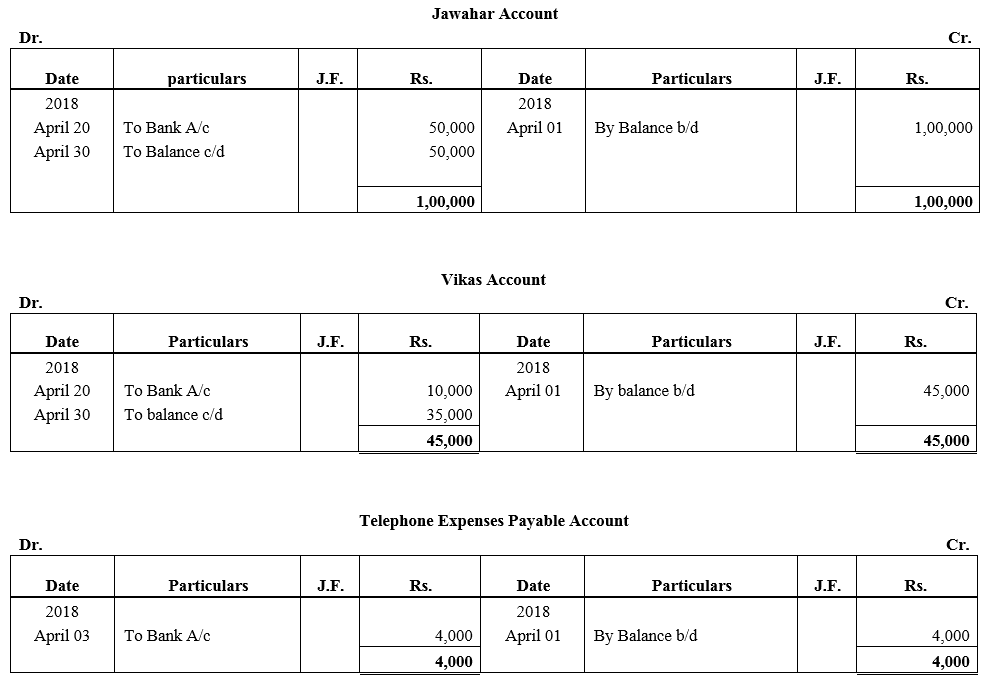

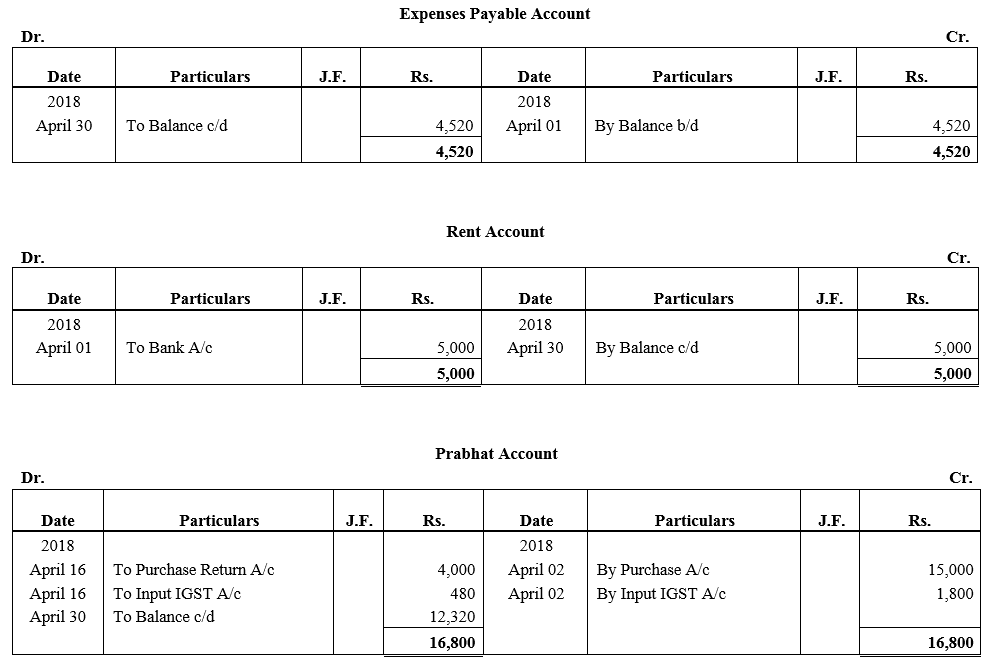

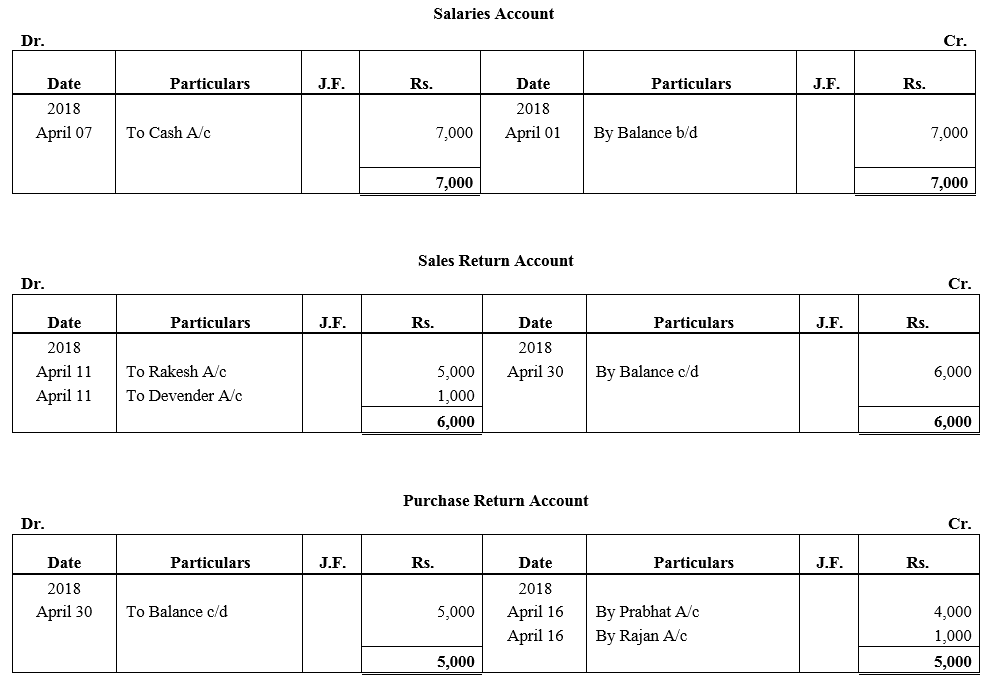

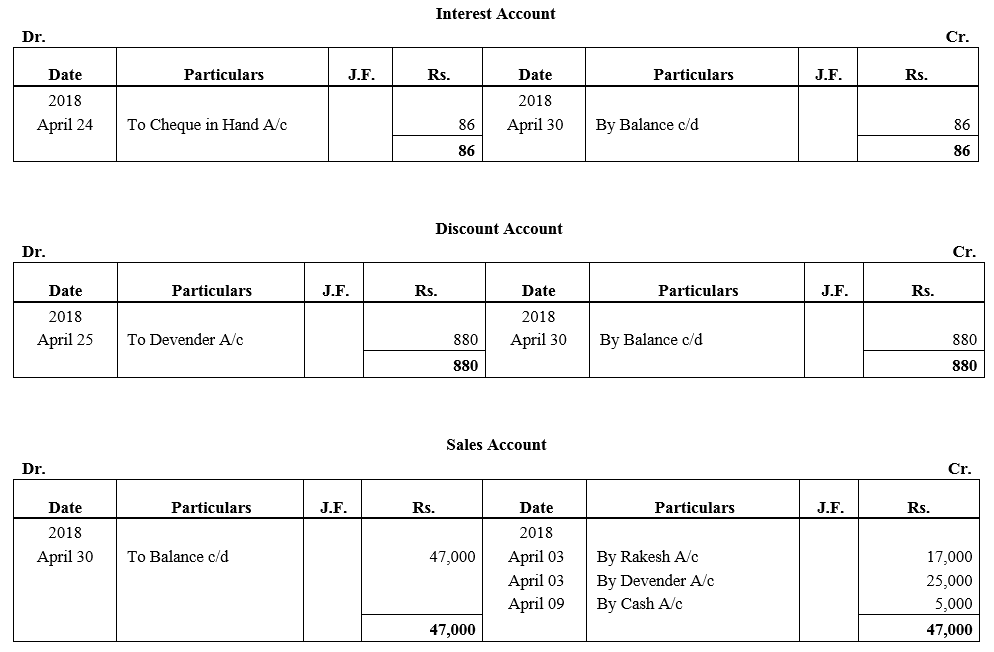

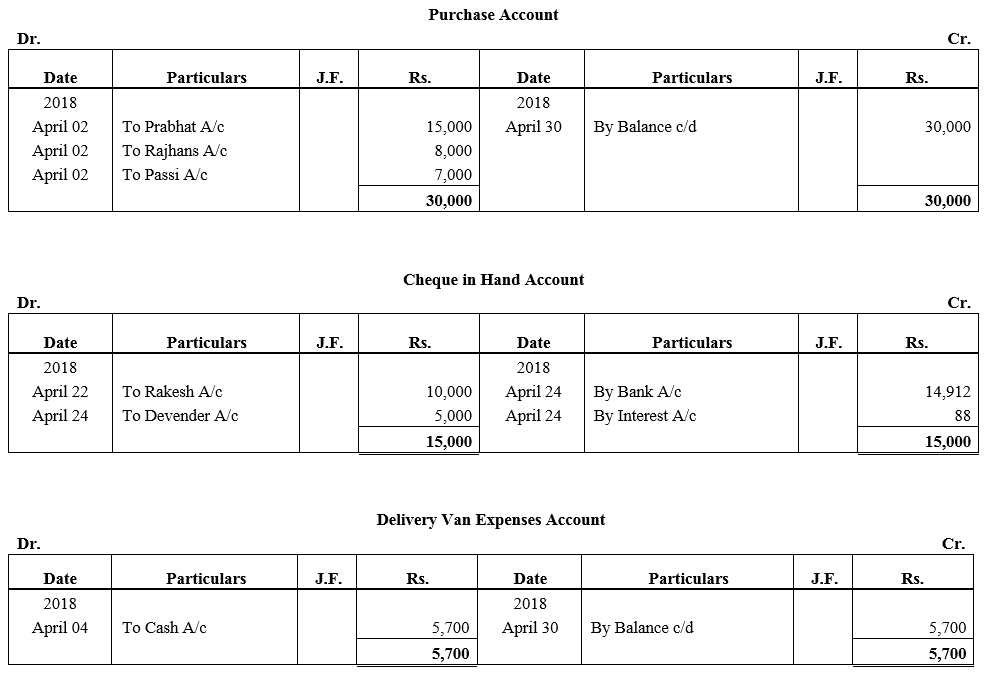

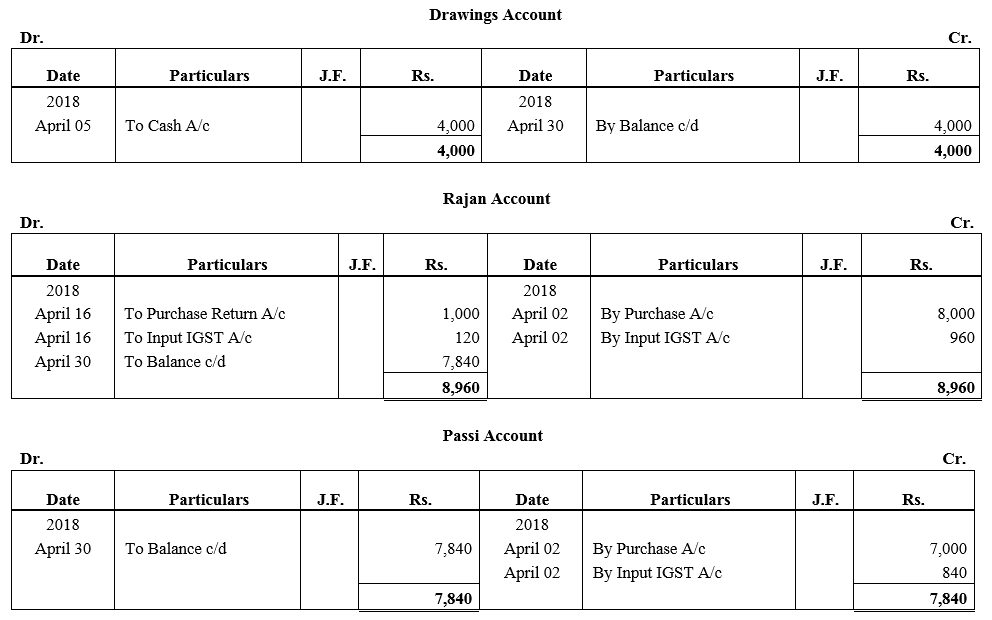

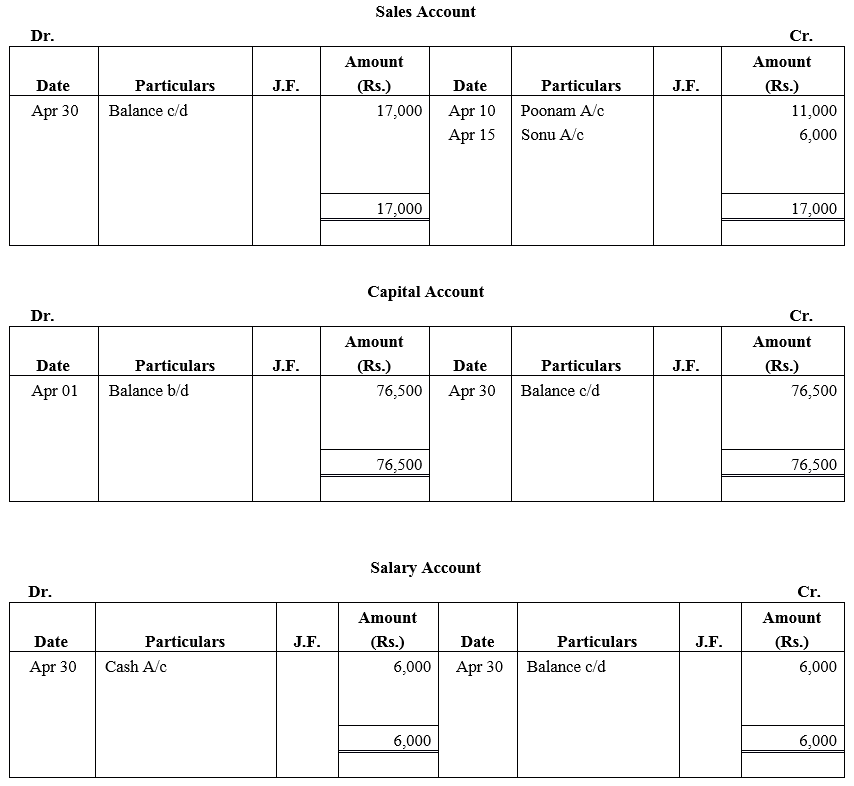

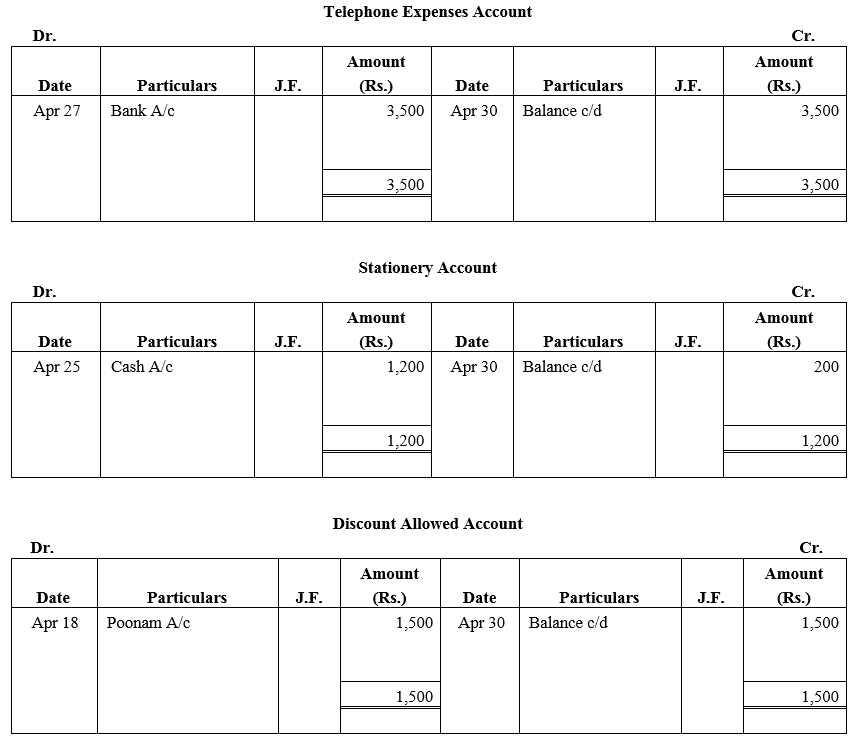

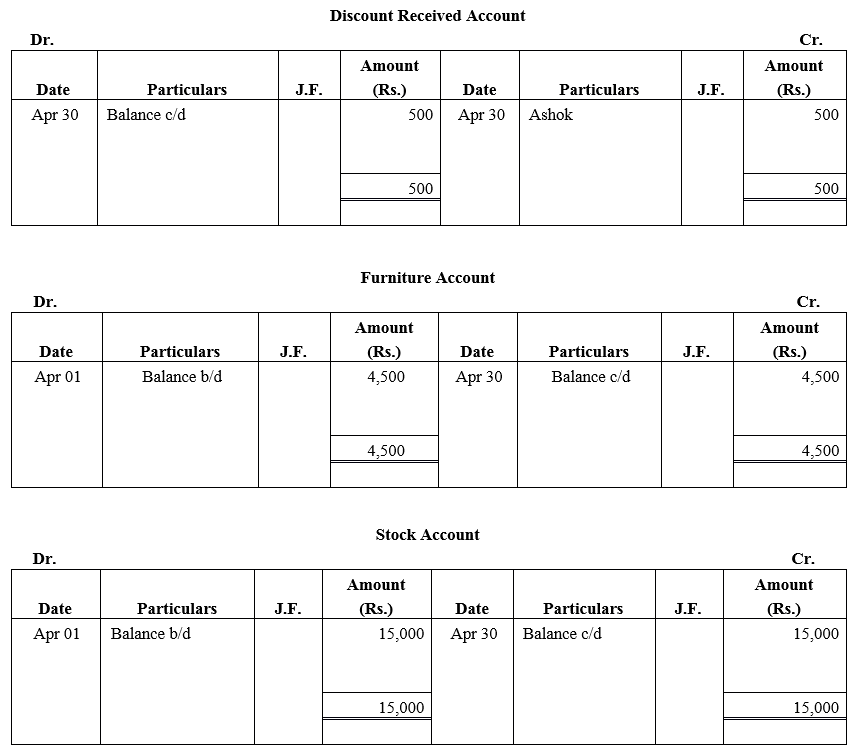

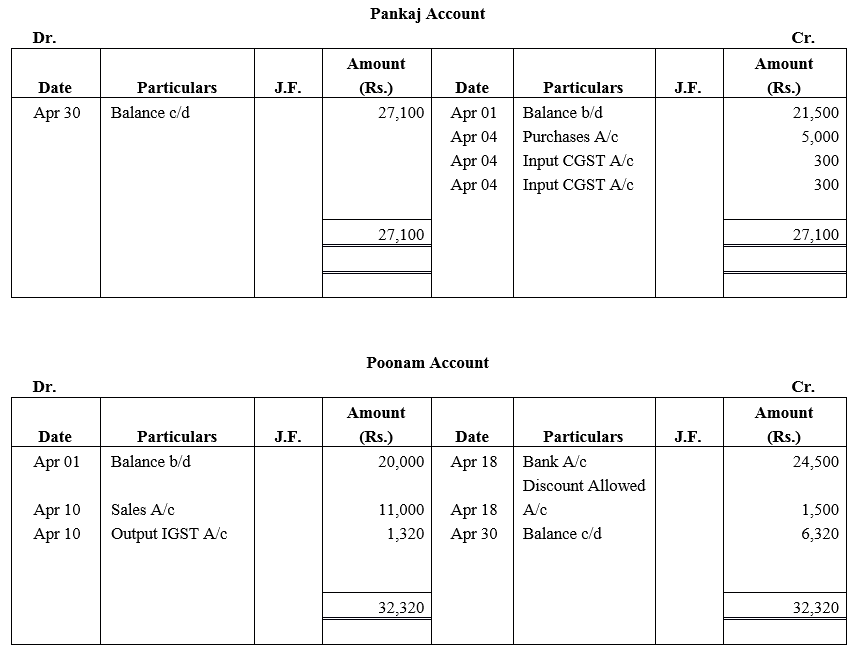

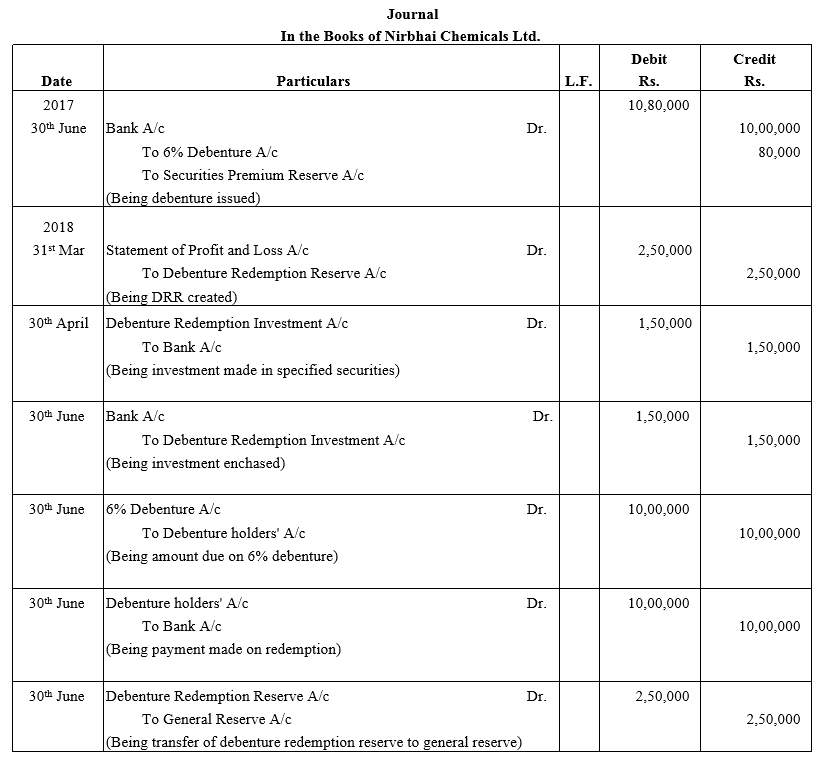

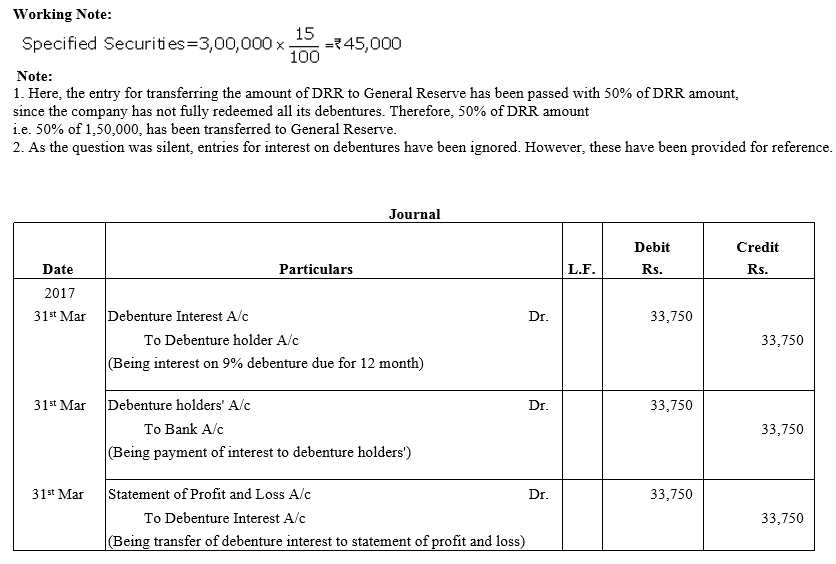

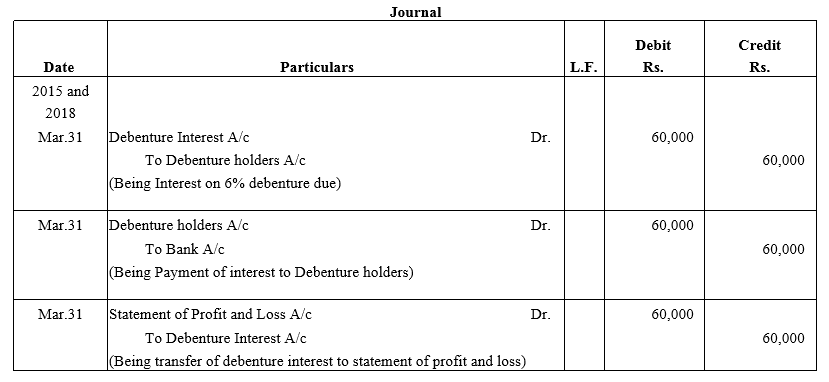

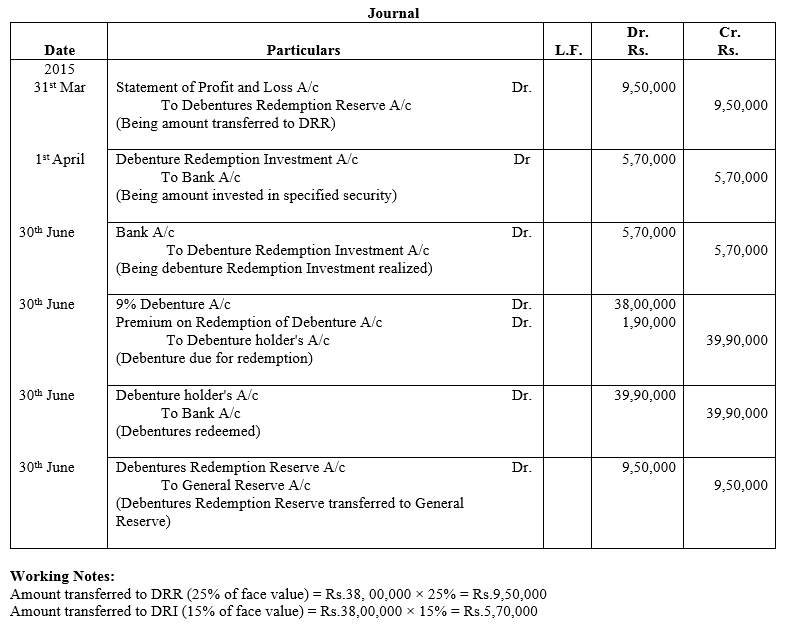

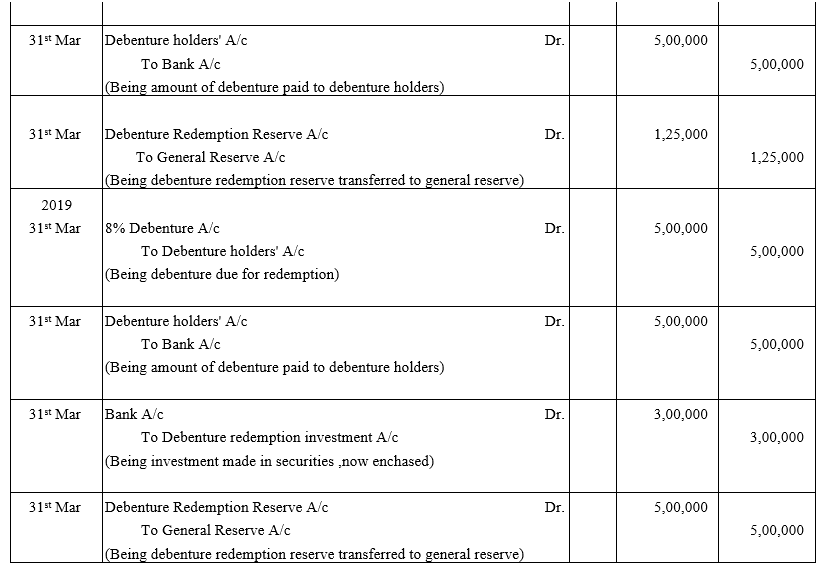

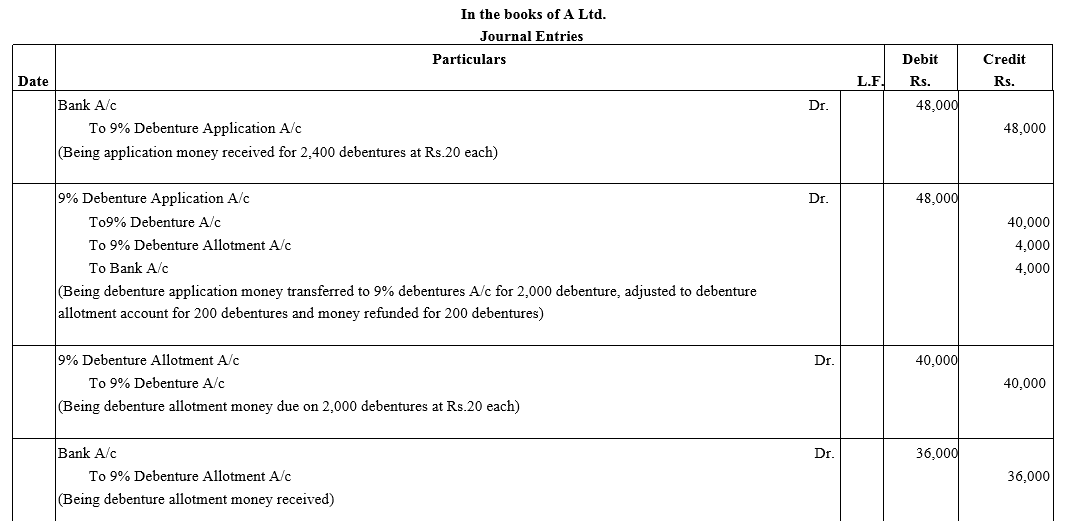

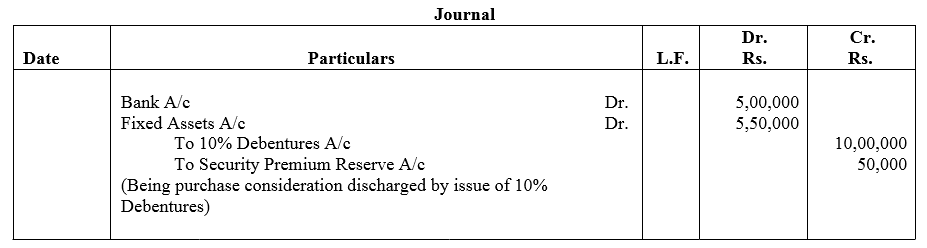

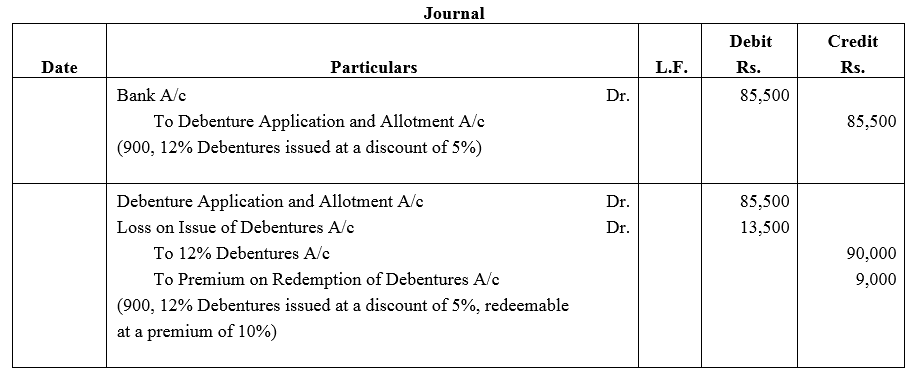

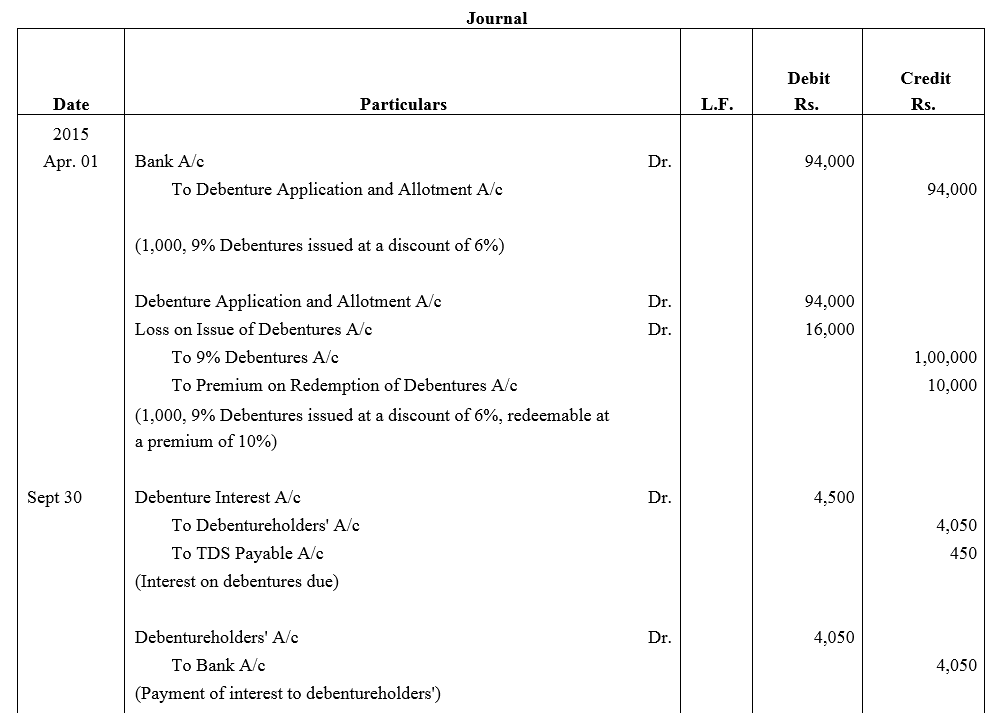

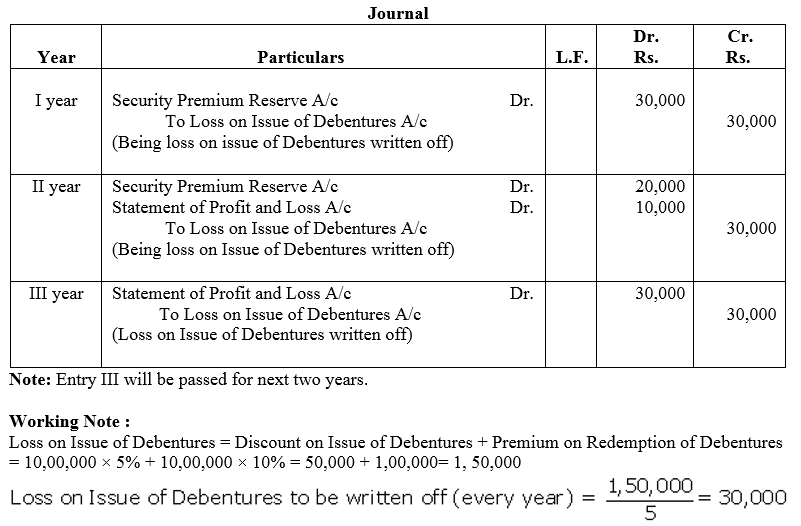

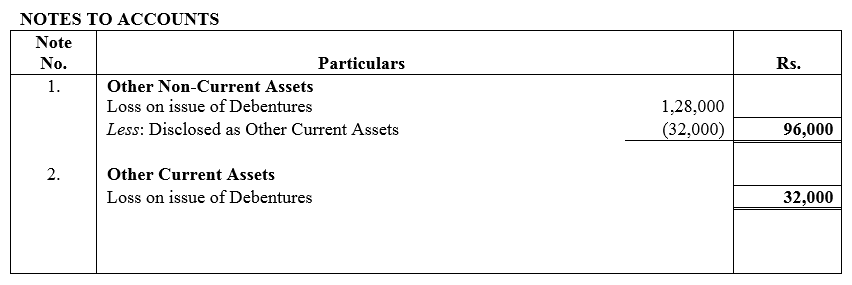

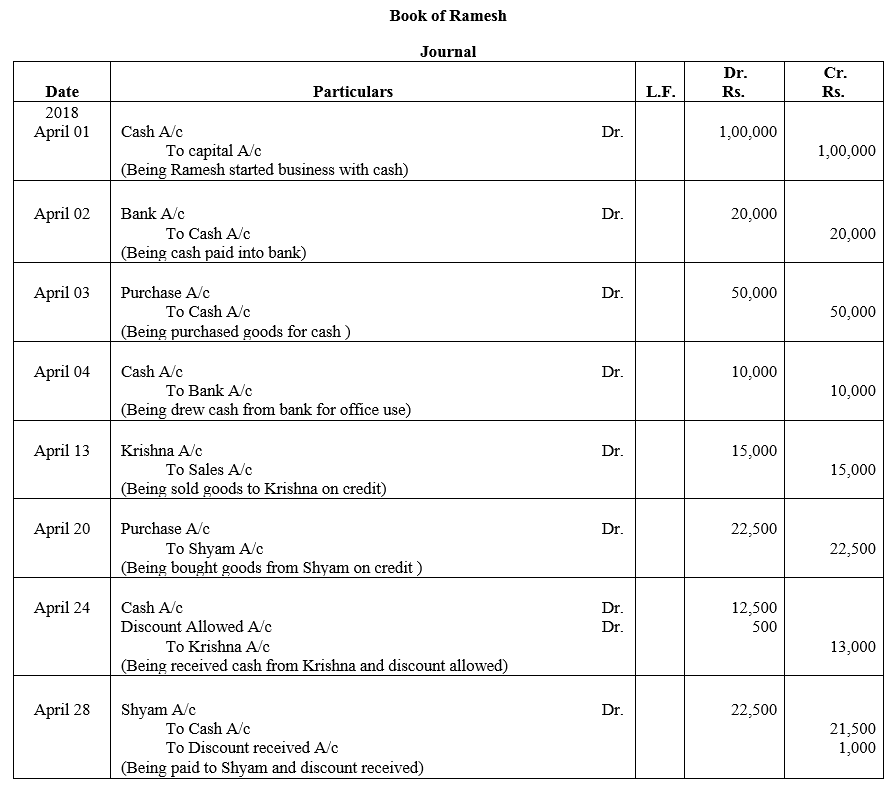

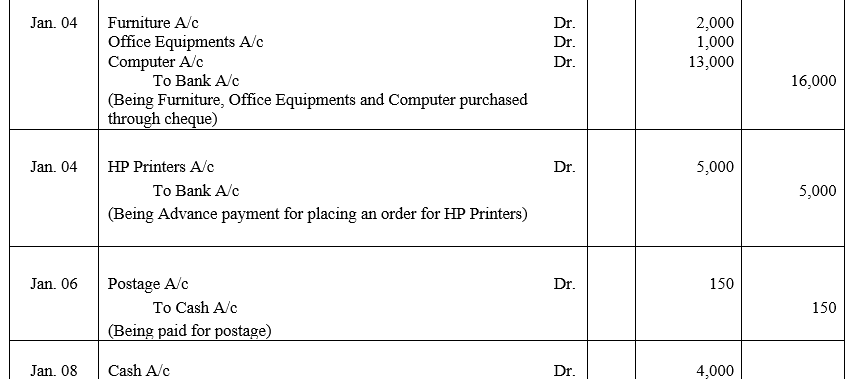

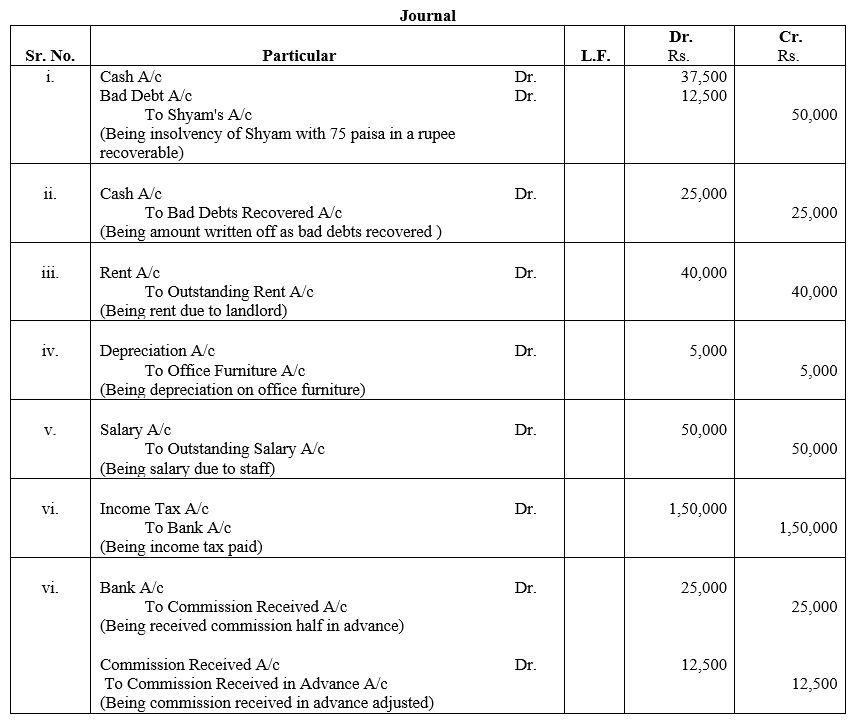

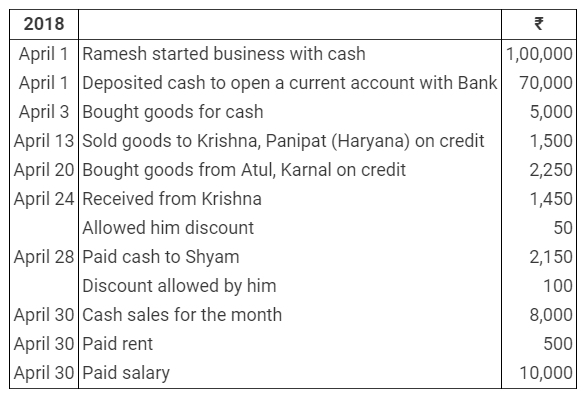

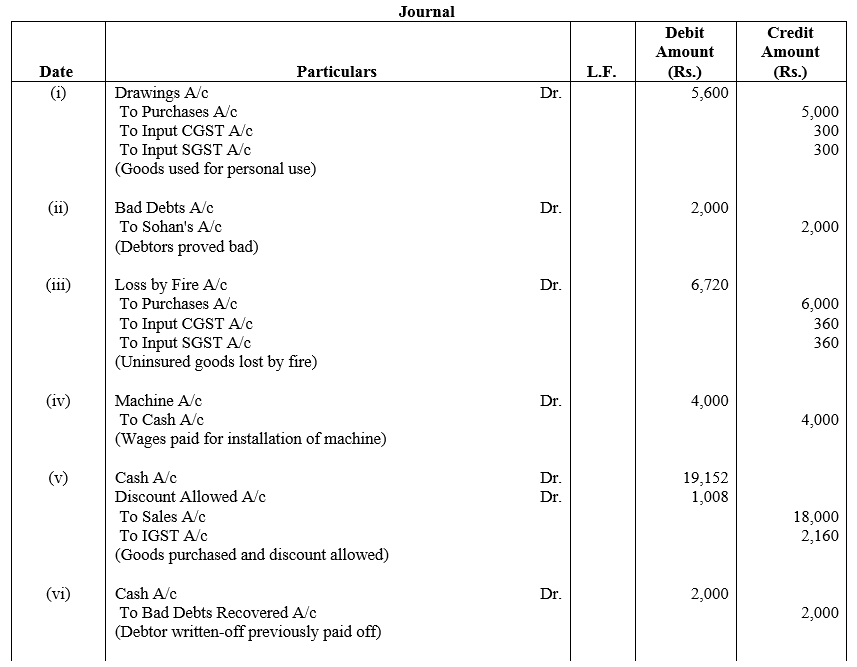

Question 1.

