Looking for a job in accounting taxation or payroll? We will suggest a course that makes your career bright in accounting. Tally is one such course in Accounting that can help you climb your career ladder at a faster pace. We tried explaining complete information that can be useful for you related to Tally Course. Find details such as Tally Course Duration, Eligibility & Requirements, Colleges that offer Tally Course, Salary, etc. Have an idea what is Tally all about and why it is important by referring further.

- Tally Course Details

- Eligibility Criteria for Tally

- Tally Course Fees

- Tally Course Duration

- Colleges Offering Tally Course

- Core Features of Tally Course Syllabus

- Concepts or Modules in Tally

- Tally Modular Courses

- Job Opportunities and Career Prospects

- Salary/Wages offered to Tally Certificate Holder

- What is a Tally Course?

- What is the full form of Tally?

- Is Tally hard to learn?

- What is duration of Tally Course?

- Is Tally a Good Course?

What is Tally Course?

Tally is an accounting software that is very much useful in making calculations in small and mid-level businesses. It usually stands for Transactions Allowed in a Linear Line Yards. You can do all the Banking, Auditing and Accounting Works using this software. Tally’s accounting features permit you to record business transactions instantly and easily. Record transactions necessary for your business by creating and maintaining vouchers, masters and generating reports. It helps you manage all the major accounting operations in your business.

Tally Course Details

| Course | Tally |

| Full form | Transactions Allowed in a Linear Line Yards |

| Tally Course Eligibility & Requirement | 10+2 or equivalent |

| Duration | 3 Months |

| Fee Offered | Rs.3,000 to Rs.6,000 |

| Course Type | Regular mode |

| Starting salary offered | Rs. 12,000 to 15,000 per month |

| Advance Courses | Diploma in Tally |

| Employment opportunities | Banking Sector, MNC Companies. |

Eligibility Criteria for Tally

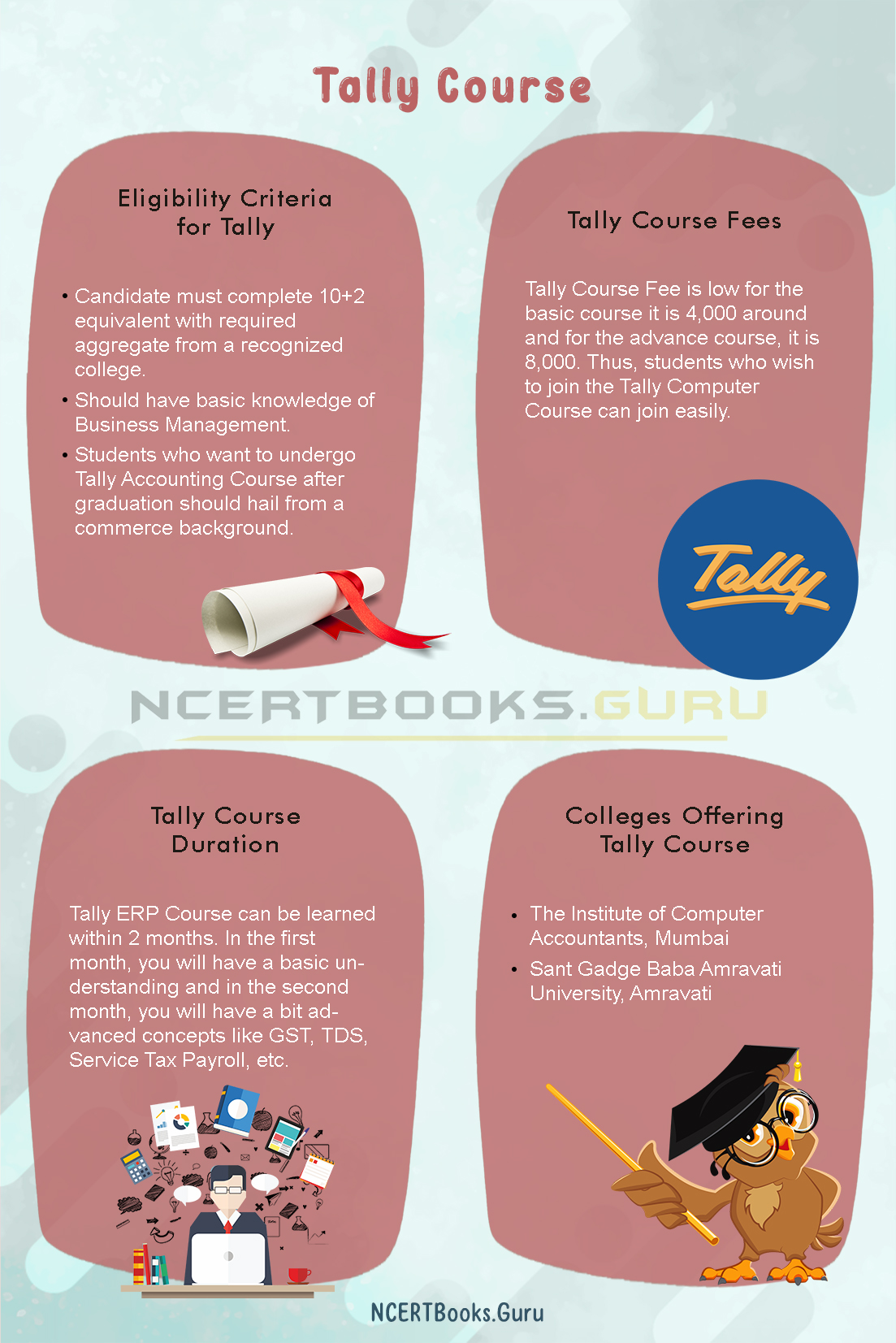

- Candidate must complete 10+2 equivalent with required aggregate from a recognized college.

- Should have basic knowledge of Business Management.

- Students who want to undergo Tally Accounting Course after graduation should hail from a commerce background.

You can also check the best Courses After 12th Class from our website.

Tally Course Fees

Tally Course Fee is low for the basic course it is 4,000 around and for the advance course, it is 8,000. Thus, students who wish to join the Tally Computer Course can join easily.

Tally Course Duration

Tally ERP Course can be learned within 2 months. In the first month, you will have a basic understanding and in the second month, you will have a bit advanced concepts like GST, TDS, Service Tax Payroll, etc.

Colleges Offering Tally Course

- The Institute of Computer Accountants, Mumbai

- Sant Gadge Baba Amravati University, Amravati

More Related Articles

Core Features of Tally Course Syllabus

Accounting – It is the most important feature of Tally ERP. the very first thing that comes to anyone’s mind after listening about Tally is Accounting.

Billing – Billing is a significant part of any business. As and when you pass an accounting entry synchronously a bill is generated which you can use for raising or sending an invoice. Most people believe that Billing is a part of Accounting which is not true when it comes to business. Billing Option present in Tally eliminates the task of entering separate accounting.

Payroll – This feature can be used when you have a good number of employees. To maintain Payroll in Tally, functions such as employee groups, employee categories, pay heads, attendance, and course employees are used.

Banking – In this era of digitalization, no business can survive without Banking. With the help of Tally ERP, TDS GST both direct and indirect tax can be calculated automatically and its returns will be also be filed online.

Taxation – For any business to survive it shouldn’t operate in isolation. The Business should work in cooperation with State as well as Central Government by paying appropriate Taxes. Calculation of Taxes based on the income, sale, and dispatch is quite hectic. Tally makes it easy for you to prepare any bill or invoice as it can give VAT, Income Tax, Excise, Customs, Service tax, etc.

Inventory – Maintenance of Stock is of utmost importance for any business. It’s vital as it gives better control over business sales. Thus, the movement of stock is an integral part that can be kept in control.

Concepts or Modules in Tally

- Fundamentals of accounting

- Introduction of Tally

- Meaning of company creation and opening accounting in Tally

- Opening a ledger account and how to create a voucher

- How to modify a company or industry detail

- How to set the features of a company

- Selecting the cost category and cost center

- How to create a godown and how to maintain an inventory

- How to set price list and the budget

- A brief introduction of F11 and F12

- How to produce profit and loss balance sheet from accounting

- Introduction to VAT

- Calculation of VAT

- Introduction to TDS

- Calculation of TDS

- How to add excise duty and customs duty

Tally Modular Courses

TALLY.ERP9 Simplified

Volume IA

- Accounting & Inventory Management Getting Started with Tally.ERP 9 & Fundamental Features

- Creating Masters in Tally.ERP 9Voucher Entry & Invoicing

- Bill – is Details, Credit Limits

- Basics of Banking, Interest Calculation, Simple Interest Calculation

- Cost Centres and Cost Categories

- Reports in Tally.ERP 9

- Order Processing & Pre-closure of orders

- Price Levels & Price Lists

- Point of Sale (POS)

- Zero-Valued Entries

- Different Actual and Billed Quantities

- Batch-wise Details,

- Bill of Materials.

Volume IIA

- Essentials of Taxation

- VAT

- Service Tax

- TDS

- Excise (Dealers)

- Excise(Manufacturer)

- Advanced Features.

TALLY.ERP9 Advanced

Volume I

Fundamentals of Accounts and Inventory

Volume II

Advanced Inventory and Technological Capabilities

Volume III

Fundamentals of Taxation

TALLY.ERP9 Advanced Taxation

Volume IV

Advanced Taxation

Volume V

Payroll and Advanced Features

TALLY.ERP9 Comprehensive

Volume I

Fundamentals of Accounts and Inventory

Volume II

Advanced Inventory and Technological Capabilities

Volume III

Fundamentals of Taxation

Volume IV

Advanced Taxation

Volume V

Payroll and Advanced Features

Job Opportunities and Career Prospects

- Accountant

- Accounts Executive

- Tally Operator

- Tally Accounts Manager

- Service Coordinate with Tally

- Tally Junior Accountant

- Tax Accountant

- Accounting Assistant

- Supervisory Accountant

Salary/Wages offered to Tally Certificate Holder

Average Salary for Tally Certificate Course can be ranging from 2 – 10 Lakhs. This can vary depending on the experience and several other factors.

FAQs on Tally Course?

Tally is an accounting software that is very much useful in making calculations in small and mid-level businesses. You can do all the Banking, Auditing and Accounting Works using this software.

2. What is the full form of Tally?

Tally Stands for Transactions Allowed in a Linear Line Yards.

No, it is very easy to learn if you are from the commerce stream. It’s easy if you are from a non-commerce stream too and all that depends is your interest to learn.

4. What is duration of Tally Course?

Tally can be completed within a span of 2 months usually. However, it even varies from institute to institute.

Yes, it is a good course and is the most widely used software in today’s business world.

Conclusion

We hope, you will find everything you need related to Tally Course Details like Eligibility, Duration, Fee Structure, Salary, etc. For further doubts do drop us a comment and we will be of your help at the earliest possible. Stay in touch with our site for more updates on Course Details.