The government of India provides a number of schemes to Indian poor people to stay happy and desire to leave like others. One of such schemes is Pradhan Mantri Jan Dhan Yojana. It was announced by Prime Minister, Narendra Modi on 15 August 2014 and was launched on 28 August 2014. The main aim of launching this PM Jan Dhan Yojana Scheme is to empower citizens financially and everyone can get the benefits of growth and development. This was the first biggest financial inclusion initiative in the world.

At the time of originating the Yojana, the Prime Minister had expressed this event as a festival to commemorate the liberation of the poor from a vicious cycle. There are various achievements received under this Pradhan Mantri Jan-Dhan Yojana. Also, the Guinness Book of World Records recognised the achievements made under PMJDY Scheme. For more information of PMJDY Scheme, kindly look at the below links and grab the accurate details of your need.

This Article Contains:

- What is PM Jan Dhan Yojana (PMJDY)?

- Objectives of PM Jan-Dhan Yojana Scheme?

- Eligibility for PMJDY Scheme

- How to Open a Bank Account under PMJDY?

- Documents Required for Opening a Bank Account under PMJDY

- Private & Public Bank Sectors that provide the PM Jan Dhan Yojana Account List

- Benefits of PM Jan-Dhan Yojana

- FAQs on PM Jan Dhan Yojana (PMJDY) Mission

What is PM Jan Dhan Yojana (PMJDY)?

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is a National Mission launched by the Indian Government for accessing various financial services, such as Banking/ Savings & Deposit Accounts, Remittance, Insurance, Credit, Pension to the poor citizen in the country.