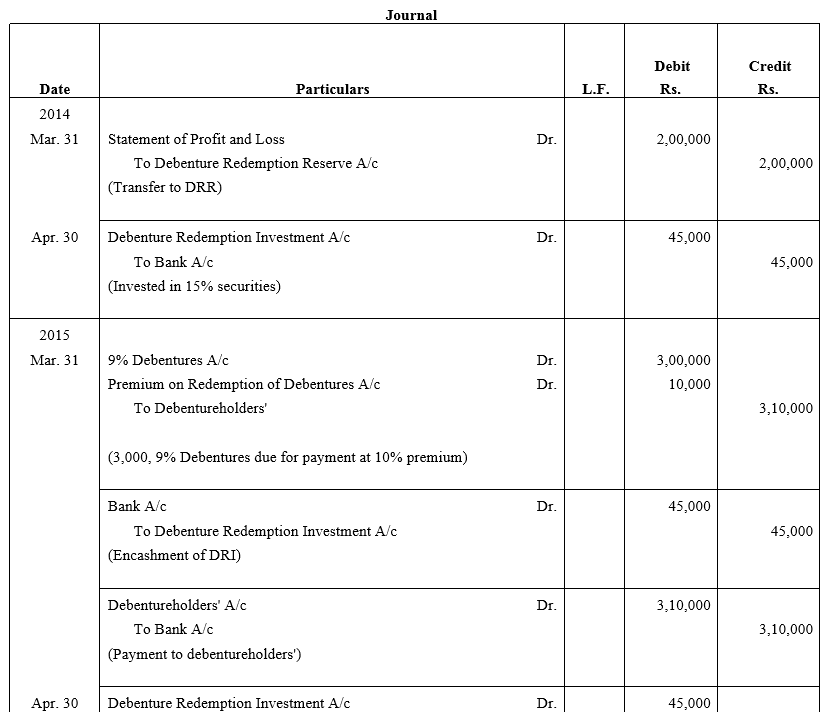

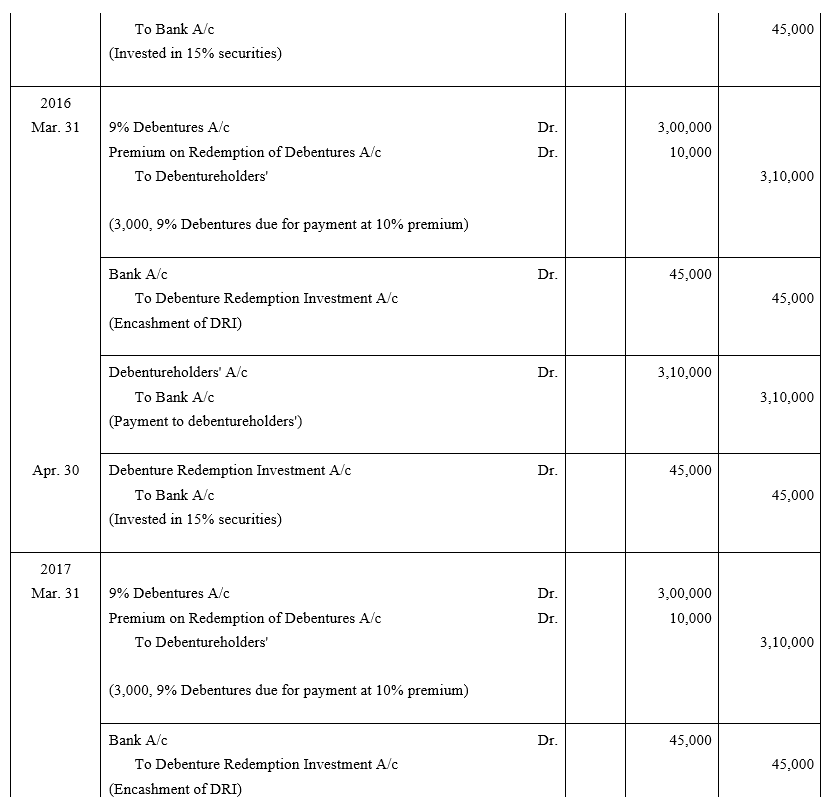

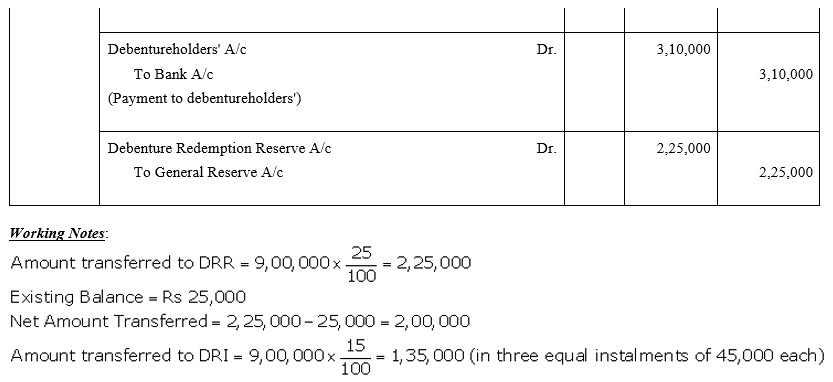

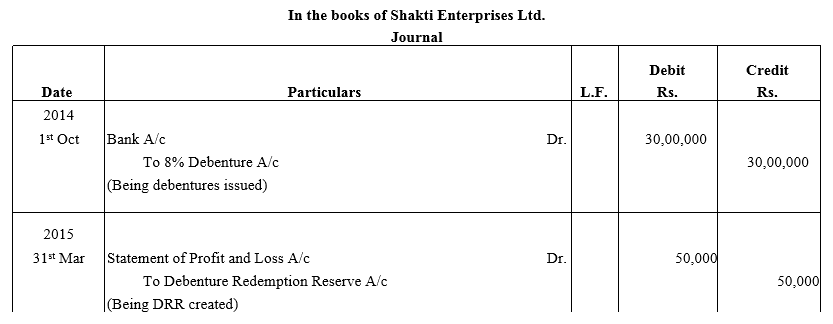

Journal

Without Goods and Services Tax (GST)

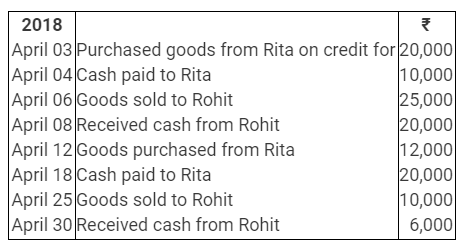

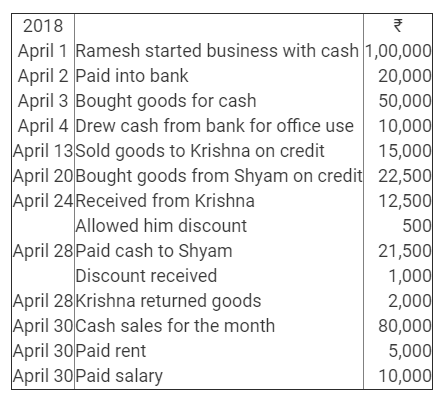

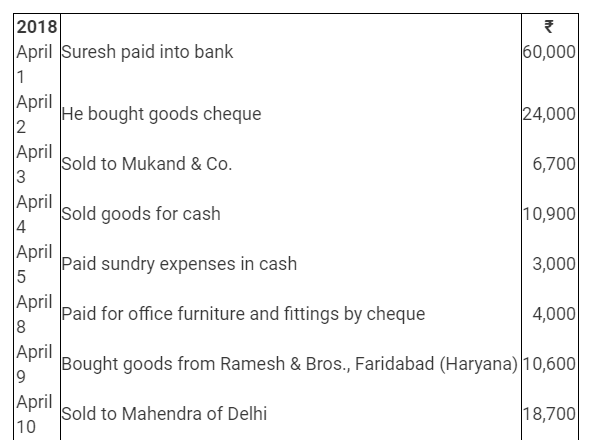

Following transactions of Ramesh for April,2018 are given below. Journalise them.

Solution:

![]()

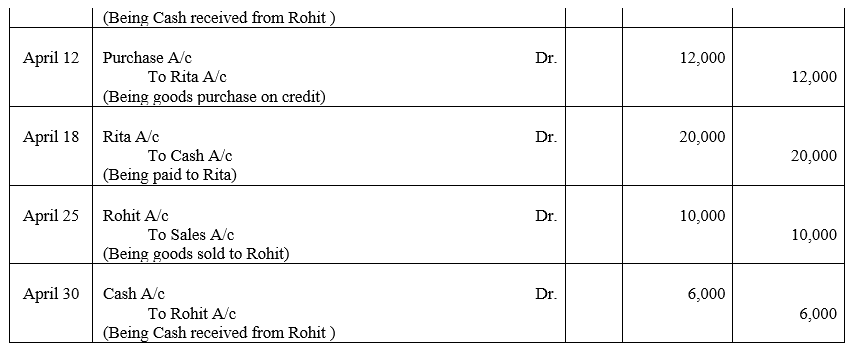

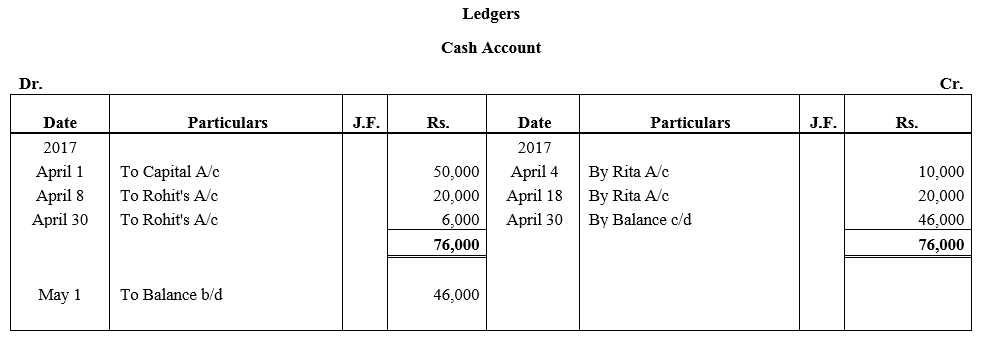

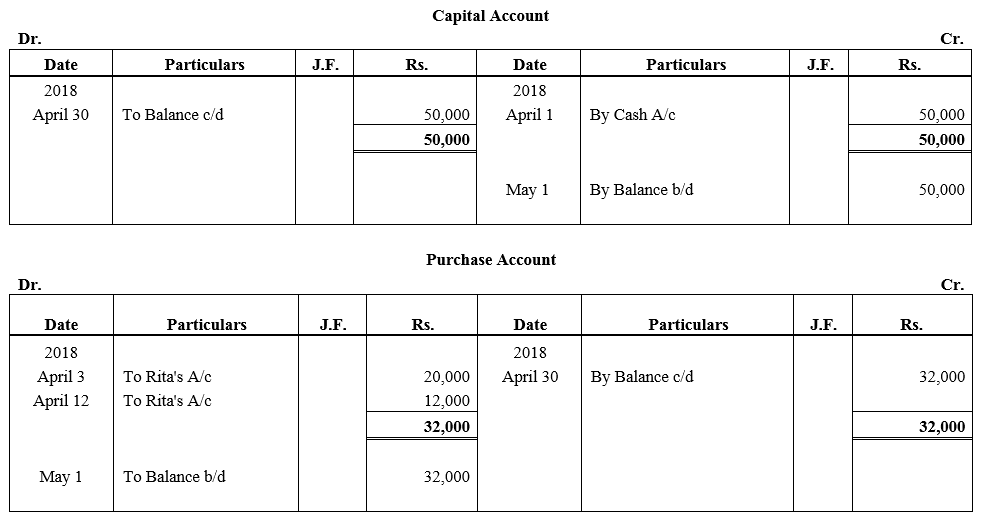

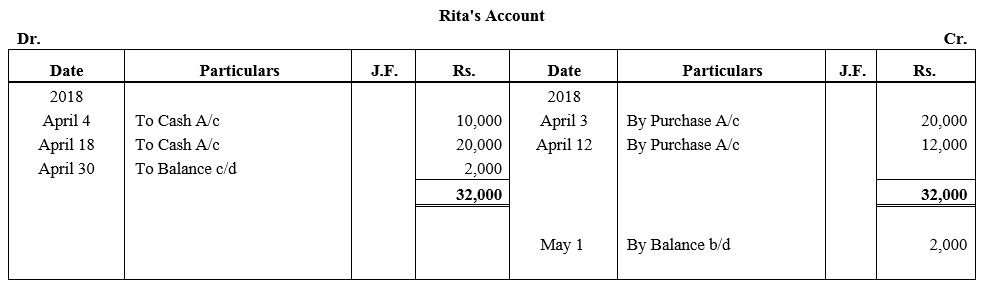

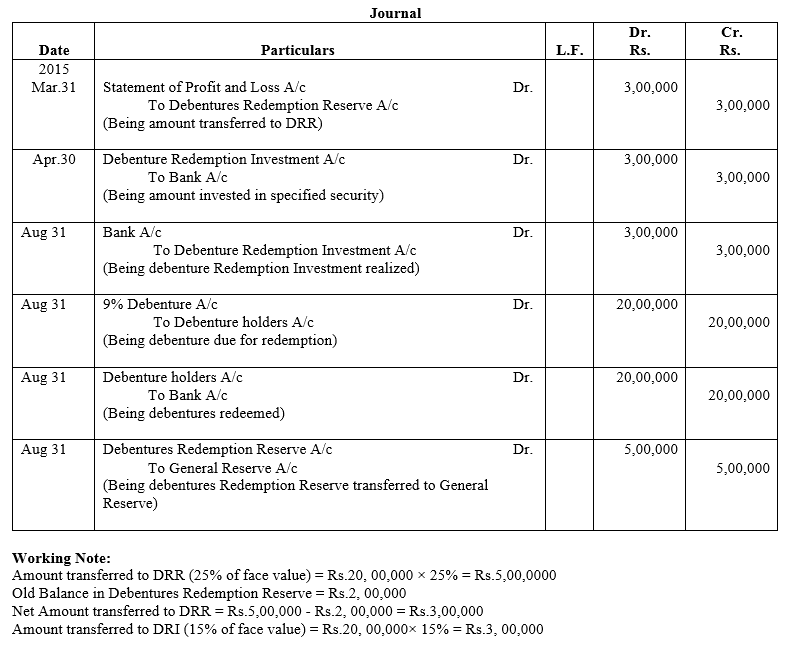

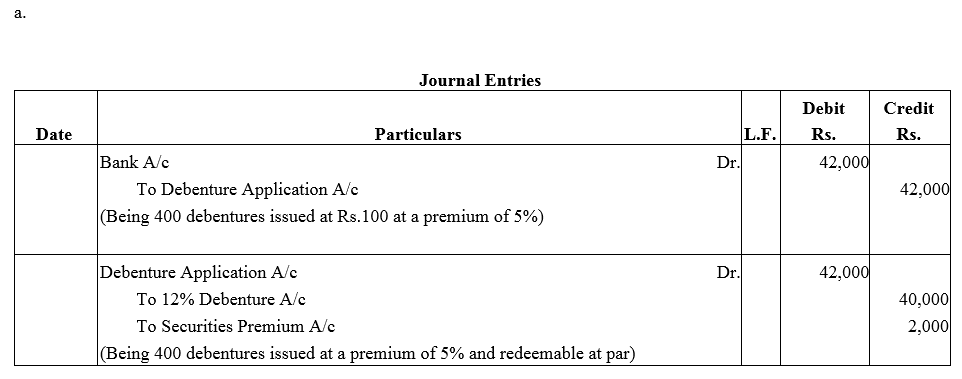

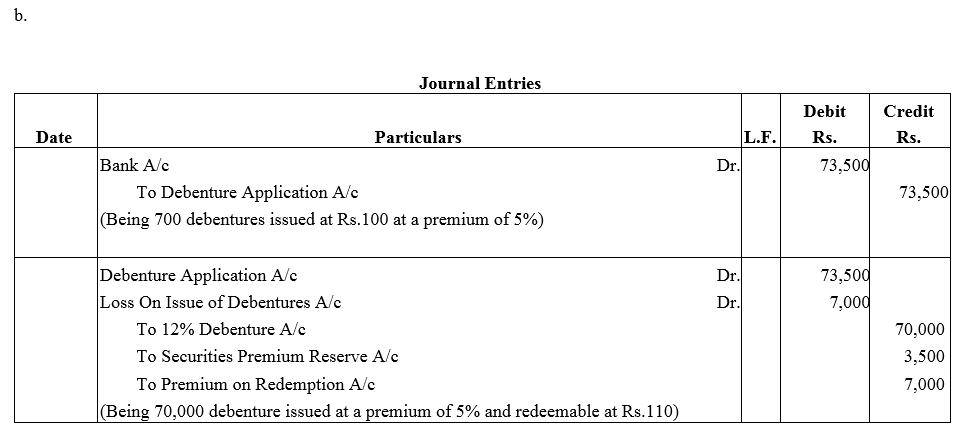

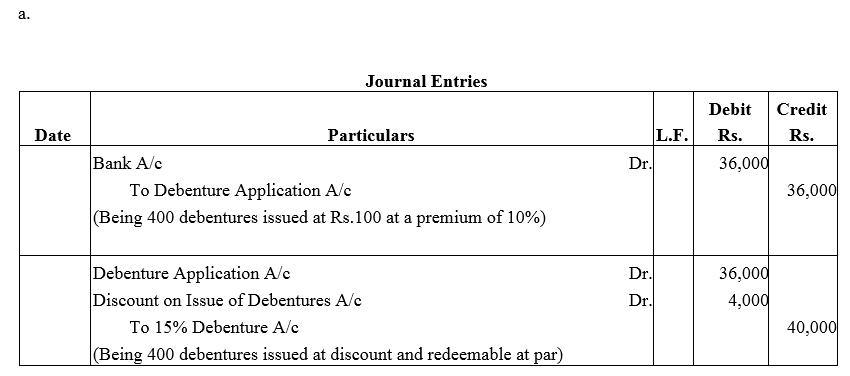

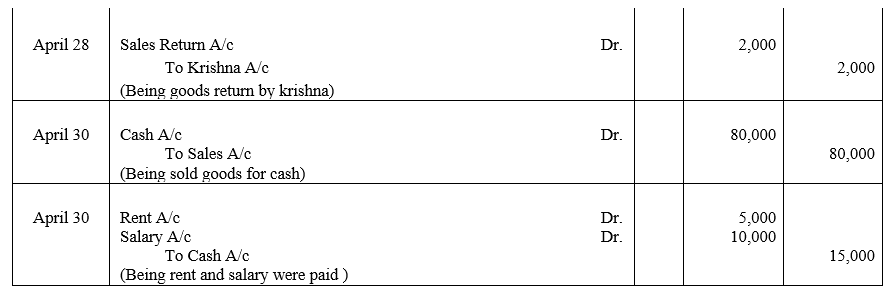

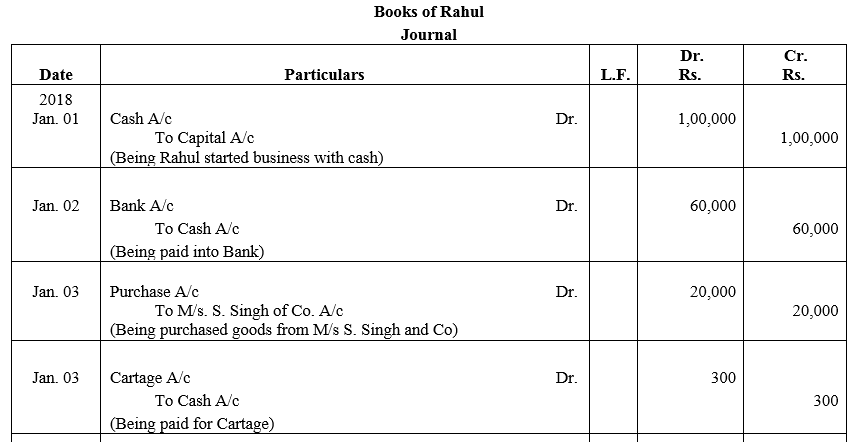

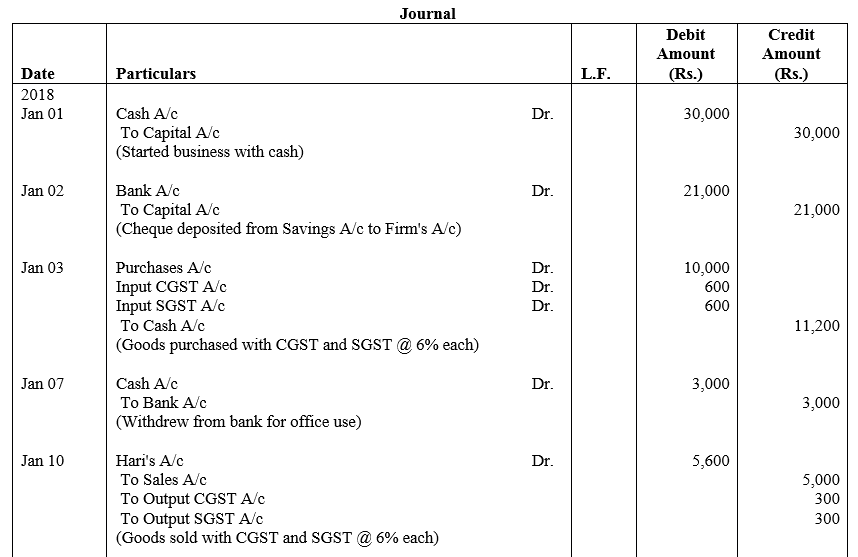

Question 2.

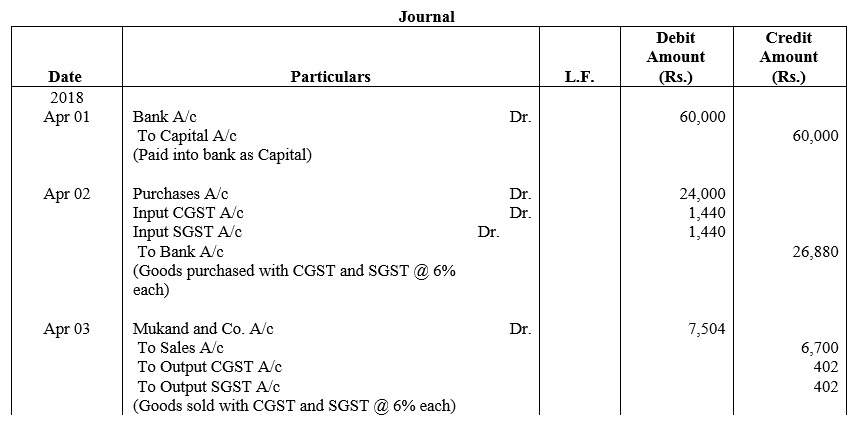

Journalise the following transactions of Mr. Rahul:

Solution:

![]()

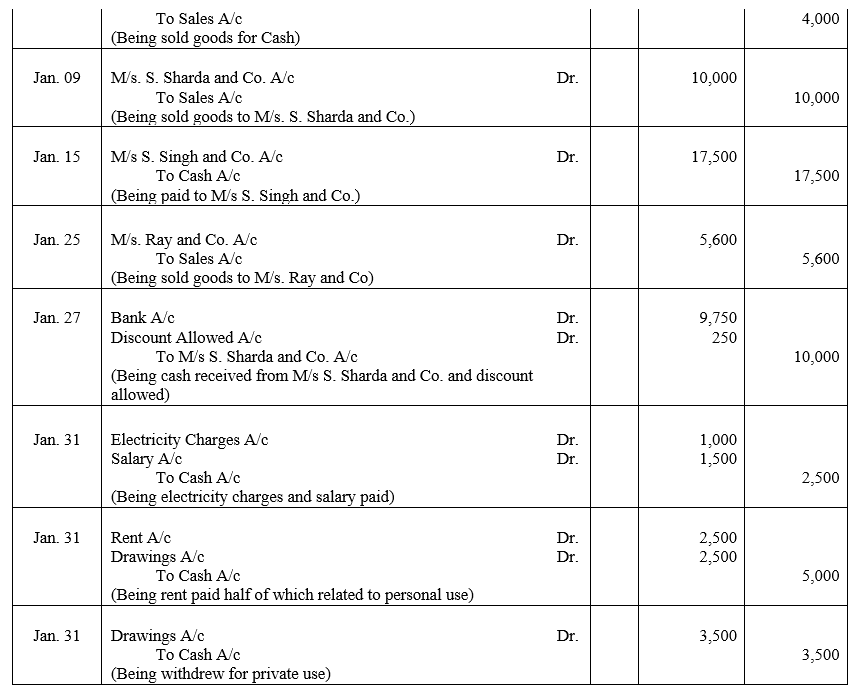

Question 3.

Journalise the following transactions in the books of M/s. R.K. & Co.

(i) Purchased goods at list price of ₹ 20,000 from Vishal at 20% trade discount against cheque payment.

(ii) Purchased goods at list price of ₹ 20,000 from Naman at 15% trade discount against cash.

(iii) Purchased goods at list price of ₹ 30,000 from Amrit at 20% trade discount.

(iv) Purchased goods at list price of ₹ 40,000 for ₹ 35,000 for cash.

(v) Goods returned of list price ₹ 10,000 purchased from Amrit.

(vi) Sold goods to Parul at list price of ₹ 40,000 at 10% trade discount against cheque payment.

(vii) Sold goods to Aman at list price of ₹ 30,000 at 10% trade discount against cash.

(viii) Sold goods to Pawan at list price of ₹ 20,000 at 10% trade discount.

(ix) Sold goods to Yamini at list price of ₹ 25,000 for ₹ 23,000.

(x) Sold goods costing ₹ 10,000 at cost plus 20% less 10% trade discount to Bhupesh.

(xi) Sold goods purchased at list price of ₹ 50,000 less 15% trade discount sold at a profit of 25% & 10% trade discount against cheque.

(xii) Aman returned goods of list price of ₹ 10,000 sold to him at 10% trade discount.

Solution:

Working Notes:

1. Calculation of Sales Price

Sales Price = Goods Sold + Cost – trade discount

Sales Price = 10,000 + 20% – 10% = Rs. 10,800

2. Calculation of Purchase and sales Price

Purchase Price = Purchases goods – Trade Discount

Purchase Price = 50,000 – 15% = Rs.42,500

Sales Price = Goods Sold + Profit – trade discount

Sales Price = 42,500 + 25% – 10% = Rs.47,812.50

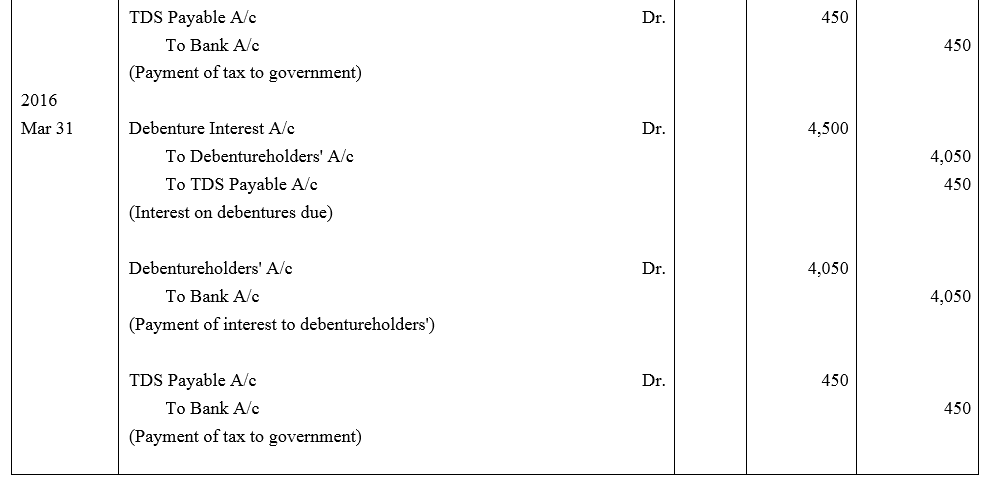

Question 4.

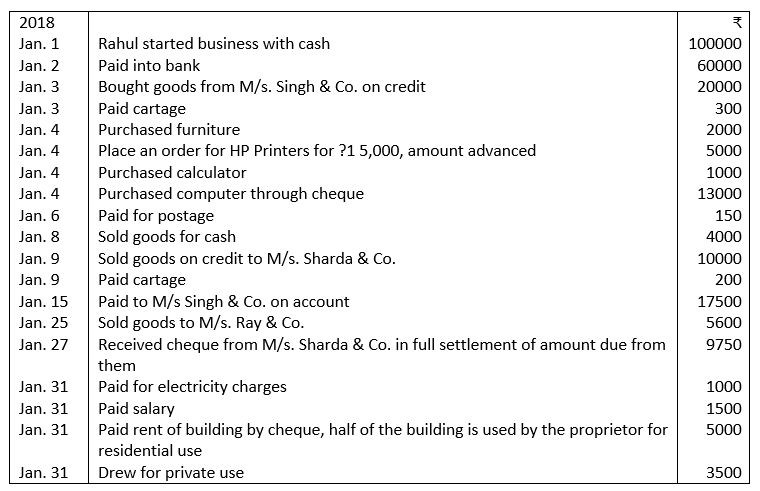

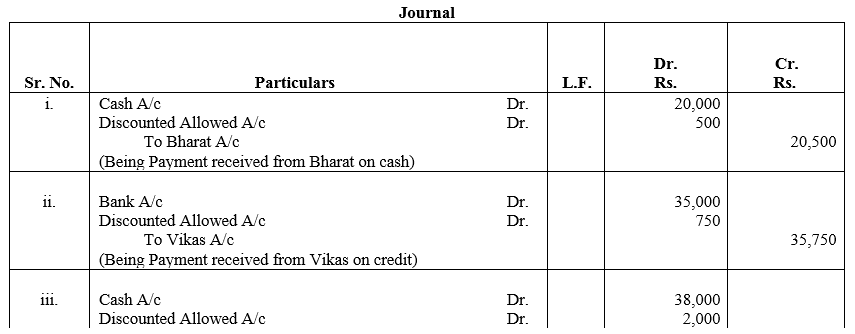

Journalise the following transactions in the books of Bhushan Agencies:

(i) Received from Bharat cash ₹ 20,000, allowed him discount of ₹ 500.

(ii) Received from Vikas ₹ 35,000 by cheque, allowed him discount of ₹ 750.

(iii) Received from Akhil ₹ 38,000 in settlement of his dues of ₹ 40,000 in cash.

(iv) Received from Amrit ₹ 50,000 by cheque on account against dues of ₹ 60,000.

(v) Paid cash ₹ 40,000 to suresh, availed discount of 2%.

(vi) Paid by cheque ₹ 25,000 to Mehar and settled her dues of ₹ 26,000.

(vii) Paid ₹ 25,000 to Yogesh by cheque on account.

(viii) Purchased goods costing ₹ 1,00,000 against cheque and availed discount of 3%.

(ix) Purchased goods costing ₹ 60,000 from Akash & Co., paid 50% immediately availing 3% discount.

(x) Sold goods of ₹ 30,000 against cheque allowing 2% discount.

(xi) Sold goods of ₹ 60,000 to Vimal received 50% of due amount allowing 2% discount.

Solution:

![]()

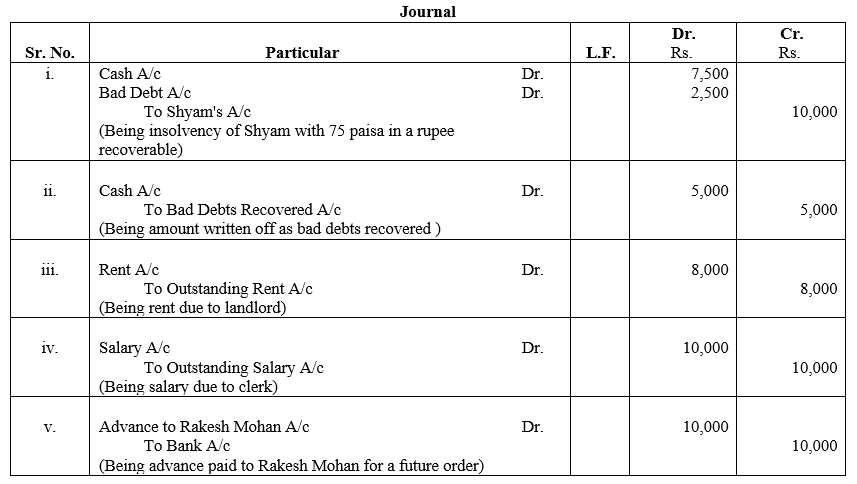

Question 5.

Journalise the following transactions:

Solution:

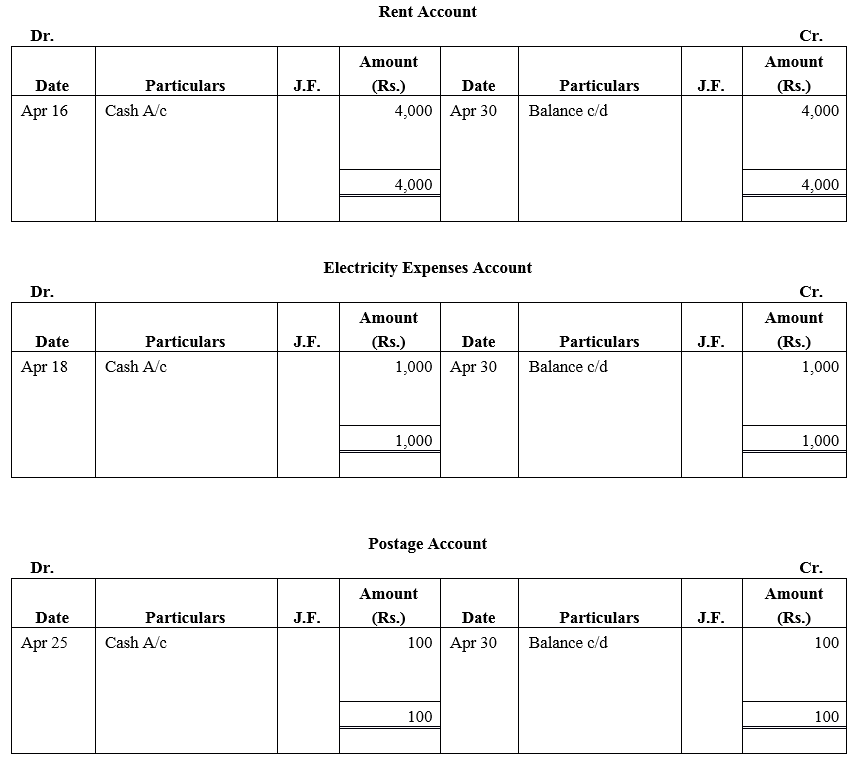

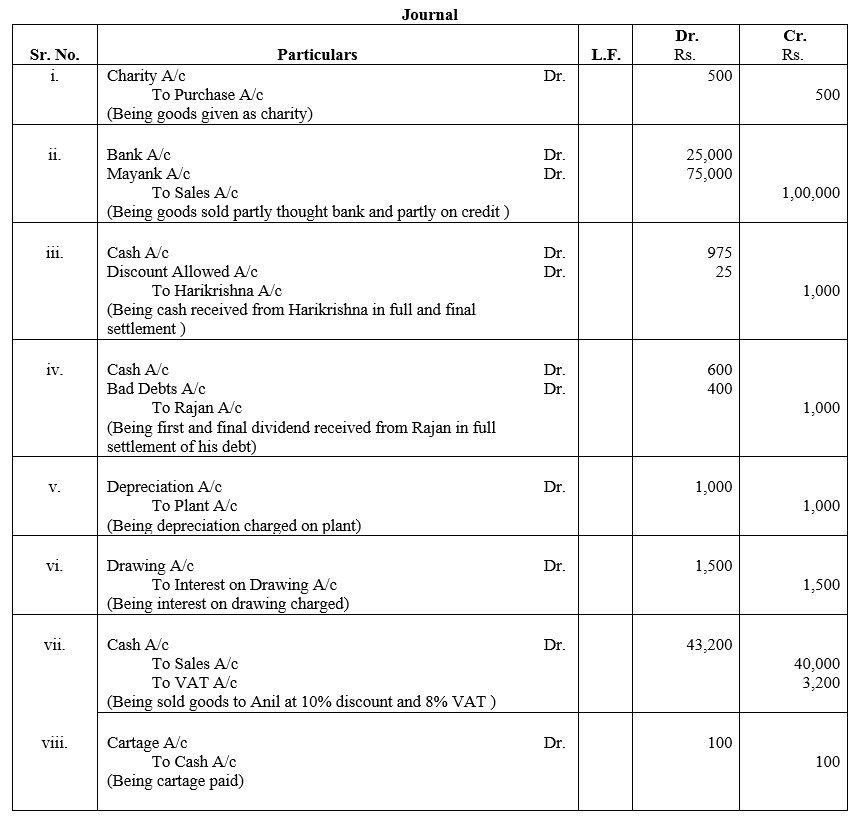

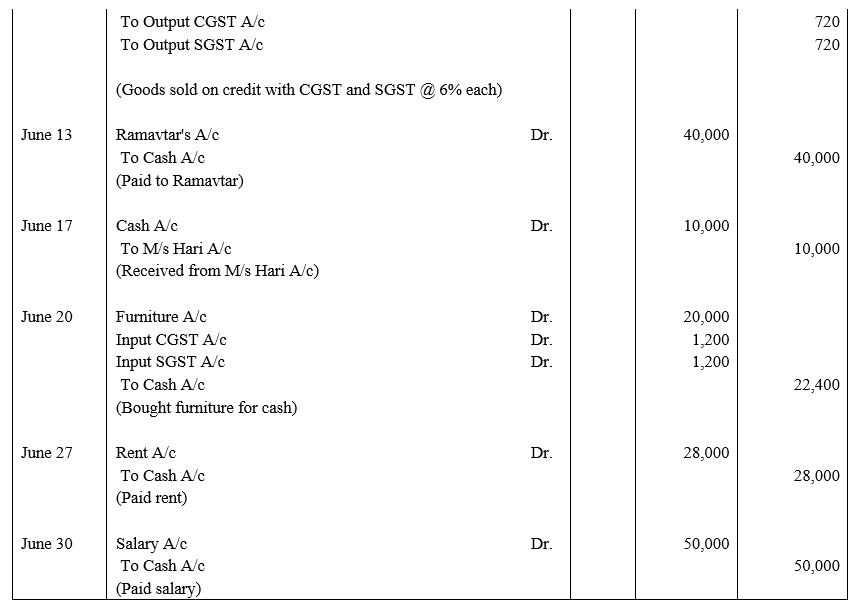

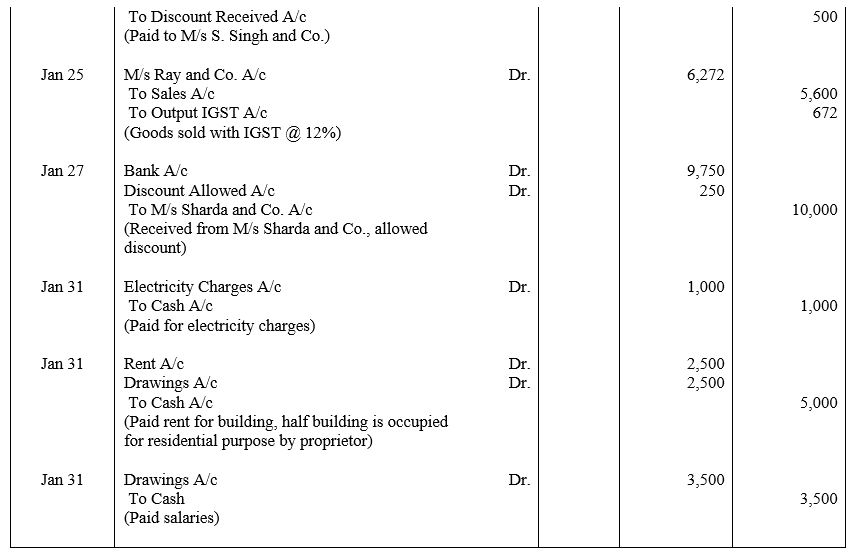

Question 6.

Journalise the following entries:

(i) Goods worth ₹ 500 given as charity.

(ii) Sold goods to Mayank of ₹ 1,00,000, payable 25% by cheque at the time of sale and balance after 30 days of sale.

(iii) Received ₹ 975 from Harikrishna in full settlement of his account for 1,000.

(iv) Received a first and final dividend of 60 paise in a rupee from the Official Receiver of Rajan, who owed us ₹ 1,000.

(v) Charged depreciation on plant ₹ 1,000.

(vi) Charge interest on Drawings ₹ 1,500.

(vii) Sold goods costing ₹ 40,000 to Anil for cash at a profit of 25% on cost less 20% trade discount and charged 8% Value Added Tax and paid cartage ₹ 100, which is not to be charged from customer.

Solution:

![]()

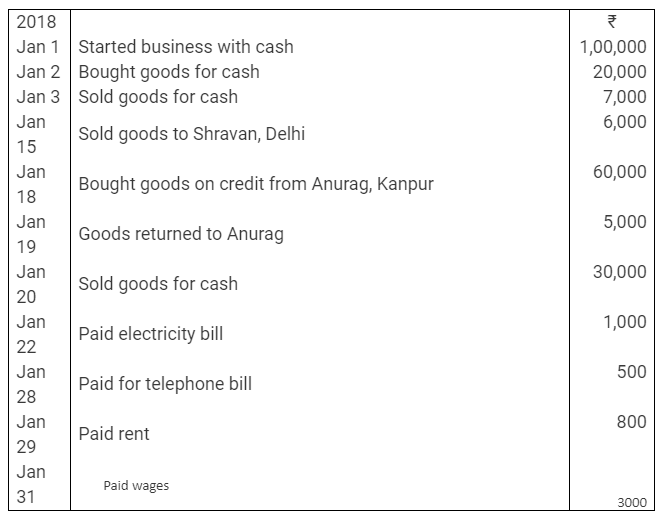

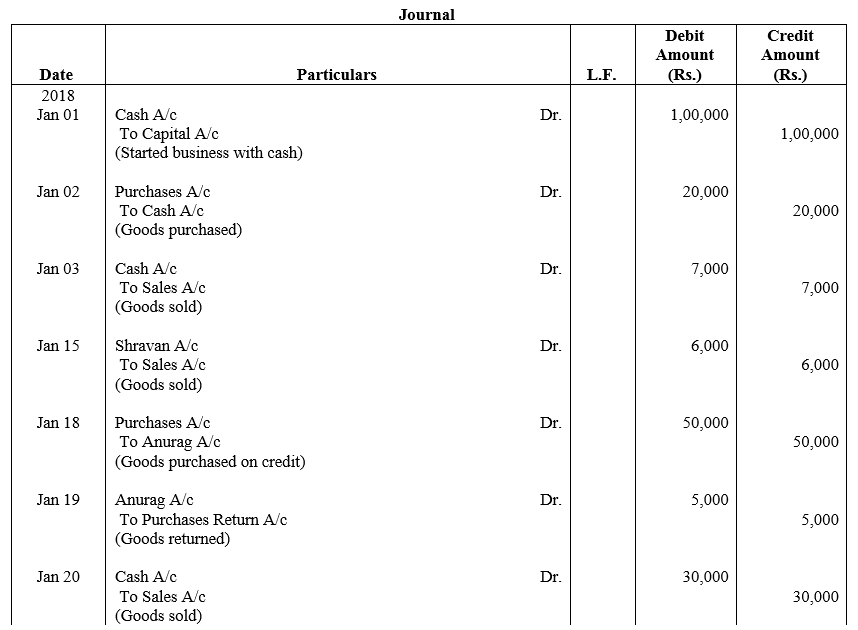

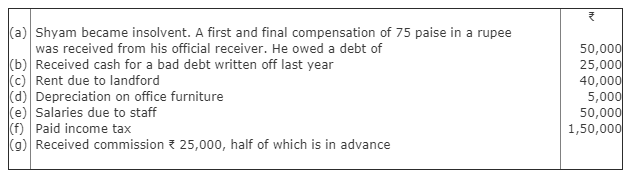

Question 7.

Journalise the following transaction:

Solution:

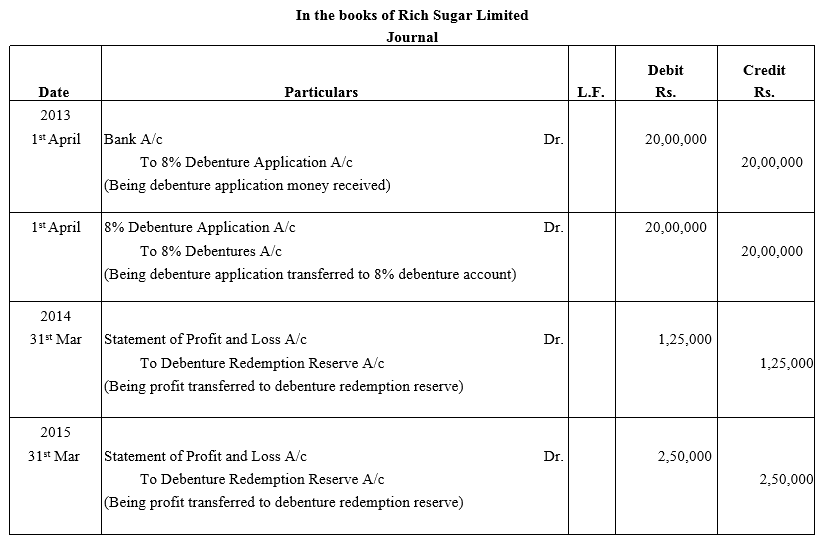

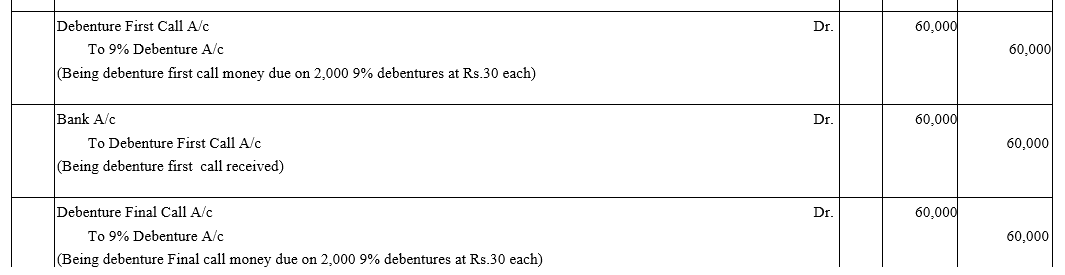

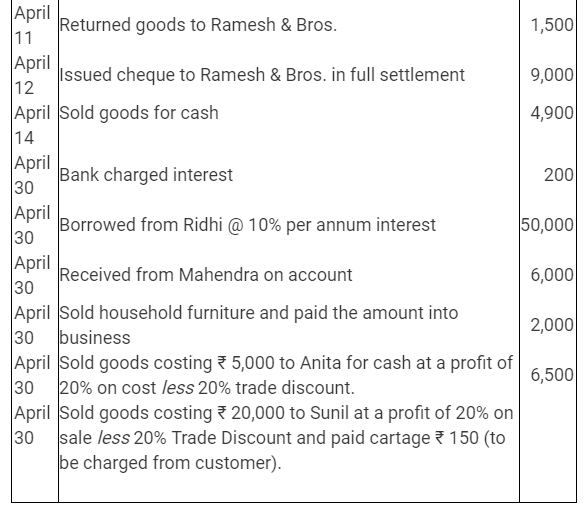

Question 8.

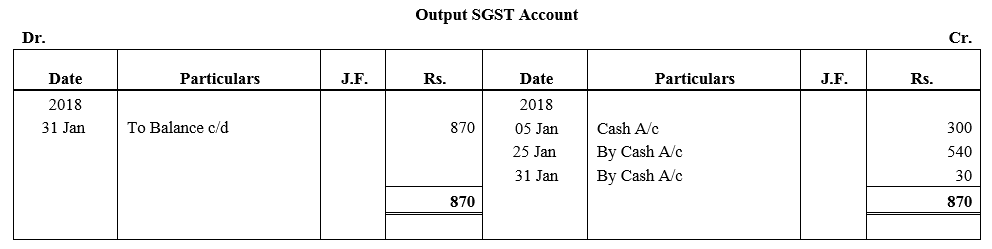

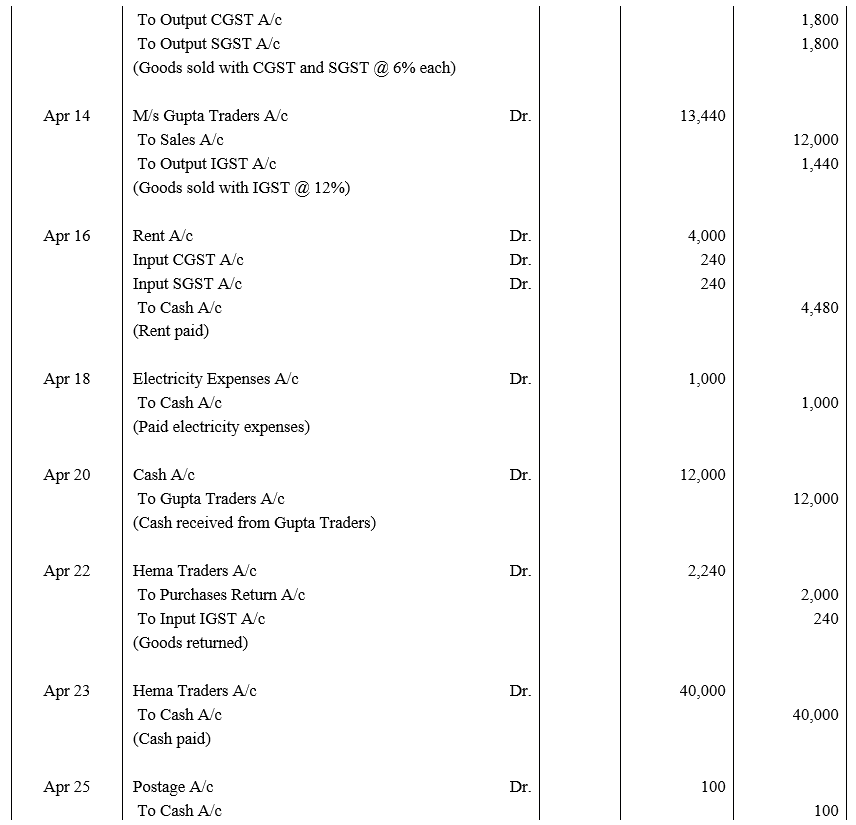

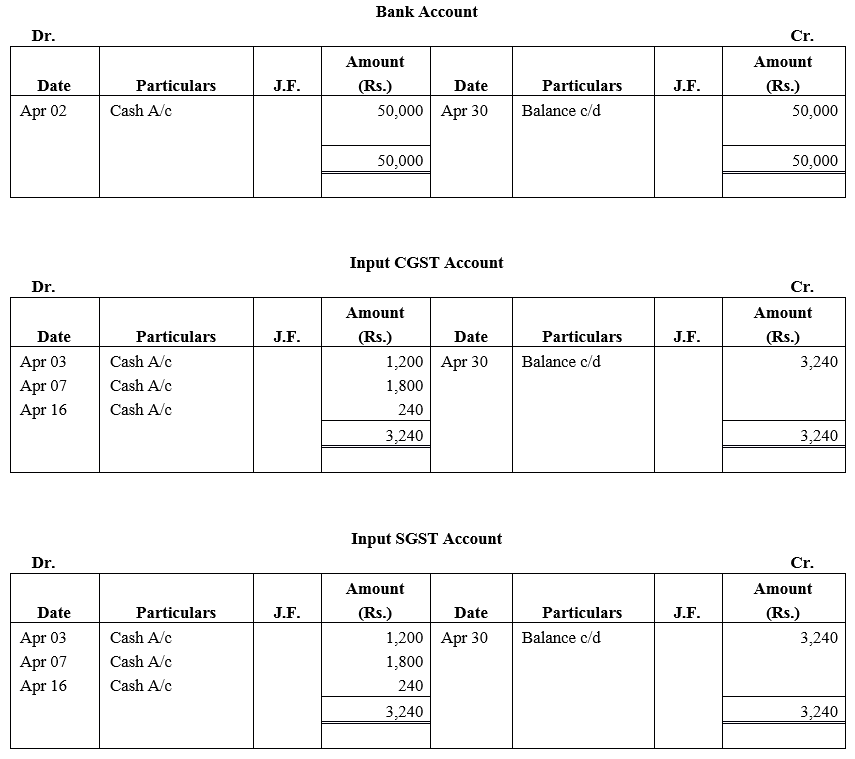

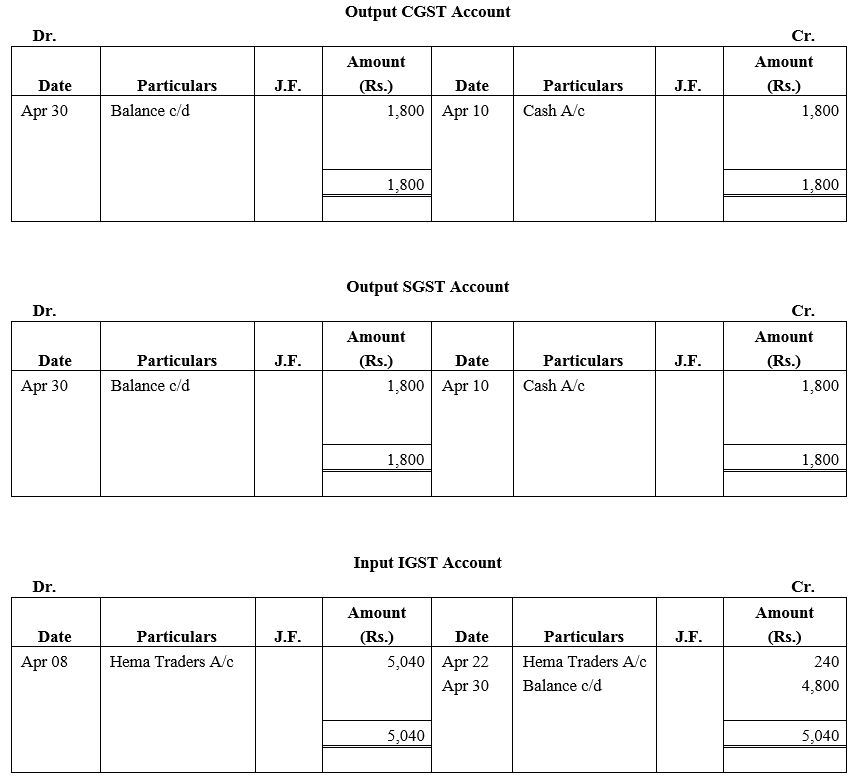

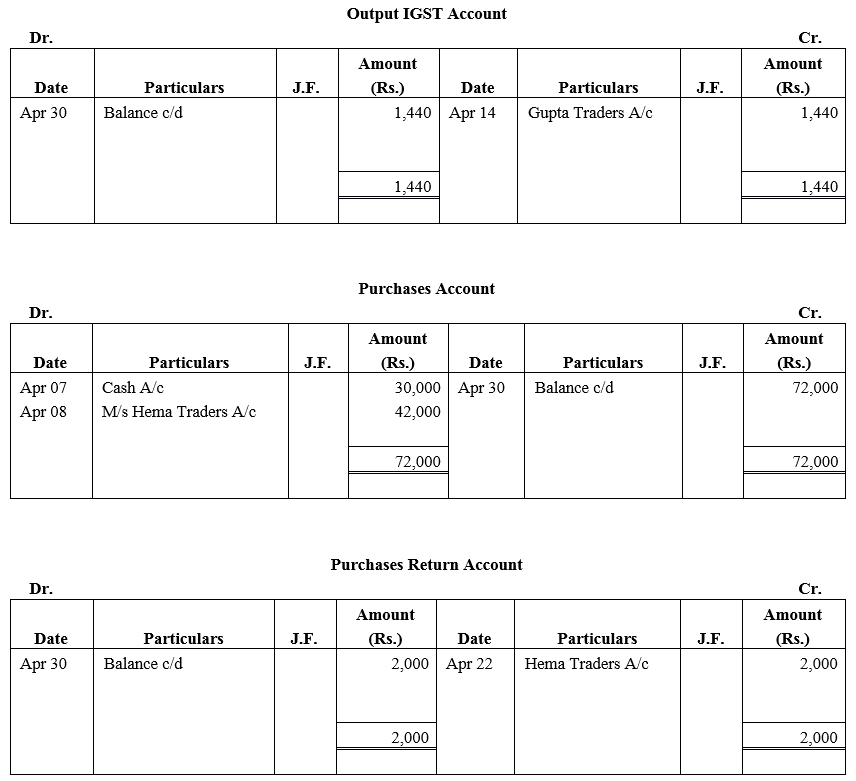

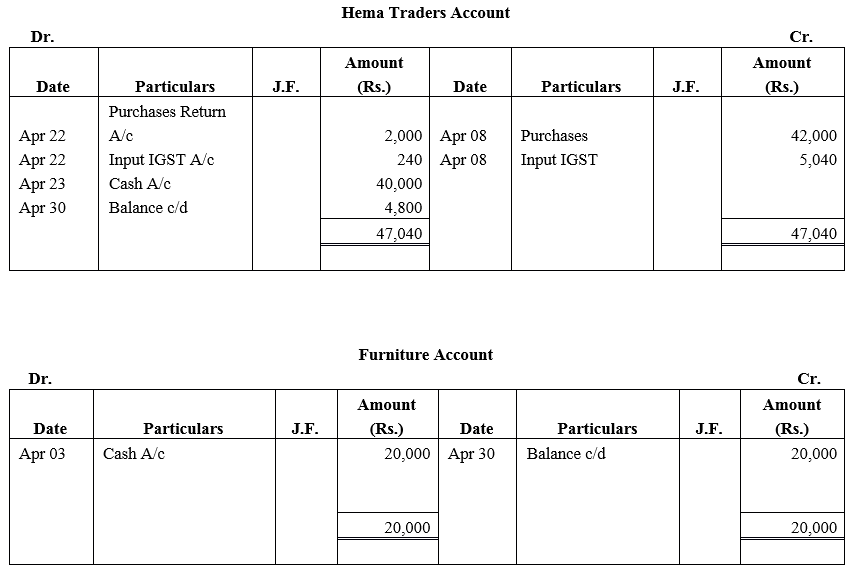

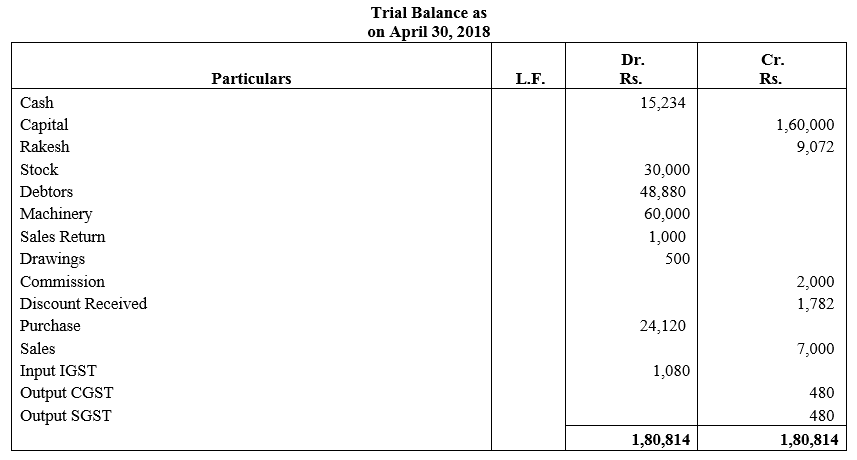

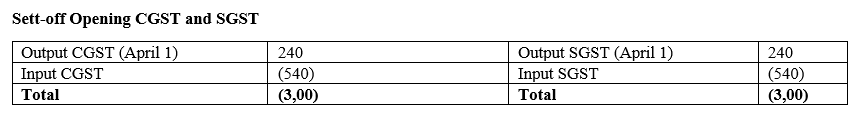

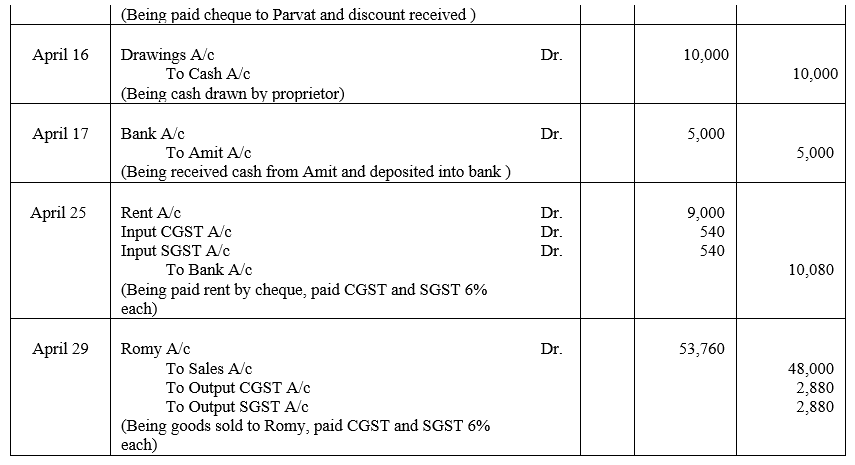

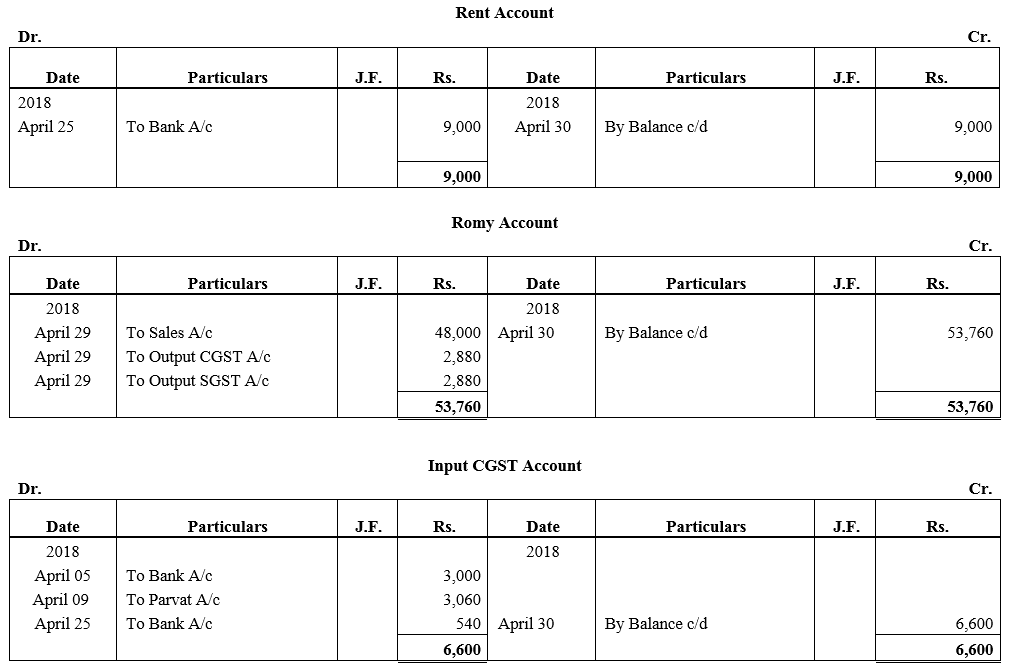

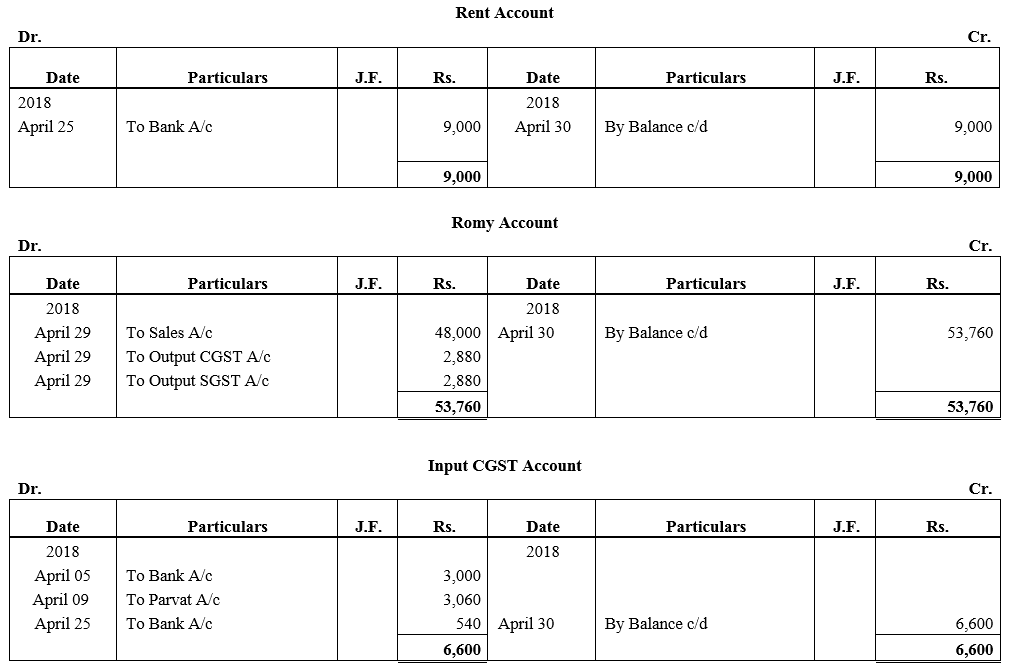

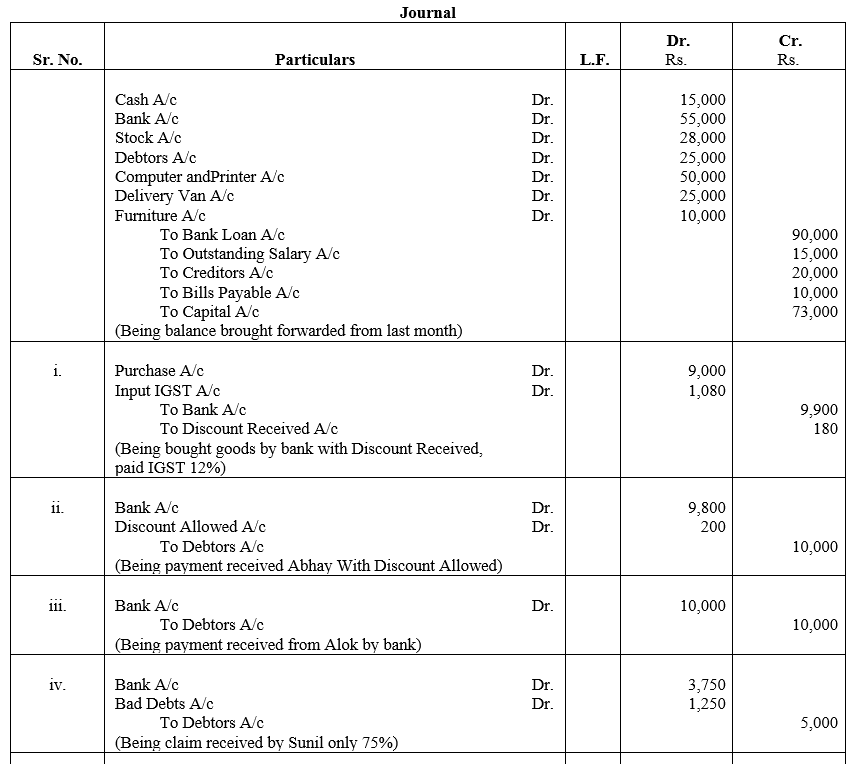

With Goods and Services Tax (GST)

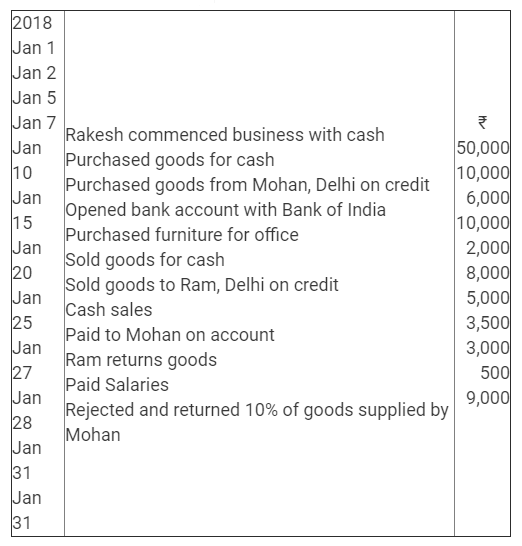

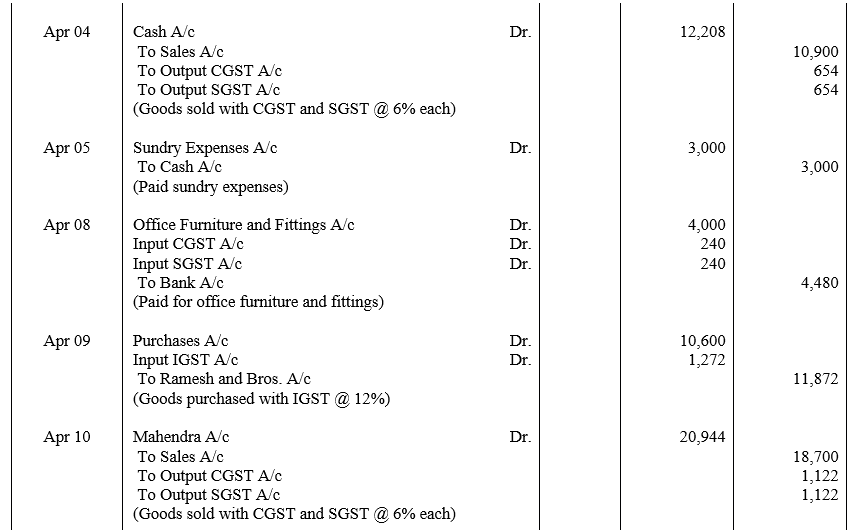

Journalise the following transactions of Singh Enterprises, Delhi:

CGST and SGST @ 6% each is levied on Intra-state sale and purchase.

Solution:

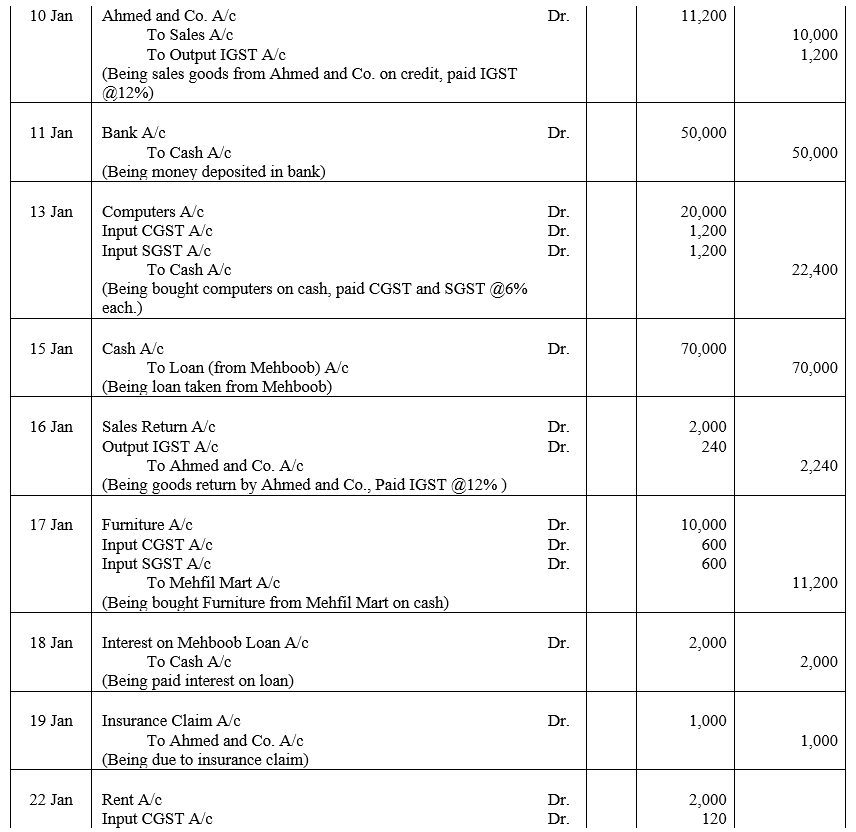

![]()

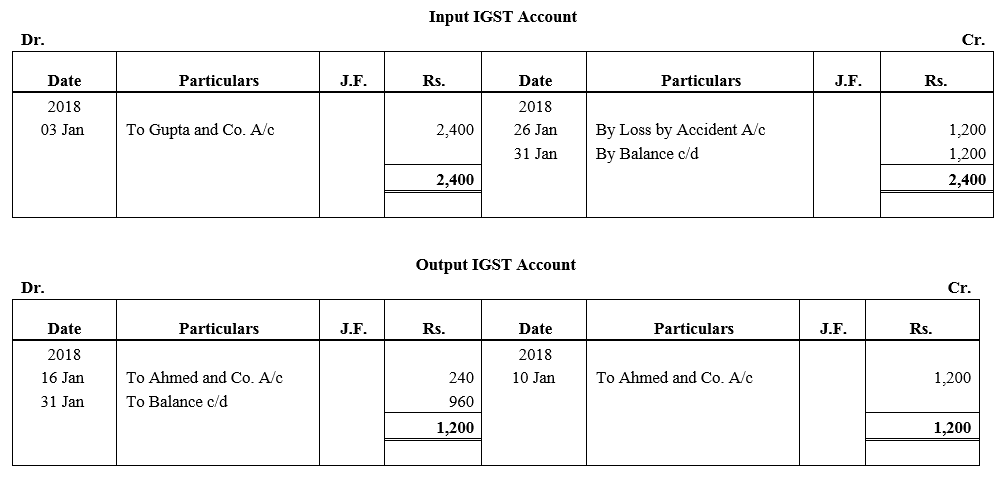

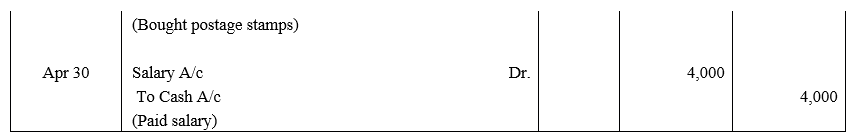

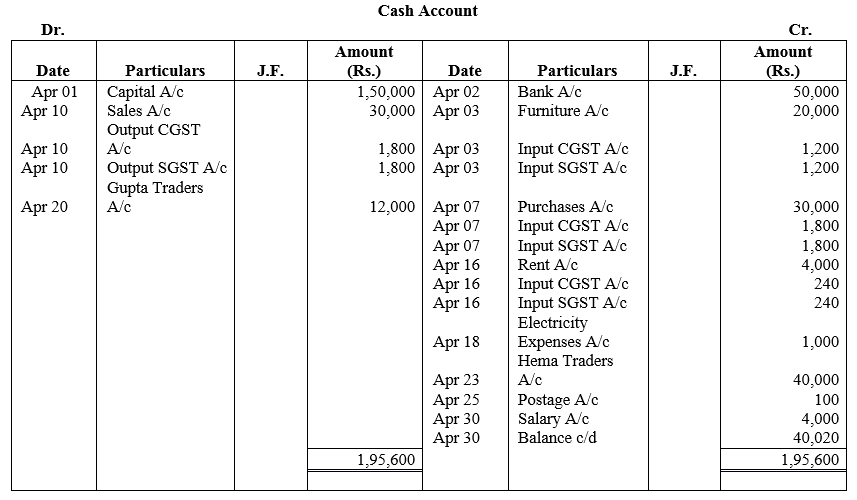

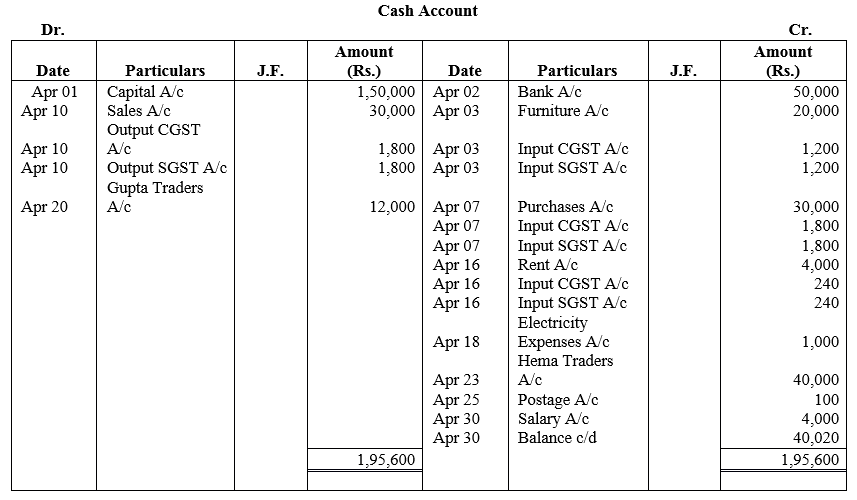

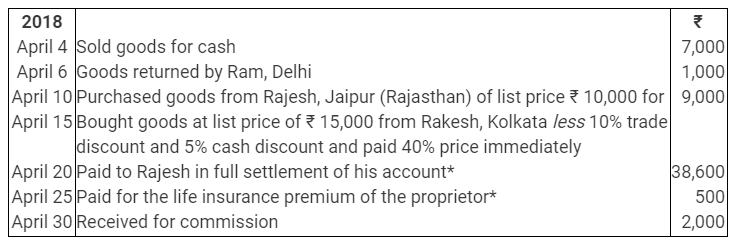

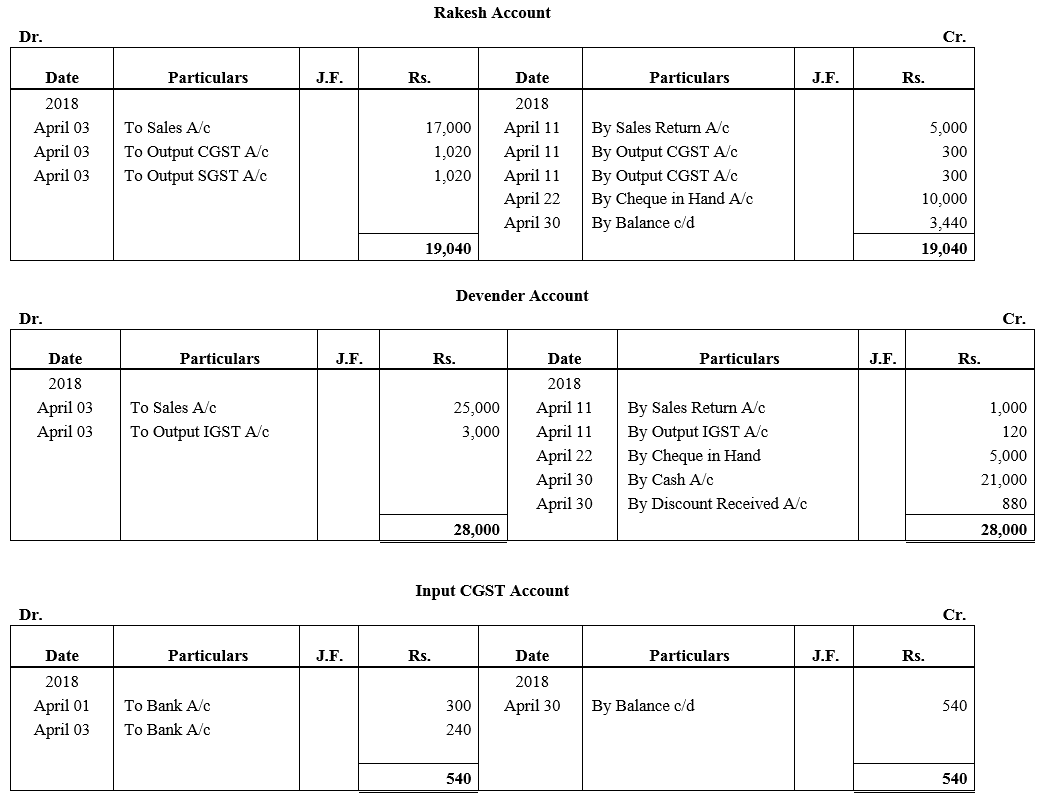

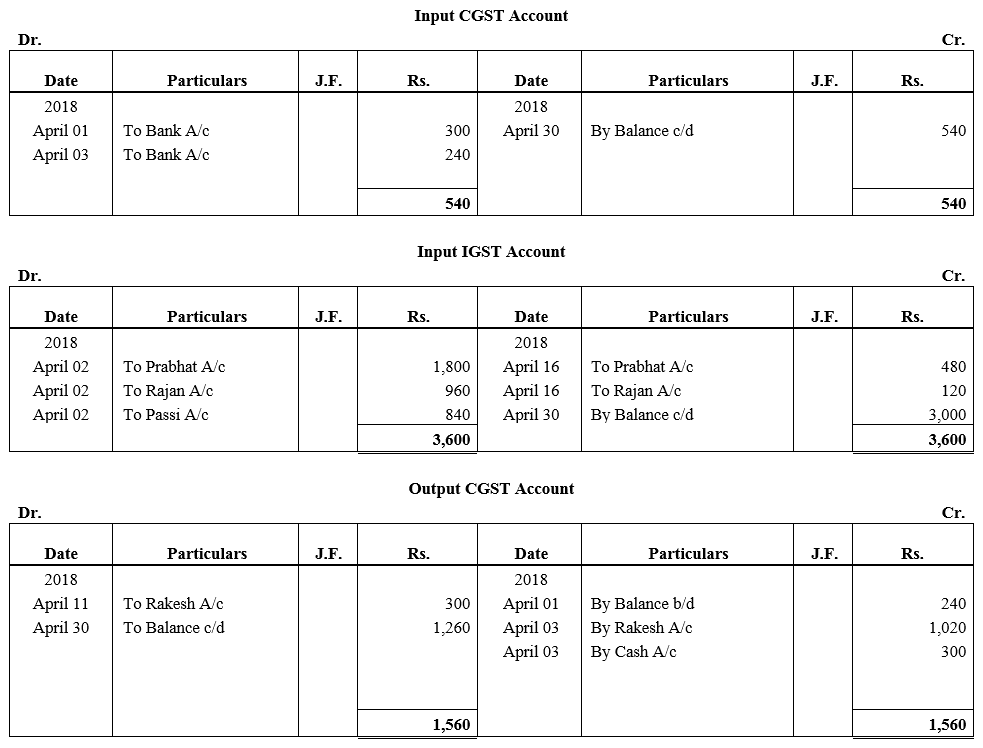

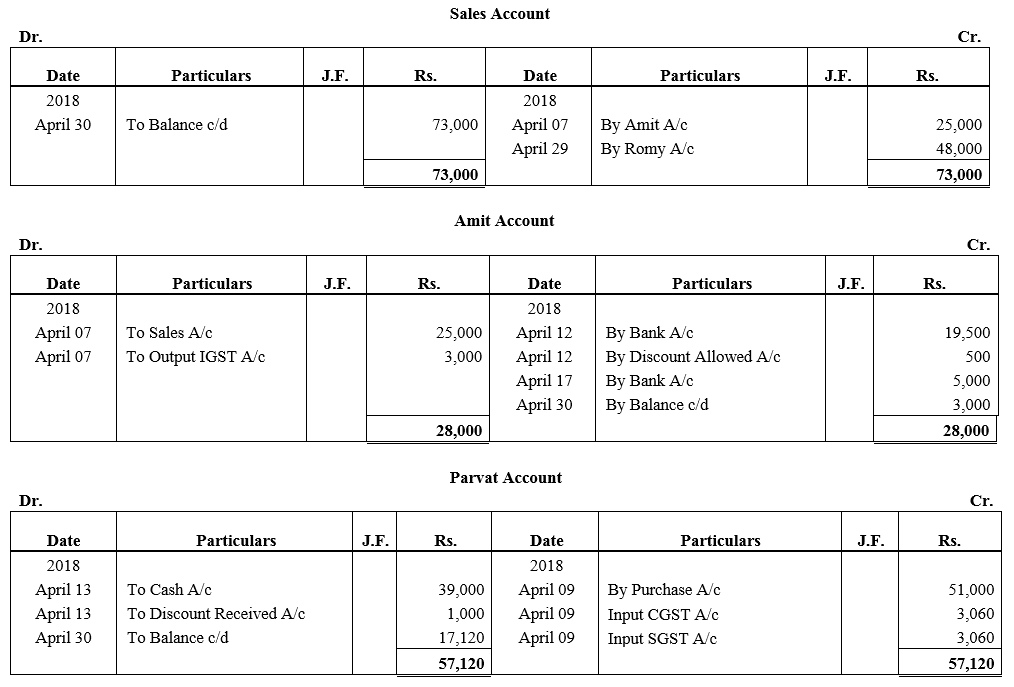

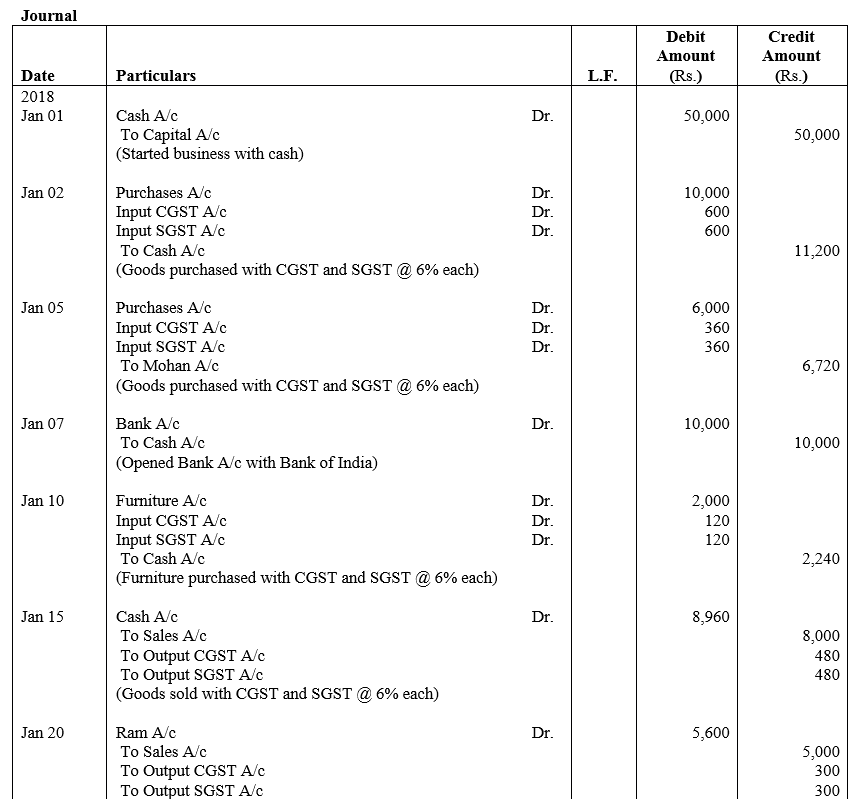

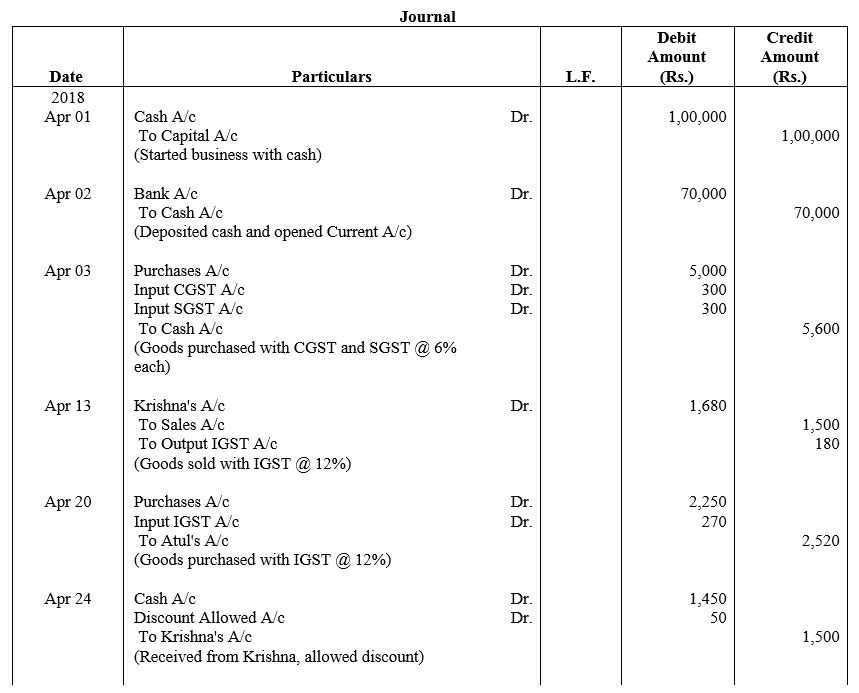

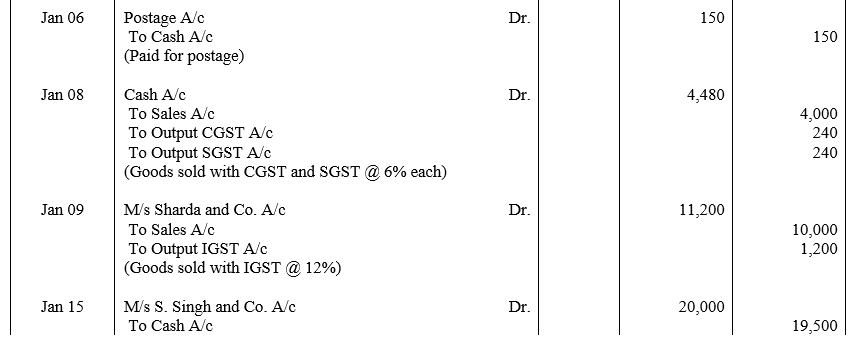

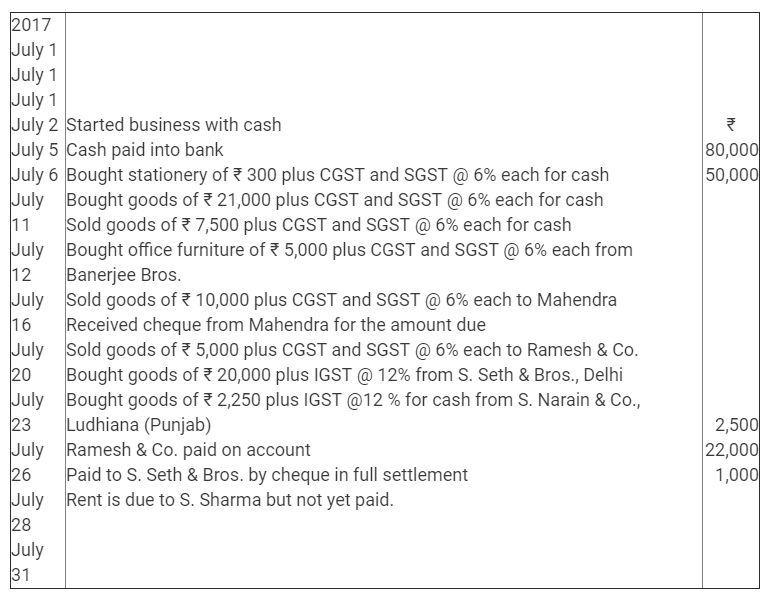

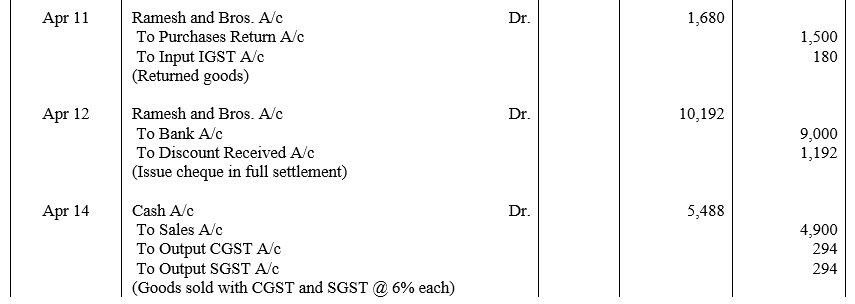

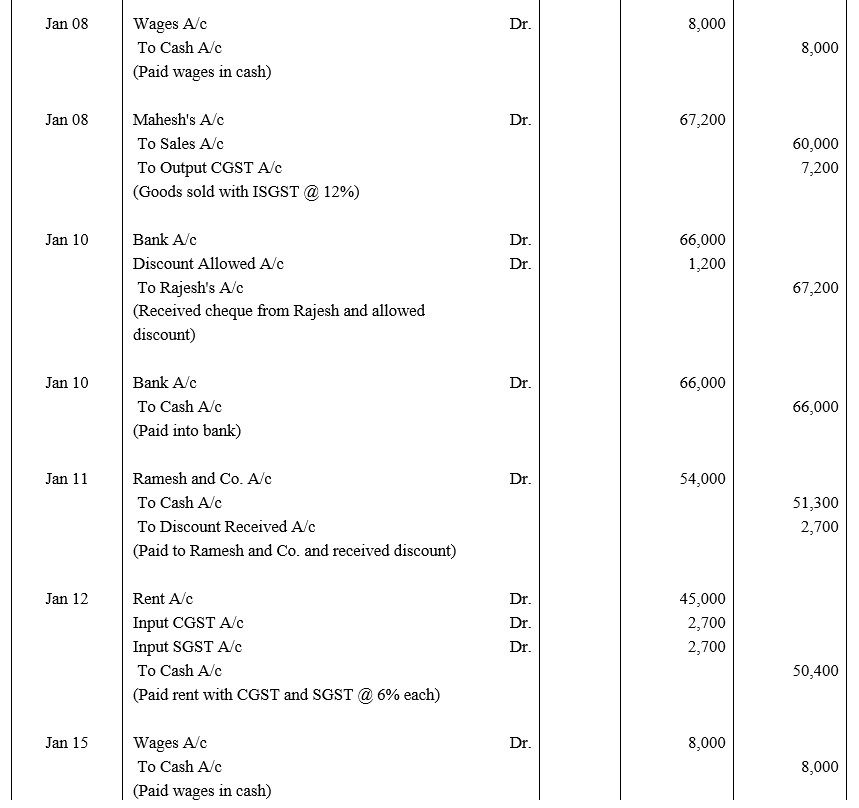

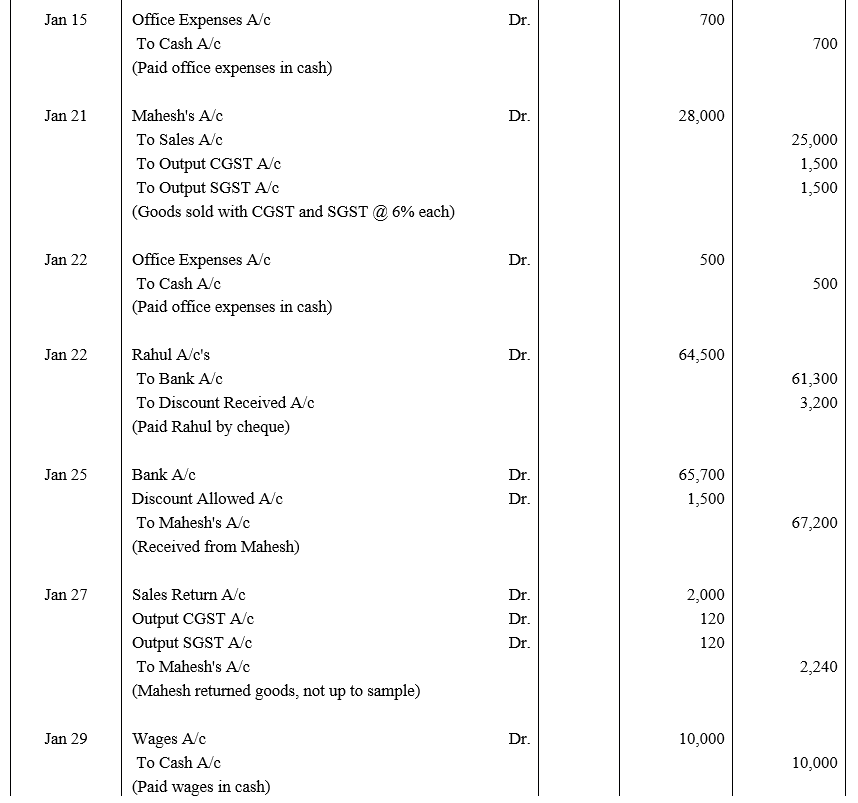

Question 9.

Journalise the following transactions of Rakesh Agencies, Delhi (Proprietor Shri Rakesh):

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @12% on inter-state sale and purchase.

Solution:

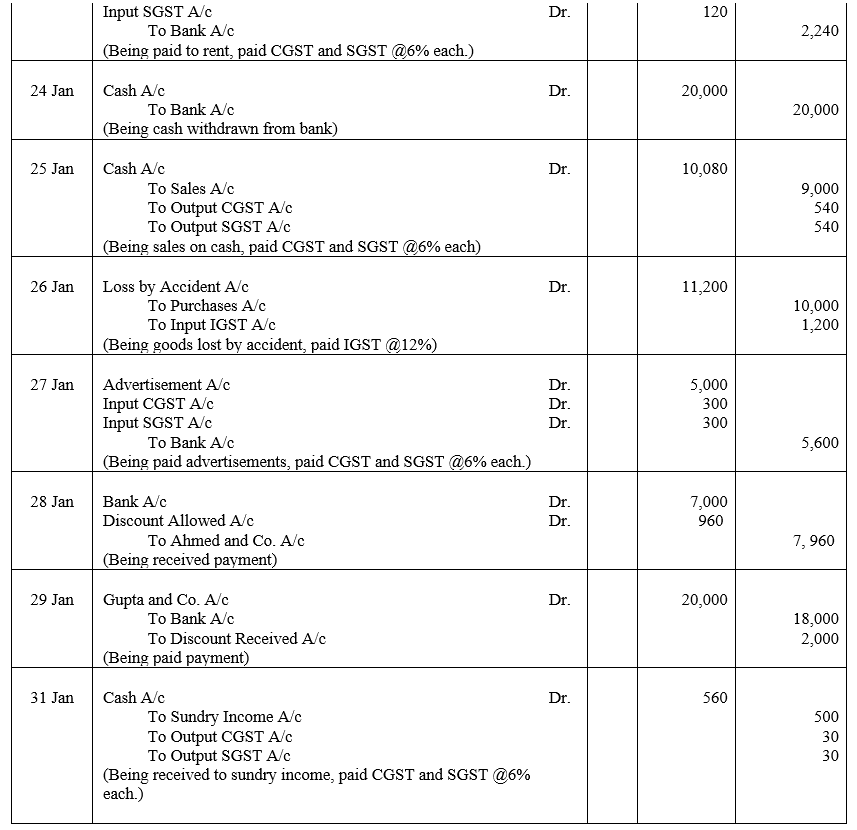

![]()

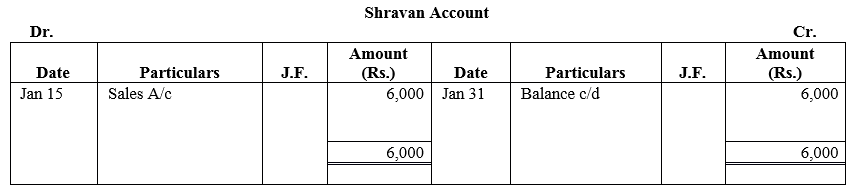

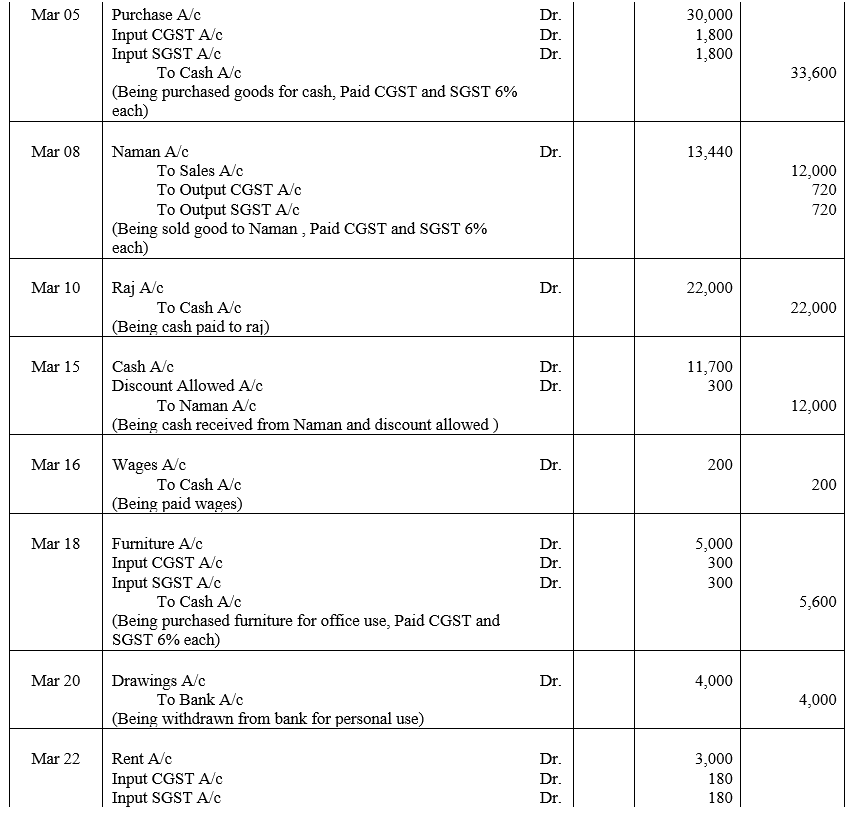

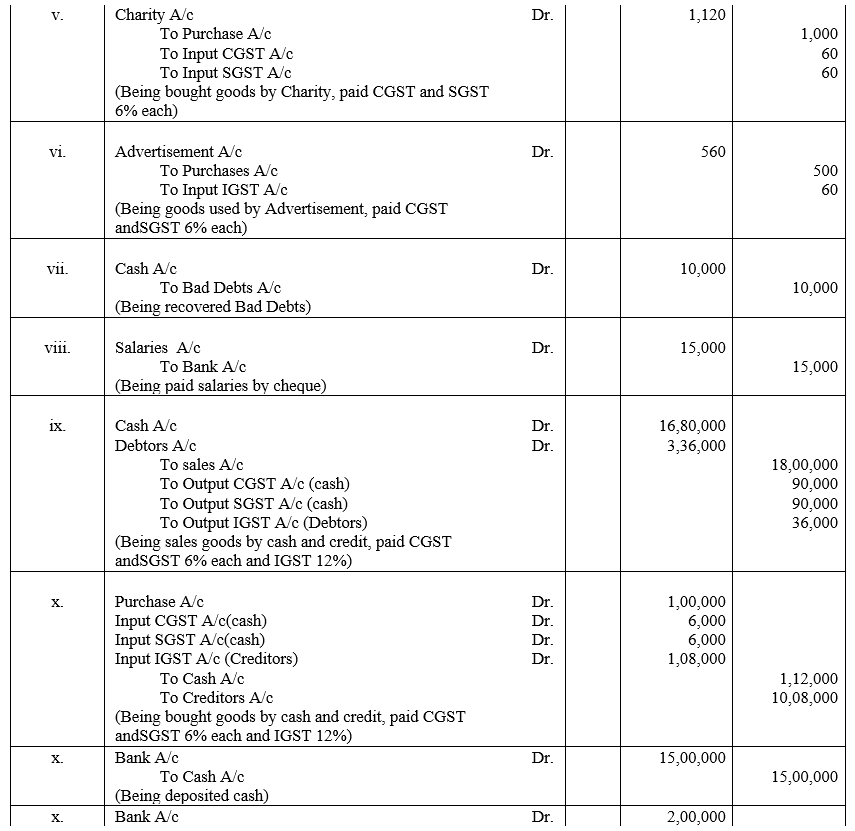

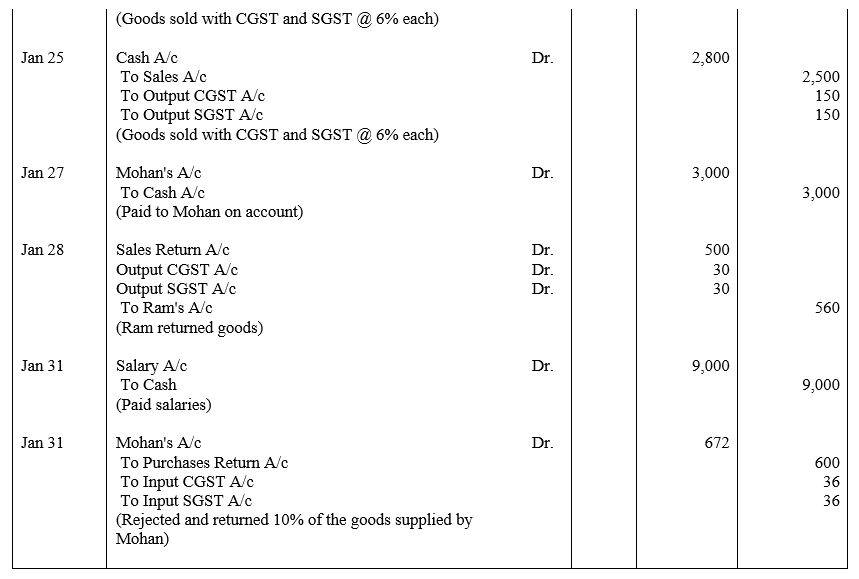

Question 10.

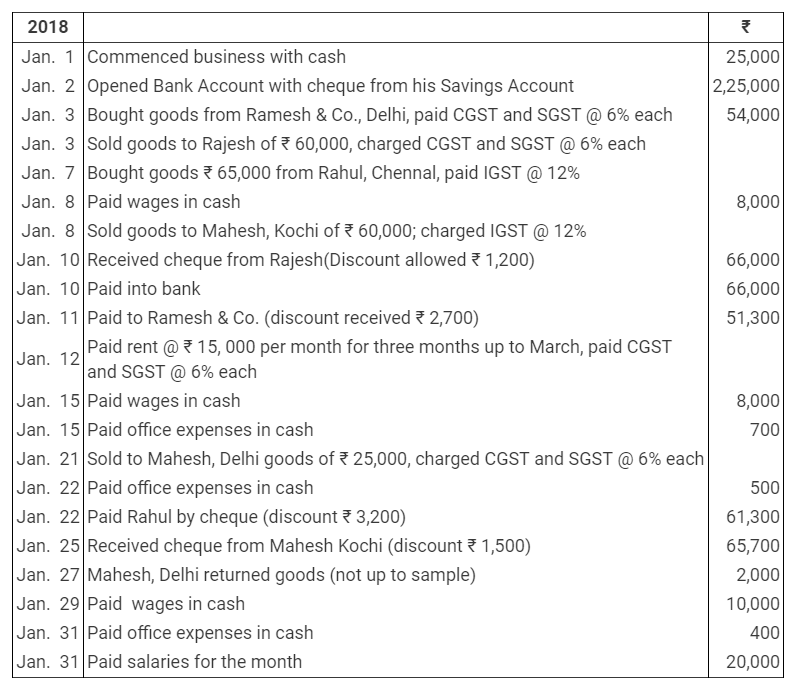

Journalise the following transactions of Ram Delhi:

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @12% on inter-state sale and purchase.

Solution:

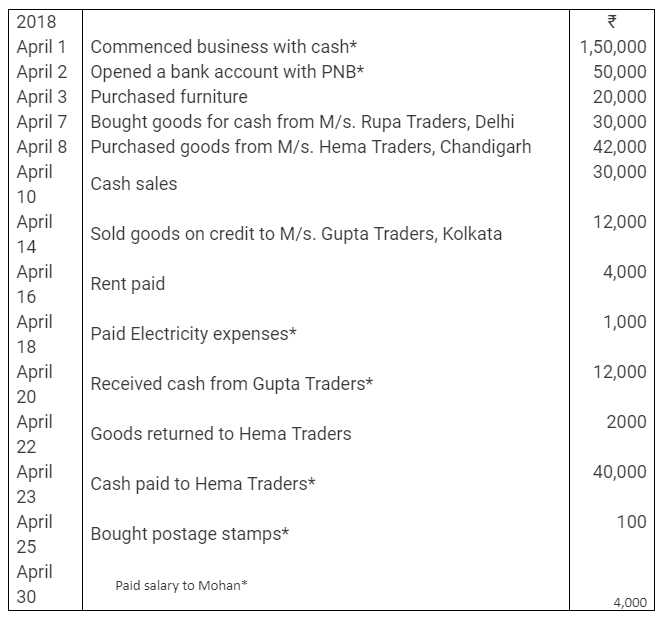

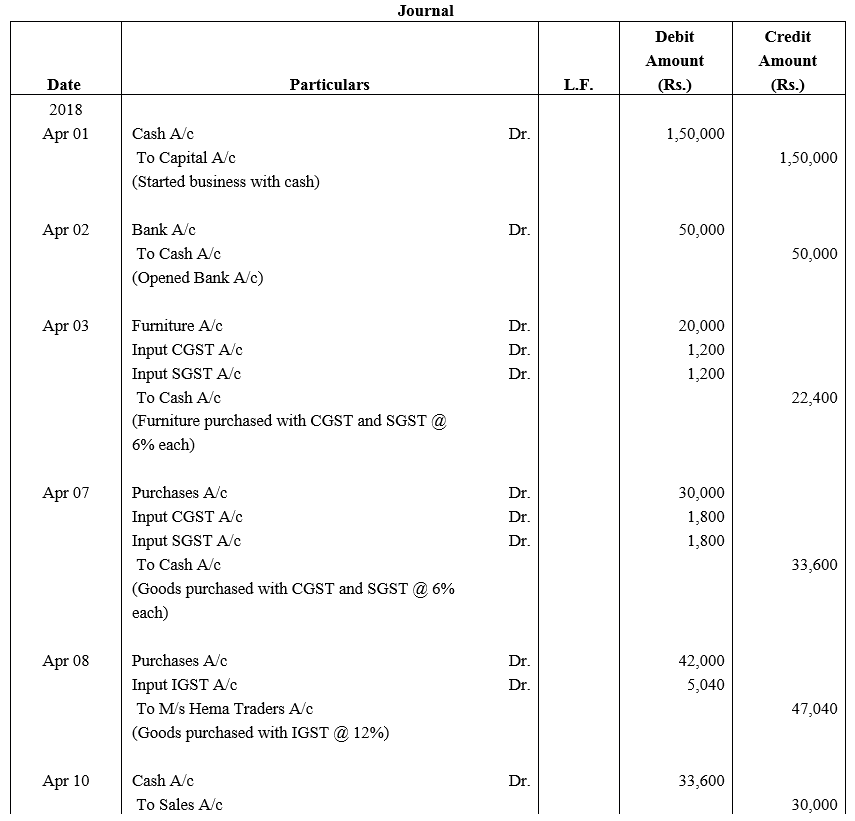

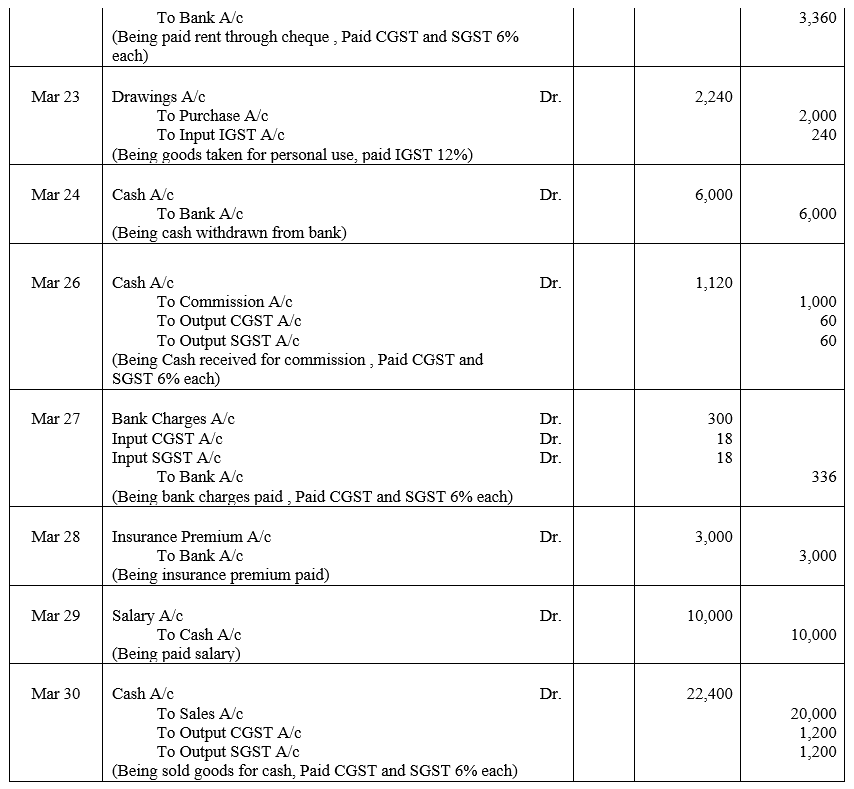

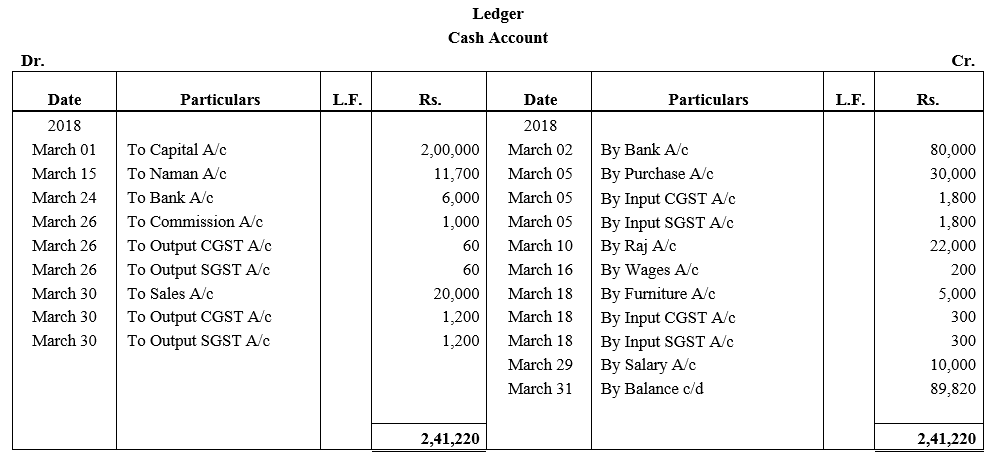

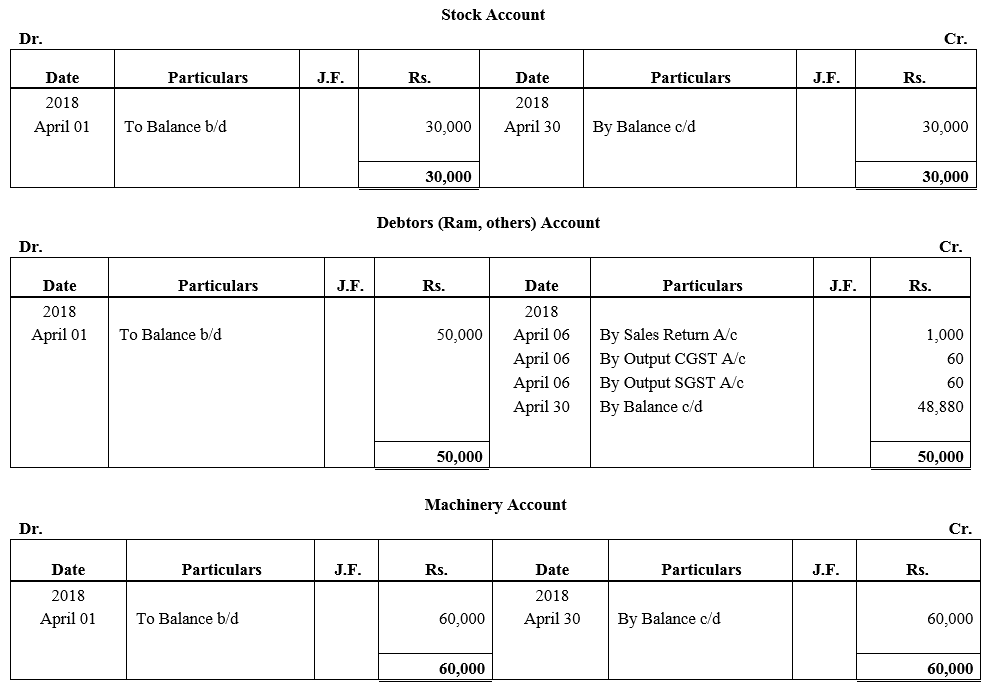

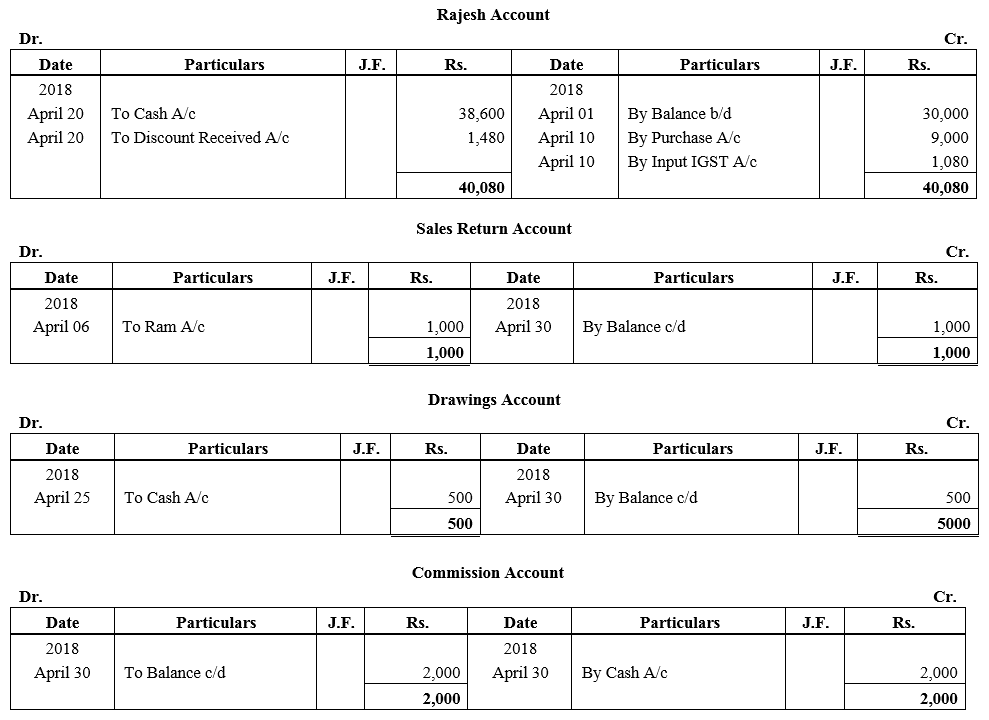

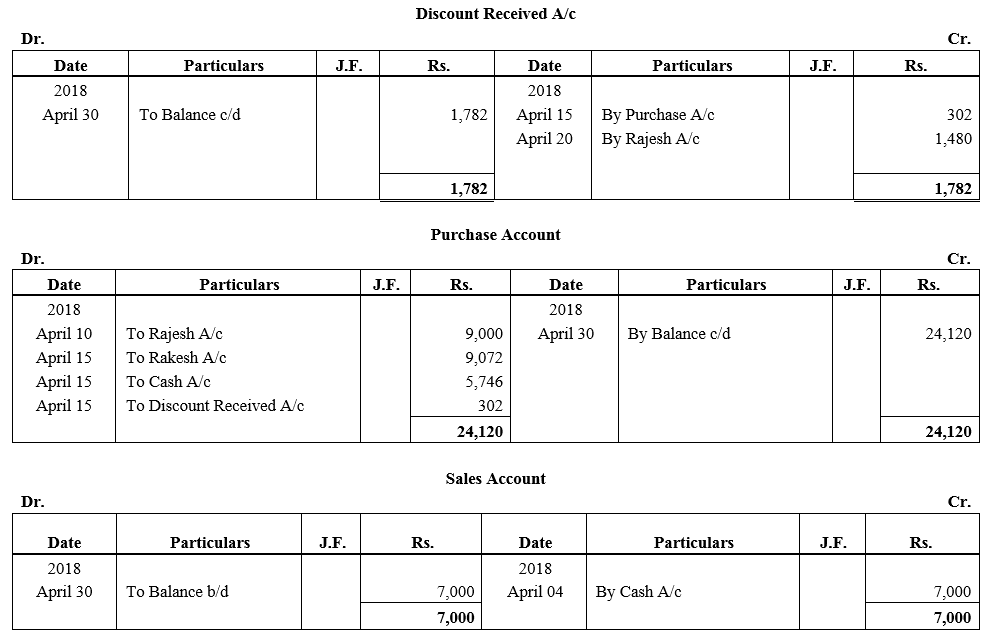

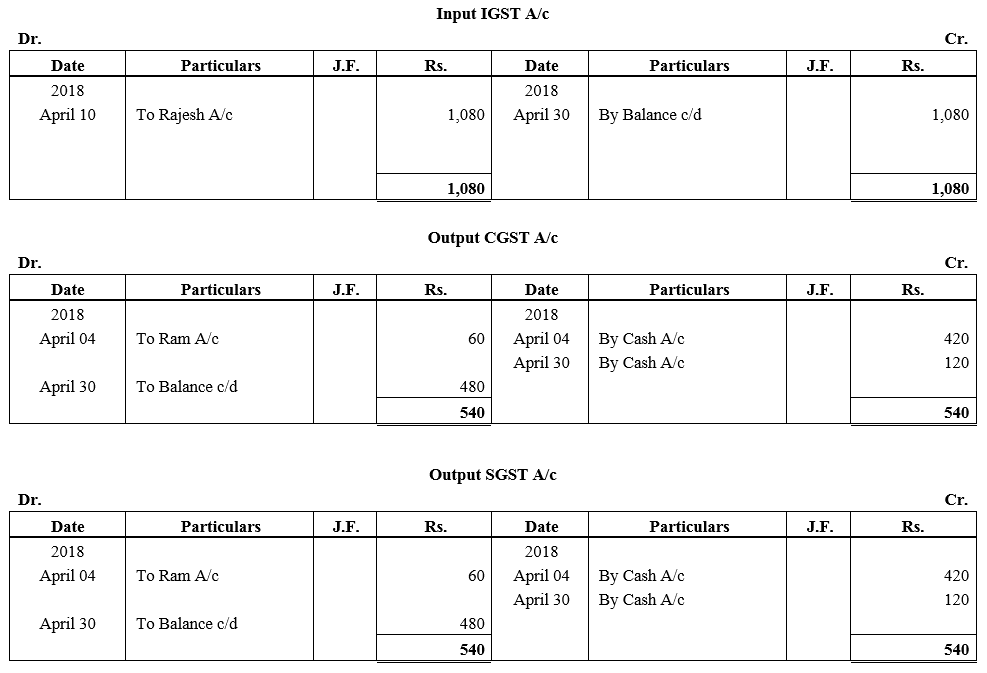

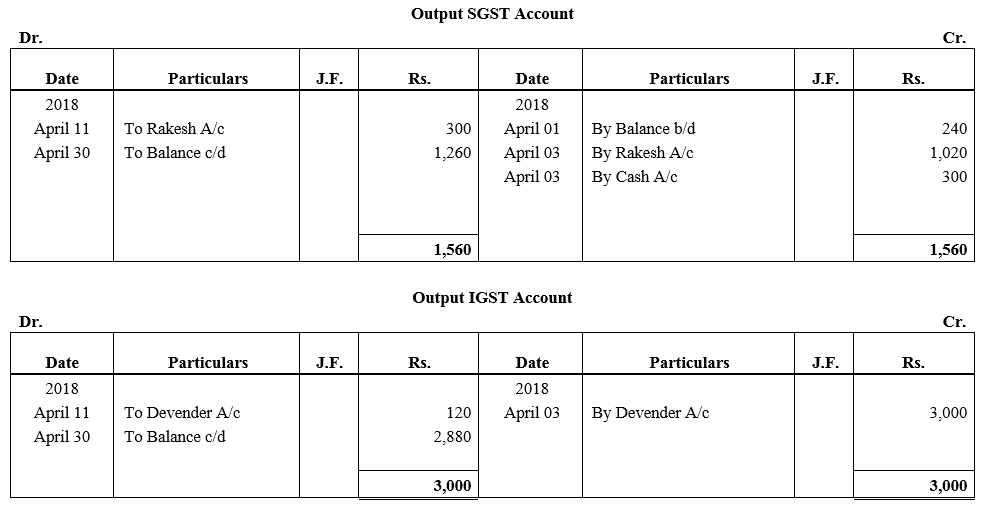

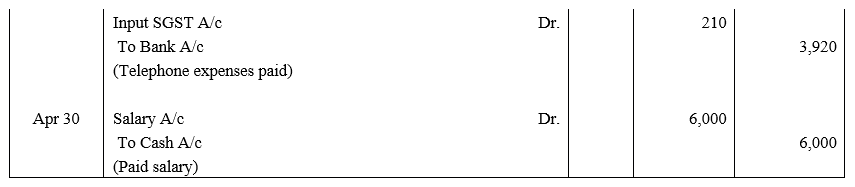

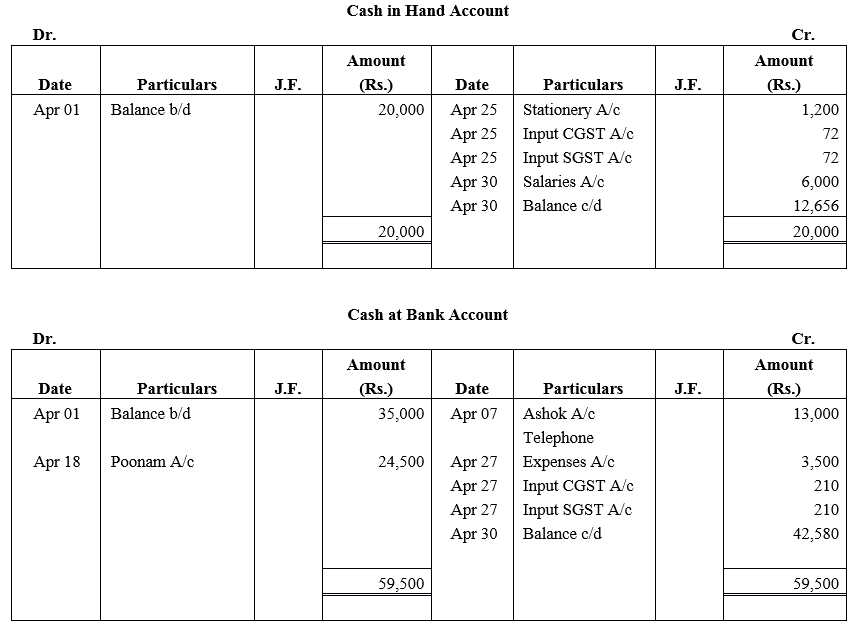

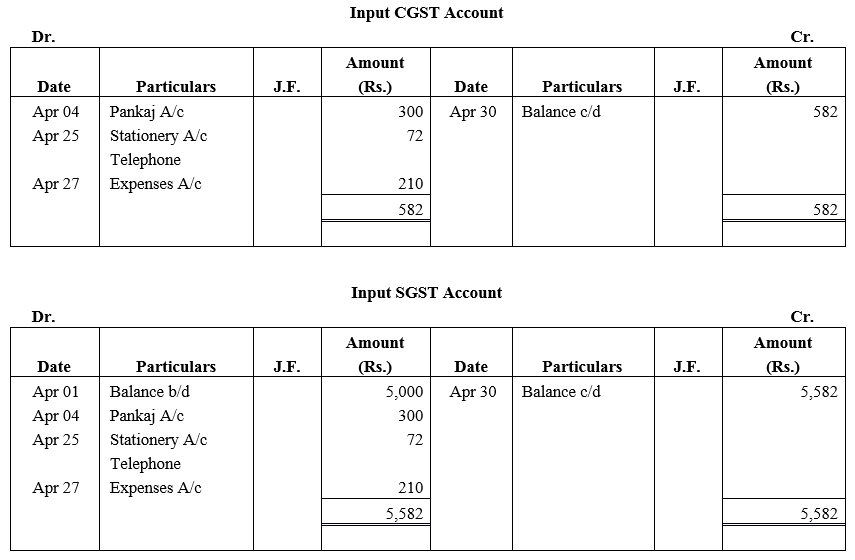

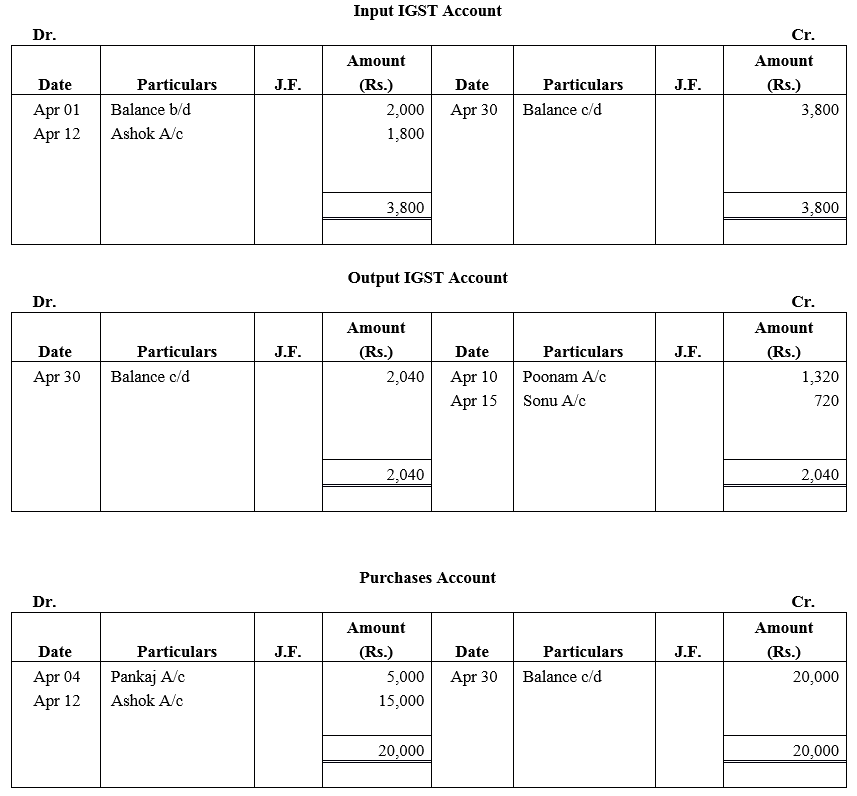

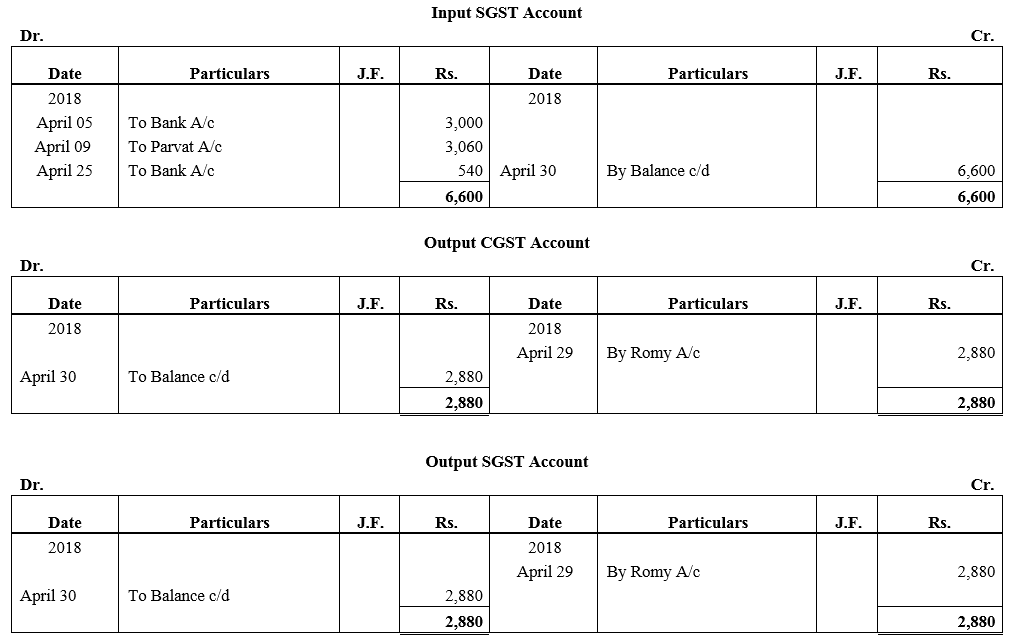

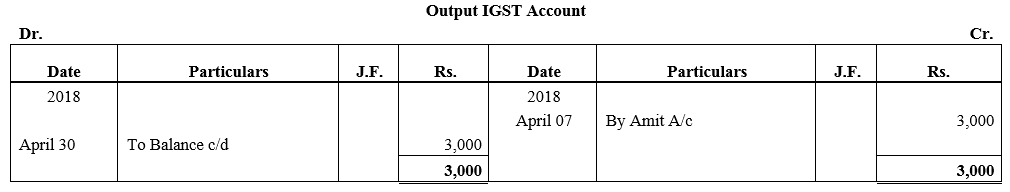

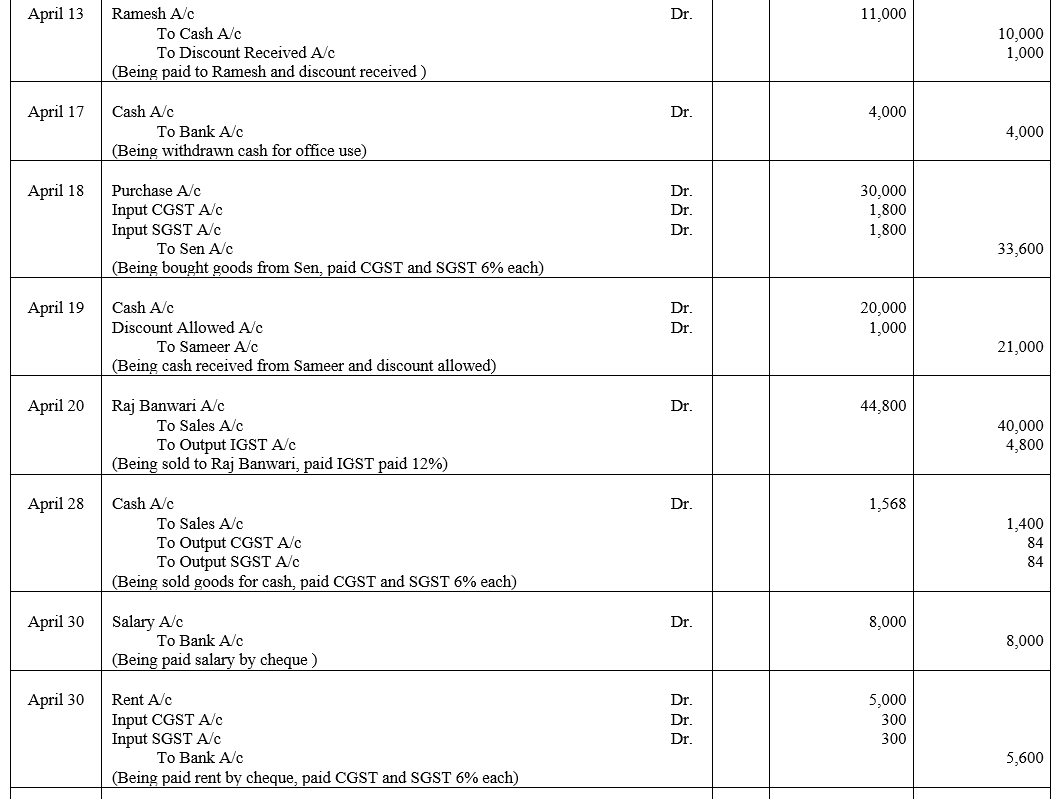

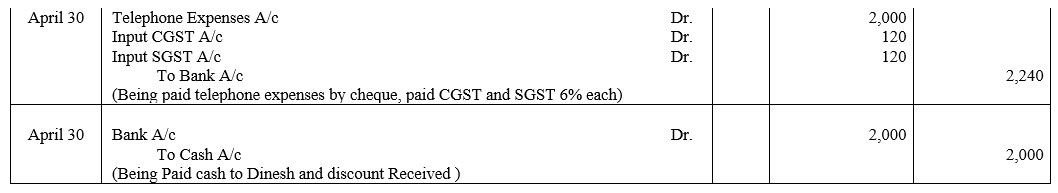

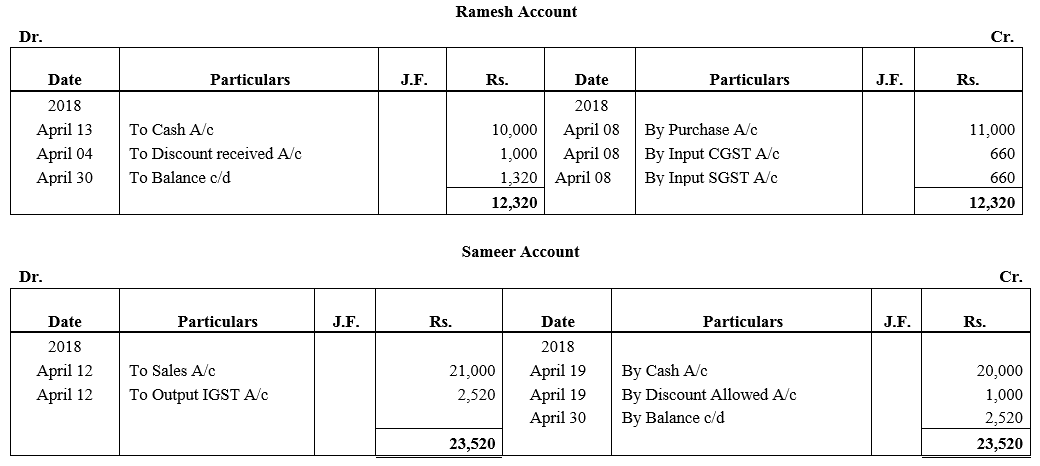

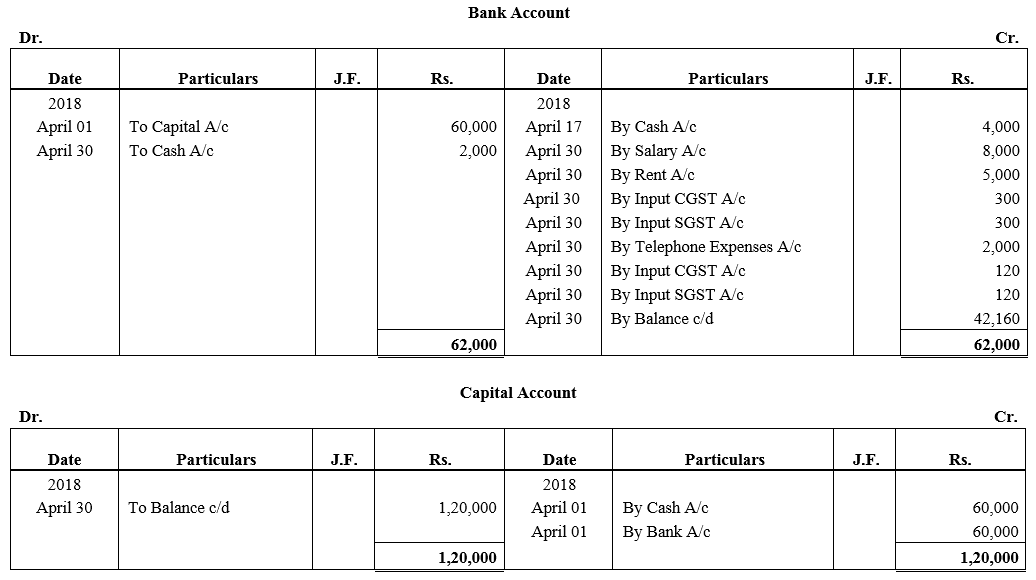

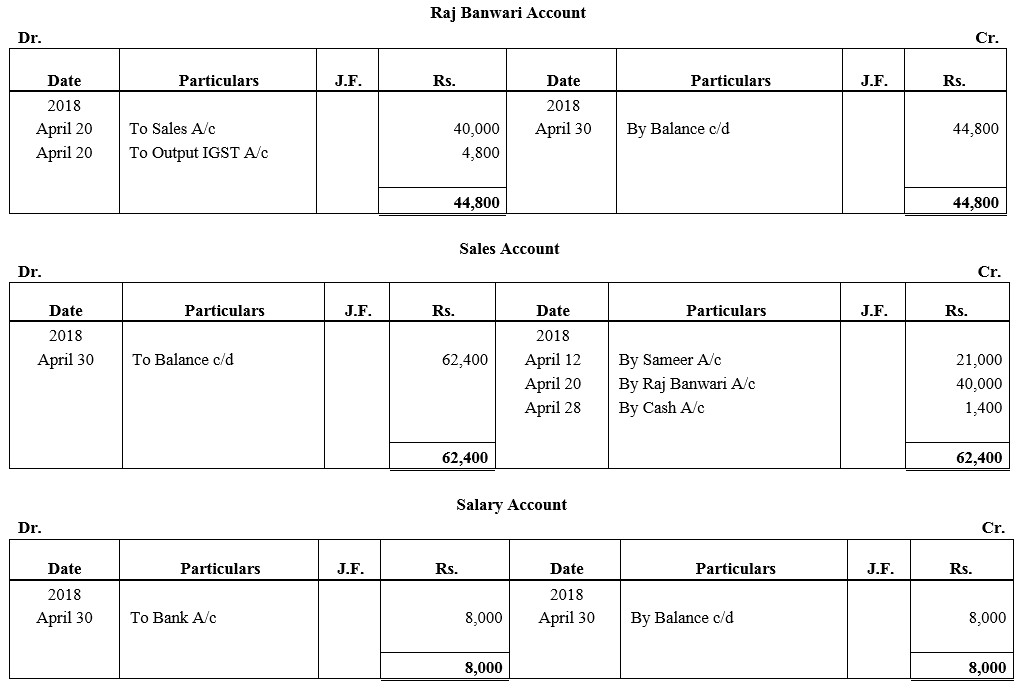

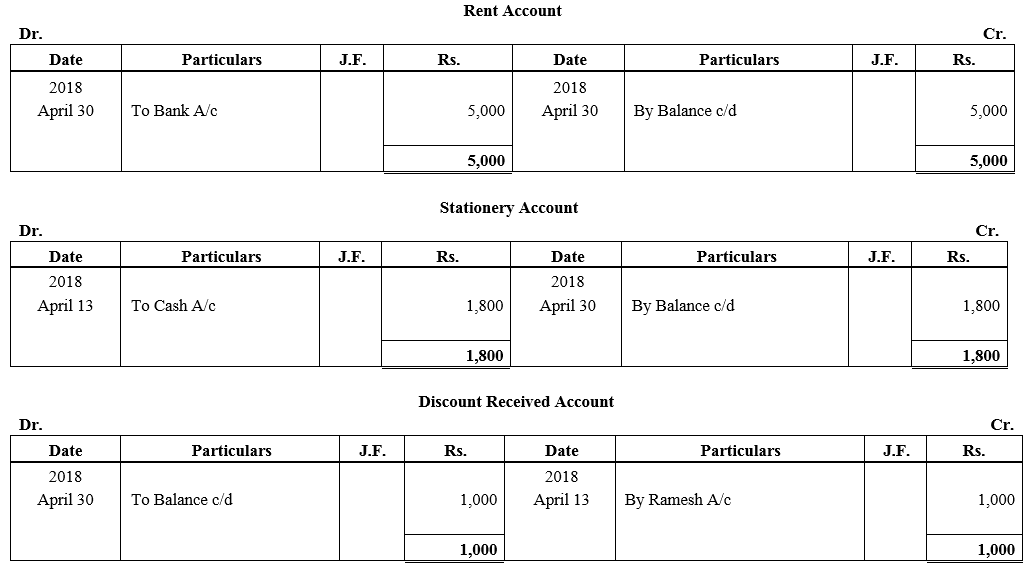

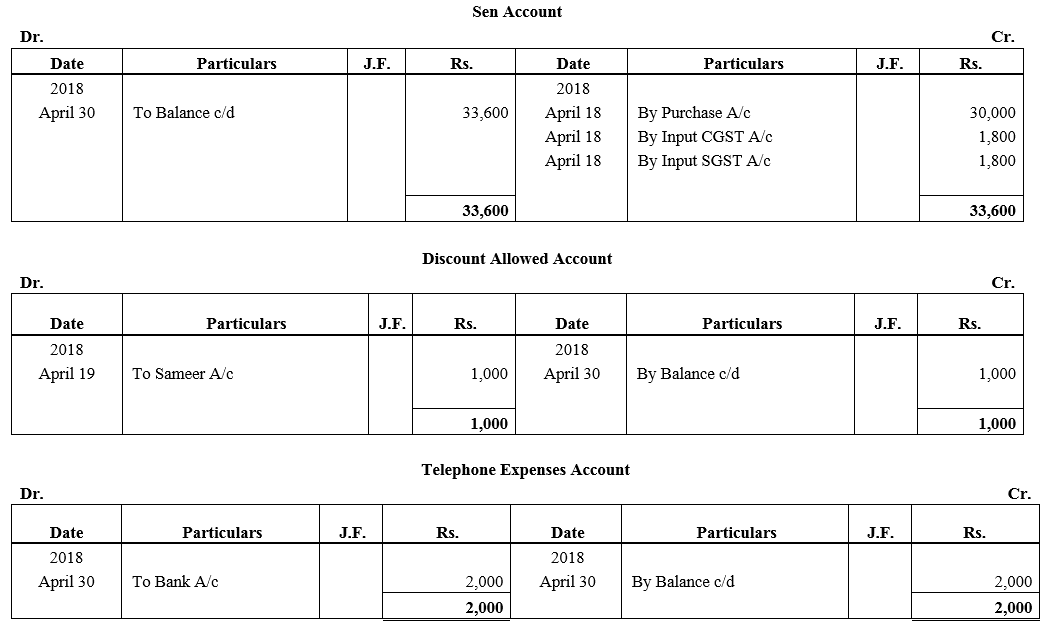

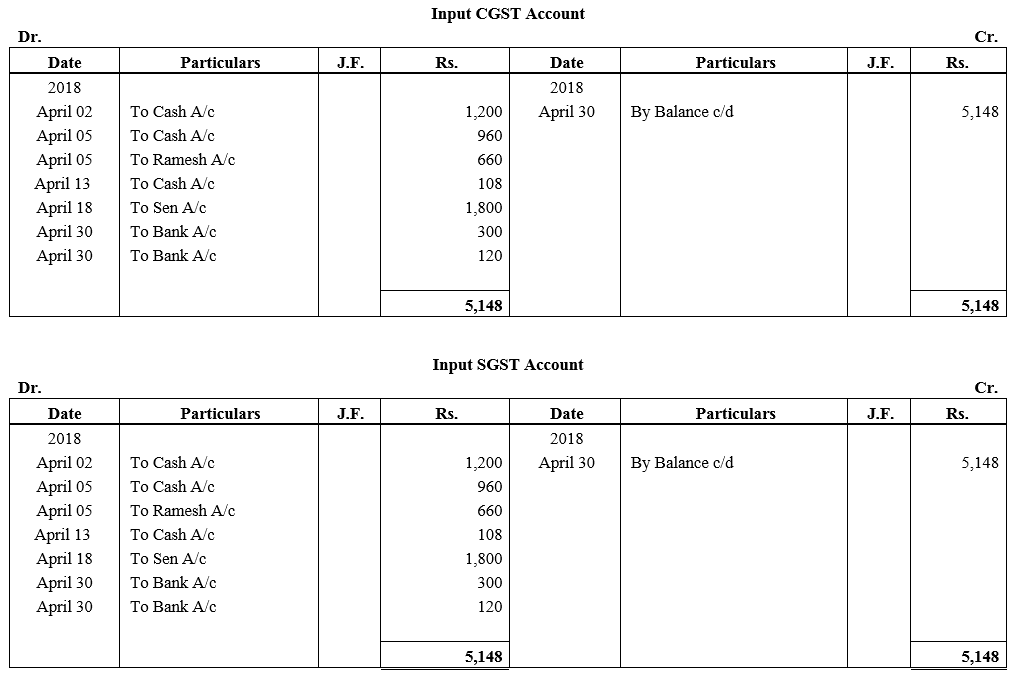

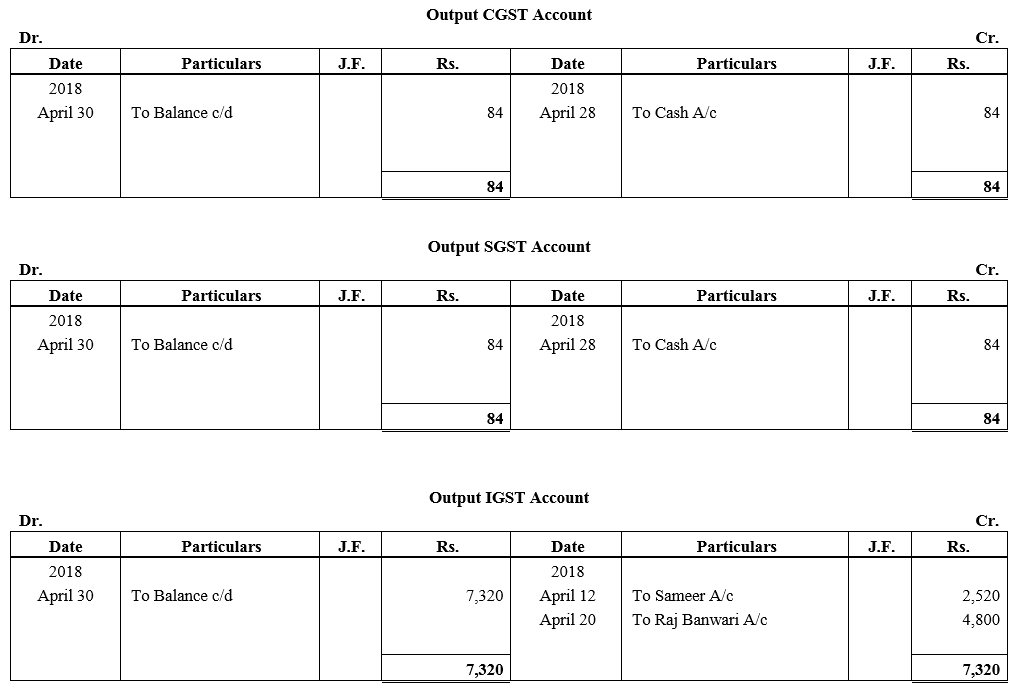

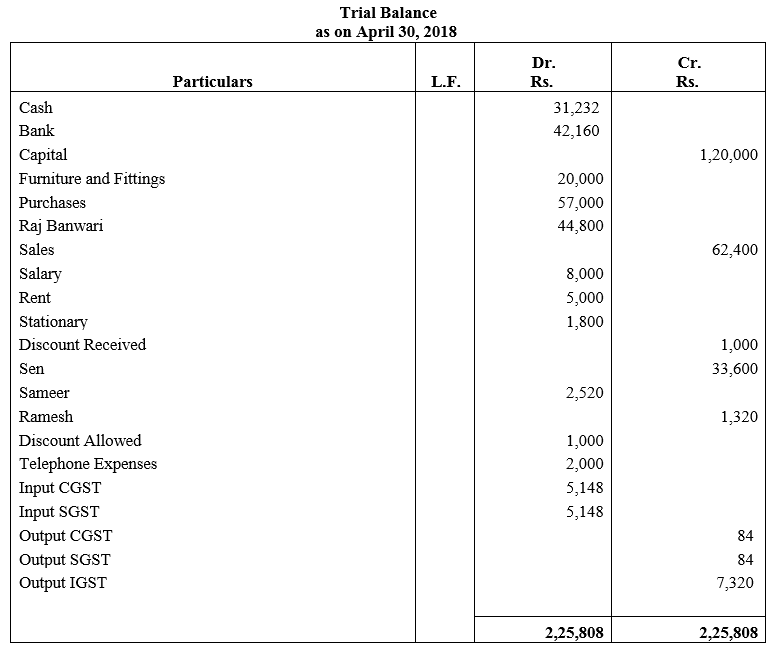

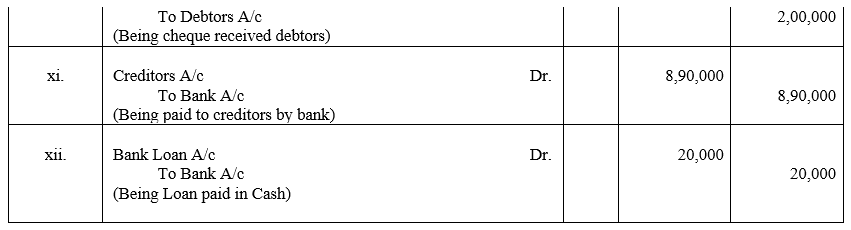

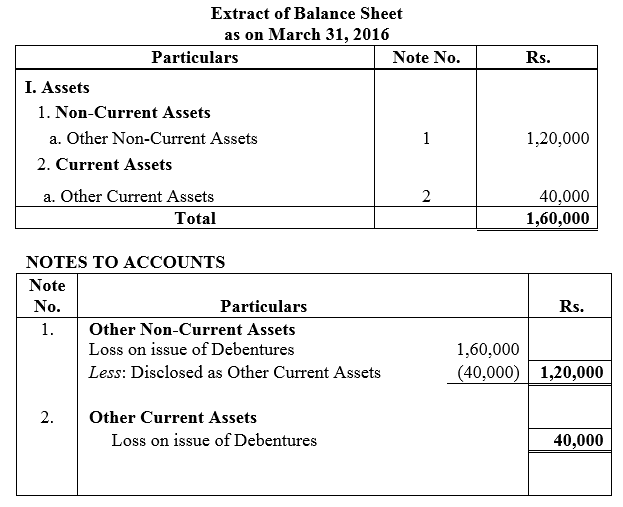

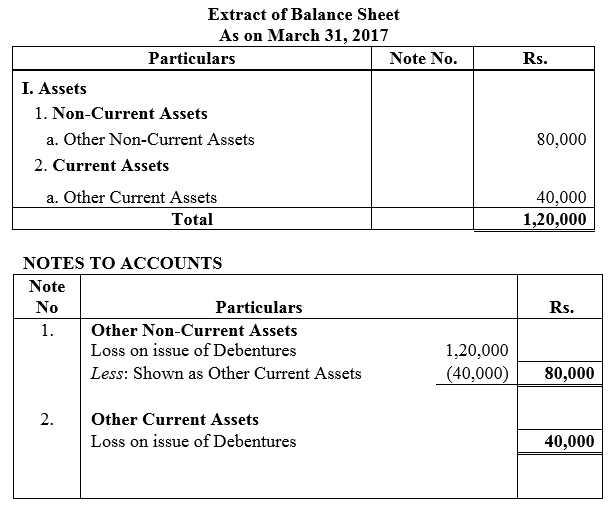

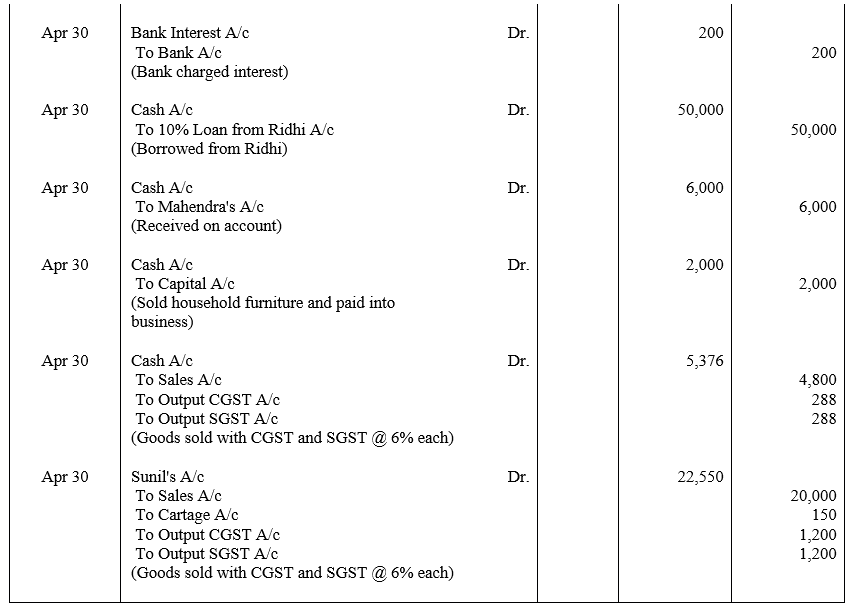

Question 11.

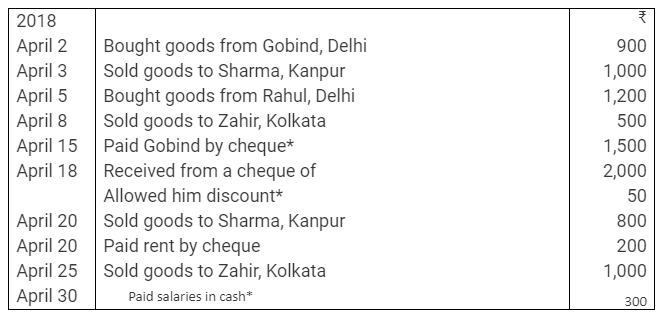

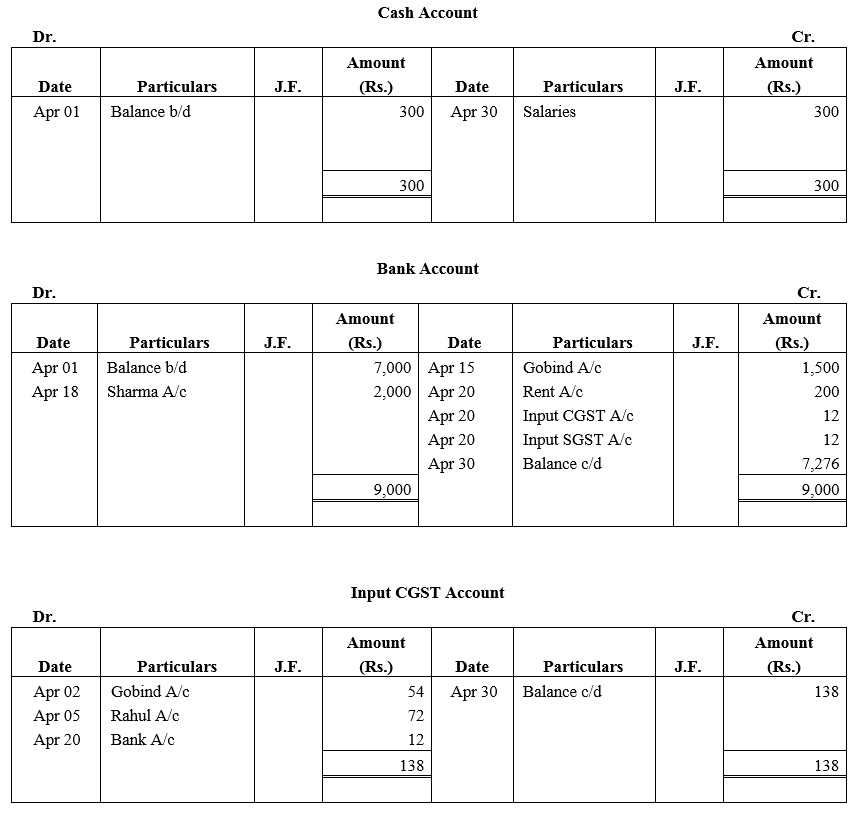

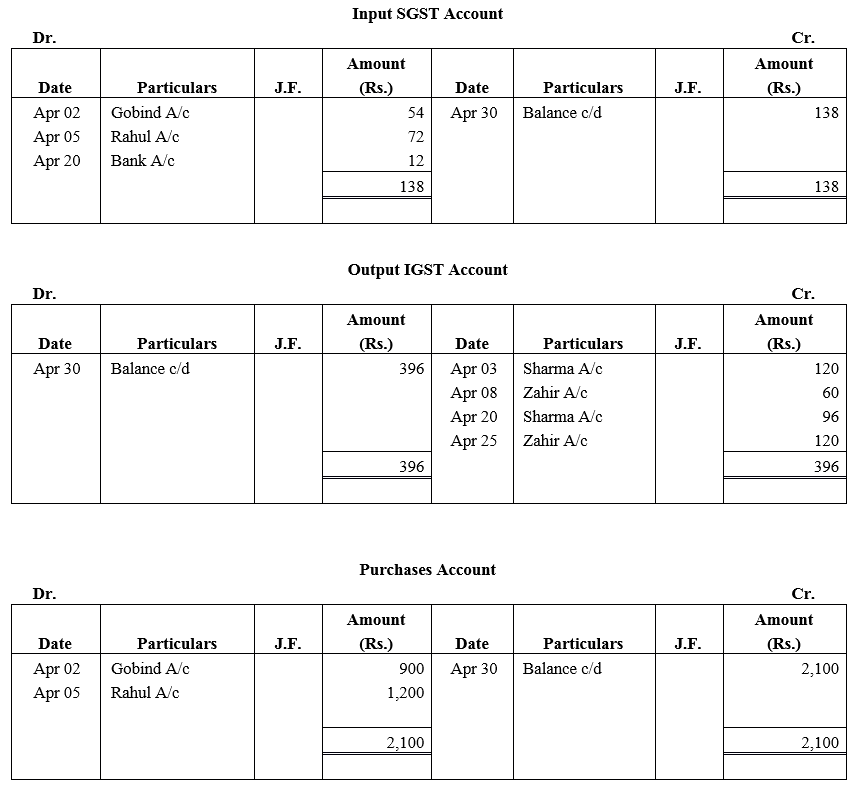

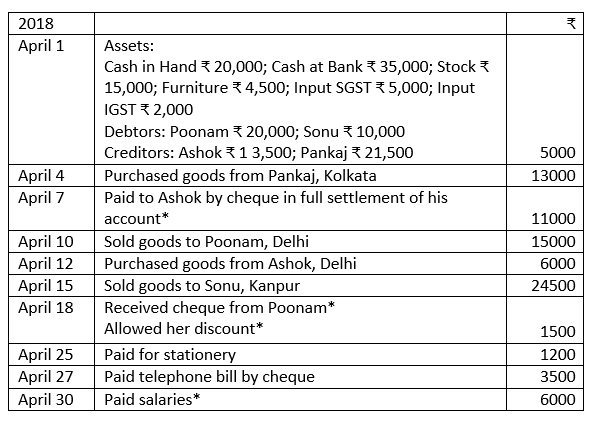

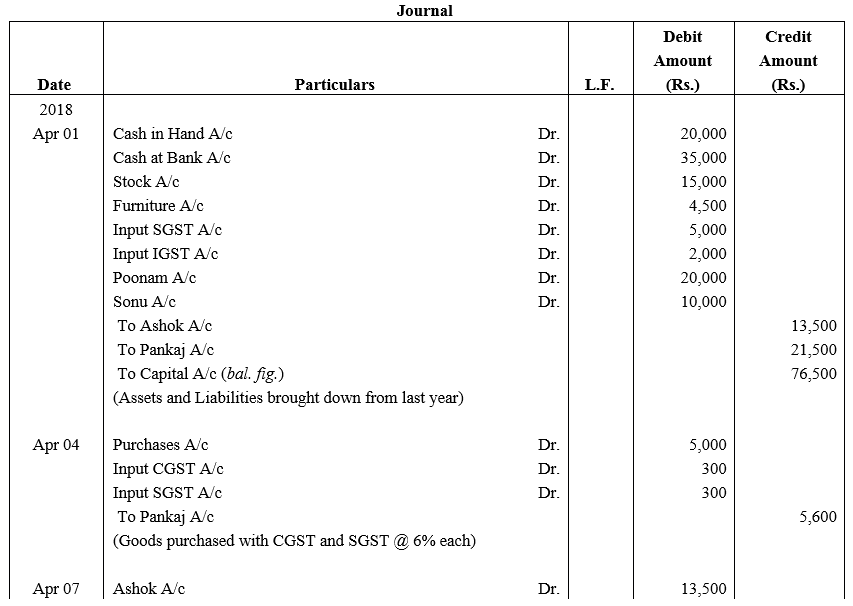

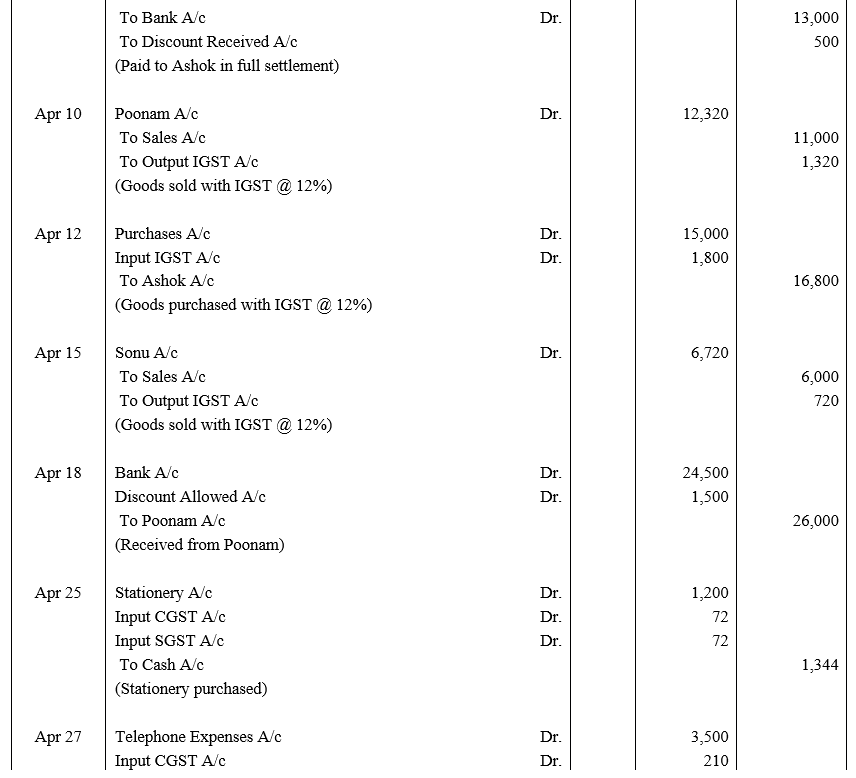

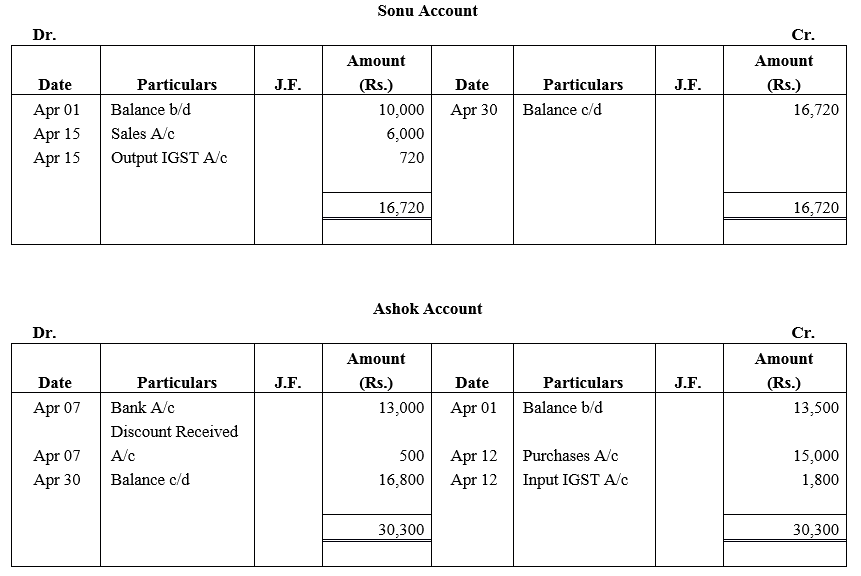

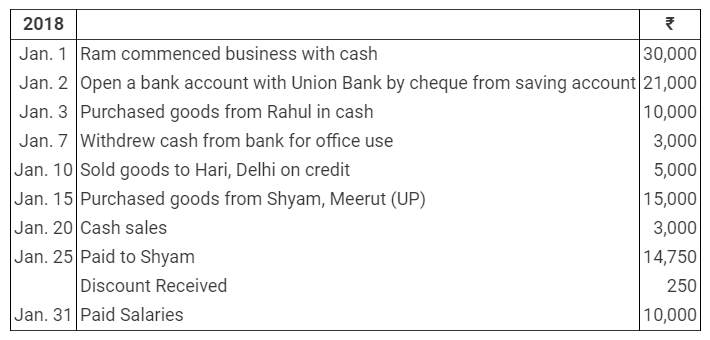

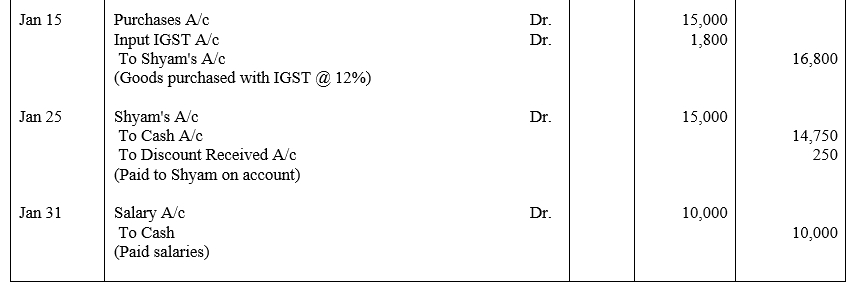

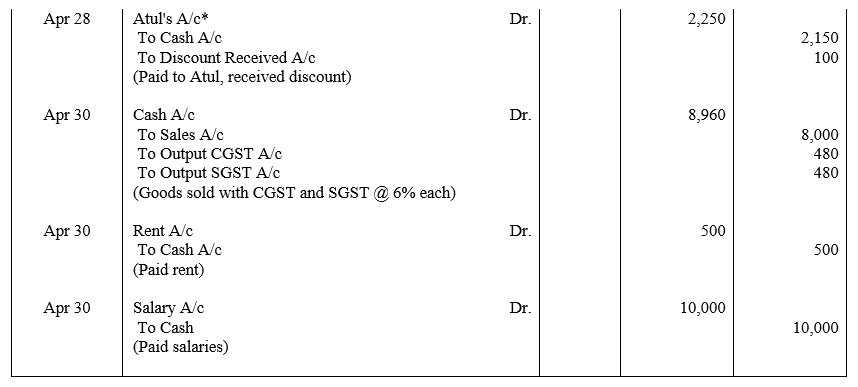

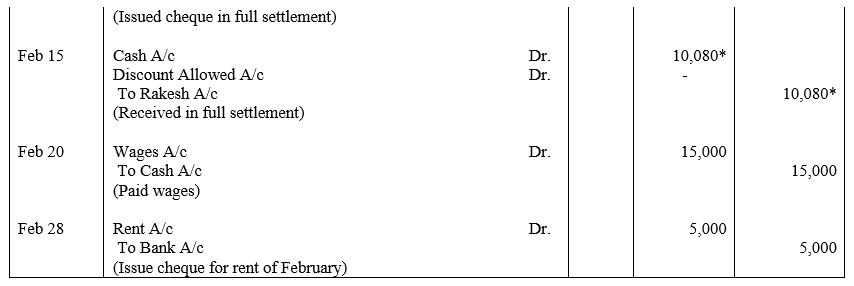

Following transactions of Ramesh Delhi for April, 2018 are given below. Journalise them.

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @12% on inter-state sale and purchase.

Solution:

Note: In transaction dated Apr 28, there is a misprint in the book. The payment of Rs 2,150 is made to Atul and not Shyam.

