ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS

ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS

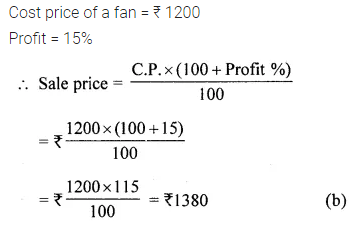

A retailer purchases a fan for ₹ 1200 from a wholesaler and sells it to a consumer at 15% profit. If the rate of sales tax (under VAT) at every stage is 8%, then choose the correct answer from the given four options for questions 1 to 5:

Question 1.

The selling price of the fan by the retailer (excluding tax) is

(a) ₹ 1200

(b) ₹ 1380

(c) ₹ 1490.40

(d) ₹ 11296

Solution:

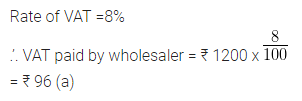

Question 2.

VAT paid by the wholesaler is

(a) ₹ 96

(b) ₹ 14.40

(c) ₹ 110.40

(d) ₹ 180

Solution:

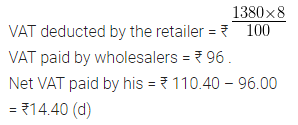

Question 3.

VAT paid by the retailer

(a) ₹ 180

(b) ₹ 110.40

(c) ₹ 96

(d) ₹ 14.40

Solution:

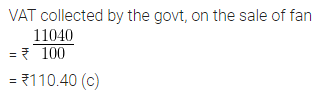

Question 4.

VAT collected by the Government on the sale of fan is

(a) ₹14.40

(b) ₹96

(c) ₹110.40

(d) ₹180

Solution:

Question 5.

The cost of the fan to the consumer inclusive of tax is

(a) ₹1296

(b) ₹1380

(c) ₹1310.40

(d) ₹1490.40

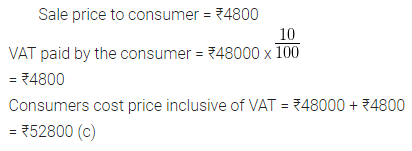

Solution:

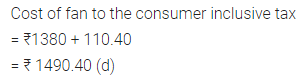

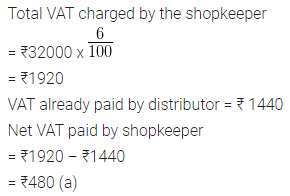

A shopkeeper bought a TVfrom a distributor at a discount of 25% of the listed price of ₹ 32000. The shopkeeper sells the TV to a consumer at the listed price. If the sales tax (under VAT) is 6% at every stage, then choose the correct answer from the given four options for questions 6 to 8:

Question 6.

VAT paid by the distributor is

(a) ₹1920

(b) ₹1400

(c) ₹480

(d) ₹8000

Solution:

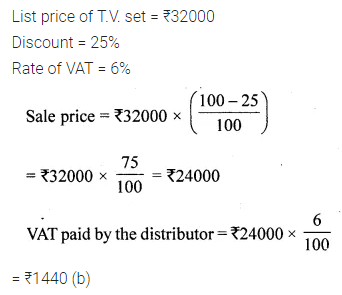

Question 7.

VAT paid by the shopkeeper is

(a) ₹480

(b) ₹1440

(c) ₹1920

(d) ₹8000

Solution:

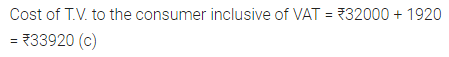

Question 8.

The cost of the TV to the consumer inclusive of tax is

(a) ₹8000

(b) ₹32000

(c) ₹33920

(d) none of these

Solution:

A wholesaler buys a computer from a manufacturer for ₹ 40000. He marks the price of the computer 20% above his cost price and sells it to a retailer at a discount of 10% on the marked price. The retailer sells the computer to a consumer at the marked price. If the rate of sales tax (under VAT) is 10% at every stage, then choose the correct answer from the given four options for questions 9 to 15:

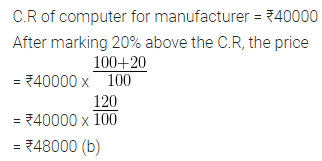

Question 9.

The marked price of the computer is

(a) ₹40000

(b) ₹48000

(c) ₹50000

(d) none of these

Solution:

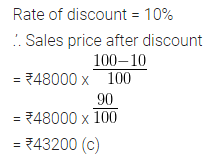

Question 10.

Cost of the computer to the retailer (excluding tax) is

(a) ₹36000

(b) ₹40000

(c) ₹43200

(d) ₹47520

Solution:

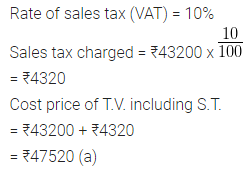

Question 11.

Cost of the computer to the retailer inclusive of tax is

(a) ₹47520

(b) 43200

(c) 44000

(d) none of these

Solution:

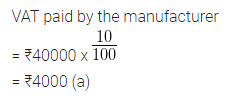

Question 12.

VAT paid by the manufacturer is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) none of these

Solution:

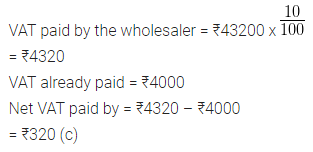

Question 13.

VAT paid by the wholesaler is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) ₹480

Solution:

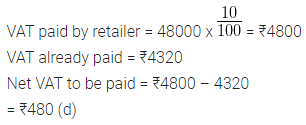

Question 14.

VAT paid by the retailer is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) ₹480

Solution:

Question 15.

Consumer’s cost price inclusive of VAT is

(a) ₹47520

(b) ₹48000

(c) ₹52800

(d) ₹44000

Solution: