Do you know how to become an IRS Indian revenue Service Officer in India? If not, Don’t get tensed we will provide guidance regarding eligibility, selection process, salary, course details, etc from this article. Indian Revenue Services are recruited from Central Services (Group B). They are related to the income tax and customs department. Know more about the IRS Officers in India from here.

Every year some number of lakhs will apply for the Indian Revenue Sevices. In which 70,000 will be shortlisted in various locations across the country. Go through the complete details related to the IRS officer like what to study, entrance exam details, course details, educational qualifications, age limit, nationality, duties of IRS officer, and so on.

- Who is an IRS? | Indian Revenue Service Officer

- How to become an IRS (Indian Revenue Service Officer) in India?

- Eligibility Criteria to Become an Indian Revenue Service – Education Qualification, Age Limit, Nationality

- Syllabus of IRS Exam – Prelims & Mains

- Selection Process for IRS Officer in India

- UPSC IRS Exam Pattern

- Duties of an IRS [Indian Revenue Service] Officer in India | Roles and Responsibilities of an IRS Officer in India

- Career Path – Indian Revenue Service Officer (IRSO)

- Pay Scale for an Indian Revenue Service

- FAQs on how to become an IRS Officer in India

Who is an IRS? | Indian Revenue Service Officer

The full form of IRS is the Indian Revenue Service. They are recruited by the government of India based on the UPSC exam (Union Public Service Commission). IRSO [Indian Revenue Service Officer] works for the headquarters of the Ministry of Health Affairs and PMs office. They lead the income tax offices all over the country and take the positions in the President’s secretariat.

How to become an IRS (Indian Revenue Service Officer) in India?

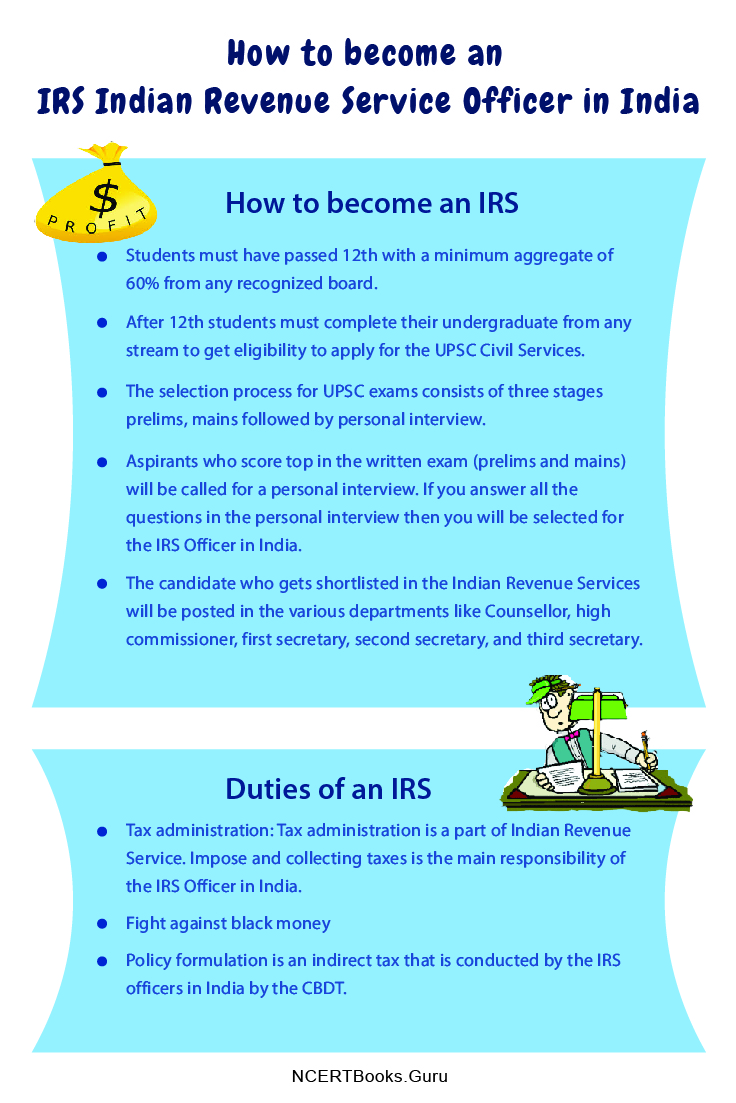

Steps to become an Indian Revenue Service Officer are given below,

- Students must have passed 12th with a minimum aggregate of 60% from any recognized board.

- After 12th students must complete their undergraduate from any stream to get eligibility to apply for the UPSC Civil Services.

- The selection process for UPSC exams consists of three stages prelims, mains followed by personal interview.

- Aspirants who score top in the written exam (prelims and mains) will be called for a personal interview. If you answer all the questions in the personal interview then you will be selected for the IRS Officer in India.

- The candidate who gets shortlisted in the Indian Revenue Services will be posted in the various departments like Counsellor, high commissioner, first secretary, second secretary, and third secretary.