![]()

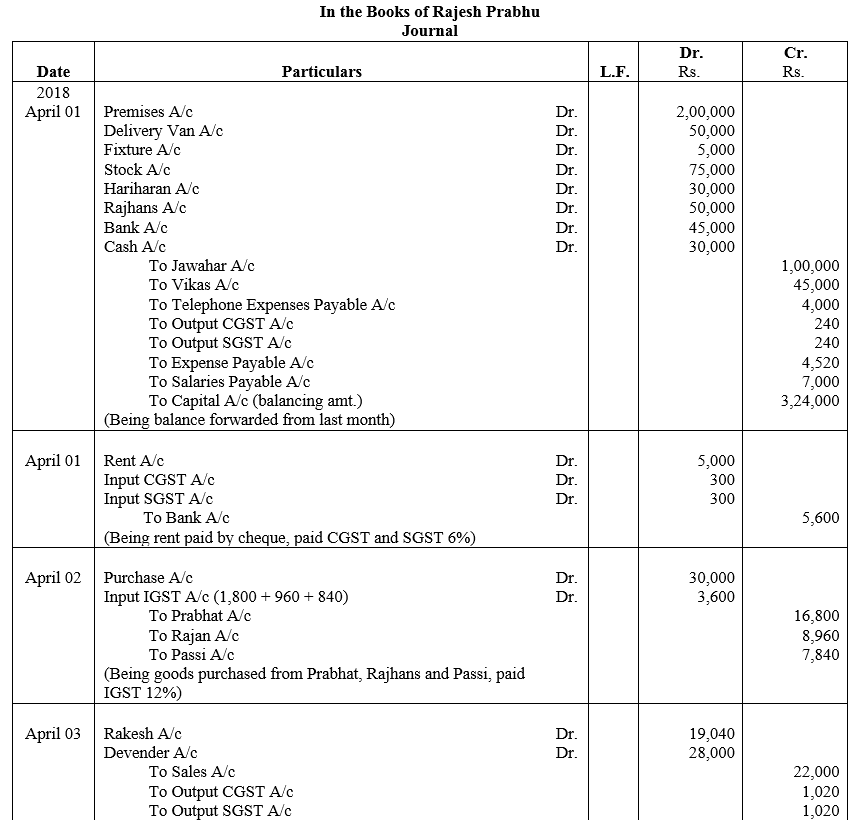

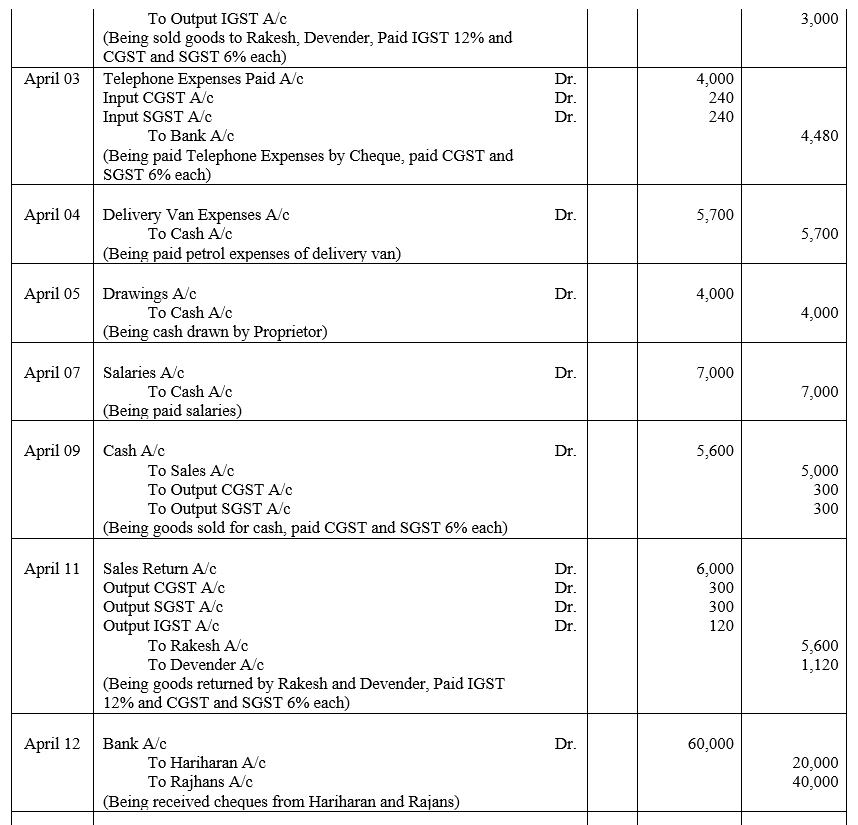

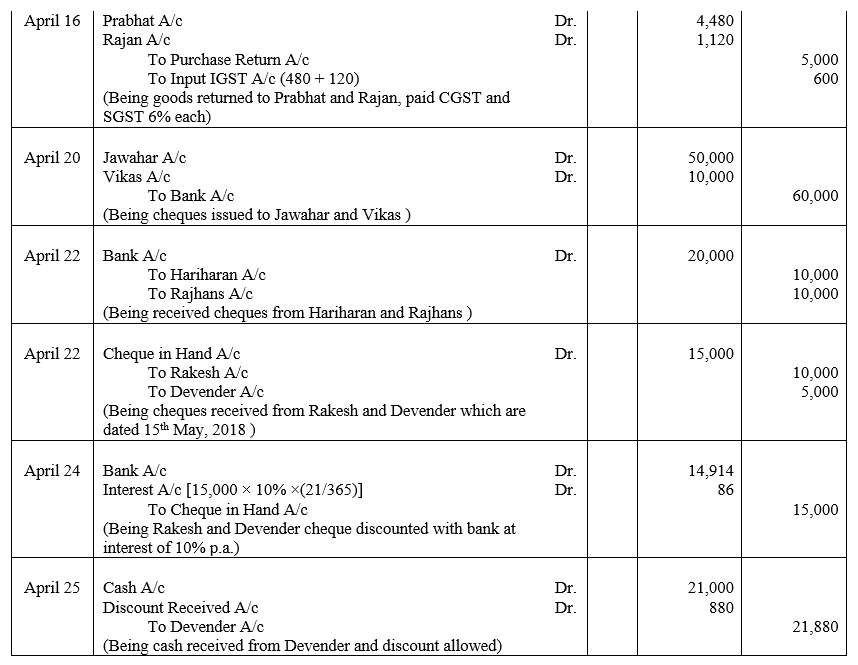

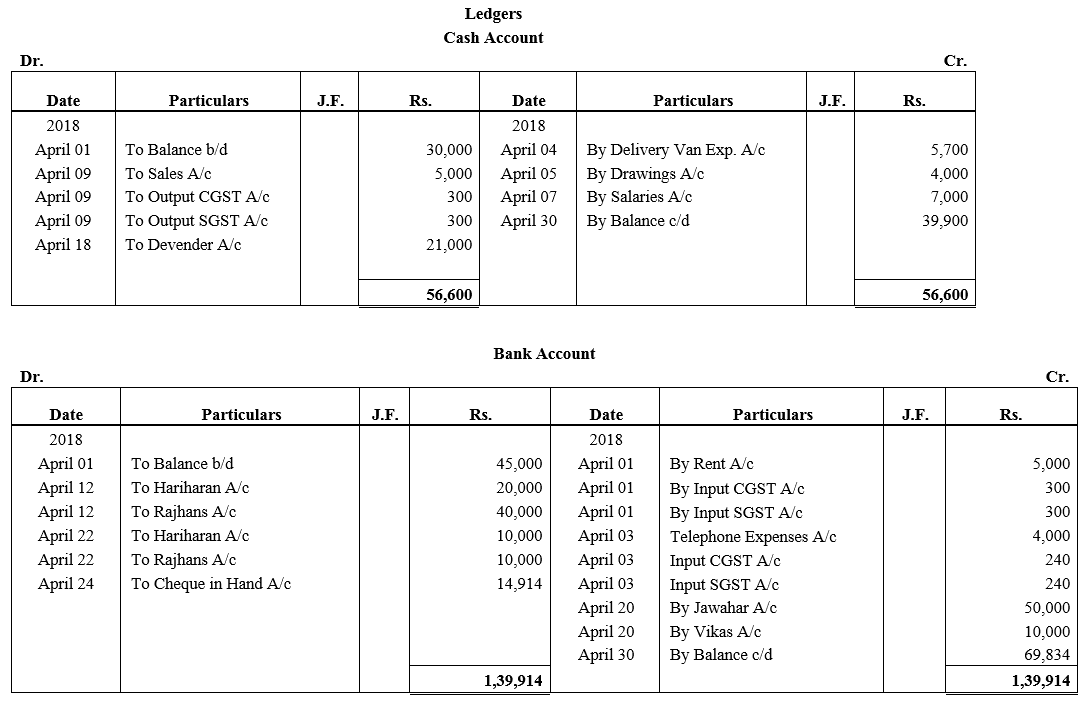

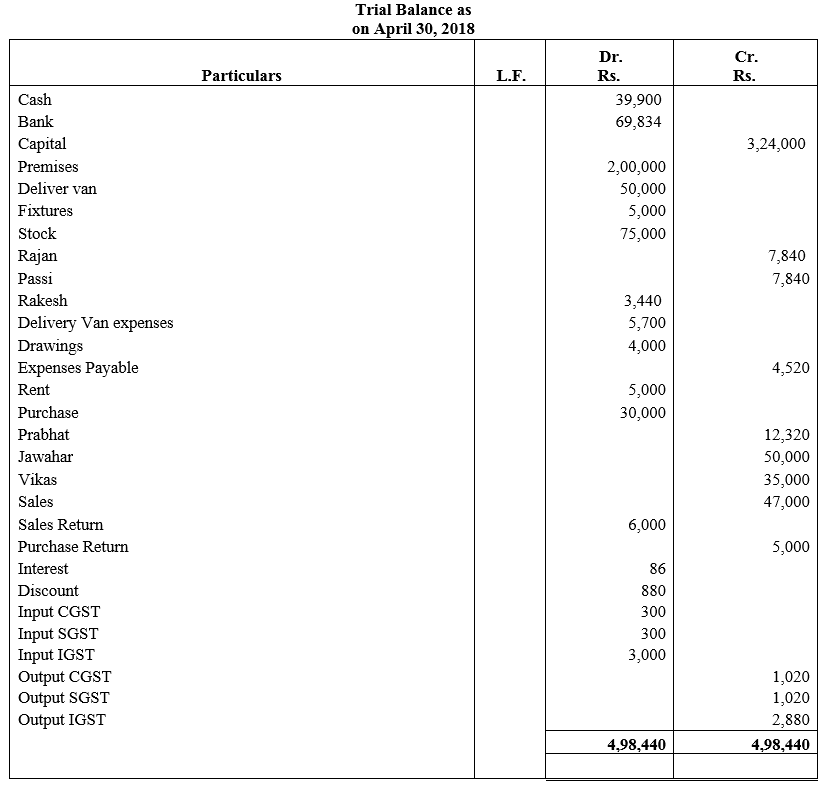

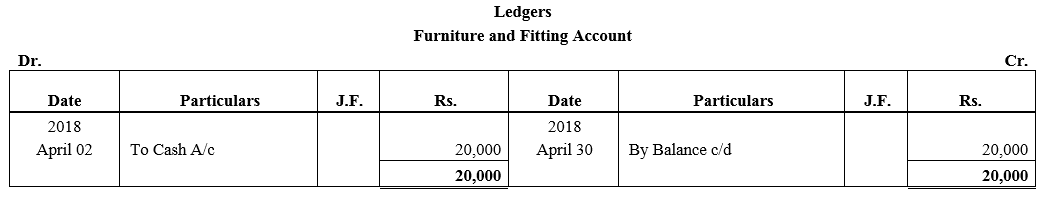

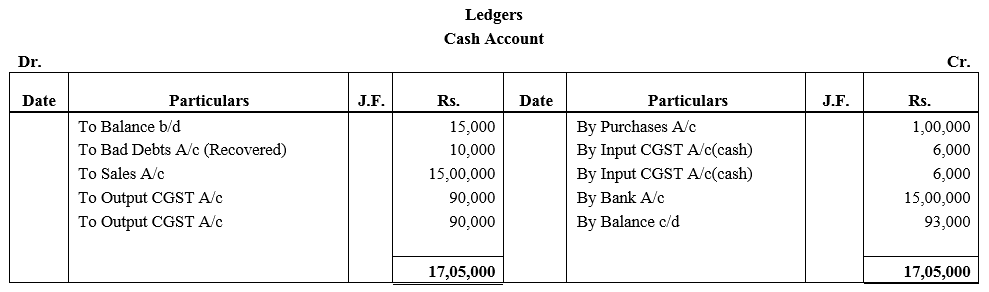

Question 12.

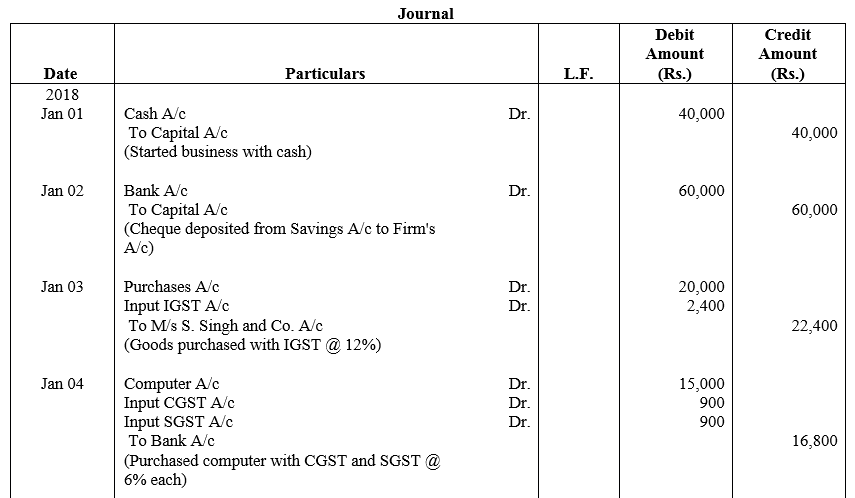

Journalise the following transactions of Satish, Noida (UP):

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase.

Solution:

![]()

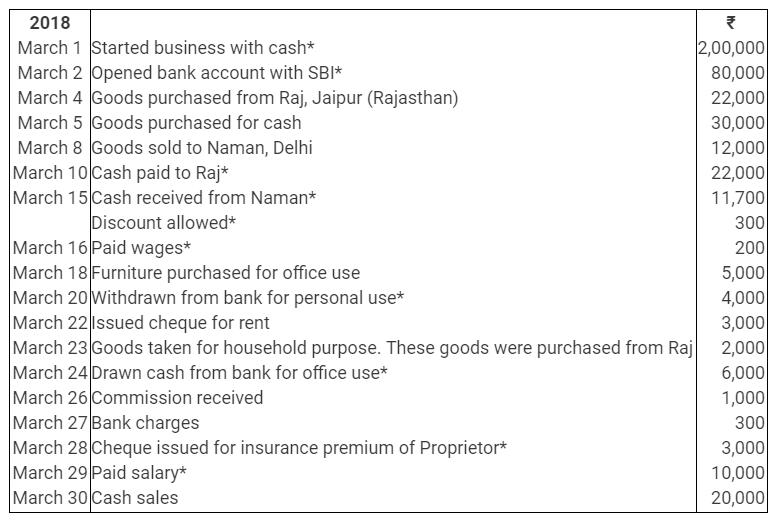

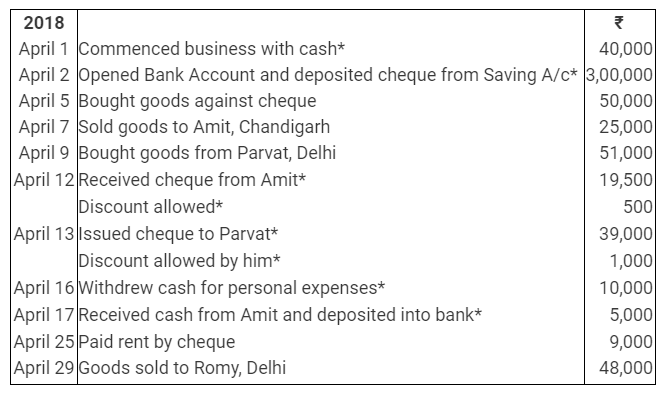

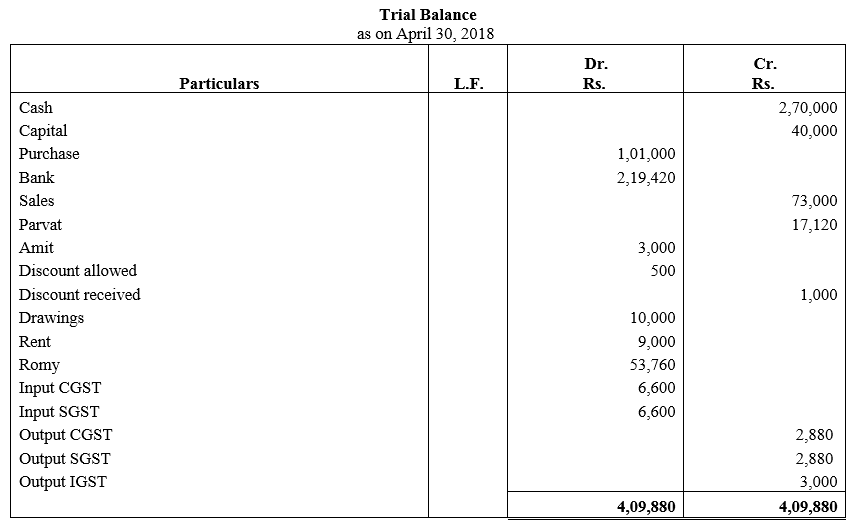

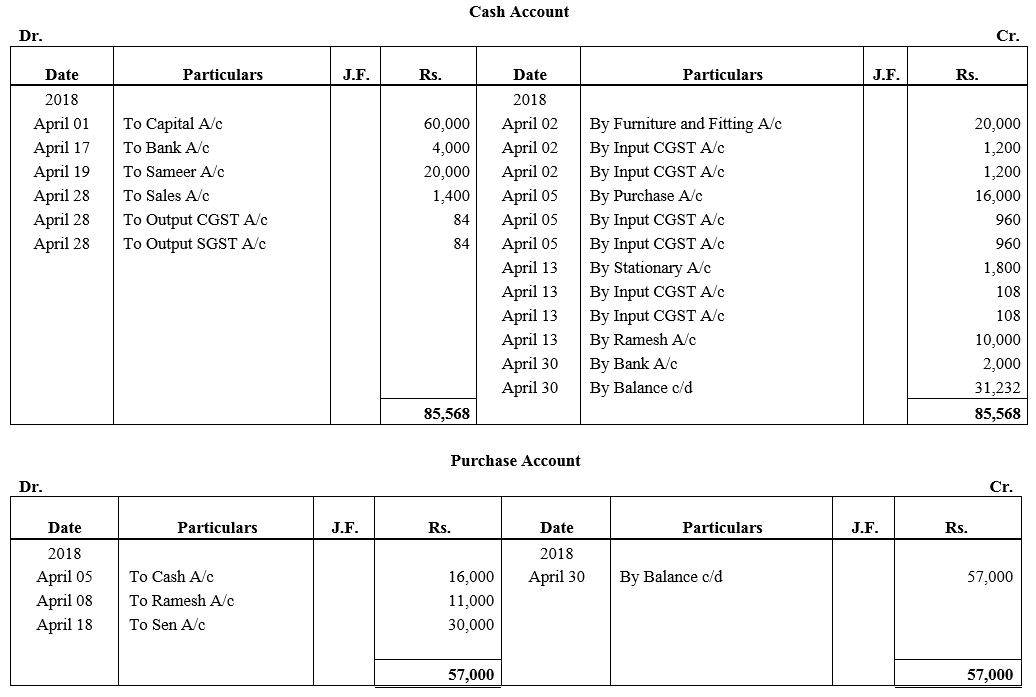

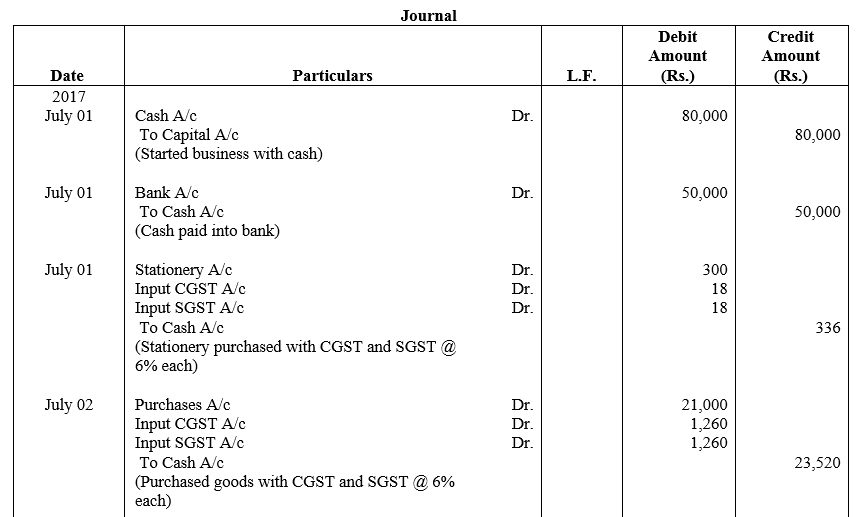

Question 13.

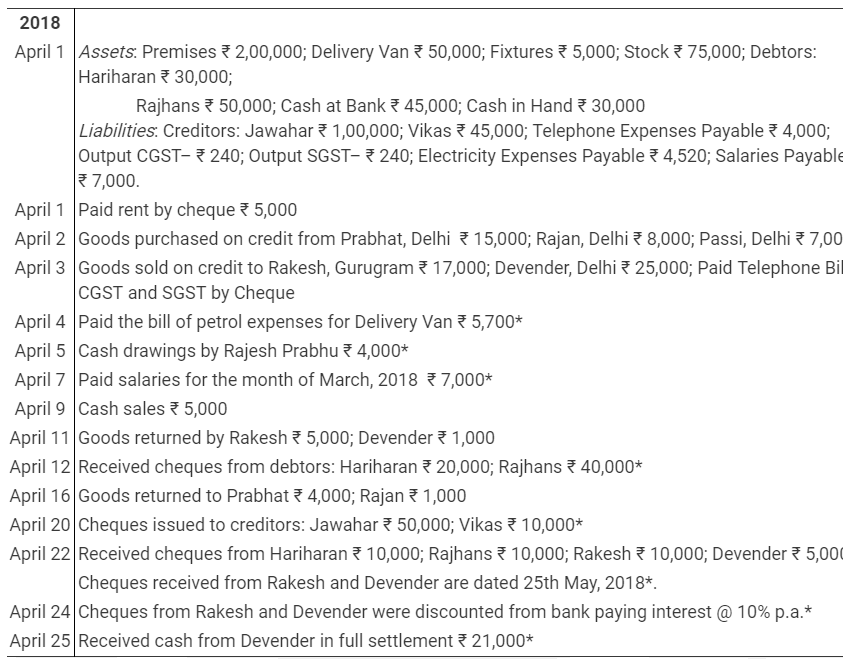

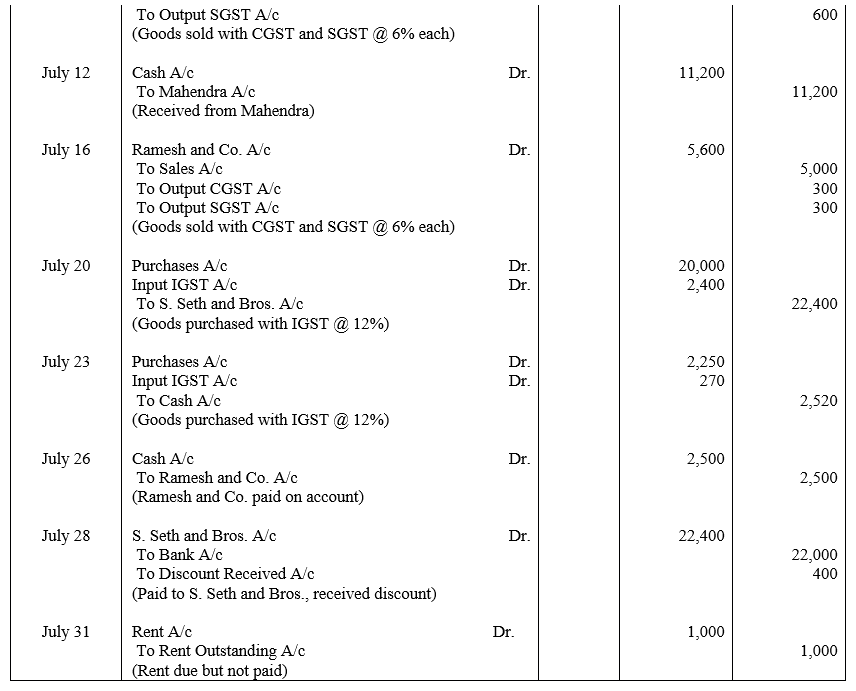

Following are the transactions of R.Singh & Co., Kanpur (UP) for the month of July, 2017. You are required to Journalise them:

Solution:

![]()

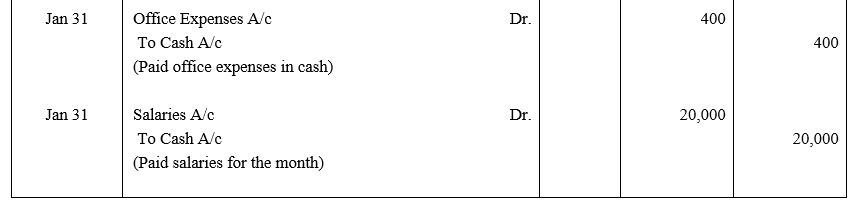

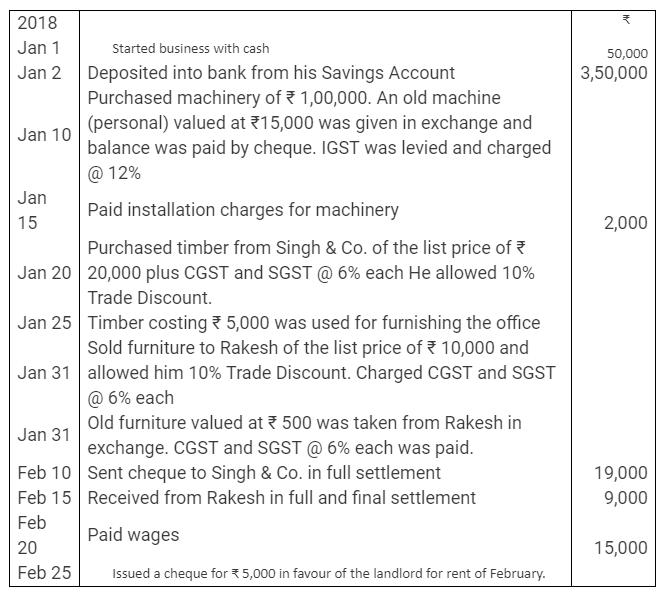

Question 14.

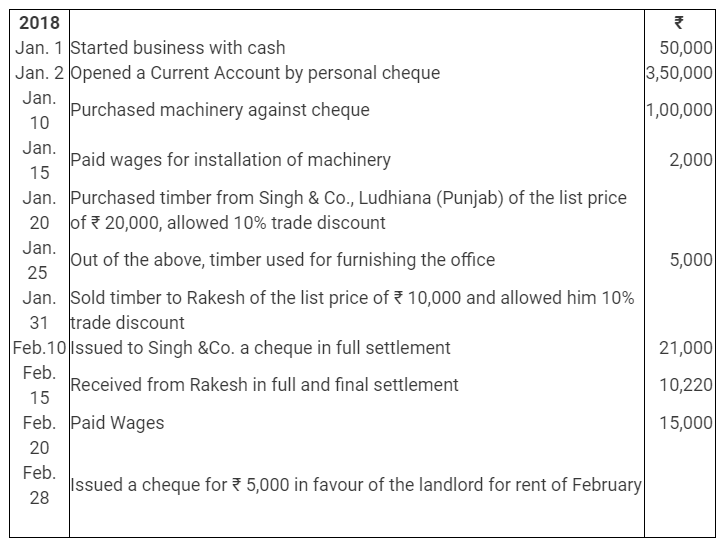

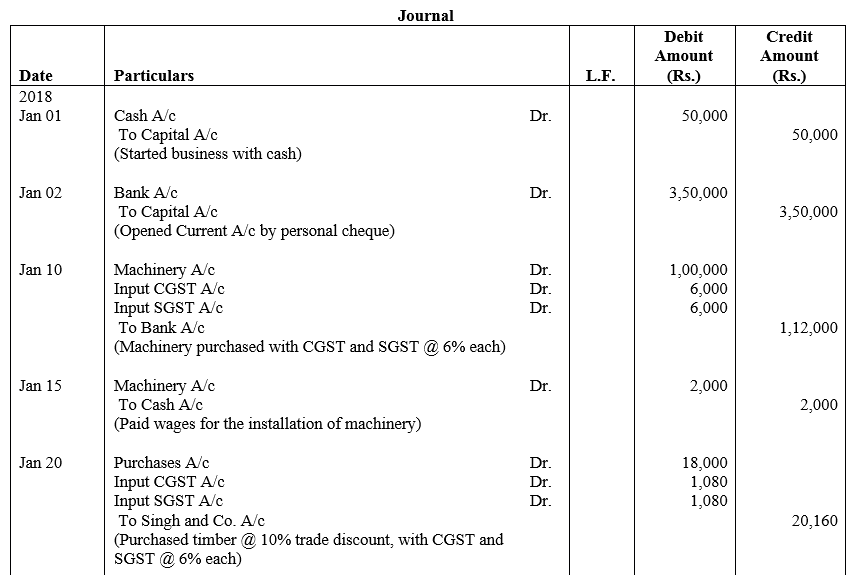

Record the following transactions in the Journal of Ashoka Furniture Traders, Ludhiana (Punjab):

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase.

Solution:

![]()

*Some Error in Question. Amount specified is more than actual amount due.

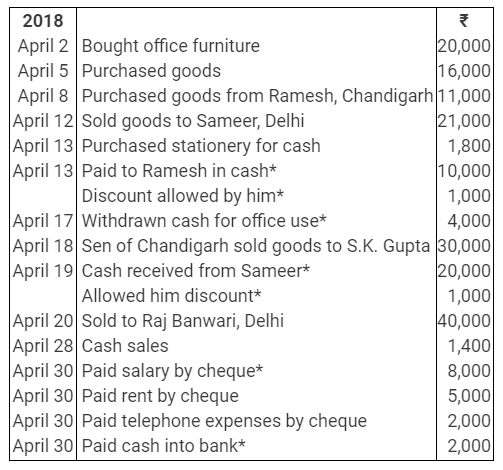

Question 15.

Enter the following transactions in the Journal of Suresh who trades in ready-made garments:

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase.

Solution:

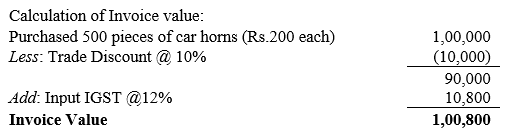

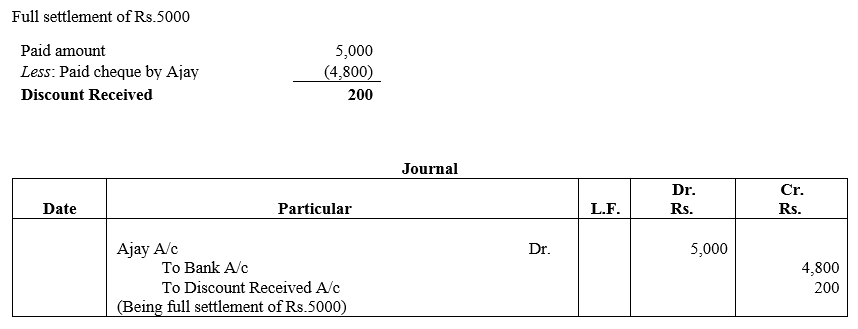

Question 16.

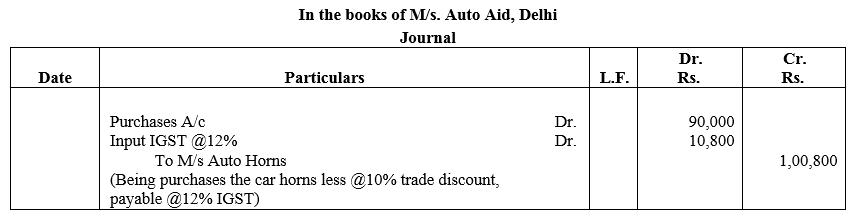

M/s. Auto Aid, Delhi purchased 500 pieces of car horns @ ₹ 200 each less 10% Trade Discount plus IGST @ 12% from M/s Auto Horns, Chandigarh. What is the invoice value?

Solution:

![]()

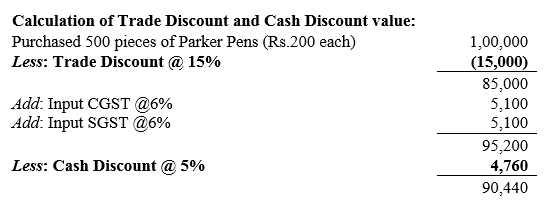

Question 17.

M/s. Vaish Traders, Delhi purchased 500 Parker Pens @ ₹ 200 each less Trade Discount @ 15% from Luxor Pens Ltd., Delhi. CGST and SGST was levied @ 6% each. Further, Cash Discount was allowed @ 5% as the payment was made within specified time. What will be the amount of trade discount and cash discount ?

Solution:

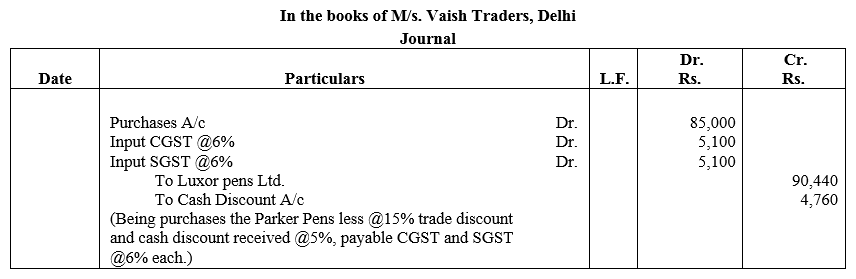

Question 18.

On 1st April, 2018, the position of Rahman was as follows: Cash-in-Hand ₹ 11,200; Cash at Bank ₹ 2,57,600; Bills Receivable ₹ 68,000; Jai Ram (Dr.) ₹ 16,000; Ram Kumar (Dr.) ₹ 48,080; Office Furniture ₹ 52,800; Stock-in-Trade ₹ 4,16,000; Doulat Ram (Cr.) ₹ 1,74,720, Hari Ram (Cr.) ₹ 2,16,960; Bills Payable ₹ 80,000. What was the amount of capital of Rahman on that date? Show the Journal entry to Open his books.

Solution:

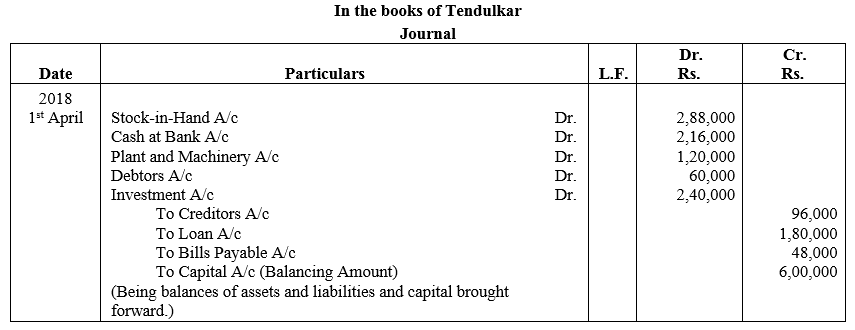

Question 19.

On 1st April, 2018, the position of Tendulkar was as follows: Stock-in-Hand ₹ 2,88,000; Bills Payable ₹ 48,000; Cash at Bank ₹ 2,16,000; Plant and Machinery ₹ 1,20,000; Owing by debtors ₹ 60,000; Owing to creditors ₹ 96,000; Investment ₹ 2,40,000; Loan from S.K. Garg ₹ 1,80,000. What was the amount of Tendulkar’s capital on the date? Show an opening Journal entry.

Solution:

![]()

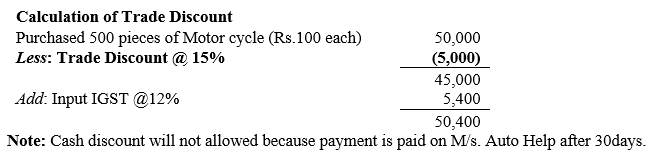

Question 20.

M/s. Auto Help, Delhi purchased 500 pieces of motor cycle horns at ₹ 100 each plus IGST @ 12% from M/s G.S., Auto, Ghaziabad, (UP). Trade terms settled were: Trade Discount will be allowed @ 10% and Cash Discount @ 5% if payment is made within 7 days. M/s. Auto Help made the payment after 30 days. Determine the amount of Trade Discount and Cash Discount.

Solution:

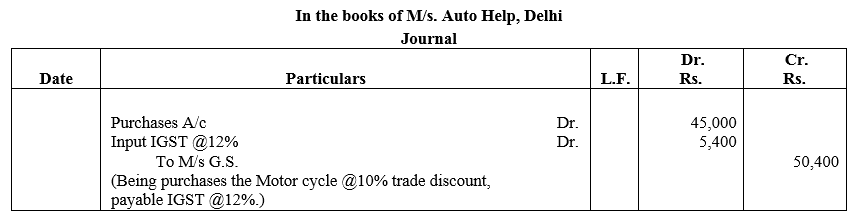

Question 21.

Name the accounts to be credited along with the amount for payment to Ajay of ₹ 4,800 by cheque in full settlement of ₹ 5,000.

Solution:

Question 22.

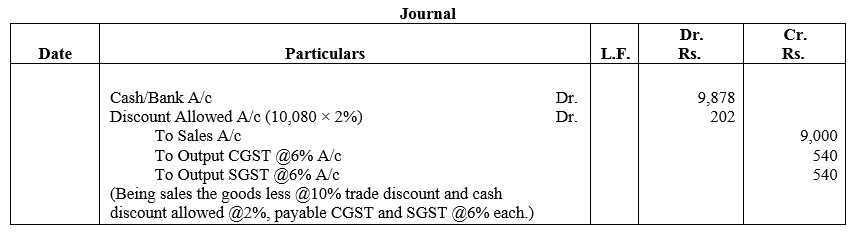

Pass Journal entry for sale of goods by Rahul, Delhi to Anish, Delhi for ₹ 10,000 less 10% Trade Discount and 2% Cash Discount. Assume payment is received at the time of sale. CGST and SGST is levied @ 6% each.

Solution:

Question 23.

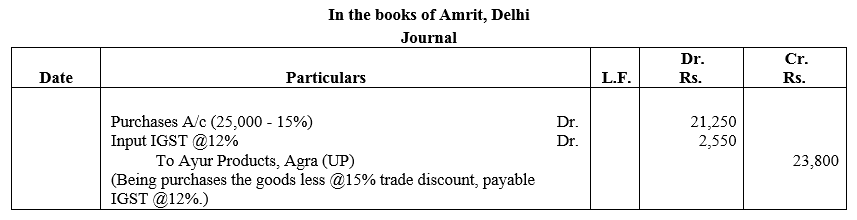

Pass Journal entry for purchase of goods by Amrit, Delhi from Ayur Products, Agra, (UP) for ₹ 25,000 less Trade Discount @ 15% plus IGST @ 12%.

Solution:

Question 24.

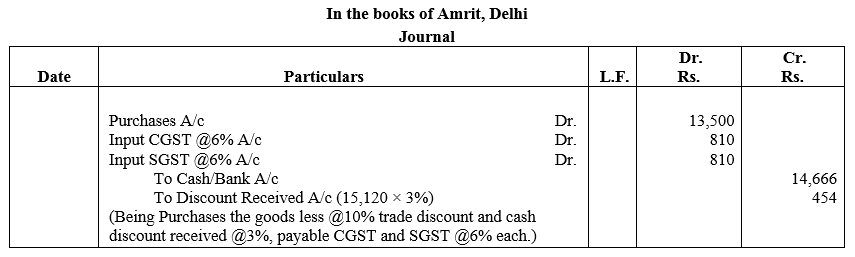

Pass Journal entry for purchase of goods by Amrit, Delhi from Add Gel Pens, Delhi for ₹ 15,000 less Trade Discount 10% and Cash Discount 3% CGST and SGST is levied @ 6% each. Assume payment is made at the time of purchase.

Solution:

Question 25.

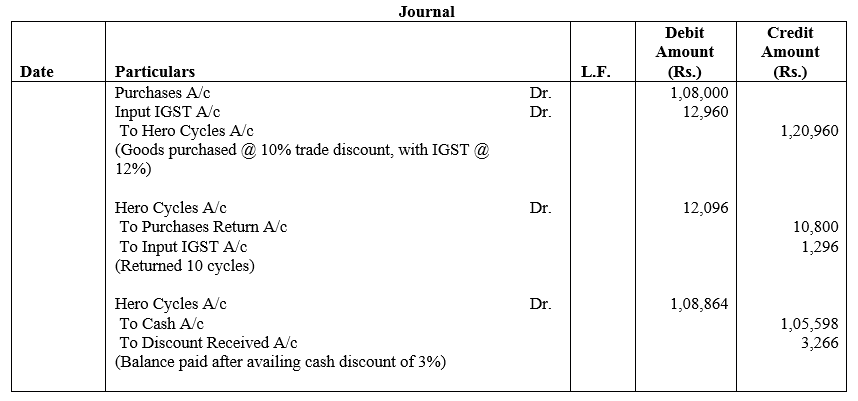

Mittal Cycles purchased 100 cycles from Hero Cycles, Ludhina (Punjab) @ ₹ 1,200 per cycle plus IGST @ 12%. Hero Cycles allowed 10% Trade Discount and 3% Cash Discount if payment is made within 14 days. Mittal Cycles received 10 cycles damaged during transit, which it returned. Mittal Cycles settled the payment in 10 days time.

Pass Journal entries for the above transactions.

Solution:

![]()

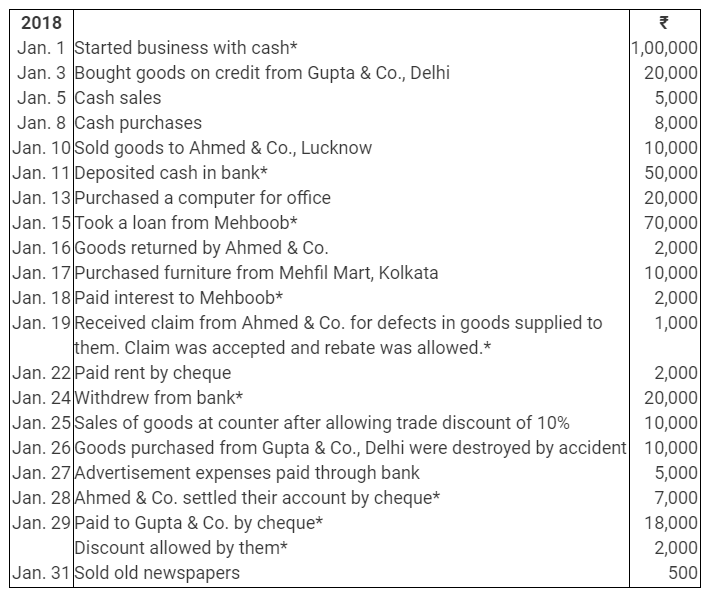

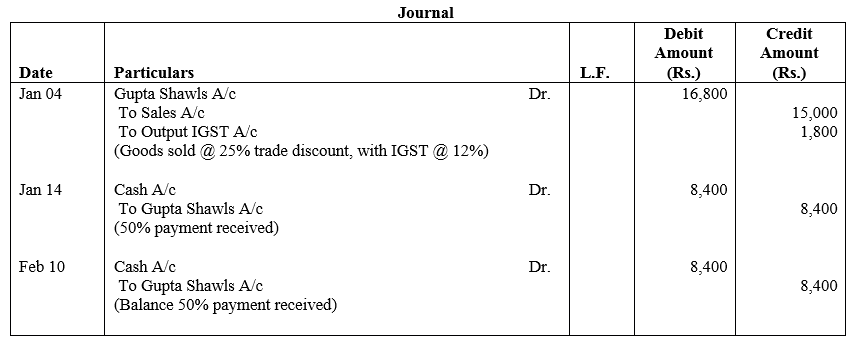

Question 26.

Oswal Woollen Mills, Amritsar (Punjab) sold shawls to Gupta Shawls, Jaipur as per details: Sold 100 shawls @ ₹ 200 per shawl on 4th January, 2018, IGST is levied @ 12%. Trade Discount 25% and Cash Discount 5% if full payment is made within 14 days. Gupta Shawls sent 50% of the payment on 14th January, 2018 and balance payment on 10th February,2018. Pass Journal entries.

Solution:

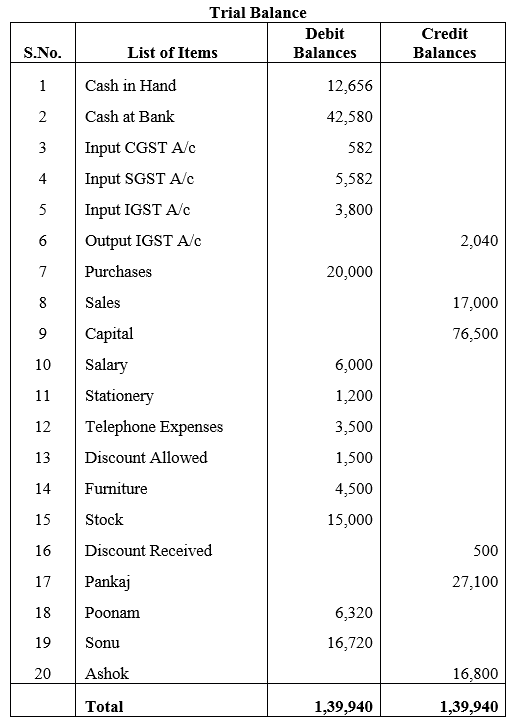

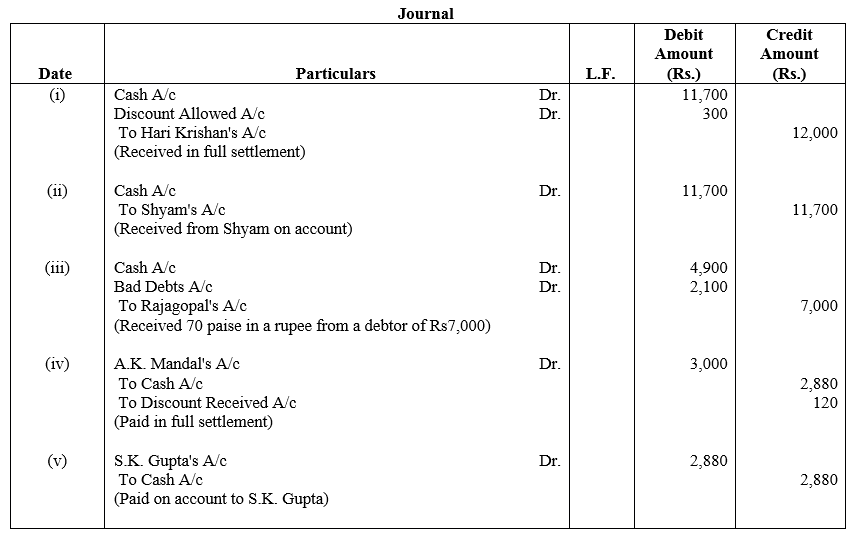

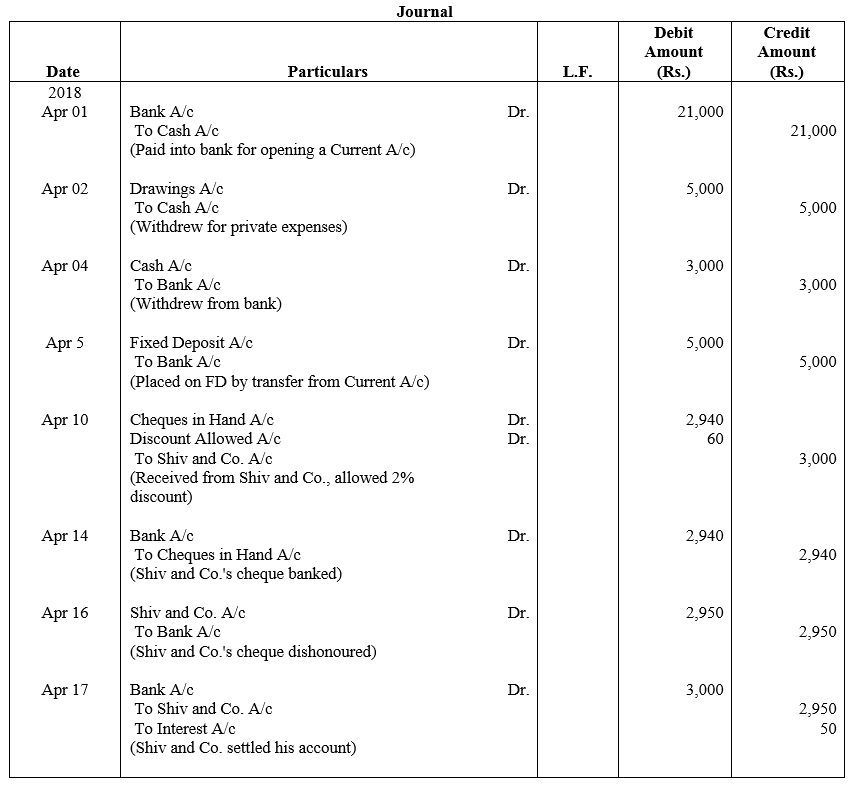

Question 27.

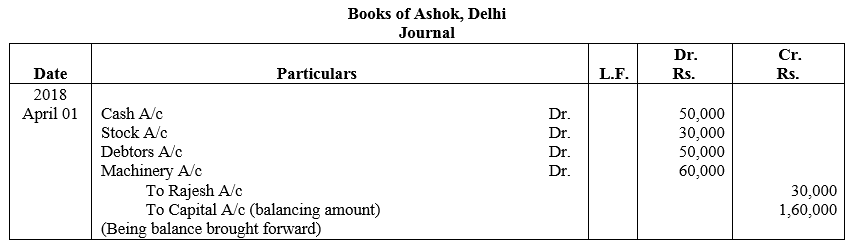

Journalise the following transactions in the books of Ashok:

(i) Received ₹ 11,700 from Hari Krishan in full settlement of his account for ₹ 12,000.

(ii) Received ₹ 11,700 from Shyam on his account fro ₹ 12,000.

(iii) Received a first and final divident of 70 paise in the rupee from the official receiver of Rajagopal who owed us ₹ 7,000.

(iv) Paid ₹ 2,880 to A.K. Mandal in full settlement of his account for ₹ 3,000.

(v) Paid ₹ 2,880 to S.K. Gupta on his account for ₹ 3,000.

Solution:

![]()

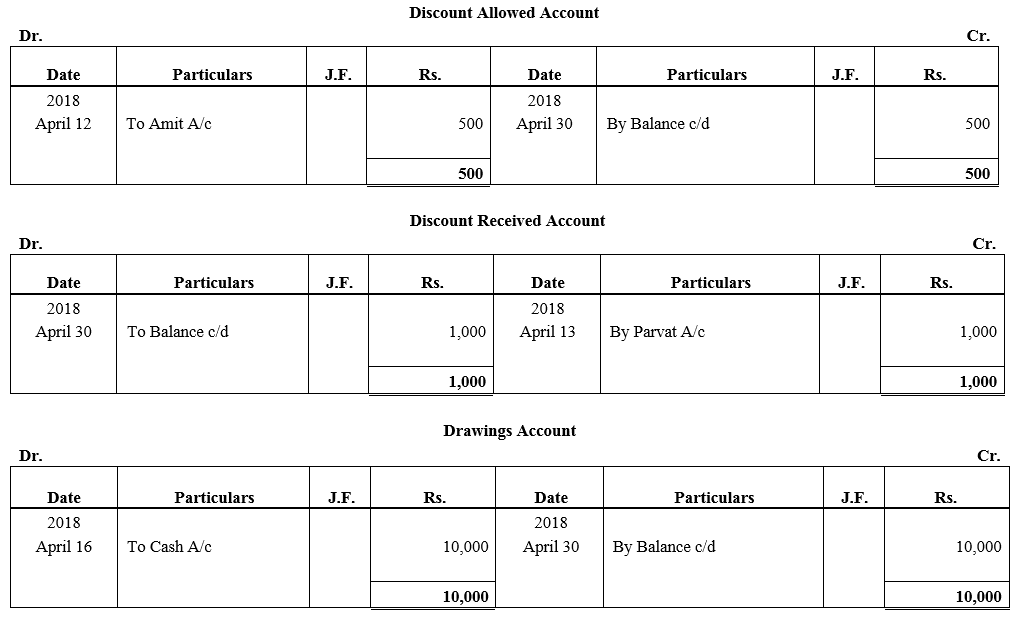

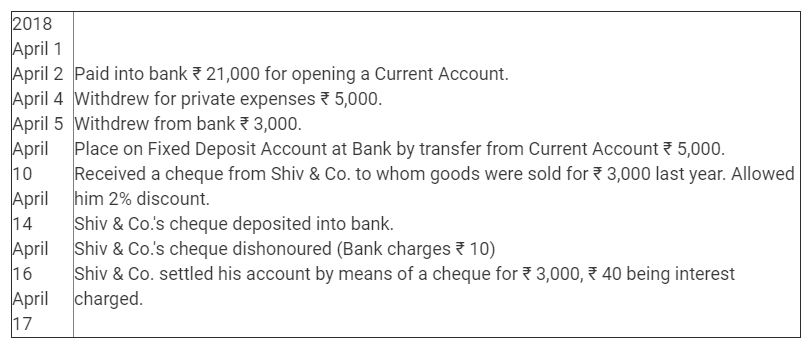

Question 28.

Journalise the following transactions:

Solution:

Note for Apr 17:

Cheque of Rs 2,940 dishonoured. Bank charged Rs 10 (to be recovered from Shiv and Co.). Total due from Shiv and Co. Rs 2,950. New cheque received for Rs 3,000, so interest charged should be Rs 50 (not Rs 40, as given in the book).

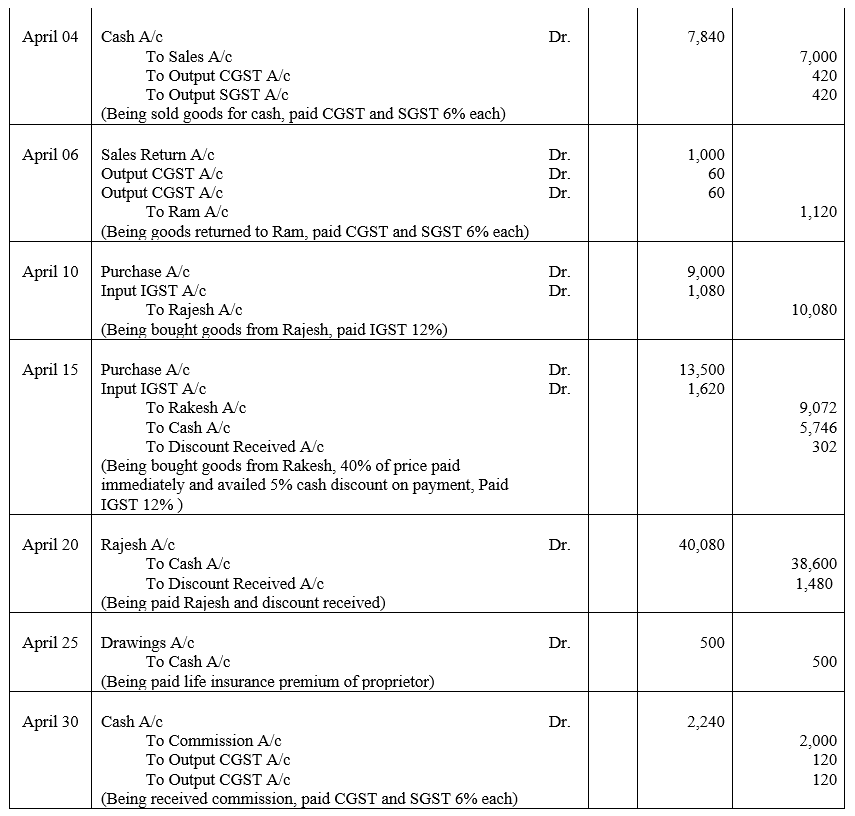

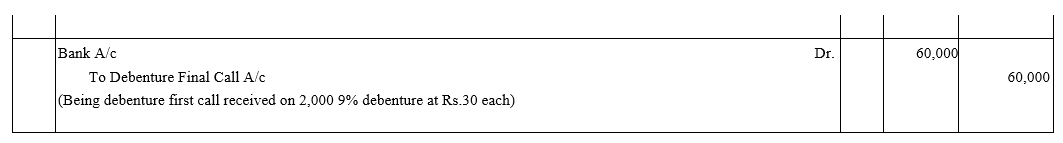

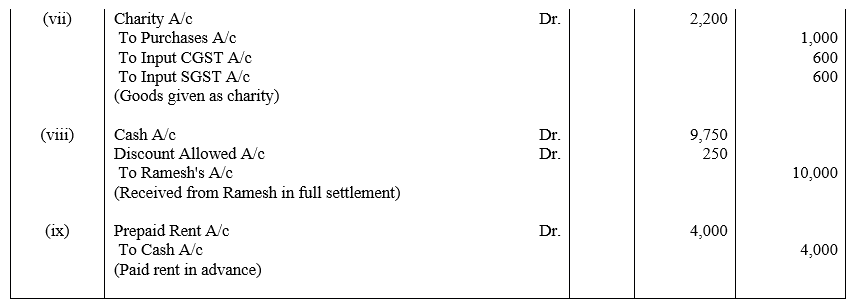

Question 29.

Journalise the following in the books of Amit Saini, Gurugram (Haryana):

(i) Goods of ₹ 5,000 were used by him for domestic purpose.

(ii) ₹ 2,000 due from Sohan became bad debts.

(iii) Goods of ₹ 6,000 were destroyed by fire and were not insured.

(iv) Paid ₹ 4,000 in cash as wages on installation of machine. GST is not to be levied.

(v) Sold goods to Arjun of Delhi of list price ₹ 20,000. Trade discount @ 10% and cash discount of 5% was allowed.

He paid the amount on the same day and availed the cash discount.

(vi) Received cash for a bad debt written off last year ₹ 2,000.

(vii) Goods of ₹ 1,000 given as charity.

(viii) Received ₹ 9,750 from Ramesh in full settlement of his account of ₹ 10,000.

(ix) Paid rent in advance ₹ 4,000.

CGST and SGST is to be levied on intra-state sale @ 6% each and IGST @ 12% on inter-state sale.

Solution:

![]()

Question 30.

Journalise the following transactions in the books of Mohan Singh, Delhi:

(i) Raj of Alwar, Rajasthan who owed Mohan Singh ₹ 25,000 became insolvent and received 60 paise in a rupee as full and final settlement.

(ii) Mohan Singh owes to his landlord ₹ 10,000 as rent.

(iii) Charge depreciation of 10% on furniture costing ₹ 50,000.

(iv) Salaries due to employees ₹ 20,000.

(v) Sold to Sunil goods in cash of ₹ 10,000 less 10% trade discount plus CGST and SGST @ 6% each and received a net of ₹ 8,500.

(vi) Provided interest on capital of ₹ 1,00,000 @ 10% per annum.

(vii) Goods lost in theft – ₹ 5,000, which were purchased paying IGST @ 12% from Alwar, Rajasthan.

Hint:

(vii) Loss of Stock by Theft A/c – ₹ 5,600

To Purchase A/c – ₹ 5,000

To Input IGST A/c – ₹ 600

Solution:

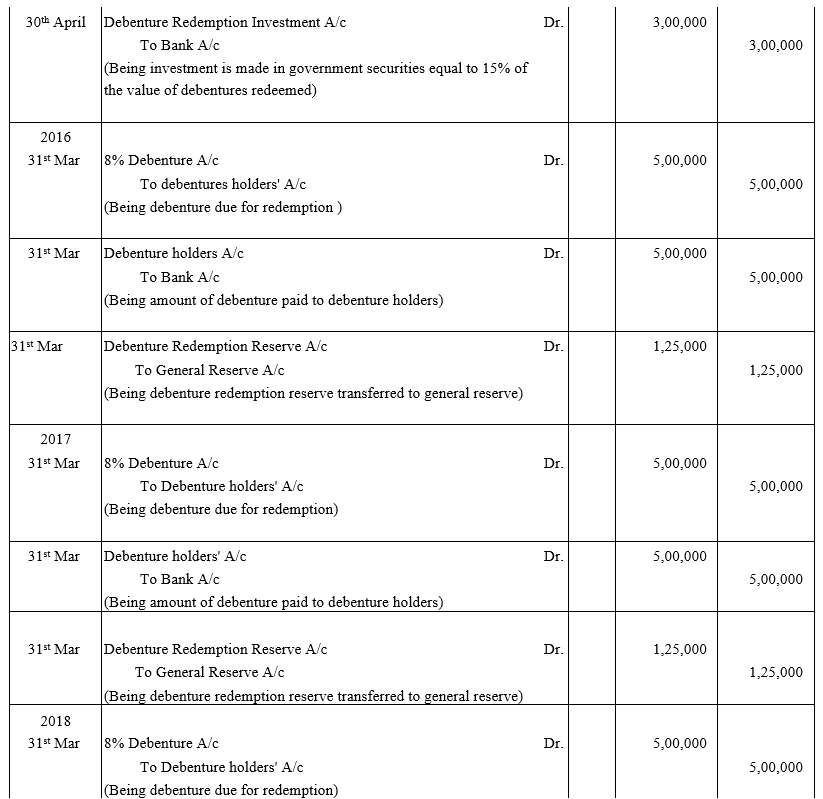

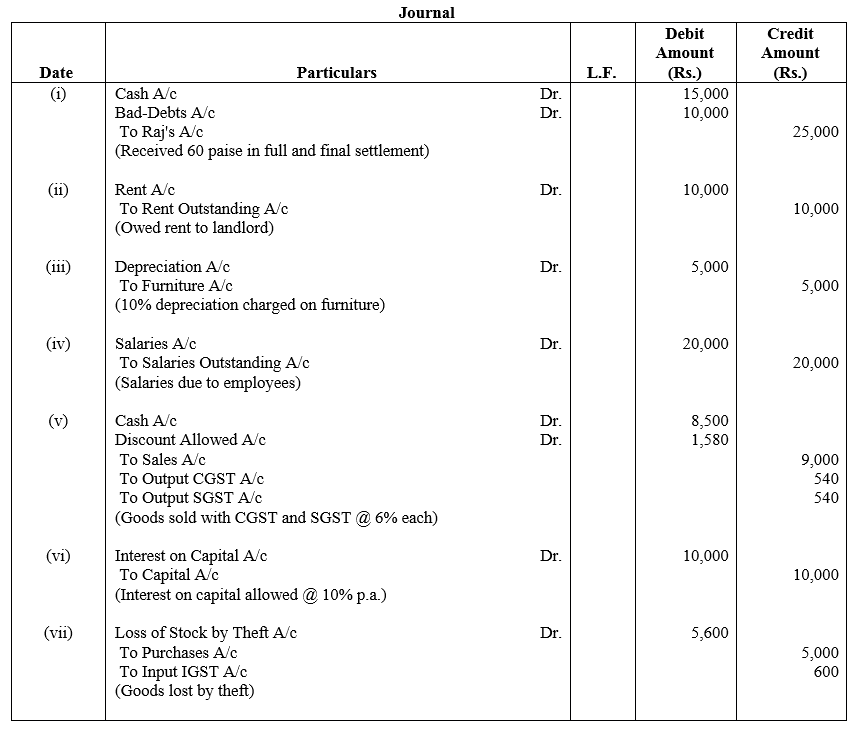

Question 31.

Pass Journal entries in the books of Puneet, Delhi for the following:

(i) Received an order from Karan & Co. for supply of goods of ₹ 50,000.

(ii) Received an order from AK & Co. for goods of ₹ 1,00,000 along with a cheque for ₹ 25,000 as advance.

(iii) Paid to staff ₹ 40,000 against outstanding salary of ₹ 60,000.

(iv) Sold goods to Bharat, Kaithal (Haryana) of ₹ 10,000 plus IGST @ 12% out of which 1/5th were returned being defective.

(v) Cheque of ₹ 20,000 issued by Feroz was dishonoured.

(vi) Received 40 paise in a rupee from Feroz against the above dues.

(vii) Received a cheque of ₹ 25,000 from Mohan after banking hours.

(viii) Purchased goods from Barun of Chandigarh of ₹ 10,000 plus IGST @ 12% and sold them to Arun of Shimla (HP) at ₹ 22,400, including IGST @ 12%.

(ix) Arun returned goods of ₹ 6,720, including IGST which were returned to Barun.

(x) ABC & Co. purchased 10 TV sets @ 20,000 per set and paid IGST @ 12%. It sold all the sets @ 25,000 per set plus CGST and SGST @ 6% each.

(xi) Paid insurance of ₹ 12,000 plus CGST and SGST @ 6% each for a period of one year.

(xii) Sold personal car for ₹ 1,00,000 and invested the amount in the firm.

(xiii) Goods costing ₹ 1,00,000 were destroyed in fire. Insurance company admitted the claim for ₹ 75,000. These goods were purchased within Delhi.

(xiv) Purchased machinery for ₹ 56,000 including IGST of ₹ 6,000 and paid cartage thereon ₹ 5,000 and installation charges ₹10,000.

(xv) Goods costing ₹ 40,000 sold to Mr. X at a profit of 20% on sales less 10% Trade Discount plus CGST and SGST @ 6% each and received a cheque under 2% cash discount.

(xvi) Purchased machinery from New Machinery House for ₹ 50,000 and paid it by means of a bank draft purchased from bank. Paid charges ₹ 500.

Solution:

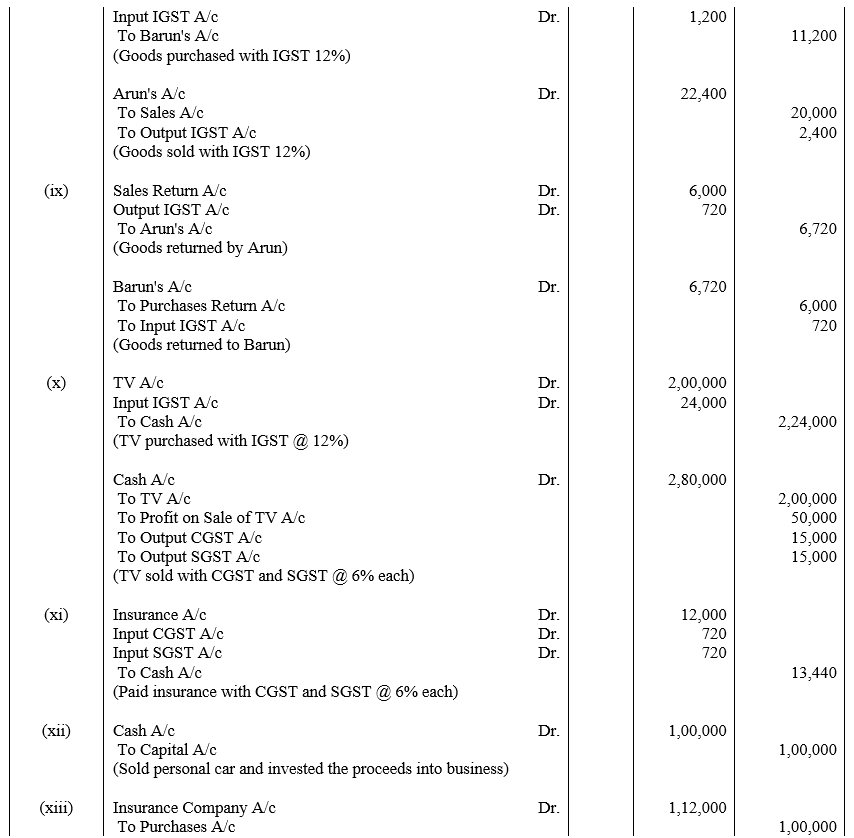

![]()

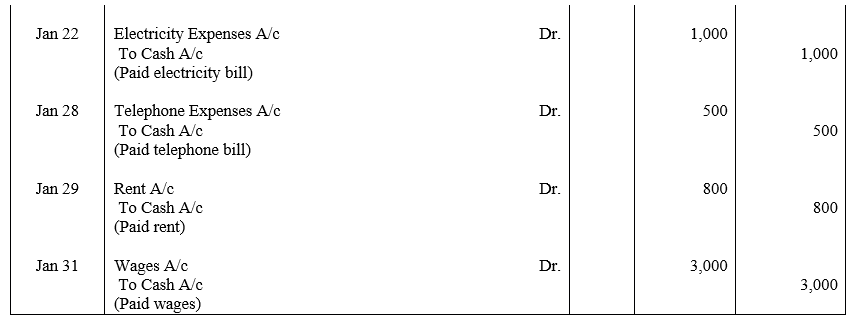

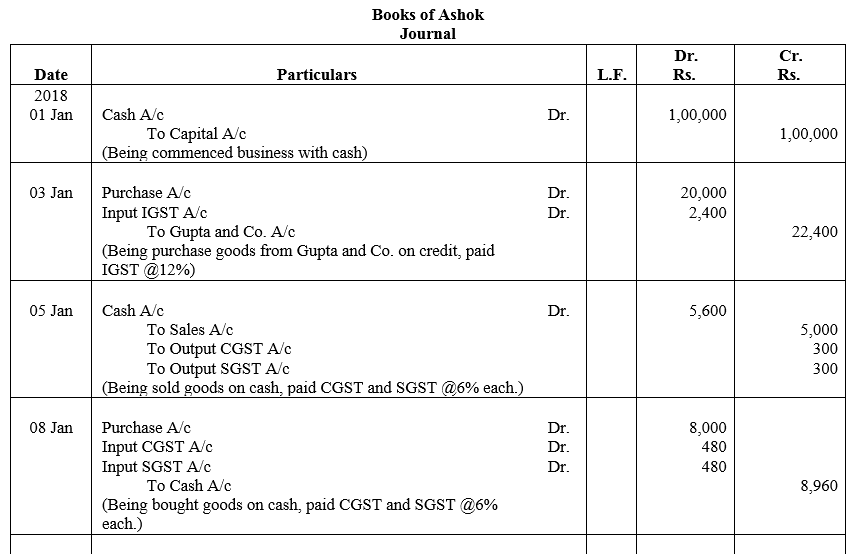

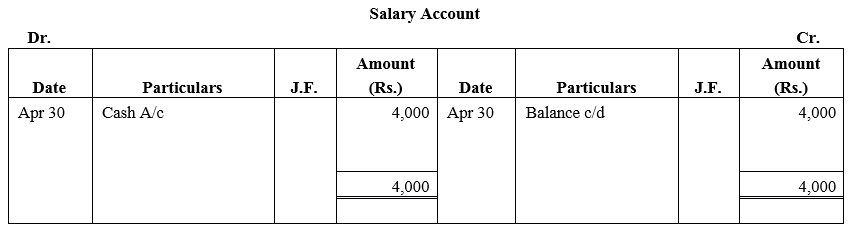

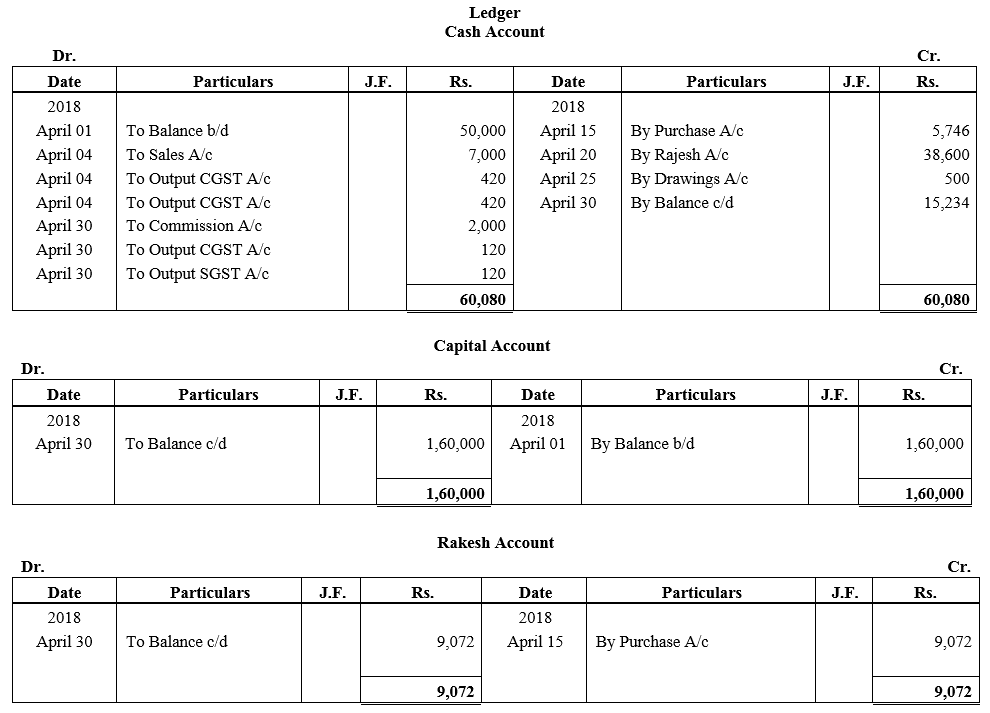

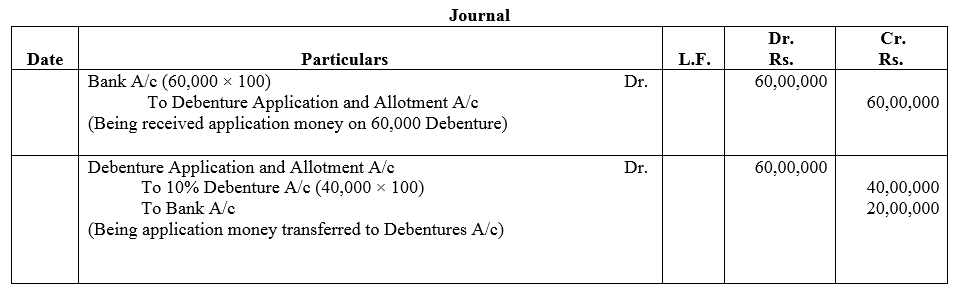

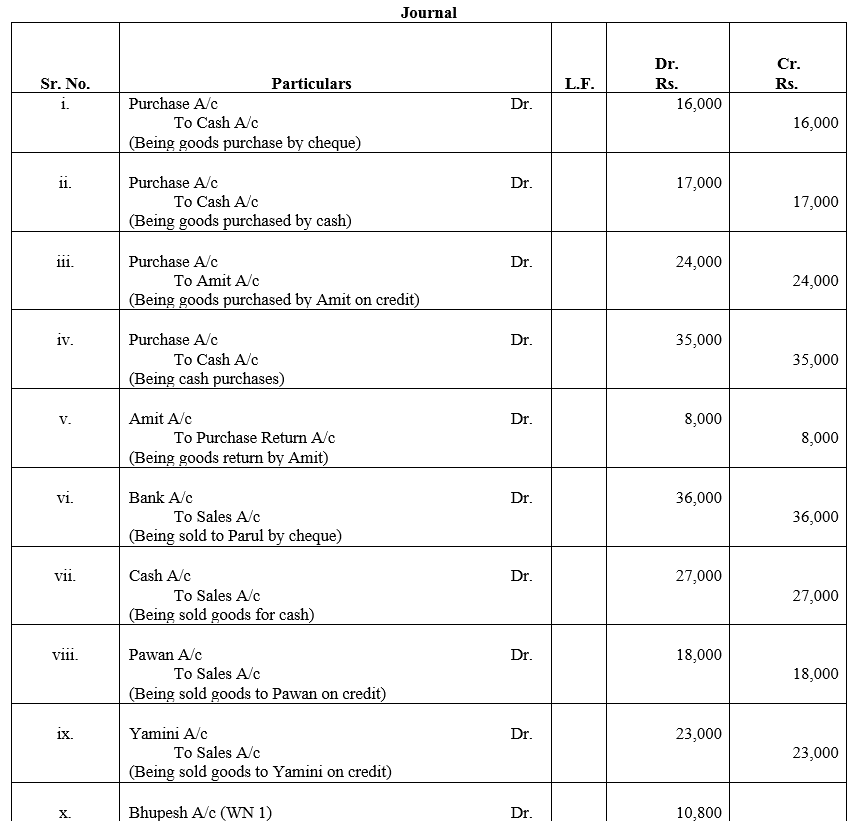

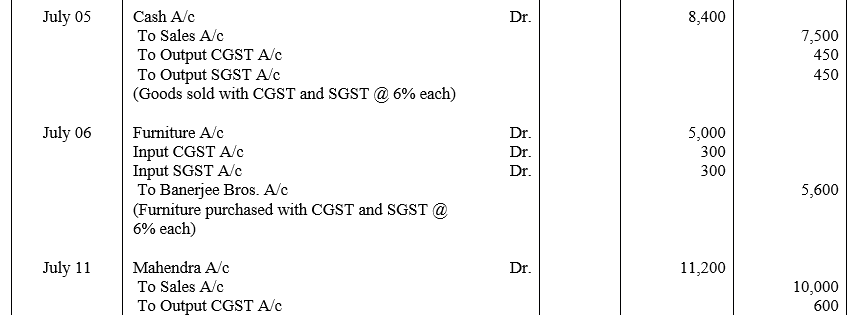

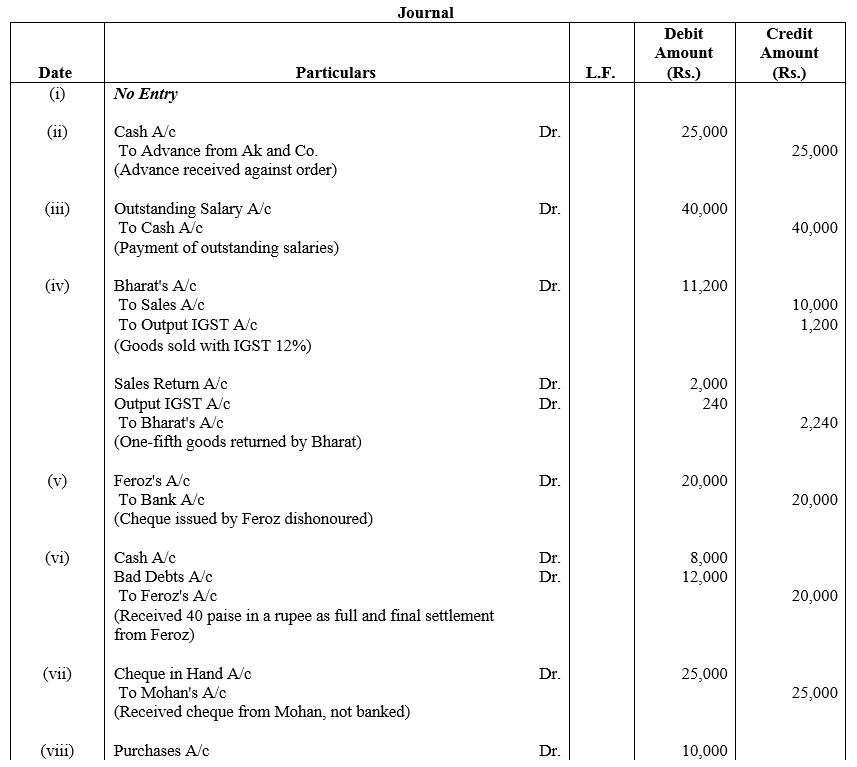

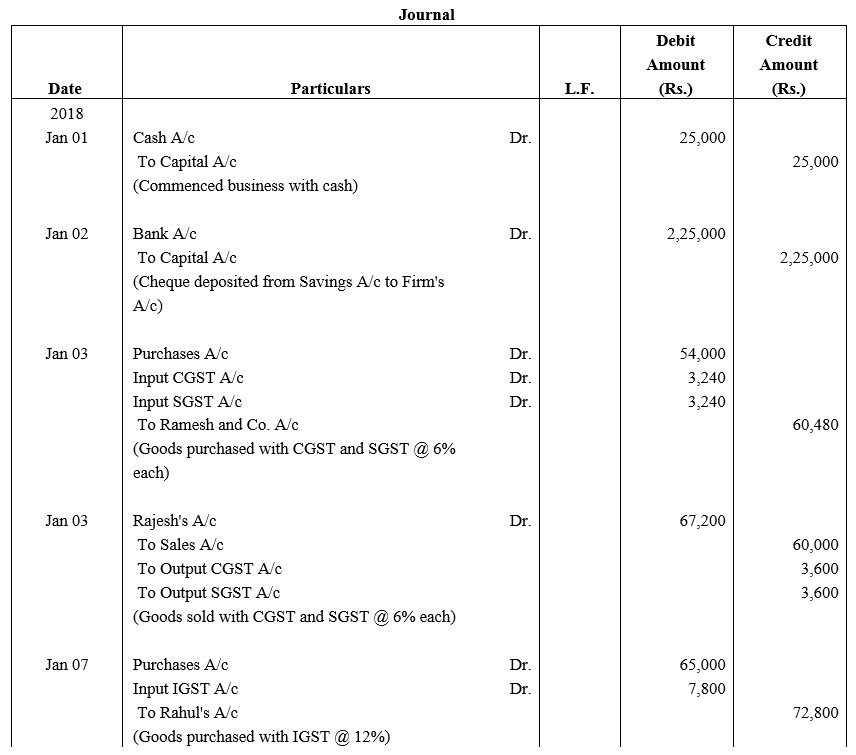

Question 32.

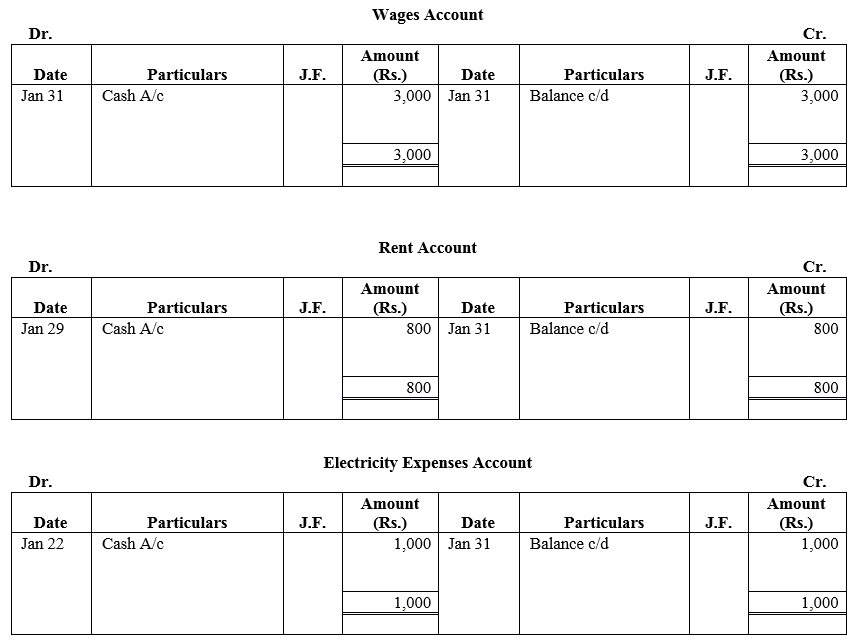

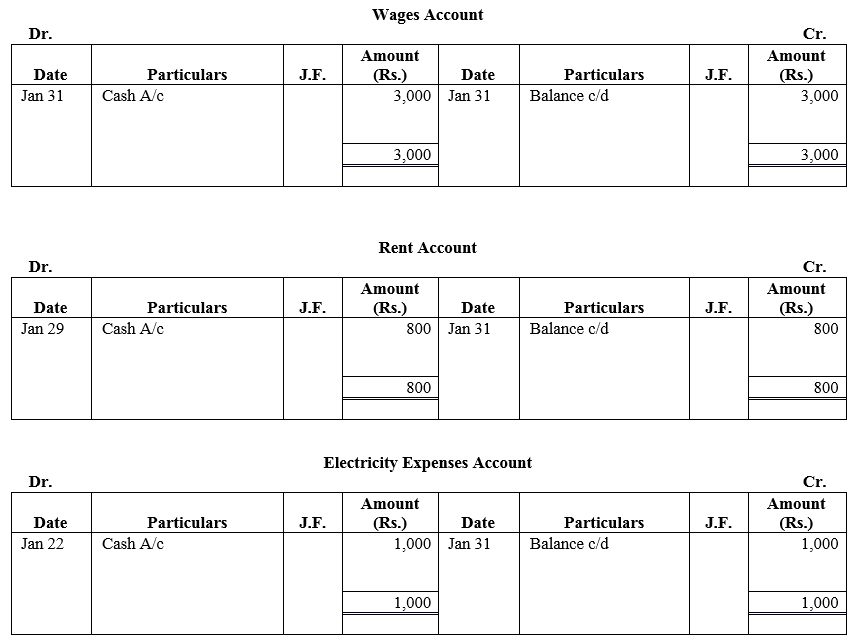

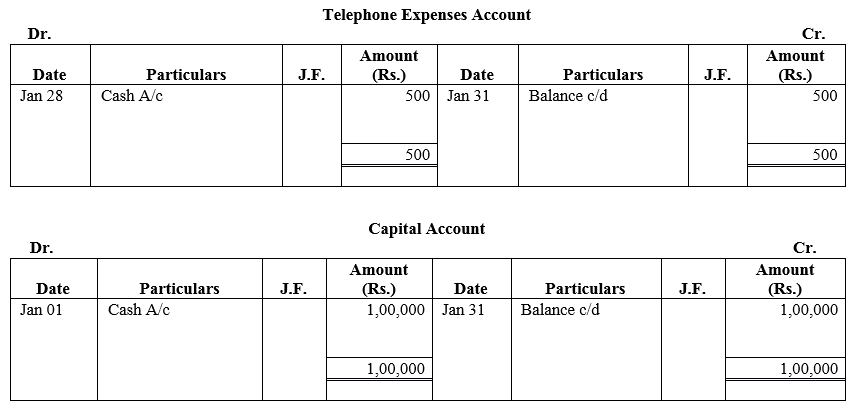

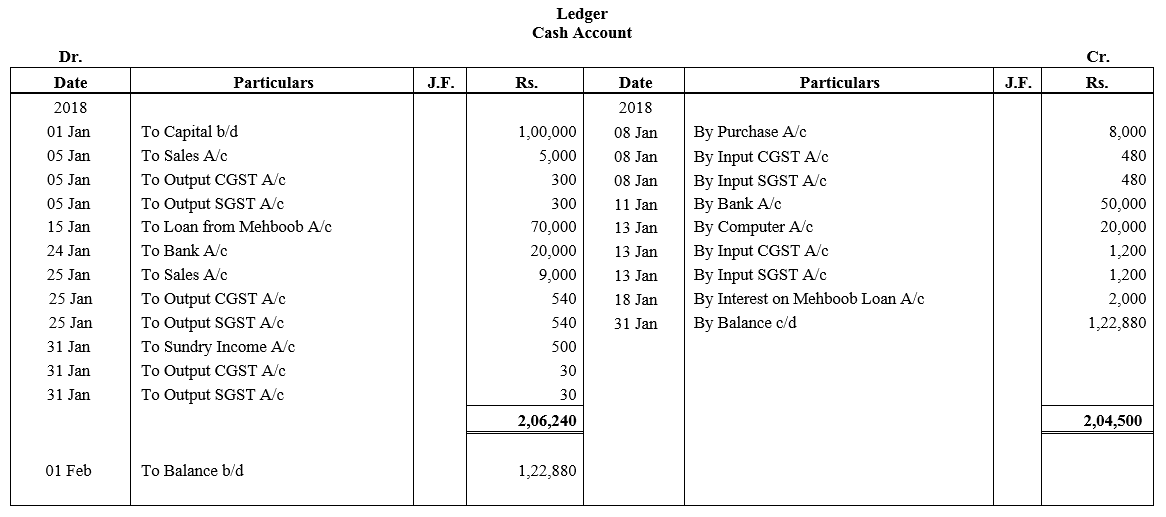

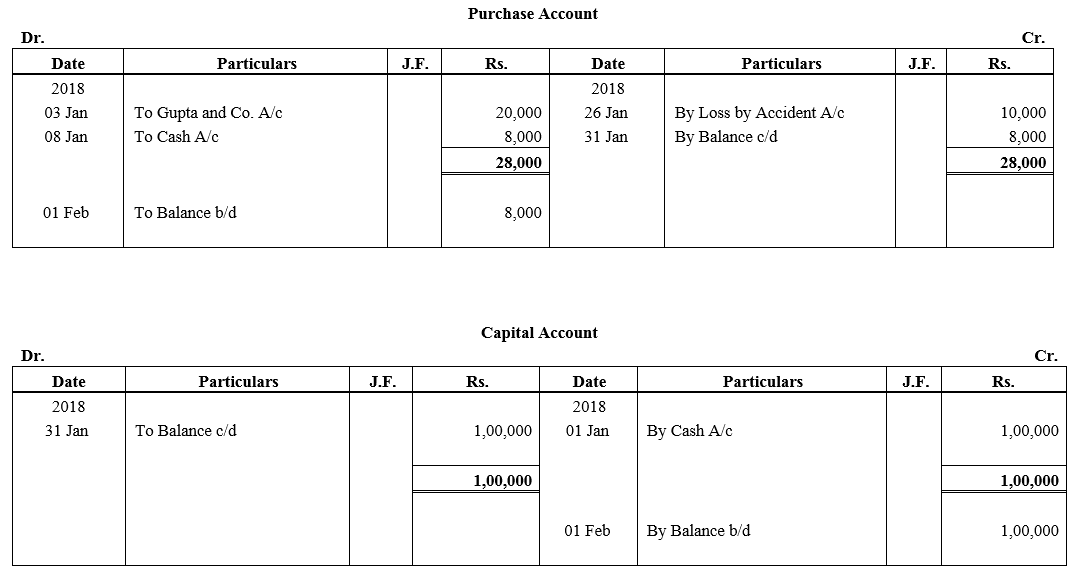

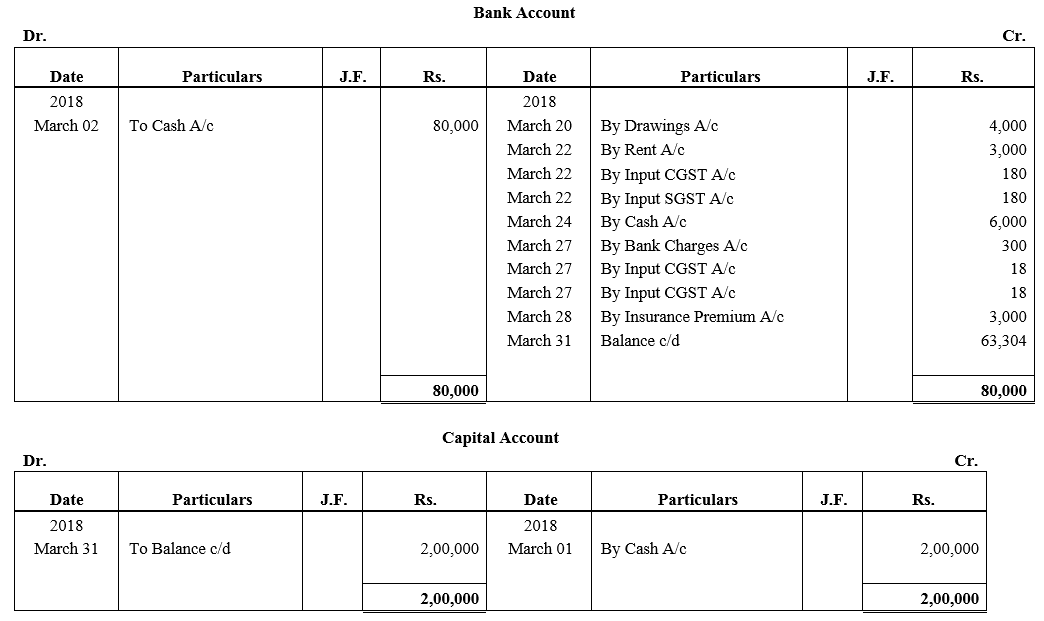

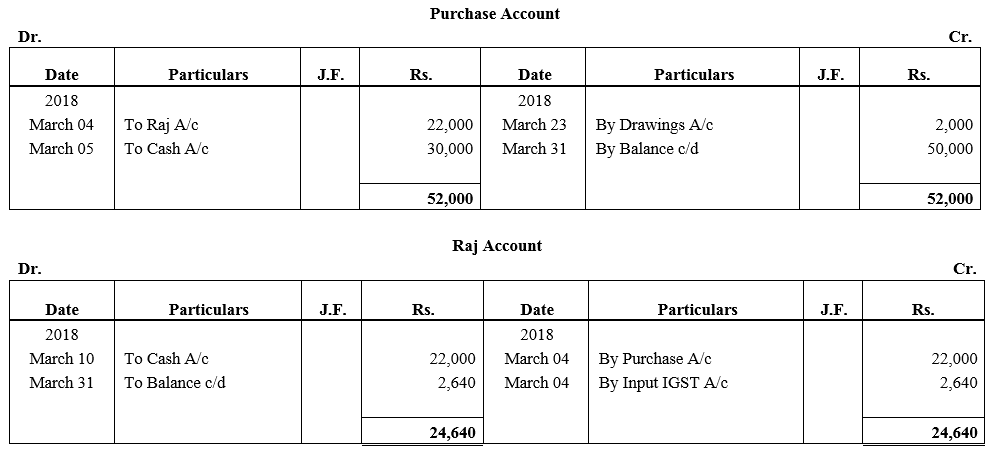

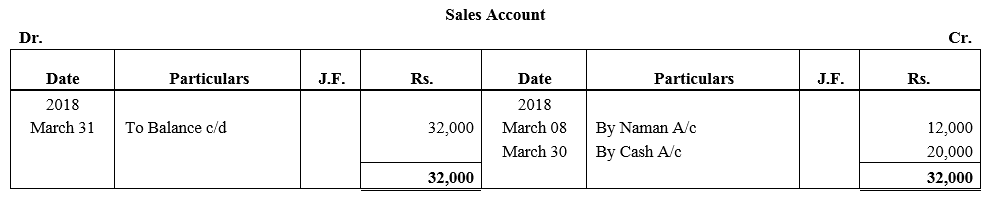

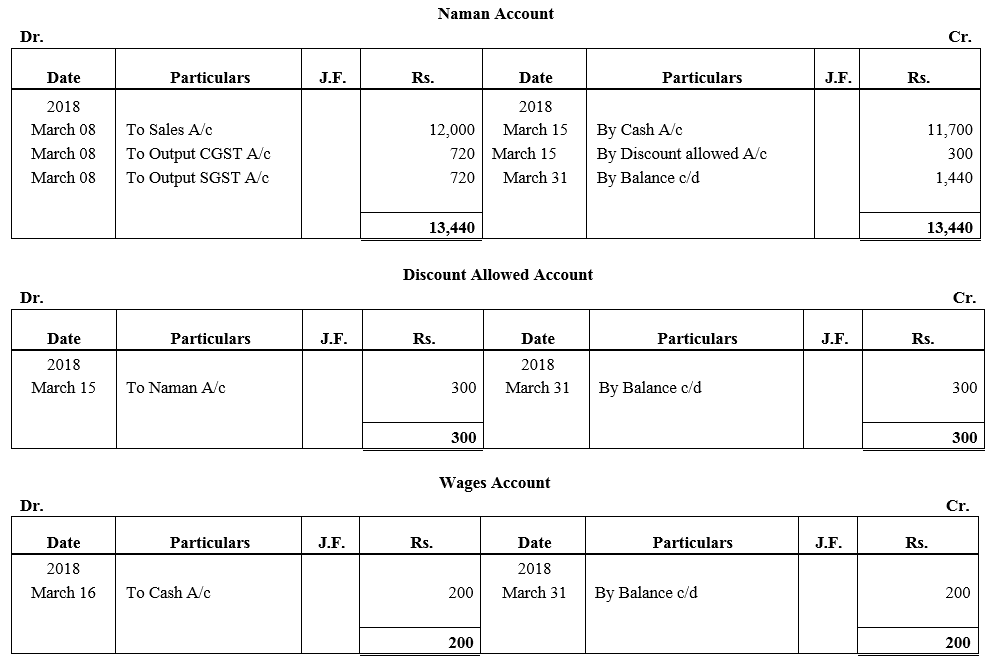

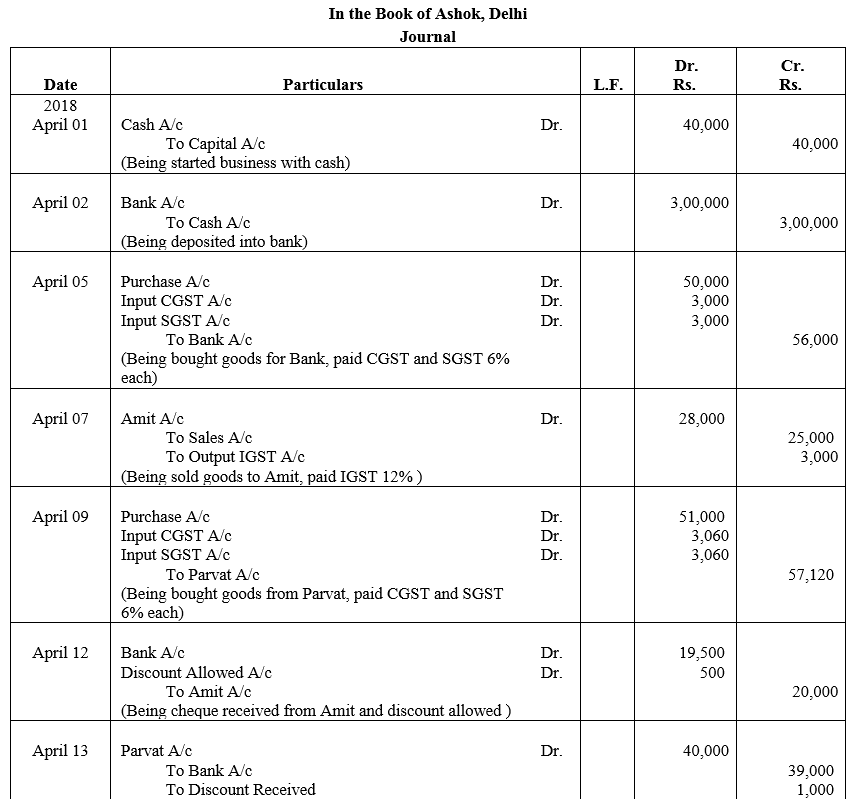

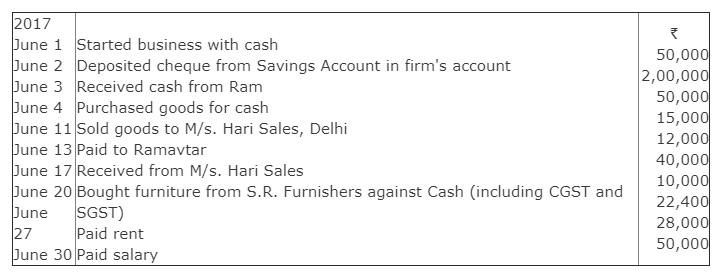

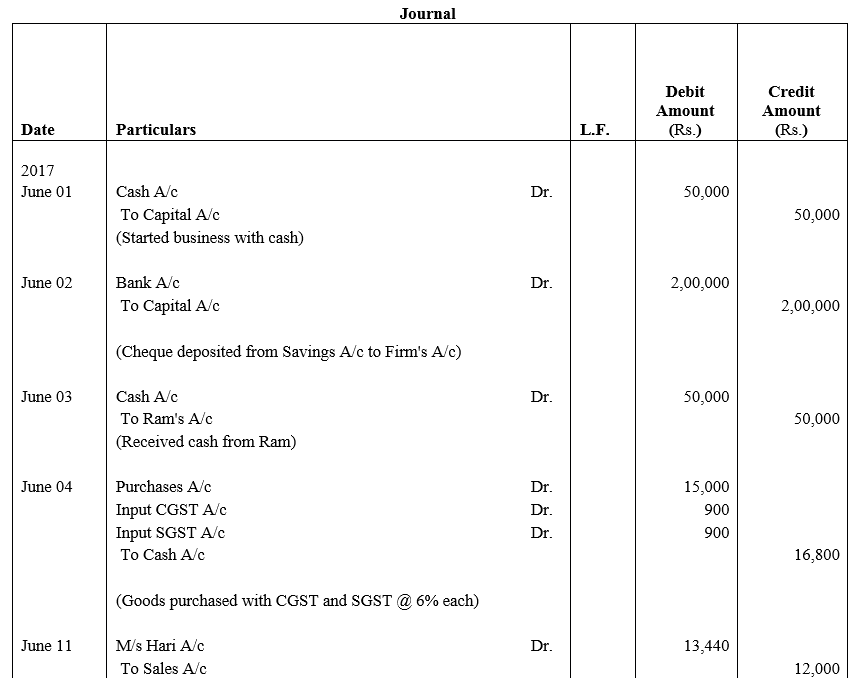

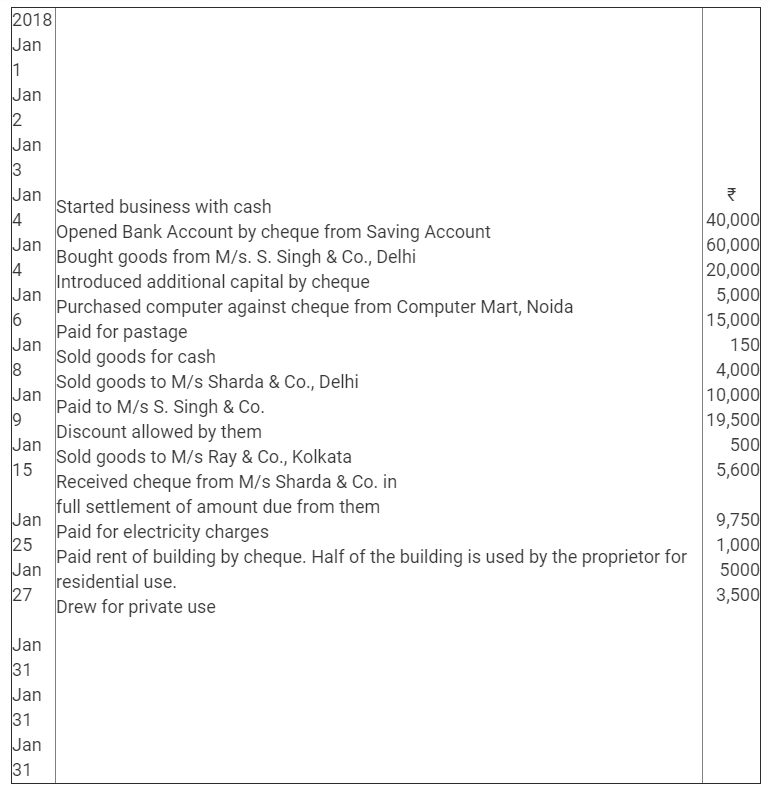

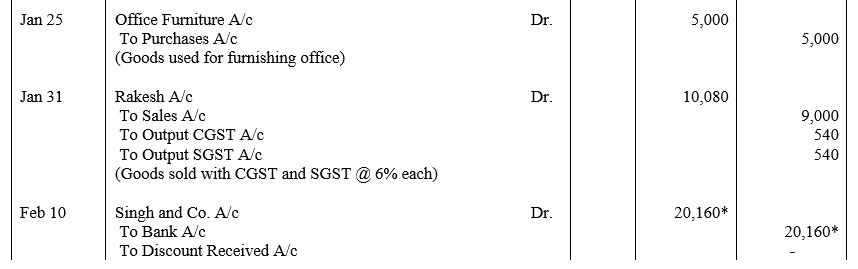

D.Chadha commenced business on 1st January, 2017. His transactions for the month are given below. Journalise them.

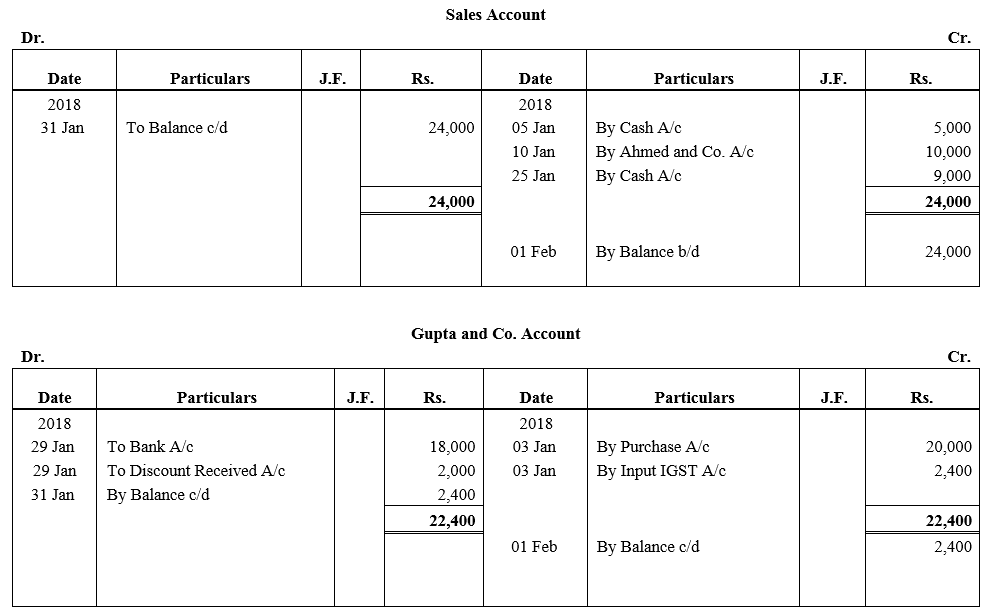

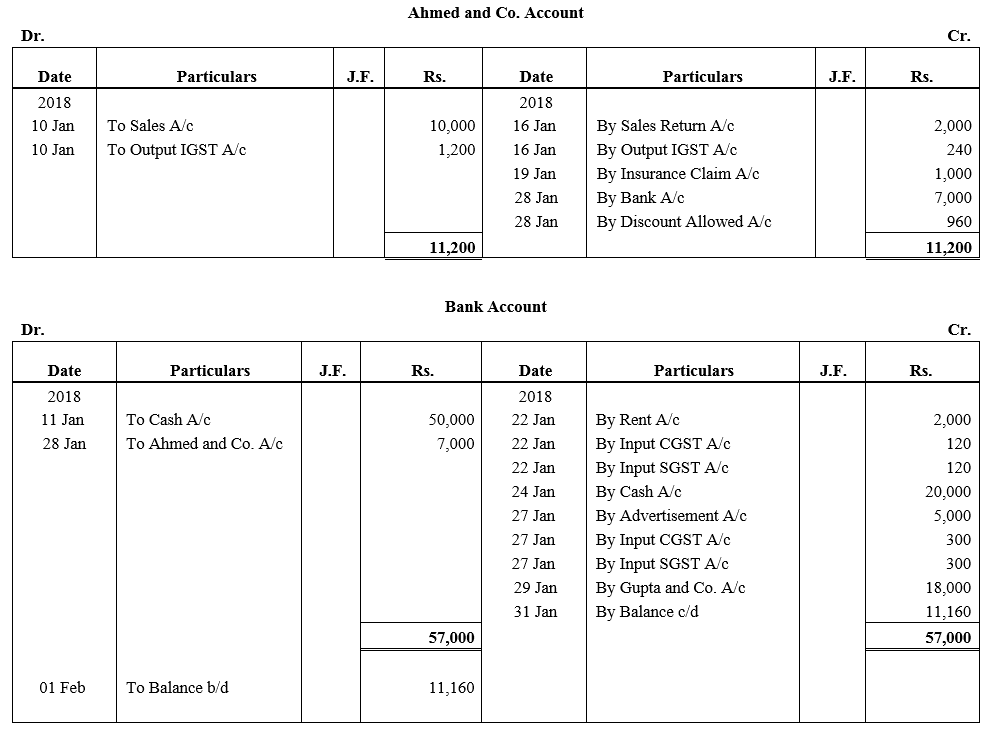

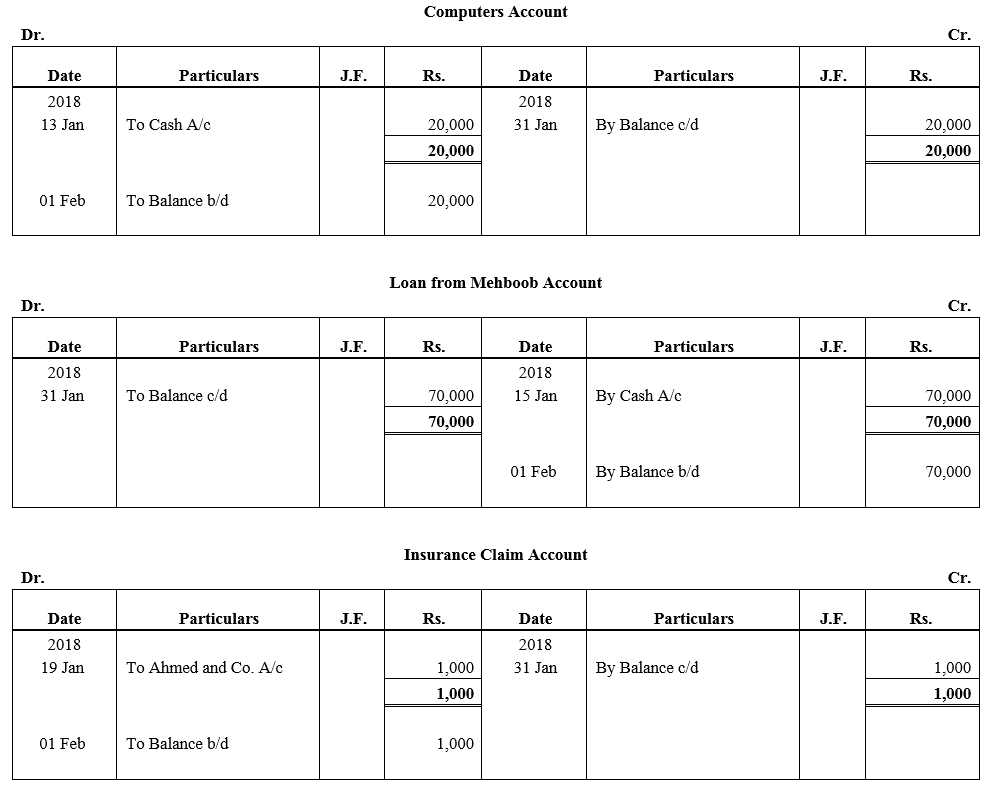

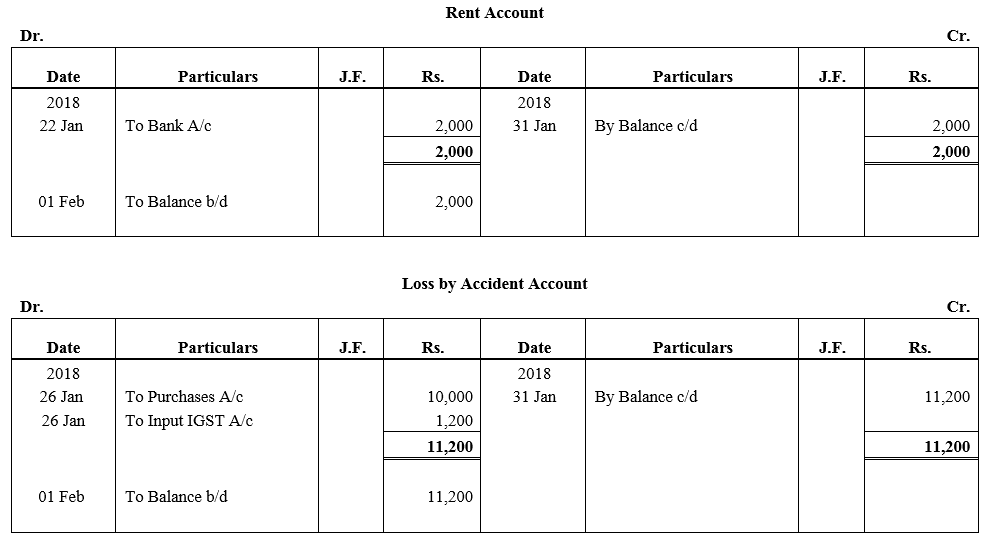

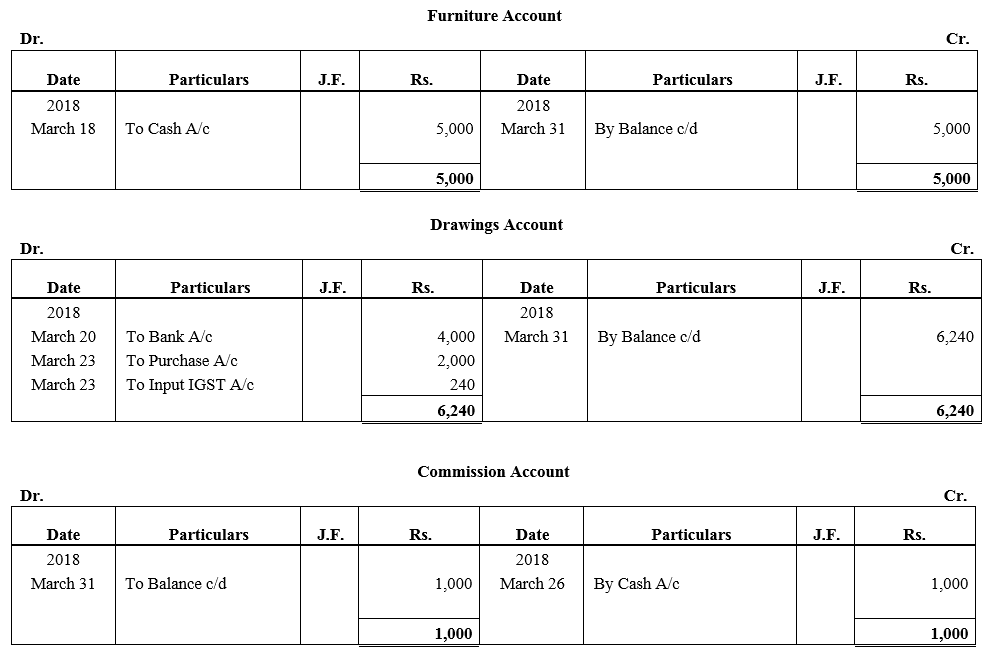

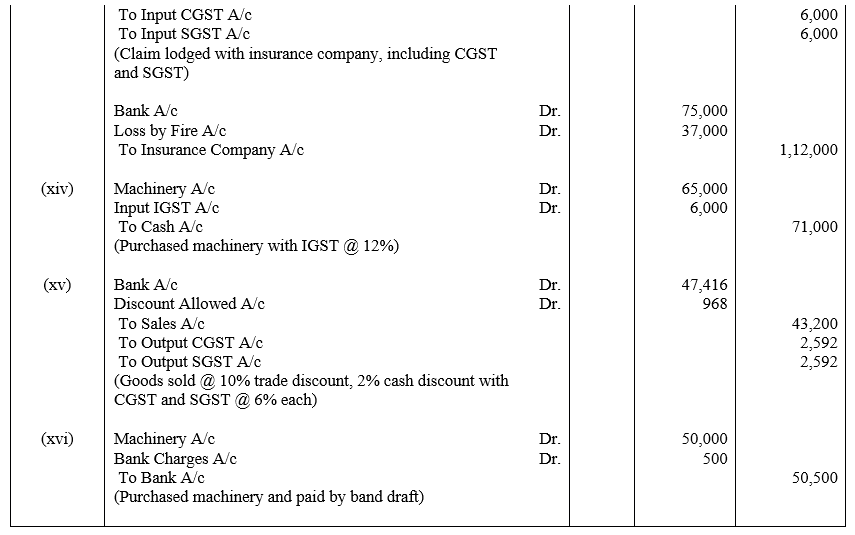

Solution:

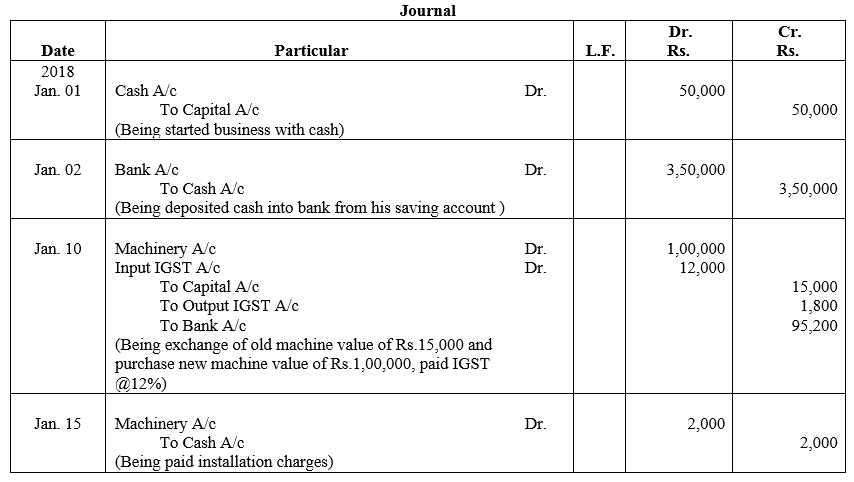

![]()

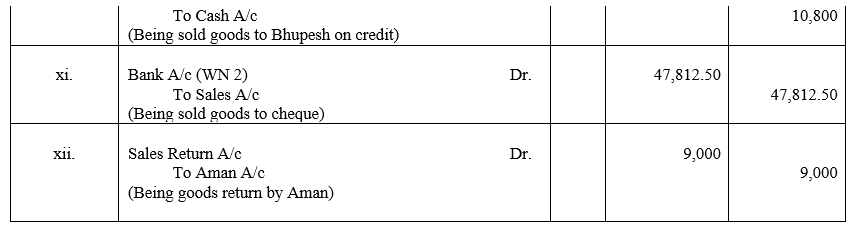

Question 33.

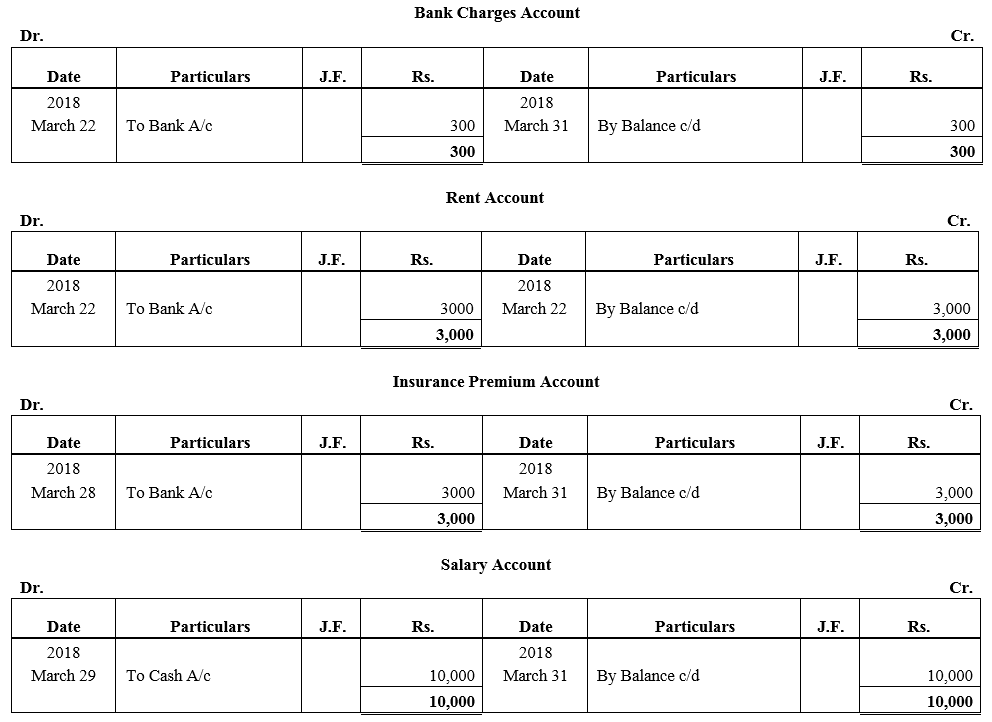

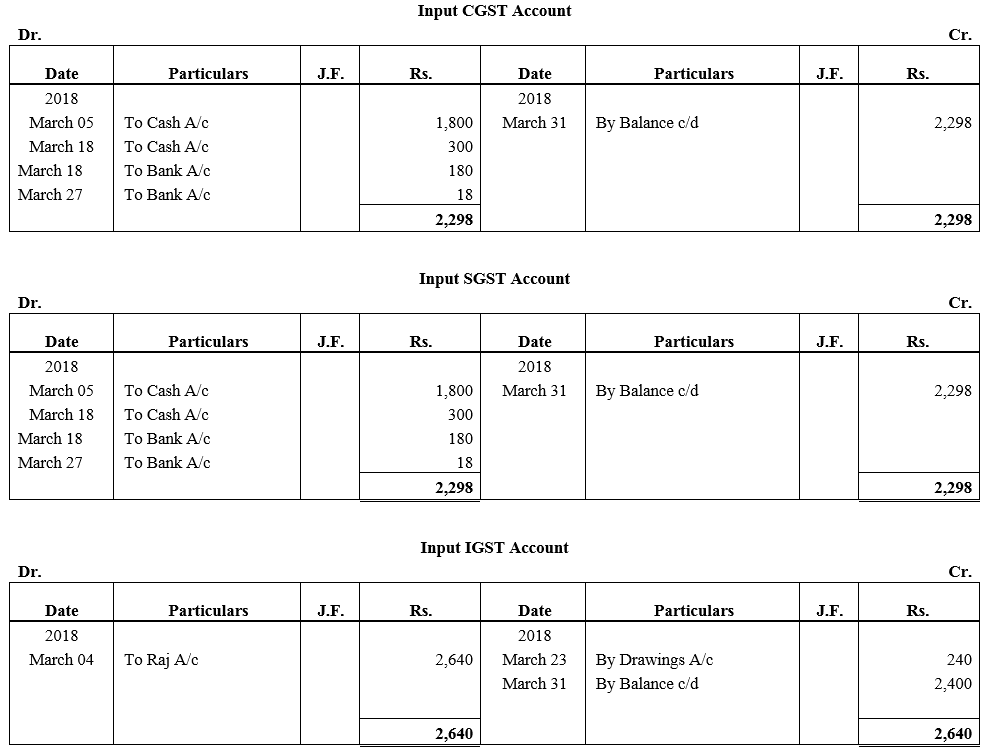

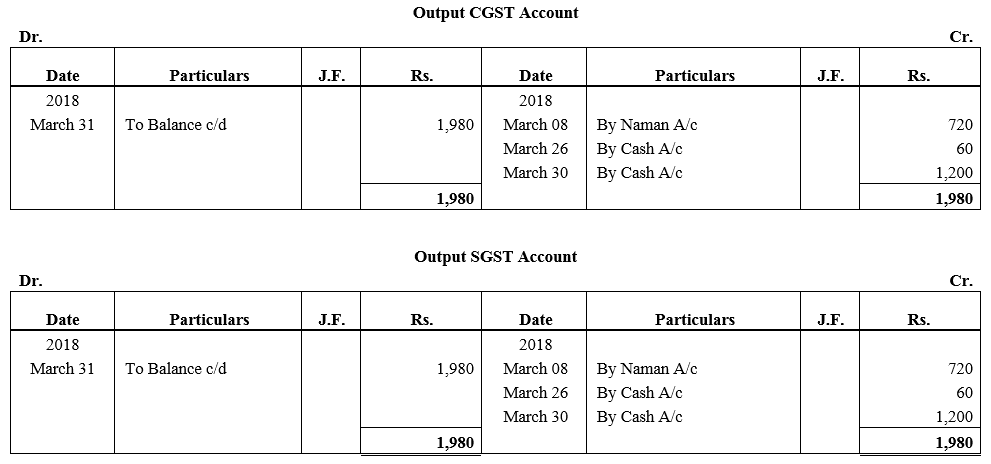

Record the following transactions in the Journal of Ashoka Furniture Traders:

Solution:

![]()

Question 34.

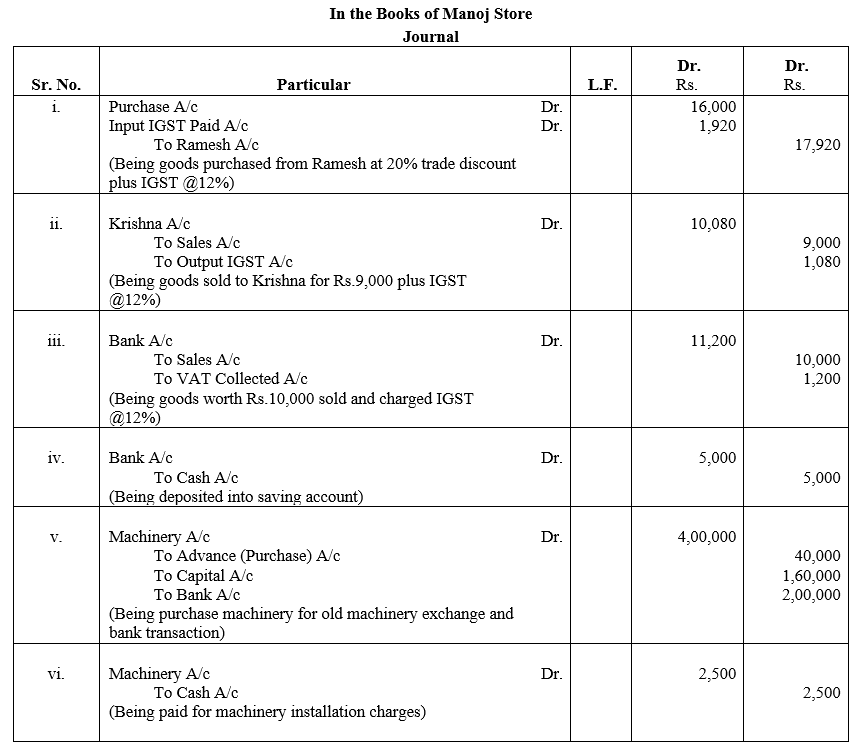

Journalise the following transactions in the books of Manoj Store:

(i) Purchased goods from Ramesh ₹ 20,000 less Trade Discount at 20% plus IGST @ 12%.

(ii) Sold goods costing ₹ 7,000 to Krishna for ₹ 9,000 plus IGST @ 12%.

(iii) Sold goods for ₹ 10,000 and charged IGST @ 12% against cheque.

(iv) ₹ 5,000 were deposited into Saving Account.

(v) Machinery costing ₹ 4,00,000 for which order was placed earlier paying advance of ₹ 40,000. The balance payment was paid as follows:

(a) An old machine (personal) valued at ₹ 30,000 was given in exchange;

(b) Issued a cheque from his savings account for ₹ 1,30,000; and

(c) Balance by issue cheque from firm’s bank account.

(vi) Paid in cash wages ₹ 2,500 for installation of machine.

Solution:

Note: An old personal machinery in exchange of Rs.30,000 and bank transaction of Rs.1,30,000 from Saving account will increasing the Capital account of proprietor.

![]()

Question 35.

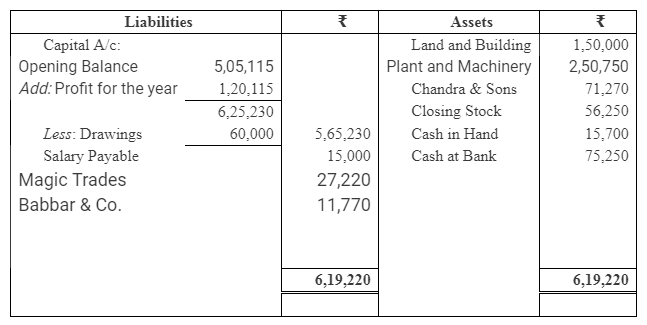

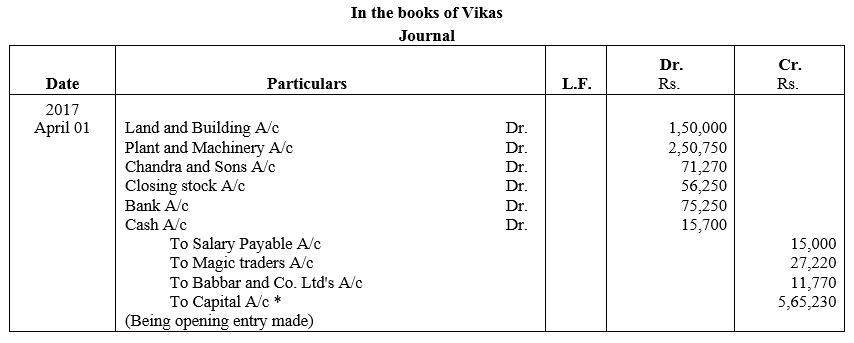

Pass the Opening Entry from the following Balance Sheet as at 31st March, 2018 of Vikas:

Solution:

* Capital Account is tally amount of Balancing Figure.

We hope the TS Grewal Accountancy Class 11 Solutions Chapter 5 Journal help you. If you have any query regarding TS Grewal Accountancy Class 11 Solutions Chapter 5 Journal, drop a comment below and we will get back to you at the earliest.

Read More: