Financial Management Notes: Financial management is that aspect of a business that focuses on planning, organizing, directing and controlling the financial activities such as procurement and utilization of funds of the enterprise. It means applying general management principles to the financial resources of the enterprise

A manager, across different functional and business levels of a company, has to have a basic and rudimentary understanding of the principals for financial management. Every leader in a business environment is expected to understand the fundamentals of financial aspects because crucial management and business development decisions are taken based on the financial analysis of a company

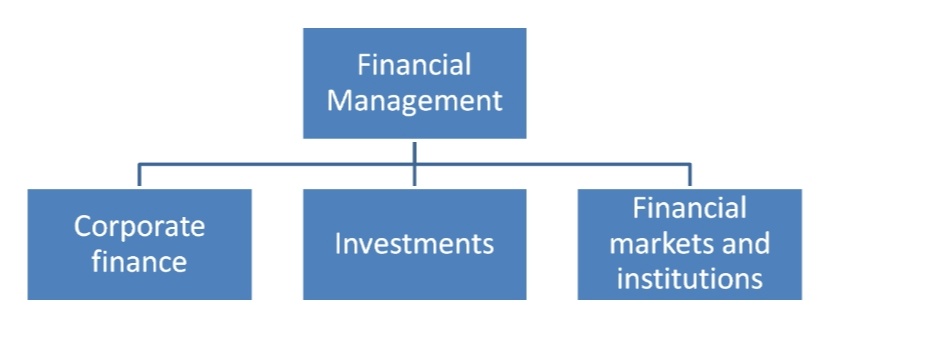

Financial Management Notes | The three major areas of business finance are corporate finance, investments, and financial markets and institutions.

-

Corporate finance

Corporate finance is a broad description of a company’s balances, income, and cash flow information. The balance, income, and cash flows statements are generated for accounting purposes. Performance is measured by developing metrics such as the current ratio—the ability to pay your financial obligations on time. Working capital is the capital money that a business can use to finance its daily functions. Some working capital examples are cash or inventory.

-

Investments

Another area of finance is investment. Businesses may invest in assets ranging from short-term securities to long-term securities like stocks and bonds. Companies can invest in financial assets such as stocks of other firms, or invest in themselves with physical assets such as buildings or new equipment.

-

Financial markets and institutions

Financial markets include the stocks and bonds, commodities, and derivatives markets. Financial institutions such as banks, investment companies, and brokerages work in the financial markets. Financial institutions generally act as intermediaries that help make transfers of funds between businesses and savers (working as a broker or agent for the trade).

Since finance is the lifeline of an organization, the importance of this subject is paramount for a company.

Hence, let us discuss a few points on

Financial Management Notes | Why financial management is important?

Let us discuss each of the attributes in brief:

-

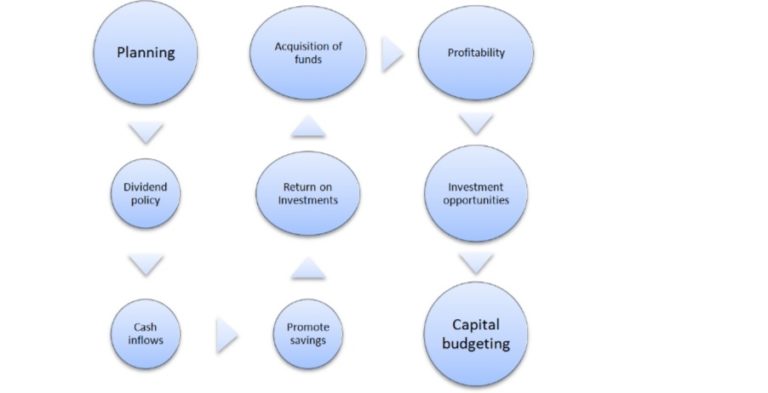

Planning

In general usage, a financial plan is a comprehensive evaluation of an individual’s current pay and future financial state by using current known variables to predict future income, asset values and withdrawal plans

-

Acquisition of funds

acquisition financing. The type of funding obtained by a business for the purpose of purchasing another business. These funds allow the purchaser to provide the seller with the needed funds immediately for the purchase. It is common for the debt to be repaid with shares or minority interest in the company being acquired.

-

Profitability

Profit, in accounting, is an income distributed to the owner in a profitable market production process. Profit is a measure of profitability which is the owner’s major interest in the income-formation process of market production. There are several profit measures in common use

-

Dividend policy

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage.

-

Return on Investments

Return on investment is a ratio between net profit and cost of investment. A high ROI means the investment’s gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.

-

Investment opportunities

This deals with various investment opportunities for companies to increase their revenue flow

-

Cash flow

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business. At the most fundamental level, a company’s ability to create value for shareholders is determined by its ability to generate positive cash flows, or more specifically, maximize long-term free cash flow (FCF).

-

Promote savings

Savings are possible only when the business concern earns higher profitability and maximizing wealth. Effective financial management helps in promoting and mobilizing individual and corporate savings.

-

Capital budgeting

Capital budgeting, and investment appraisal, is the planning process used to determine whether an organization’s long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm’s capitalization structure.

From an academic and examination point of view, these are some of the favourite topics for examination paper setters:

- Cost Accounting- Cost accounting is defined as a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and detail.

- Banking and insurance- Banking, financial services and insurance(BFSI) is an industry term for companies that provide a range of such financial products or services.

- Security analysis- Security analysis is the analysis of tradable financial instruments called securities. It deals with finding the proper value of individual securities. These are usually classified into debt securities, equities, or some hybrid of the two. Tradable credit derivatives are also securities

- Business communication- Business communication is exchanging information to promote an organization’s goals, objectives, aims, and activities, as well as increase profits within the company

- Financial accounting- Financial accounting is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to business. This involves the preparation of financial statements available for public use.

- Principles of management- principles of management are the activities that “plan, organize, and control the operations of the basic elements of [people], materials, machines, methods, money and markets, providing direction and coordination, and giving leadership to human efforts, to achieve the sought objectives.

- Advance financial management- The Advanced Financial Management exam is designed to replicate the role of a senior financial executive or advisor and prepares candidates to advise management and/or clients on complex strategic financial management issues facing an organization.

- Portfolio and risk management- Portfolio management involves building and overseeing a selection of investments that will meet the long-term financial goals and risk tolerance of an investor. Active portfolio management requires strategically buying and selling stocks and other assets in an effort to beat the broader market.

There are plenty of reference textbooks and articles in the market that one can refer to for an in-depth understanding of the topics mentioned above.

Financial Management Notes | Some of those textbooks are:

- Khan MY, Jain PK, BASIC FINANCIAL MANAGEMENT, Tata McGraw Hill, Delhi, 2005.

- Chandra, Prasanna, FINANCIAL MANAGEMENT, Tata McGraw Hill, Delhi.

- Bhabatosh Banerjee, FUNDAMENTALS OF FINANCIAL

MANAGEMENT, PHI, Delhi, 2010. - Chandra Bose D, FUNDAMENTALS OF FINANCIAL MANAGEMENT, PHI, Delhi, 2010.

- Preeti Singh, FUNDAMENTALS OF FINANCIAL MANAGEMENT, Ane, 2011.

- Aswat Damodaran, Corporate Finance Theory and Practice, John Wiley & Sons, 2011.

- James C. Vanhorne –Fundamentals of Financial Management– PHI Learning, 11th Edition,2012.

- Brigham, Ehrhardt, Financial Management Theory and Practice, 12th edition, Cengage Learning 2010.

- Prasanna Chandra, Financial Management, 9th edition, Tata McGraw Hill, 2012.

- Srivatsava, Mishra, Financial Management, Oxford University Press, 2011

Other than the academic textbooks, one needs to understand the real-life financial problems and ground realities in the world. There are plenty of non-fiction books in the market which explains concepts with real-life examples and understandings. Some of them are

- The Big Short: Inside the Doomsday Machine- Book by Michael Lewis

- Freakonomics- Book by Stephen J. Dubner and Steven Levitt

- The Millionaire Next Door: The Surprising Secrets of America’s Wealthy- Book by Thomas J. Stanley

- History of economic thought- Book by Eric Roll, Baron Roll of Ipsden

- Capital in the Twenty-First Century-Book by Thomas Piketty

- Why Nations Fail- Book by Daron Acemoglu and James A. Robinson

- Poor Economics-Book by Abhijit Banerjee and Esther Duflo

- When Genius Failed: The Rise and Fall of Long-Term Capital Management-Book by Roger Lowenstein

- Rich Dad Poor Dad- Book by Robert Kiyosaki and Sharon Lechter

- Too Big to Fail- Book by Andrew Ross Sorkin

- Liar’s Poker: Rising Through the Wreckage on Wall Street- Book by Michael Lewis

- Barbarians at the Gate: The Fall of RJR Nabisco- Book by Bryan Burrough and John Helyar

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing- Book by Burton Malkiel

- Capital Ideas: The Improbable Origins of Modern Wall Street- Book by Peter L. Bernstein

- Flash Boys: A Wall Street Revolt- Book by Michael Lewis

- The Overspent American: Why We Want What We Don’t Need- Book by Juliet B. Schor

- Refinery29 Money Diaries: Everything You’ve Ever Wanted to Know About- Book by Lindsey Stanberry

Every company in every industry needs a finance manager and their competencies for proper and judicious use of the funds and resources. Financial mismanagement can cost companies dearly to an extent where they might not be able to recover. Given its importance in the business world, every B-School across the world has created its program structure and pedagogy for finance in such a way that students across all specializations understand the basic theories of the subjects.

The job opportunities for financial management students are plenty that promises them financial independence and job satisfaction.

Related Articles:

FAQs on Financial Management Notes

1. What are the reference textbooks for Financial Management?

You can refer to the following textbooks for Financial Management and use them as a reference during your preparation.

1. Khan MY, Jain PK, BASIC FINANCIAL MANAGEMENT, Tata McGraw Hill, Delhi, 2005.

2. Chandra, Prasanna, FINANCIAL MANAGEMENT, Tata McGraw Hill, Delhi.

3. Bhabatosh Banerjee, FUNDAMENTALS OF FINANCIAL MANAGEMENT, PHI, Delhi, 2010.

2. Where can I download Finance Management Notes PDF?

You can download the Finance Management Notes & Study Material from this page. You can use the suggested books by experts during your preparation and get a good grip on the subject.

3. Where can I get Financial Management Notes?

You can get Study Materials and preparation resources related to Finance Management for free of cost from our webpage.