Indian Revenue Service Officer in India Courses List

The relevant courses to complete in order to become the Indian Revenue Service Officer.

- BBA Finance

- B.Com Hons.

- B.Com Finance

- BA Economics

Eligibility Criteria to Become an Indian Revenue Service – Education Qualification, Age Limit, Nationality

- Nationality:

- The applicant must be a citizen of India

- Candidates of Indian origin who has immigrated from Myanmar, Pakistan, Tanzania, Zambia, Malawi, Zaire, Uganda, Kenya, Sri Lanka, Ethiopia, or Vietnam with the intention of permanently settling in India

- Age Limit:

| Category | Age Limit |

| General | 21-32 years |

| OBC | Up to 35 years |

| SC/ST | Up to 37 years |

| Phc | – |

- Number of attempts:

General Category: 6 attempts

OBC: 6 attempts

SC/ST: No limit - Educational Qualifications:

- Candidates who have passed 12th from any recognized board.

- An undergraduate degree from any central or state university.

- A degree from an open university

Syllabus of IRS Exam – Prelims & Mains

Prelims Exam Syllabus:

Paper – I:

1. General Science

2. Environmental ecology

3. Current affairs of international & national interest

4. National movement & Indian History

5. Indian Polity and Governance – Political System, Constitution, Public Policy, Rights Issues, Panchayati Raj, and so on.

6. Bio-diversity

7. General issues on Climate Change; Economic and Social Development – Social Sector

8. Indian and World Geography- Indian Economic Geography, the World as well as Social

Paper – II:

1. General mental ability

2. Solving problems and decision planning

3. Basic numerals

4. Comprehension

5. Logical reasoning as well as analytical ability

6. Interpersonal skills including communication skills

Mains Exam Syllabus

Paper I – Essay

Paper II – General Studies I

- Indian Culture

- Indian Society

- Geographical elements of the world

Paper III – General Studies II

- Historical foundations

- Government policies and interventions

- Indian Governance

- International relations

Paper IV – General Studies III

- Indian Economy

- Security

- Disaster management

- Science and technology

Paper V – General Studies IV

- Civil

- Ethics and Human Interface

- Attitude

- Probity in Governance

- Emotional Intelligence

- Agriculture animal

- Aptitude

Optional Subjects

- Mathematics

- Physics

- Management

- Geology

- Physics

- Medical Science

- History

- Geography Commerce and Accountancy

- Political Science and International Relations

- Statistics

- Psychology

- Zoology

Recommended Books

- IRS enrolled agent exam study guide 2013-14.

- IRS tax preparer course & Rprt exam study guide 2013

- CSAT-UPSC – Civil Services Aptitude Test

- DUVALL’s Master study guide series, United States Tax Code, IRS Publication 15, Employer’s Tax Guide Tax Year 2013.

Related Articles:

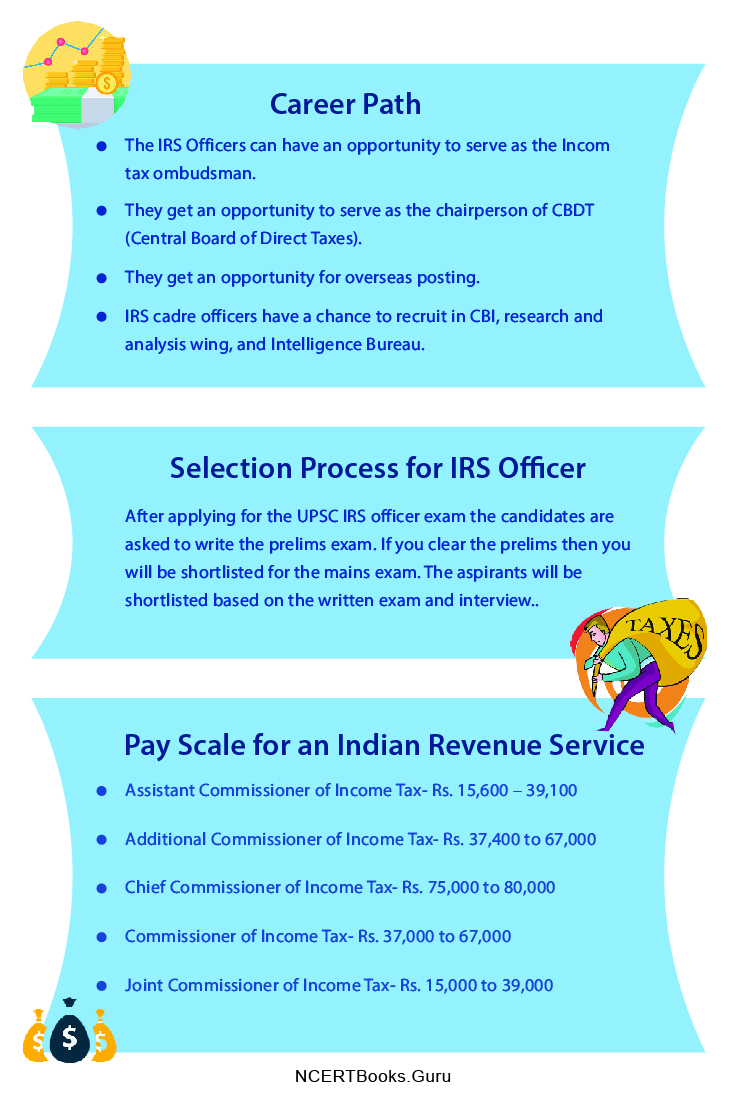

Selection Process for IRS Officer in India

After applying for the UPSC IRS officer exam the candidates are asked to write the prelims exam. If you clear the prelims then you will be shortlisted for the mains exam. The aspirants will be shortlisted based on the written exam and interview.

- Preliminary exam

- Mains exam

- Personal interview

UPSC IRS Exam Pattern

After qualifying for both the written exams the candidates will be called for a personal interview.

| Prelims Exam | |

| Paper – I (General Studies) | 200 marks |

| Paper – II (Aptitude test) | 200 marks |

| Mains Exam | |

| Paper A | 300 marks |

| Paper B – English language | 300 marks |

| Paper – I – Essay | 250 |

| Paper – II General studies I | 250 |

| Paper – III General studies II | 250 |

| Paper – IV General Studies III | 250 |

| Paper – V General studies IV | 250 |

| Paper VI Optional subject paper I | 250 |

| Paper VII Optional subject paper II | 250 |

| Personality test | 275 |

| Total Marks | 2025 |

Optional Subjects for prelims exam:

| Language | Script |

| Assamese | Assamese |

| Bengali | Bengali |

| Gujarati | Gujarati |

| Kannada | Kannada |

| Hindi | Devanagari |

| Konkani | Devanagari |

| Kashmiri | Persian |

| Marathi | Devanagari |

| Malayalam | Malayalam |

| Manipuri | Bengali |

| Odia | Odia |

| Nepali | Devanagari |

| Punjabi | Gurumukhi |

| Sanskrit | Devanagari |

| Tamil | Tamil |

| Sindhi | Devanagari |

| Urdu | Persian |

| Telugu | Telugu |

| Bodo | Devanagari |

| Dogri | Devanagari |

| Santhali | Devanagari |

| Maithili | Devanagari |

Duties of an IRS [Indian Revenue Service] Officer in India | Roles and Responsibilities of an IRS Officer in India

The roles and responsibilities of an Indian Revenue Service Officer are as follows,

- Tax administration: Tax administration is a part of Indian Revenue Service. Impose and collecting taxes is the main responsibility of the IRS Officer in India.

- Fight against black money

- Policy formulation is an indirect tax that is conducted by the IRS officers in India by the CBDT.

- Training of IRS officers

Career Path – Indian Revenue Service Officer (IRSO)

- The IRS Officers can have an opportunity to serve as the Incom tax ombudsman.

- They get an opportunity to serve as the chairperson of CBDT (Central Board of Direct Taxes).

- They get an opportunity for overseas posting.

- IRS cadre officers get the chance to serve in ministries.

- IRS cadre officers have a chance to recruit in CBI, research and analysis wing, and Intelligence Bureau.

Go through our Course Details Page a one-stop destination for all kinds of course-related information like Eligibility, Admission Process, Career Prospects, Salary, etc.

Pay Scale for an Indian Revenue Service

The estimated salary for IRSO in different designations is shown in the below table.

| Designation | Salary per month |

| Assistant Commissioner of Income Tax | Rs. 15,600 – 39,100 |

| Additional Commissioner of Income Tax | Rs. 37,400 to 67,000 |

| Chief Commissioner of Income Tax | Rs. 75,000 to 80,000 |

| Commissioner of Income Tax | Rs. 37,000 to 67,000 |

| Deputy Commissioner of Income Tax | Rs. 15,000 to 39,000 |

| Joint Commissioner of Income Tax | Rs. 15,000 to 39,000 |

| Principal Commissioner of Income Tax | Rs. 67,000 to 80,000 |

| Principal Chief Commissioner of Income Tax | Rs. 80,000 |

FAQs on how to become an IRS Officer in India

1. Are females suitable for the Indian Revenue Service Officer in India?

Yes, the profession is gender-neutral, both men and women can join the Indian Revenue Services.

2. What are the skills required to join the IRS Officer in India?

- Communication skills

- Research skills

- Judgment skills

- Analytical skills

- Perseverance

3. How are IRS officers selected?

IRS and IAS officers are selected through the UPSC Civil Services Exam. The candidates will be shortlisted as per the declaration of the UPSC merit list.

Conclusion

We wish the information prevailed in the above article i.e., “How to become an IRS Indian revenue Service Officer in India” is helpful for you guys. Please contact us by posting the comments in the below-mentioned comment box to know details about joining the Indian Revenue Services.