There are various schemes introduced by the Prime Minister, Narendra Modi every year for India’s citizens, to provide support and benefit the needy. Among many such schemes launched by our PM, people often confuse the two popular schemes known as PMJJBY and PMSBY. The best way to understand the difference between Pradhan Mantri Jeevan Jyoti Bima Yojna and Pradhan Mantri Suraksha Bima Yojna is to get into the in-depth description of the policies.

You can also find differences between articles on various topics that you need to know. Just tap on the quick link available and get to know the basic differences between them.

What is the Difference Between PMJJBY and PMSBY

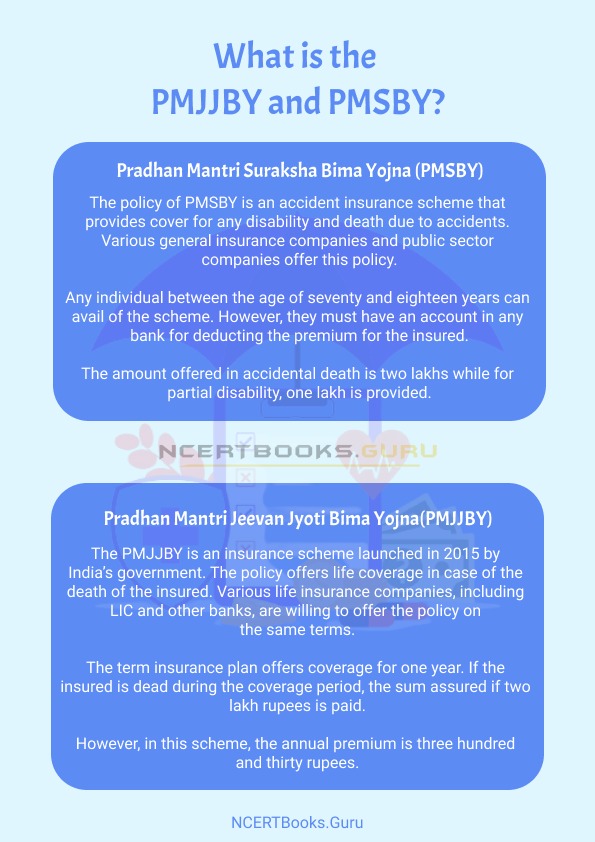

What Is Pradhan Mantri Suraksha Bima Yojna (PMSBY)?

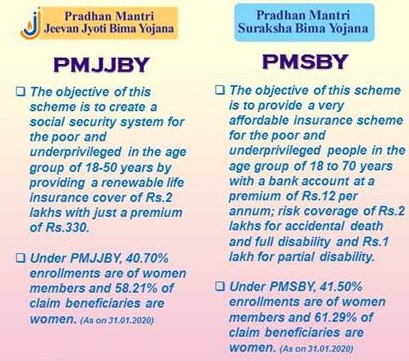

The policy of PMSBY is an accident insurance scheme that provides cover for any disability and death due to accidents. Various general insurance companies and public sector companies offer this policy.

Any individual between the age of seventy and eighteen years can avail of the scheme. However, they must have an account in any bank for deducting the premium for the insured. As per the survey of 2016, around 124 million people have availed for the scheme.

The policy is active for a year and requires the insured to renew it every year. The amount offered in accidental death is two lakhs while for partial disability, one lakh is provided. The premium every year is only twelve rupees.

What is Pradhan Mantri Jeevan Jyoti Bima Yojna(PMJJBY)?

The Pradhan Mantri Jeevan Jyoti Bima Yojna or PMJJBY is an insurance scheme launched in 2015 by India’s government. The policy offers life coverage in case of the death of the insured. Various life insurance companies, including LIC and other banks, are willing to offer the policy on the same terms.

Any individual resident of India between the age of eighteen and fifty years can avail of the scheme. However, the only criteria are to own a bank account. An individual can own a single policy through anyone’s savings bank account.

The term insurance plan offers coverage for one year. If the insured is dead during the coverage period, the sum assured if two lakh rupees is paid. However, in this scheme, the annual premium is three hundred and thirty rupees.

Differences between PMJJBY and PMSBY

Since there are too many similarities between the two schemes, it often confuses people claiming both the schemes to be the same. We have assembled some significant differences between the two schemes.

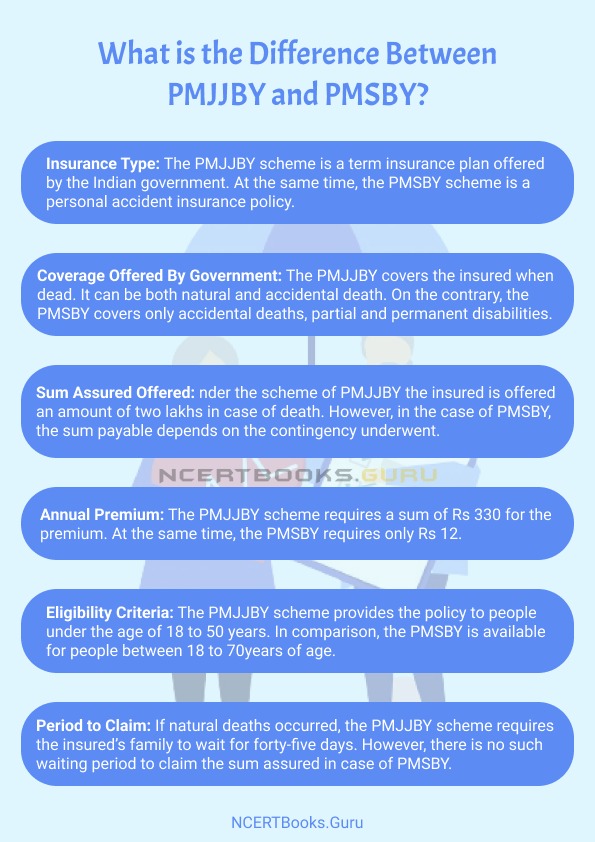

Insurance Type: The PMJJBY scheme is a term insurance plan offered by the Indian government. At the same time, the PMSBY scheme is a personal accident insurance policy.

Coverage Offered By Government- The Pradhan Mantri Jeevan Jyoti Bima Yojna covers the insured when dead. It can be both natural and accidental death. However, any partial disability is not covered in this scheme. On the contrary, the Pradhan Mantri Suraksha Bima Scheme covers only accidental deaths, partial and permanent disabilities.

Sum Assured Offered- Under the scheme of PMJJBY the insured is offered an amount of two lakhs in case of death. However, in the case of PMSBY, the sum payable depends on the contingency underwent. The full amount of two lakh rupees is paid in case of accidental death. However, in the case of partial disabilities, only one lakh is paid to the insured.

Annual Premium: The PMJJBY scheme requires a sum of Rs 330 for the premium. At the same time, the PMSBY requires only Rs 12.

Eligibility Criteria: Although both the schemes require a mandatory savings bank account for the insured to pay premiums, the age required to activate the scheme is different. The PMJJBY scheme provides the policy to people under the age of 18 to 50 years. In comparison, the PMSBY is available for people between 18 to 70years of age.

Period to Claim: If natural deaths occurred, the PMJJBY scheme requires the insured’s family to wait for forty-five days. However, there is no such waiting period to claim the sum assured in case of PMSBY.

These are the basic differences between the two low-cost coverage schemes provided by our honourable prime minister.