ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax Chapter Test

ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax Chapter Test

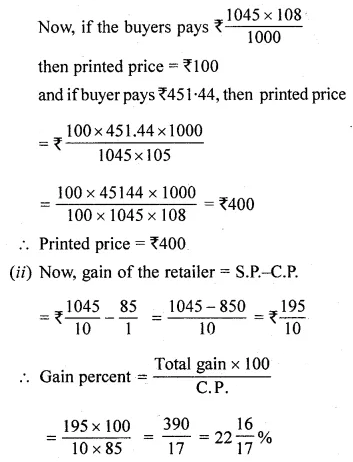

Question 1.

A shopkeeper bought a washing machine at a discount of 20% from a wholesaler, the printed price of the washing machine being ₹ 18000. The shopkeeper sells it to a consumer at a discount of 10% on the printed price. If the rate of sales tax is 8%, find:

(i) the VAT paid by the shopkeeper.

(ii) the total amount that the consumer pays for the washing machine.

Solution:

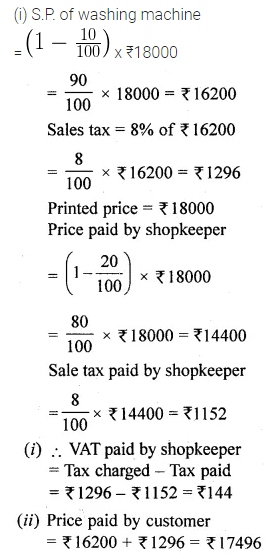

Question 2.

A manufacturing company sold an article to its distributor for ₹22000 including VAT. The distributor sold the article to a dealer for ₹22000 excluding tax and the dealer sold it to a consumer for ₹25000 plus tax (under VAT). If the rate of sales tax (under VAT) at each stage is 10%, find :

(i) the sale price of the article for the manufacturing company.

(ii) the amount of VAT paid by the dealer.

Solution:

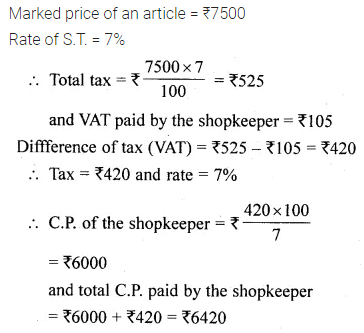

Question 3.

The marked price of an article is ₹7500. A shopkeeper sells the article to a consumer at the marked prices and charges sales tax at . the rate of 7%. If the shopkeeper pays a VAT of ₹105, find the price inclusive of sales tax of the article which the shopkeeper paid to the wholesaler.

Solution:

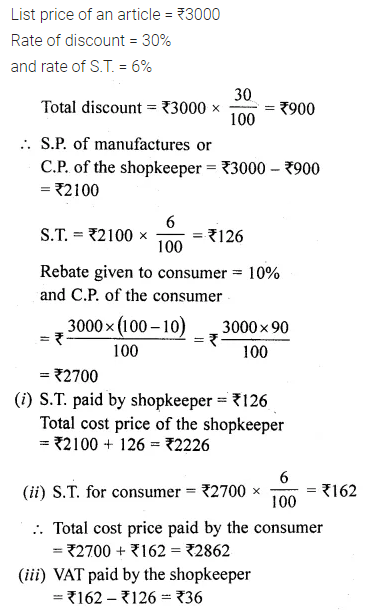

Question 4.

A shopkeeper buys an article at a discount of 30% and pays sales tax at the rate of 6%. The shopkeeper sells the article to a consumer at 10% discount on the list price and charges sales tax at the’ same rate. If the list price of the article is ₹3000, find the price inclusive of sales tax paid by the shopkeeper.

Solution:

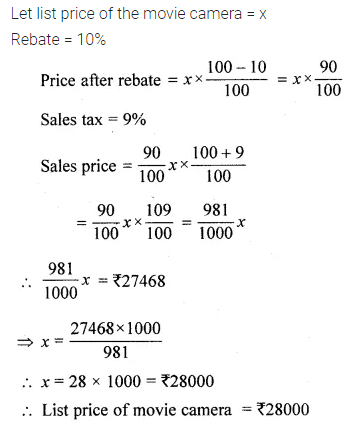

Question 5.

Mukherjee purchased a movie camera for ₹27468. which includes 10% rebate on the list price and then 9% sales tax (under VAT) on the remaining price. Find the list price of the movie camera.

Solution:

Question 6.

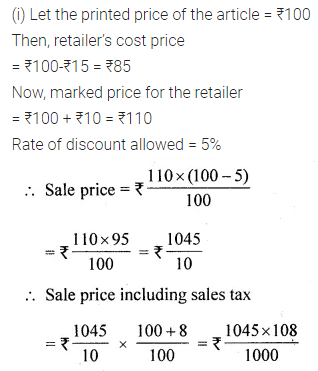

A retailer buys an article at a discount of 15% on the printed price from a wholesaler. He marks up the price by 10%. Due to competition in the market, he allows a discount of 5% to a buyer. If the buyer pays ₹451.44 for the article inclusive of sales tax (under VAT) at 8%, find :

(i) the printed price of the article

(ii) the profit percentage of the retailer.

Solution: