Insurance Courses: Insurance courses offer a plethora of career options for those who feel that they have a knack for this sector. The educational goal in insurance offers a wide range of courses, which specializes in several fields, such as health insurance, life insurance, property insurance, accident, travel, and many more. Furthermore, insurance courses highlight actuarial analysis, financial planning, risk management, and so on.

The insurance industry is waiting for people like you, who have strong interpersonal and analytical skills. If you feel that you are people’s person with excellent communication skills, you should put your best foot forward in the insurance sector.

Get to Know More about other types of Course Details in Stream wise, and Category wise

If pursuing an insurance course is on your mind, here you will find accurate and precise information on everything you need to know. This report explicate overall topics, such as –

- What is Insurance?

- Essential Skill sets for Insurance Course

- Insurance Course Details

- Subjects, Concepts in Insurance Course

- College List Offering Insurance Courses

- Insurance Course And Eligibility

- Course Fee Structure

- Insurance Course Admission Procedure

- Course Duration

- Job Profiles

- Prospects of Insurance Courses

- Salary Offered to Insurance Professionals

- What is the Insurance course all about?

- Are Insurance courses tough?

- Is the insurance course the right career choice for me?

- What do I need to do to become an IRDA agent?

What is Insurance?

Damage, loss, or death never knock at your door before arriving. Thus, one needs insurance coverage that undertakes the responsibility to protect the monetary interest of a person or an organization. Insurance is much more than a piece of paper. It is an arrangement that provides a protective shield to you in the form of monetary compensation for specified damage, loss, death, or illness. Hence, insurance is an assurance against any eventuality that may take you by surprise.

Essential Skill Set for Insurance Course

Apart from interest and mental aptitude for an insurance course, you would need to display an exceptional portfolio that entails your essential skill sets. Clearing the interview could be easy. However, climbing the hierarchical ladder is a different story altogether. Apart from technical skills, the insurance industry would require the following soft skills to absorb the prospective candidates in their organization.

- Attention for details

- Alertness

- Excellent communication skills

- Outgoing

- Interpersonal skills

- Systematic

- Customer service

- Mathematical skills

- Analytical skills

- Problem-solving skills

- Visionary for future growth

Insurance Courses Details

Insurance courses are available for undergraduates and postgraduates. Furthermore, doctoral degree courses are also available for aspirants who want to pursue further.

| Types of Insurance Courses | Programmes |

| Certificate Courses |

|

| Diploma Courses |

|

| Bachelor’s Degree Courses |

|

| Master’s Degree Courses |

|

| Ph.D. Programs |

|

However, here is a brief highlight of various insurance course details in a tabular form. The candidate desirous of pursuing a doctoral degree’s insurance course must have cleared his master’s degree and must not be drawing income.

| Course Highlights | Master’s Degree/ PG Programme | Bachelor’s Degree Programme | Diploma/Certificate Programme |

| Duration | 2 years | 3 years | 6 months to 2 year |

| Eligibility | Completed 10+2+3 from a recognized university | Completed 10+2 from any stream from a recognized | Completed 10/10+2 from any stream from a recognized board/school |

| Admission Process | Merit list/Admission test | Merit List/Admission test | Merit List |

| Course Fee | INR 10,000 to 10,00,000 | INR 14,000 to 5,00,000 | INR 1,000 to 10,000 |

| Average Salary | INR 3,00,000 to 20,00,000 | INR 1,20,000 to 10,00,000 | INR 1 lakh to 7 lakhs |

| Job Positions | Insurance Underwriter, Insurance Adjustor, Surveyor, Risk Manager, Actuary, etc. | Executive | Sales agent, Insurance agents |

Subjects, Concepts in Insurance Courses

Doctoral Degree in Insurance Course

The current Ph.D. students have opted for the following subject for a doctoral degree in Insurance –

- Organization management

- Financial management

- Insurance and Transport

- Marketing Management

Master’s Degree in Insurance Course

In the first year of a master’s degree insurance course, students will undertake the following subjects – risk management, fire insurance, marine insurance, principles, and practice of life, and general insurance, etc. However, in the second year, the subjects will pertain to liability insurance, life insurance, investment planning and management, marketing financial services, motor insurance and agricultural, and miscellaneous insurance.

Bachelor Degree in Insurance Course

In the first year of a bachelor’s degree insurance course, the subjects included economics, financial accounting, quantitative methods, business law, management of financial services, principles of banking, and insurance, etc.

In the second year of a bachelor’s in the insurance programme, the subjects comprise financial management, accounting, entrepreneurship management, taxation of financial services, financial reporting and analysis, customer relationship, and financial market.

The final year subjects of BBI are international banking, auditing, portfolio management, strategic management, business ethics, turnaround management, and banking projects.

Certificate or Diploma in Insurance Course

The subjects pertaining to diploma and certificate insurance courses are general insurance I and II, and personal insurance I and II. Apart from that, students would thoroughly study insurance principles, life insurance, and insurance concept and laws.

List of Colleges Offering Insurance Courses

Here is a list of top colleges, universities, and institutes for insurance courses.

| Sl.No. | Name of Educational Institutions | Location |

| 1 | Nalanda University (NOU) | Bihar |

| 2 | JSS College Arts, Science & Commerce | Karnataka |

| 3 | Silver Jubliee Degree College | Andhra Pradesh |

| 4 | Vinayak Rao Patil Mahavidyalaya | Maharashtra |

| 5 | Mahatma Gandhi Open University | Meghalaya |

| 6. | Amity School of Insurance and Actuarial Science | Uttar Pradesh |

| 7. | Insurance Institute of India | Mumbai |

| 8. | Government Degree College for Boys | Jammu and Kashmir |

| 9. | National Insurance Academy | Pune |

| 10. | Sir Durga Malleswara Siddhartha Mahila Kalasala | Andhra Pradesh |

| 11. | SVKM’s NMIMS University | Mumbai |

| 12. | Institute of Insurance and Risk Management | Hyderabad |

| 13. | International Institute for Insurance and Finance | Hyderabad |

Insurance Courses Eligibility Criteria

Doctoral Degree in Insurance Course

The candidate must have completed a master’s degree in commerce, economics, or management from any university or institute recognized by UGC in the full-time mode. Furthermore, to pursue a Ph.D. in insurance course, the candidate must fulfill the conditions

- The candidate must not be earning a remuneration from any source, grant, or organization.

- The candidate must not be pursuing any other Ph.D. course from a distance learning mode.

Master’s Degree in Insurance Course

Colleges, and institutes will deem the aspirants eligible for a postgraduate course, such as PG Diploma in insurance, or master’s degree in insurance if the following criteria are met:

- The candidate applying for a master’s degree insurance course must be a graduate in a similar specialization.

- The candidate must have attained at least 55% aggregate marks in bachelor’s degree course.

Bachelor’s Degree in Insurance Course

The candidates preparing to apply for a bachelor’s degree in insurance should have the following qualifications to become eligible for admission.

- The candidate must possess a 10+2 certificate from a recognized board of education or equivalent.

- The aggregate marks secured in 10+2 must be at least 50% to 60%.

Certificate or Diploma in Insurance Course

Candidates must fulfill the following criteria to become eligible for a certificate or diploma insurance course.

- Candidates must possess S.S.C.or any equivalent exam certificate from a recognized educational board or equivalent.

- Candidates must have completed 18 years of age.

- It will be an added advantage if the candidate is working with any insurance company.

However, each college has its set of rules and regulations for enrollment.

Insurance Courses Fee Structure

The fee structure for insurance courses varies from college to college. Furthermore, government colleges’ fee is more reasonable than private institutions. Moreover, the rating of colleges also decides the free structure. Another factor that determines the fee structure is the type, of course, you opt for. You may refer to insurance course details for an overview of fee structure.

Insurance Courses Admission Procedure

The admission procedure is based on the programme. A degree course’s admission process differs from a diploma or a certificate programme. However, in each case, the candidate must carry the necessary documents as prescribed by the university, college, or institute at the time of admission.

Doctoral Degree in Insurance Course

The candidate must follow the following admission procedure to enroll himself in a Ph.D insurance course.

- The candidate must have the title of the thesis for pursuing a PhD.

- The candidate must carry an abstract of his proposed topic.

- The candidate must carry an admission letter.

- A declaration that proves that he is not employed elsewhere, or drawing remuneration for any source, grant, or organization.

Degree, Diploma, and Certificate in Insurance Courses

Sometimes, admission to degree, diploma, and certificate insurance courses are through entrance examinations. However, some colleges also conduct interviews and group discussions to assess the candidates’ interpersonal skills. Some institutes may only consider your mark sheet percentage for admission.

At the time of admission, the candidate must carry the mandatory documents. You would need to present original documents, a mark sheet, two passport-sized photographs, and other requirements as specified by the college or institute.

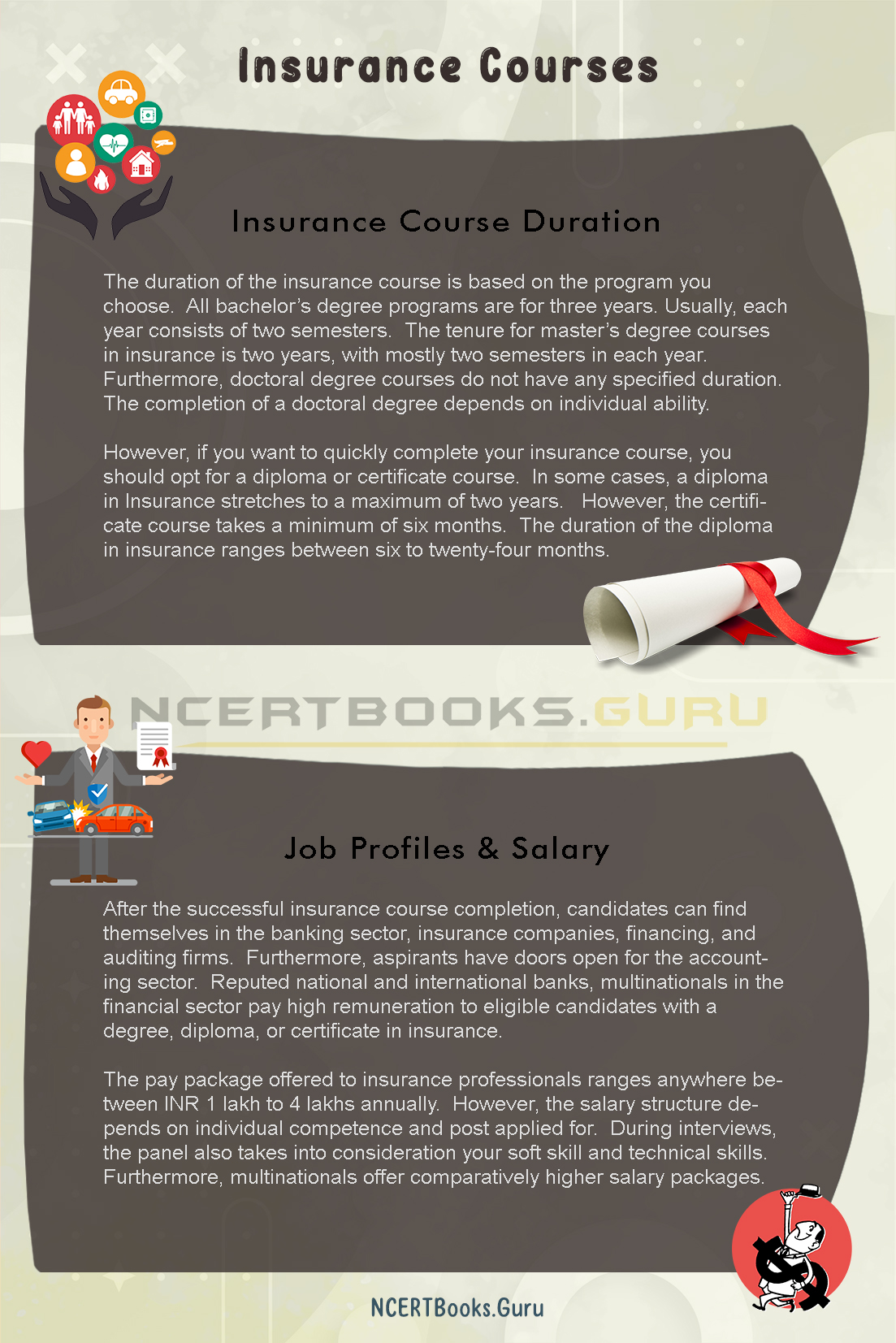

Insurance Course Duration

The duration of the insurance course is based on the program you choose. All bachelor’s degree programs are for three years. Usually, each year consists of two semesters. The tenure for master’s degree courses in insurance is two years, with mostly two semesters in each year. Furthermore, doctoral degree courses do not have any specified duration. The completion of a doctoral degree depends on individual ability.

However, if you want to quickly complete your insurance course, you should opt for a diploma or certificate course. In some cases, a diploma in Insurance stretches to a maximum of two years. However, the certificate course takes a minimum of six months. The duration of the diploma in insurance ranges between six to twenty-four months.

Job Profiles to Insurance Holders

After the successful insurance course completion, candidates can find themselves in the banking sector, insurance companies, financing, and auditing firms. Furthermore, aspirants have doors open for the accounting sector. Reputed national and international banks, multinationals in the financial sector pay high remuneration to eligible candidates with a degree, diploma, or certificate in insurance.

Prospects of Pursuing Insurance Course

If you are desirous of pursuing an insurance course, you have found your niche for the future. The insurance industry is guaranteed to grow by leaps and bounds due to lurking dangers and uncertainty that encompasses us worldwide. Thus, the inclination towards Insurance courses is rising. A degree, diploma, or certificate in insurance will yield you excellent opportunities, and dynamic career. The candidates can apply for the managerial post, customer service representative, insurance agent, sales manager, etc.

Salary Offered to Insurance Professionals

The pay package offered to insurance professionals ranges anywhere between INR 1 lakh to 4 lakhs annually. However, the salary structure depends on individual competence and post applied for. During interviews, the panel also takes into consideration your soft skill and technical skills. Furthermore, multinationals offer comparatively higher salary packages.

You can see the applications of Tata motors pivot point to explore more…

Top Recruiting Companies for Insurance Professionals

Insurance firms, consultancies, credit, financial companies, and banks have positions open for insurance professionals and offer a decent salary package. On the other hand, Insurance professionals looking for secured government jobs can apply in relevant government departments, insurance agencies, financial institutes, etc. Here is a list of a few private companies.

- HDFC Standard Life Insurance Co.

- SBI Life Insurance

- MaxLIfe

- ICICI Prudential

- Tata AIF Life

- Om Kotak Mahindra

- Birla Sun-Life

- ING Vysya LIfe

- Reliance and many more

FAQ’s on Insurance Courses

Question 1.

What is the Insurance course all about?

Answer:

Insurance course is a blend of the marketing function, risk management, and insurance coverage. Insurance involves specialization in health, life, property, accident, travel insurance, and many more. Moreover, insurance courses outline actuarial analysis, financial planning, risk management, and so on.

Question 2.

Are Insurance courses tough?

Answer:

No. Insurance courses are not too difficult if you are persistent and study regularly.

Question 3.

Is the insurance course the right career choice for me?

Answer:

If you consider the broad career prospects, the insurance course has a variety of options for you.

Question 4.

What do I need to do to become an IRDA agent?

Answer:

IRDA or Insurance Regulatory and Development Authority of India conducts a test for the recruitment of a General Insurance Agent in India.

Read More: BAJFINANCE Pivot Calculator