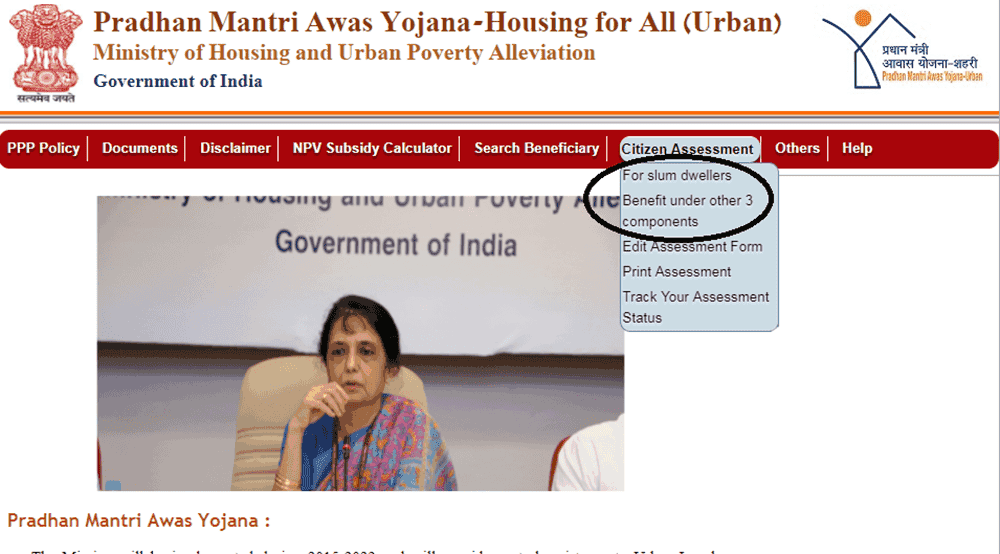

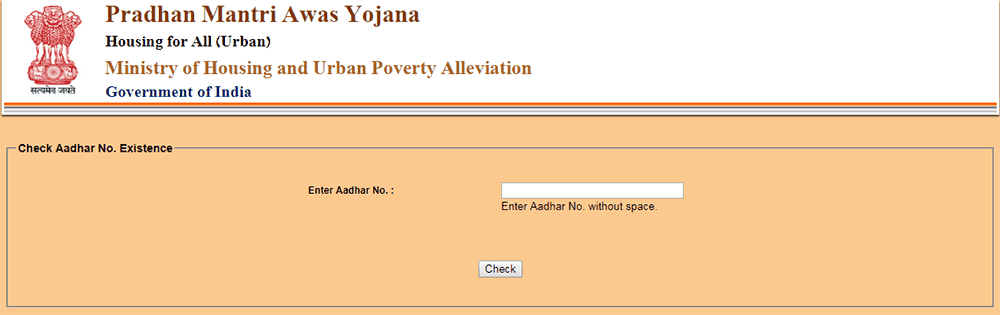

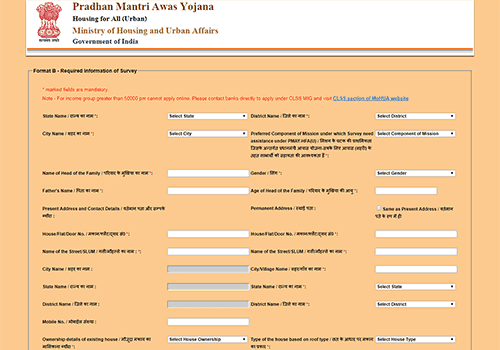

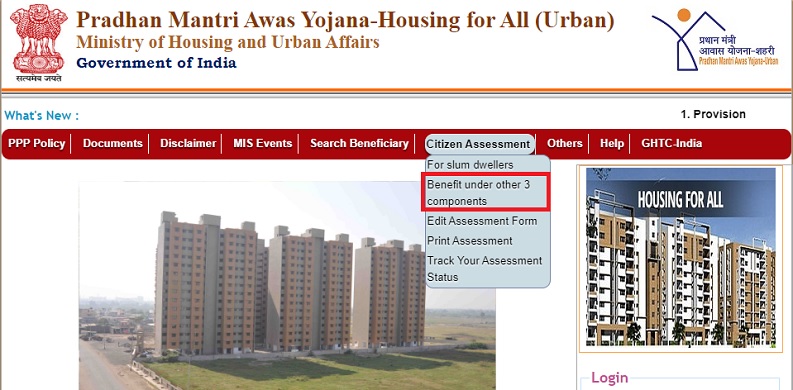

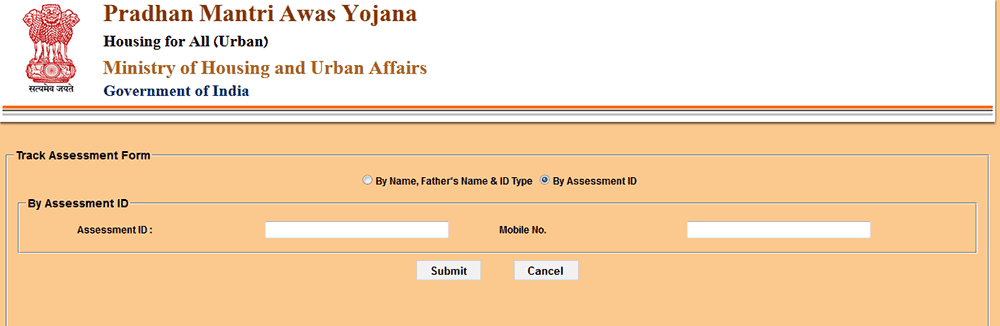

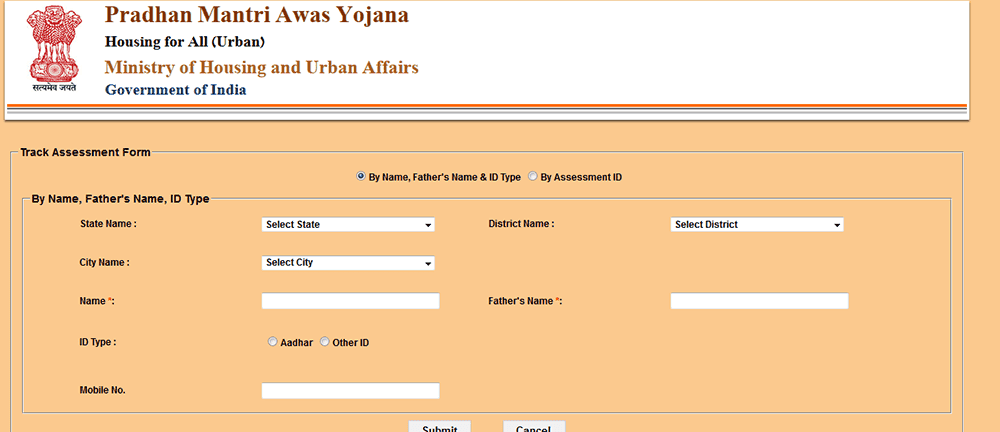

Also Check: Pradhan Mantri Awas Yojana

Overview:

| Interest Rate | Based on the saving’s account interest rate offered by the bank |

| Minimum Balance | Zero balance account |

| Accidental Insurance Cover | Under Rupay Scheme, Rs.1 lakh. Accounts opened after 28 August 2018, Rs.2 lakh |

| Overdraft Facility | Provided |

Objectives of PM Jan-Dhan Yojana Scheme?

The Indian Government started the Pradhan Mantri Jan Dhan Yojana (PMJDY) to offer financial services and products to individuals who are poor and who do not have access to a bank account. Here are the few goals to start this scheme called PMJDY:

- Universal access to banking facilities for all sections

- Credit guarantee fund

- Improving financial literacy via financial literacy centers

- RuPay debit card facility

- Pension facility for an unorganized sector (Swavalamban)

- Reactivation of dormant accounts

- Savings bank accounts for all adult citizens

- Micro-insurance facility

- Access to need-based credit

- Overdraft facility (up to Rs.5000 after six months of satisfactory credit history)

Eligibility for PMJDY Scheme

Satisfying the following conditions is necessary and mandatory for every individual applying for the PMJDY Account. Let’s take a look at the below points and then move to the next step.

- Applying candidate should be an Indian citizen

- The minimum age limit is 10 years.

- He/she do not hold any bank account previously.

How to Open a Bank Account under PMJDY?

To open a bank account under Jan Dhan Yojana, eligible candidates have to fill the application form provided by the official website of PMJDY ie., www.pmjdy.gov.in and submit it to the bank along with required documents. The bank sectors that offer the Pradhan Mantri JDY scheme are listed below, choose the nearest bank and open a zero balance account under PM Jan Dhan Yojana.

The application form name is the financial inclusion account opening form. You can see three different sections in the form where you should enter the details of yourself, the nominee, and the bank details. Also, check out the documents that are needed to submit the application from the below section and gather all required things in place.

Documents Required for Opening a Bank Account under PMJDY

The list of necessary documents that should be submitted along with the application form of Pradhan Mantri Jan Dhan Yojana is furnished here. Take a look and gather all of them without any fail to avoid last-minute removals or mistakes.

- Aadhaar

- Passport

- Driving license

- Permanent Account Number (PAN) Card

- Voter ID

- A photograph that has been attested along with a letter from a Gazetted officer need to be presented.

- The National Rural Employment Guarantee Act (NREGA) issued Job Card.

- central or state government departments, public sector undertakings, scheduled commercial banks, public financial institutions, and statutory or regulatory authorities issued Identity card with a photo.

List of Private & Public Bank Sectors that provide the PM Jan Dhan Yojana Scheme

Both public and private sector banks are providing the facility to open a bank account under the PMJDY Scheme. So, verify the list of bank sectors that offer & participate in the scheme of PM Jan Dhan Yojana:

Private Sector Banks:

- Dhanalaxmi Bank Ltd.

- YES Bank Ltd.

- Kotak Mahindra Bank Ltd.

- Karnataka Bank Ltd.

- ING Vysya Bank Ltd.

- IndusInd Bank Ltd.

- Federal Bank Ltd.

- HDFC Bank Ltd.

- Axis Bank Ltd.

- ICICI Bank Ltd.

Public Sector Banks:

- Oriental Bank of Commerce (OBC)

- Union Bank of India

- Allahabad Bank

- Dena Bank

- Syndicate Bank

- Punjab & Sind Bank

- Vijaya Bank

- Central Bank of India

- Punjab National Bank (PNB)

- Indian Bank

- IDBI Bank

- Corporation Bank

- Canara Bank

- Bank of India (BoI)

- Bank of Maharashtra

- Andhra Bank

- Bank of Baroda (BoB)

- State Bank of India (SBI)

What are the Benefits of the Pradhan Mantri Jan-Dhan Yojana Scheme?

You can find various advantages in the scheme of the PMJDY. Some of them are enlisted here for quick reference to the people who are looking for the details about PM Jan Dhan Yojana Account:

- Interest is granted on the deposits that are offered towards the savings account started under the PMJDY scheme.

- There is no minimum balance policy for the people under PMJDY Account. But, in case they wish to avail themselves cheque facilities, a minimum balance must be maintained.

- If individuals manage the account in a good manner for 6 months, an overdraft facility is granted.

- People can also hold Accidental Insurance cover of Rs.1 lakh under the RuPay scheme.

- If the account was initiated between 20 August 2014 and 31 January 2015, a life cover of Rs.30,000 is given when the beneficiary passes away.

- Under this PMJDY, insurance products and pension access are presented.

- In case individuals are beneficiaries of government schemes, the Direct Benefit Transfer option is provided.

- An overdraft facility of Rs.5,000 is given to one account in the household. The facility is normally contributed to the lady in the house.

- The Personal Accident cover can be claimed only after the RuPay Cardholder has made a successful non-financial or financial transaction.

- Transactions made within 90 days of the accident are supposed to be PMJDY qualified transactions under the scheme. Yet, the transaction must be performed at an E-COM, POS, ATM, Bank Mitra, bank branch, etc.

- Account-holders can verify their balance with the help of the mobile banking facility.

FAQs on PM Jan Dhan Yojana (PMJDY) Mission

1. Is a minor candidate eligible for PMJDY?

Yes, a minor is also eligible for the PMJDY scheme and to open a bank account under the supervision of seniors.

2. What are the ID proofs needed to open a bank account under PM Jan-Dhan Yojana?

The ID’ proof that is presented in the following list are important & needed to open a bank account under PMJDY:

- Aadhaar Card

- Voter ID Card

- Passport

- Driving license

3. प्रधानमंत्री जनधन खाता कैसे खोलें? or How to Open Pradan Mantri Jan Dhan Yojana Bank Account?

To open the PM Jan Dhan Yojana Bank Account, all you have to do is check the eligibility and then fill the application form which is available on the official website of PMJDY. Later, submit it with required documents in the respective private or public bank that provide this scheme to the poor citizens in our society.